1. What is the projected Compound Annual Growth Rate (CAGR) of the H-Bar Conductor Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

H-Bar Conductor Systems

H-Bar Conductor SystemsH-Bar Conductor Systems by Type (Aluminum Conductor Bar, Copper Conductor Bar), by Application (Industrial Automation, Warehousing and Logistics, Rail Transit, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

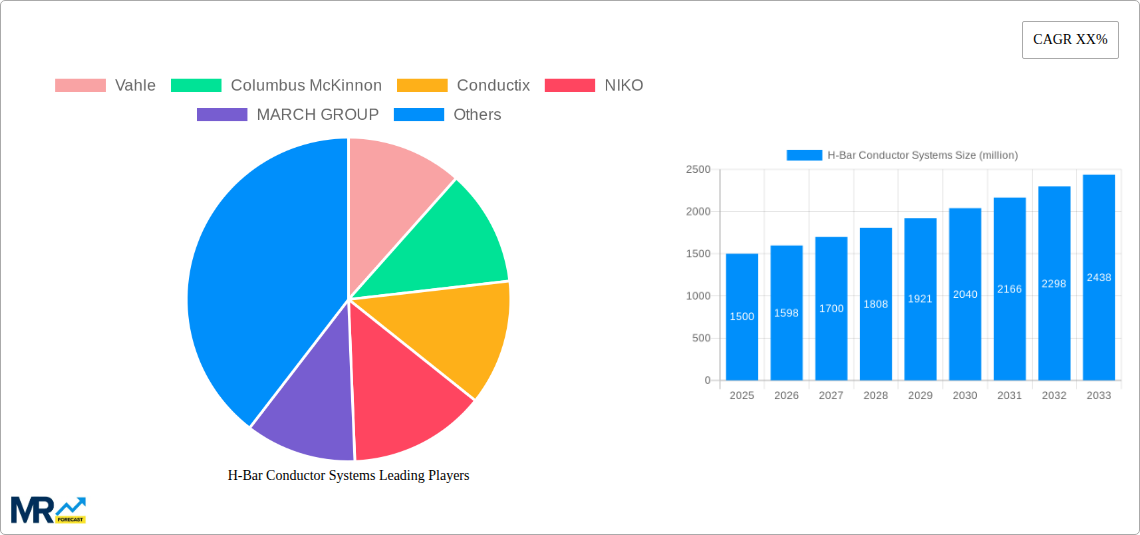

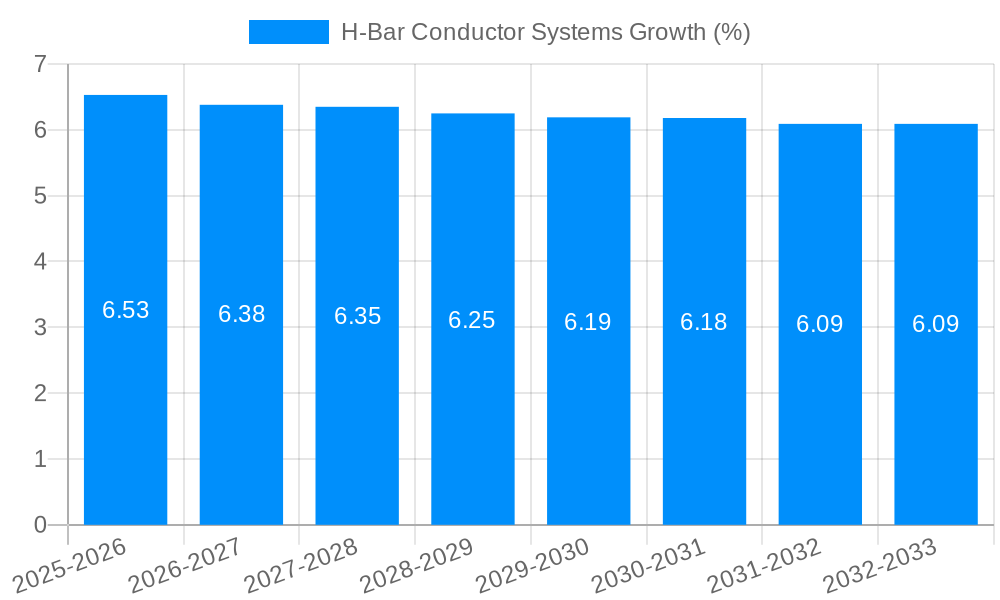

The H-Bar Conductor Systems market is poised for substantial growth, projected to reach a market size of approximately USD 1.5 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 6.5% for the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand for efficient and reliable power delivery solutions across burgeoning industrial sectors. Key applications such as industrial automation, warehousing and logistics, and rail transit are acting as significant growth catalysts. The increasing adoption of automated systems in manufacturing, coupled with the booming e-commerce sector necessitating advanced material handling in warehouses, directly fuels the need for robust conductor bar systems. Furthermore, the ongoing modernization and expansion of public transportation networks, particularly in rail transit, present a continuous and substantial opportunity for market players. The inherent benefits of H-Bar conductor systems, including their durability, safety features, and flexibility in design, make them an attractive choice for these demanding environments.

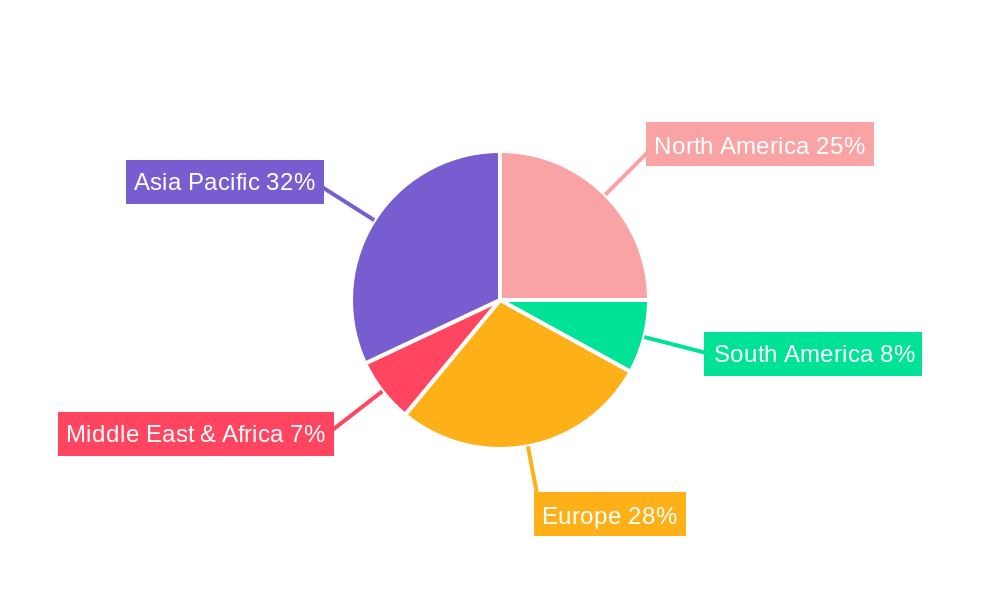

The market's trajectory is further shaped by several key trends and restraints. Emerging trends include the integration of smart technologies for enhanced monitoring and predictive maintenance of conductor systems, as well as the development of more energy-efficient and environmentally friendly conductor materials. The growing emphasis on workplace safety and operational efficiency across industries strongly supports the adoption of these advanced systems. However, the market also faces certain restraints, such as the initial capital investment required for installation and the availability of alternative power transmission technologies in niche applications. Geographically, the Asia Pacific region, particularly China and India, is expected to dominate the market due to rapid industrialization and significant infrastructure development. North America and Europe will remain strong markets, driven by technological advancements and stringent safety regulations. The Middle East & Africa and South America are anticipated to exhibit considerable growth potential as developing economies invest in modernizing their industrial and transport infrastructure.

This report offers an in-depth analysis of the global H-Bar Conductor Systems market, spanning the historical period of 2019-2024 and projecting robust growth through 2033. Utilizing the Base Year of 2025 and a comprehensive Forecast Period of 2025-2033, this study provides critical insights into market trends, driving forces, challenges, regional dominance, and future growth catalysts. The market is expected to witness a significant surge in demand, with projections indicating a market size of several million units by the end of the forecast period. The detailed segmentation into Aluminum Conductor Bar and Copper Conductor Bar, alongside key application segments like Industrial Automation, Warehousing and Logistics, and Rail Transit, ensures a granular understanding of market dynamics. Industry developments and the competitive landscape featuring prominent players like Vahle and Columbus McKinnon are thoroughly examined.

The global H-Bar Conductor Systems market is poised for substantial expansion, fueled by the increasing adoption of automated systems across various industries and significant advancements in infrastructure development. During the Study Period (2019-2033), the market is projected to experience a compound annual growth rate (CAGR) that will translate into a market valuation in the millions of units. A key trend observed is the escalating demand for energy-efficient and robust conductor bar solutions, driven by the global push towards sustainability and operational optimization. Aluminum conductor bars, known for their lightweight nature and cost-effectiveness, are gaining traction, particularly in applications where weight is a critical factor. Simultaneously, copper conductor bars continue to hold their ground in high-demand environments due to their superior conductivity and durability. The Base Year (2025) marks a pivotal point for understanding current market penetration, while the Forecast Period (2025-2033) anticipates accelerated growth, particularly in emerging economies. The historical performance from 2019-2024 provides a foundational understanding of market evolution, highlighting early adoption patterns and technological refinements. The ongoing integration of smart technologies, such as IoT sensors for real-time monitoring of conductor performance and predictive maintenance, is emerging as another significant trend. This technological integration aims to enhance system reliability, reduce downtime, and improve overall operational efficiency, thereby contributing to the market's upward trajectory. Furthermore, the increasing complexity of automated manufacturing processes and the expansion of warehousing and logistics networks necessitate sophisticated and reliable power delivery systems, directly benefiting the H-Bar conductor systems market. The growing emphasis on electrification across various transportation sectors, including mass transit and automated guided vehicles (AGVs), further solidifies the demand for these systems. Market analysts predict that the confluence of these trends will lead to a dynamic and evolving landscape for H-Bar conductor systems in the coming years. The estimated market size for 2025 serves as a benchmark against which future growth can be measured, with expectations of substantial increases driven by innovation and global industrial expansion.

The growth of the H-Bar Conductor Systems market is being propelled by a confluence of powerful economic, technological, and industrial factors. A primary driver is the unyielding surge in Industrial Automation. As industries worldwide strive for greater efficiency, precision, and reduced labor costs, the deployment of automated machinery and robotics has become paramount. H-Bar conductor systems are indispensable for providing a continuous and reliable power supply to these moving components, such as cranes, automated guided vehicles (AGVs), and robotic arms, ensuring uninterrupted operation and optimized productivity. The exponential growth in Warehousing and Logistics is another significant propellant. The rise of e-commerce has fundamentally reshaped supply chains, demanding faster order fulfillment, more efficient inventory management, and sophisticated automated storage and retrieval systems (AS/RS). H-Bar conductor systems are crucial for powering the extensive networks of conveyor belts, automated cranes, and shuttles that form the backbone of modern warehouses. In the Rail Transit sector, the ongoing development and modernization of urban and intercity rail networks globally necessitate efficient and safe power collection systems. H-Bar conductor systems offer a robust and reliable solution for powering electric trains, trams, and light rail vehicles, contributing to cleaner and more sustainable transportation. Moreover, advancements in material science and manufacturing technologies are leading to the development of more durable, energy-efficient, and cost-effective H-Bar conductor systems, making them a more attractive proposition for a wider range of applications. The increasing global focus on electrification across all sectors, driven by environmental concerns and the need to reduce reliance on fossil fuels, also indirectly boosts the demand for reliable electrical power distribution systems like H-Bar conductors. These interwoven forces are collectively shaping a robust growth trajectory for the H-Bar conductor systems market.

Despite the promising growth outlook, the H-Bar Conductor Systems market faces several challenges and restraints that could impede its full potential. A significant restraint is the high initial capital investment required for the installation of comprehensive H-Bar conductor systems. While offering long-term operational benefits, the upfront cost can be a deterrent for smaller businesses or projects with tight budgets, especially when compared to more conventional, albeit less efficient, power delivery methods. Another challenge lies in complex installation and maintenance requirements. Proper installation necessitates specialized expertise to ensure safety and optimal performance. Furthermore, regular maintenance is crucial to prevent wear and tear, and unforeseen issues can lead to costly downtime if not addressed promptly by trained professionals. Technological obsolescence is a lurking concern. As the pace of technological advancement accelerates, there's a continuous need for H-Bar systems to evolve to meet emerging demands, such as higher power densities, increased data transmission capabilities, and enhanced safety features. Companies that fail to innovate and adapt risk being outcompeted by newer, more advanced solutions. Stringent safety regulations and standards across different regions, while essential for ensuring user safety, can also present a challenge. Adhering to diverse and evolving regulatory frameworks requires significant investment in research, development, and compliance, potentially slowing down product launches and market penetration. Furthermore, the availability of alternative power solutions, such as battery-powered systems for certain mobile applications or advanced cable management systems for less demanding scenarios, poses a competitive threat. These alternatives, while not always a direct replacement, can fulfill specific niche requirements, potentially cannibalizing market share for traditional H-Bar conductor systems. The global economic climate and potential recessions can also impact investment in capital-intensive infrastructure projects, thereby indirectly affecting the demand for H-Bar conductor systems. Finally, environmental concerns related to manufacturing processes and material sourcing for some components might also pose regulatory and public perception challenges.

The H-Bar Conductor Systems market is characterized by regional disparities in adoption and segment-specific dominance. Geographically, Asia-Pacific is projected to be the dominant region, driven by rapid industrialization, extensive infrastructure development, and a burgeoning manufacturing sector, particularly in countries like China and India. The sheer scale of manufacturing operations, coupled with significant government investments in smart city initiatives and high-speed rail projects, creates a substantial and ever-growing demand for reliable power solutions. The region's focus on Industrial Automation and Warehousing and Logistics segments within this area is particularly pronounced.

Within the broader market, the Industrial Automation segment is expected to exhibit significant dominance. This is directly linked to the global trend of Industry 4.0, where interconnected smart factories rely heavily on automated processes. H-Bar conductor systems are the lifeblood of these automated environments, powering everything from robotic assembly lines and automated guided vehicles (AGVs) to material handling equipment and automated inspection systems. The continuous need for reliable, high-speed power delivery to moving machinery in these dynamic settings makes H-Bar systems an indispensable component.

Furthermore, the Warehousing and Logistics segment is another major contributor to market dominance, especially in an era defined by the exponential growth of e-commerce. The development of massive, highly automated fulfillment centers, distribution hubs, and sorting facilities worldwide necessitates sophisticated power infrastructure. H-Bar conductor systems are critical for powering automated storage and retrieval systems (AS/RS), conveyor belts, shuttle systems, and AGVs that operate within these complex environments. The efficiency and speed demands of modern logistics operations directly translate into a sustained demand for these power solutions.

In terms of product type, while both Aluminum Conductor Bar and Copper Conductor Bar will see growth, the Aluminum Conductor Bar segment is likely to witness a faster growth rate in certain applications due to its inherent advantages of being lightweight and cost-effective. This makes it particularly suitable for applications where weight is a concern, such as in certain types of automated cranes or mobile industrial equipment. However, Copper Conductor Bar will continue to hold its ground in applications demanding superior conductivity, higher current carrying capacity, and greater durability, such as in heavy-duty industrial settings and certain rail transit applications.

The Rail Transit segment, while perhaps not as broadly dominant as Industrial Automation or Warehousing, is a critical and growing area, especially in regions with significant investments in public transportation infrastructure and high-speed rail networks. The need for safe, reliable, and efficient power collection for electric trains, trams, and metro systems makes H-Bar conductor systems a vital component of modern rail infrastructure.

The interplay of these segments and the geographical concentration of industrial activity and infrastructure development will define the contours of market leadership. The Base Year (2025) provides a snapshot of these current dynamics, while the Forecast Period (2025-2033) anticipates continued expansion and potential shifts in dominance based on emerging technologies and investment patterns. The estimated market size in millions of units reflects the significant global demand across these key segments and regions.

Several key factors are acting as growth catalysts for the H-Bar Conductor Systems industry. The relentless drive towards Industry 4.0 and smart manufacturing is a primary catalyst, demanding increasingly sophisticated and reliable power solutions for automated systems. The exponential growth in e-commerce and the subsequent expansion of warehousing and logistics infrastructure is creating a massive demand for powered material handling equipment. Furthermore, government investments in public transportation and rail networks globally, aiming for sustainable and efficient mobility, are significant growth drivers. Advancements in material science and manufacturing techniques are leading to more cost-effective, durable, and energy-efficient H-Bar conductor systems, broadening their applicability.

This report provides an exhaustive exploration of the H-Bar Conductor Systems market, meticulously detailing market dynamics from 2019 to 2033. Leveraging the Base Year of 2025 and projecting through the Forecast Period of 2025-2033, it offers unparalleled insights into market trends, growth drivers, and significant challenges. The study's comprehensive nature extends to analyzing specific product types like Aluminum and Copper Conductor Bars, and key application segments such as Industrial Automation, Warehousing and Logistics, and Rail Transit. It identifies dominant regions and segments, highlighting their growth trajectories and market share. The report also elucidates the crucial growth catalysts fueling the industry's expansion, alongside a thorough listing of leading global players and their contributions. Detailed examination of significant industry developments, including technological advancements and strategic initiatives, further enriches the report's value. The estimated market size, presented in millions of units, underscores the substantial economic significance and future potential of the H-Bar Conductor Systems sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vahle, Columbus McKinnon, Conductix, NIKO, MARCH GROUP, Vilma, TransTech, Metreel, Liftsmart, ESARIS Industries, Wuxi Yingtuo Technology, Shanghai Skyland Electric Group, Sanming Jinda Mechanical and Electric Equipment, Dema Electric, Tianbao, Yangzhou Suzhong Power Equipment, Yangzhou Huayu Electrical Equipment, Wuxi Bathong Transmission Electric, Yangzhou Fengyue Electric, KLIFTING INDUSTRY.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "H-Bar Conductor Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the H-Bar Conductor Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.