1. What is the projected Compound Annual Growth Rate (CAGR) of the HASL Printed Circuit Board?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

HASL Printed Circuit Board

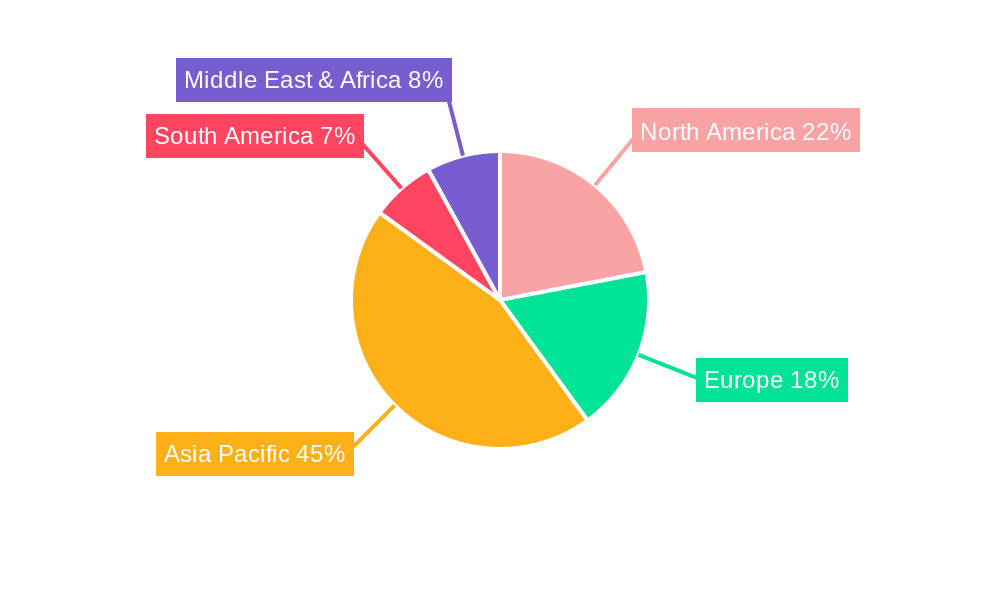

HASL Printed Circuit BoardHASL Printed Circuit Board by Type (Lead, Lead Free, World HASL Printed Circuit Board Production ), by Application (Home Appliances, Automotive Electronics, Communications Equipment, Others, World HASL Printed Circuit Board Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

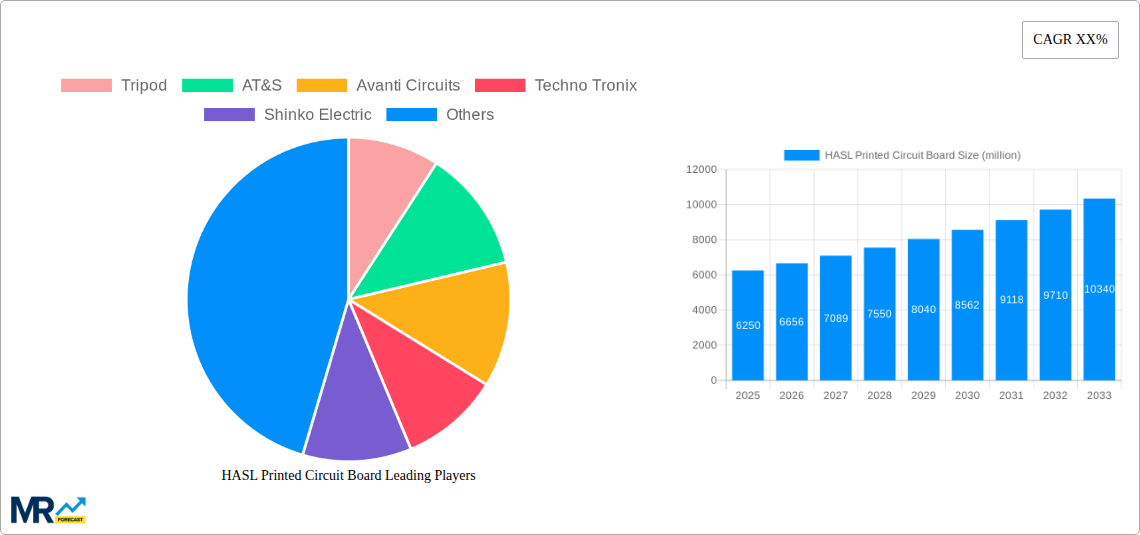

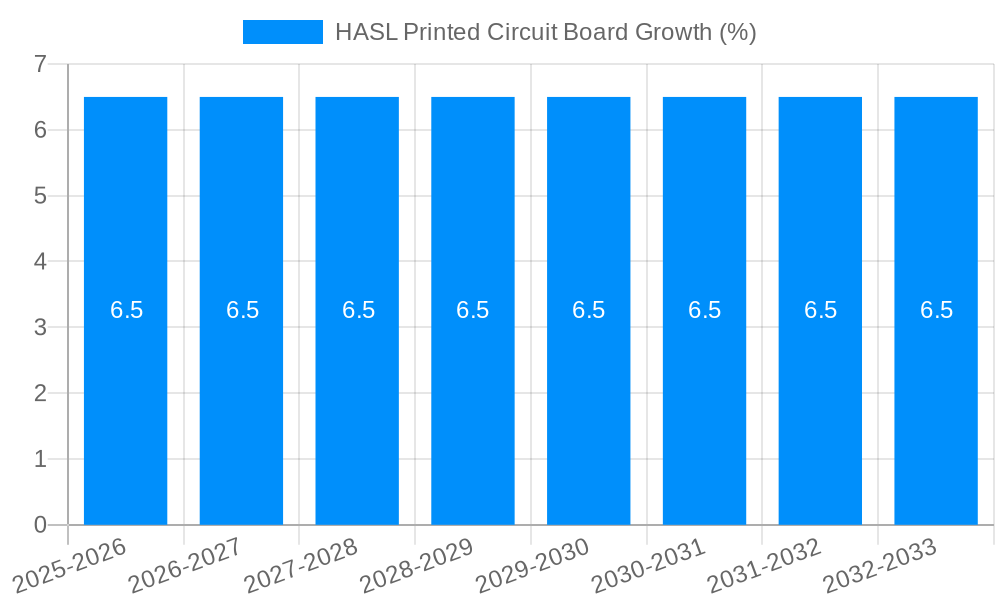

The global HASL (Hole Array and Solder Leveling) Printed Circuit Board (PCB) market is poised for significant expansion, projected to reach an estimated USD 6,250 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. The market is witnessing a strong demand driven by the increasing integration of electronics across a wide spectrum of industries, most notably in home appliances, automotive electronics, and communications equipment. The inherent cost-effectiveness and reliability of HASL finishes, coupled with advancements in PCB manufacturing technologies, are key factors propelling market expansion. Emerging applications in consumer electronics and the continuous evolution of the Internet of Things (IoT) ecosystem further contribute to this upward trajectory, creating substantial opportunities for market participants.

While the market benefits from strong demand, certain restraints may influence its growth trajectory. The increasing adoption of more advanced PCB finishes, such as ENIG (Electroless Nickel Immersion Gold) and OSP (Organic Solderability Preservative), for high-performance and miniaturized applications could pose a challenge to the widespread adoption of HASL in niche segments. However, the cost advantage and proven performance of HASL in many mainstream applications are expected to mitigate this impact. Geographically, Asia Pacific, particularly China, is expected to dominate the market due to its extensive manufacturing capabilities and a burgeoning domestic demand for electronic devices. North America and Europe will also represent substantial markets, driven by technological innovation and the increasing complexity of electronic systems in their respective automotive and industrial sectors.

This comprehensive report delves into the intricate dynamics of the World HASL Printed Circuit Board (PCB) Production market, offering a detailed analysis from the historical period of 2019 to 2024, the base year of 2025, and a robust forecast extending to 2033. With an estimated market size in the millions of units, this study provides invaluable insights for stakeholders navigating this critical segment of the electronics manufacturing ecosystem. The report meticulously examines trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments shaping the HASL PCB landscape.

XXX The World HASL Printed Circuit Board Production market is experiencing a nuanced evolutionary trajectory, driven by a confluence of technological advancements, regulatory shifts, and evolving application demands. Historically, the market has been a cornerstone for cost-effective PCB fabrication, particularly due to the solderability and reworkability offered by the Hot Air Solder Leveling (HASL) process. However, the narrative is now shifting, with Lead Free HASL emerging as a dominant force, propelled by environmental regulations such as RoHS and REACH, which have significantly curtailed the use of lead-based solders in many regions and applications. This transition, while initially posing challenges in terms of process optimization and cost, has now largely matured, with manufacturers achieving comparable reliability and performance. The study period (2019-2033) highlights this critical evolution, showing a gradual but persistent decline in Lead HASL production as Lead Free HASL gains significant market share. By the base year of 2025, Lead Free HASL is projected to represent over 70% of the global HASL PCB output in terms of units.

Furthermore, the report unpacks the diversification of applications, showcasing how HASL PCBs, despite the rise of more sophisticated surface finishes, continue to find extensive use in Home Appliances, Automotive Electronics, and Communications Equipment. Within Home Appliances, the cost-effectiveness and durability of HASL make it an ideal choice for a wide array of products, from kitchen gadgets to laundry machines. In the burgeoning Automotive Electronics sector, while high-frequency applications might lean towards more advanced finishes, HASL remains prevalent for certain power electronics and control modules where robust solderability and cost are paramount. The Communications Equipment segment, though increasingly demanding for high-speed data transmission, still relies on HASL for backbone infrastructure and less performance-critical components. The "Others" category, encompassing industrial automation, medical devices, and consumer electronics, also contributes significantly to the overall unit production. The report anticipates continued growth in unit volume for HASL PCBs across these segments, driven by sheer demand for electronic devices globally, even as the share of HASL within a single device might decrease in favor of more specialized finishes for critical functions. The sheer scale of production, measured in millions of units, underscores the enduring relevance and mass-market appeal of HASL technology.

The World HASL Printed Circuit Board Production market's sustained momentum is underpinned by a powerful set of driving forces, chief among them being the unyielding demand for cost-effective electronic solutions across a vast spectrum of industries. HASL technology, with its inherent simplicity and established manufacturing processes, continues to offer a compelling price-performance ratio, making it the default choice for mass-produced electronic goods. The Home Appliances sector, a colossal consumer of PCBs, relies heavily on the affordability and reliability that HASL provides for everything from refrigerators to washing machines. Similarly, the ever-expanding Automotive Electronics landscape, driven by the increasing integration of electronic control units (ECUs), infotainment systems, and advanced driver-assistance systems (ADAS), continues to incorporate HASL PCBs for a multitude of applications where cost optimization is a critical factor, alongside stringent reliability requirements.

Moreover, the Communications Equipment industry, encompassing everything from networking infrastructure to consumer telecommunications devices, also benefits from HASL's cost advantages, particularly for components that do not demand ultra-high-frequency performance. The ongoing global push for digitalization and connectivity across all sectors fuels a consistent demand for these essential electronic components. Furthermore, the maturity and widespread availability of HASL processing equipment and expertise globally contribute to its continued adoption. Manufacturers worldwide have invested in and refined HASL techniques, leading to efficient production lines and a stable supply chain. This established infrastructure ensures that HASL PCBs can be produced in massive quantities, meeting the burgeoning global demand for electronics, especially in developing economies where cost sensitivity is a primary concern.

Despite its enduring strengths, the World HASL Printed Circuit Board Production market faces several significant challenges and restraints that shape its growth trajectory. The most prominent among these is the increasing demand for higher performance and miniaturization in advanced electronic applications. For high-frequency and high-speed digital circuits, particularly in cutting-edge Communications Equipment and advanced Automotive Electronics, the limitations of HASL's surface roughness and potential for solder joint issues can lead to signal integrity problems and reduced reliability. This has led to a discernible shift towards more sophisticated surface finishes like ENIG (Electroless Nickel Immersion Gold), OSP (Organic Solderability Preservatives), and immersion silver/tin for these demanding applications, thereby fragmenting the market and limiting HASL's dominance in these high-end segments.

Another critical restraint stems from environmental regulations and the ongoing push for sustainable manufacturing. While Lead Free HASL has largely addressed the lead issue, the use of other chemicals and processes in HASL, such as tin and copper plating, still necessitates stringent waste management and disposal protocols, adding to operational costs and environmental compliance burdens. Furthermore, the competitive landscape is intensifying with the emergence of numerous manufacturers, particularly in Asia, leading to price pressures and thinner profit margins for HASL PCB producers. This intense competition can sometimes lead to compromises in quality control if not managed diligently, further impacting the perceived value of HASL PCBs in certain markets. The report will also analyze the impact of supply chain disruptions, raw material price volatility, and the increasing complexity of electronic designs as factors that can impede the unhindered growth of the HASL PCB market.

The World HASL Printed Circuit Board Production market is poised for significant dominance by a combination of key regions and specific segments, driven by economic factors, manufacturing capabilities, and application-specific demands.

Dominant Region/Country:

Dominant Segment:

Furthermore, within the Application segment, Home Appliances is expected to remain a significant driver of HASL PCB demand in terms of unit volume. The sheer number of electronic components in modern home appliances, coupled with the cost-sensitivity of this market, makes HASL an ideal choice. While Automotive Electronics and Communications Equipment are growing rapidly, the overall unit volume for simpler HASL applications within these sectors will contribute substantially. The "Others" category, encompassing industrial, medical, and other consumer electronics, also plays a crucial role in maintaining the high unit production of HASL PCBs. The forecast period (2025-2033) will witness a sustained demand for Lead Free HASL in these dominant regions and segments, underlining its continued importance in the global electronics supply chain.

The growth of the HASL Printed Circuit Board industry is propelled by several key catalysts. The persistent and escalating global demand for electronic devices across all sectors, particularly in burgeoning economies, acts as a fundamental driver. The increasing adoption of Lead Free HASL due to stringent environmental regulations worldwide ensures a sustained market for compliant PCBs. Furthermore, the cost-effectiveness and proven reliability of HASL technology make it the preferred choice for a vast array of applications within Home Appliances and less performance-critical parts of Automotive Electronics and Communications Equipment, ensuring continued high-volume production. Innovations in HASL processes that improve efficiency and reduce environmental impact also contribute to its longevity and market appeal.

This report provides an exhaustive exploration of the World HASL Printed Circuit Board Production market, offering a holistic view for stakeholders. It meticulously analyzes market dynamics across the Study Period: 2019-2033, with a sharp focus on the Base Year: 2025 and the Forecast Period: 2025-2033. The report details historical performance during the Historical Period: 2019-2024. It offers in-depth insights into the Type segmentation (Lead, Lead Free), the pervasive Application segments (Home Appliances, Automotive Electronics, Communications Equipment, Others), and the overarching World HASL Printed Circuit Board Production landscape. Furthermore, the report examines critical Industry Developments and provides a forward-looking perspective on the Growth Catalysts that will shape the future of HASL PCB manufacturing. With detailed analyses of key regions, leading players, and significant trends, this report is an indispensable resource for informed decision-making in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tripod, AT&S, Avanti Circuits, Techno Tronix, Shinko Electric, Daeduck Group, Aohong Electronics, Lingzhi Electric Circuit, Shennan Circuits, Avary Holding, Victory Giant Technology, Champion Asia Electronics, Ellington Electronic.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "HASL Printed Circuit Board," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the HASL Printed Circuit Board, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.