1. What is the projected Compound Annual Growth Rate (CAGR) of the Fully Automatic Three-Temperature Test Probe Station?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fully Automatic Three-Temperature Test Probe Station

Fully Automatic Three-Temperature Test Probe StationFully Automatic Three-Temperature Test Probe Station by Type (8-Inch Three-Temperature Probe Station, 12-Inch Three-Temperature Probe Station, Others, World Fully Automatic Three-Temperature Test Probe Station Production ), by Application (IDMs, OSAT, Others, World Fully Automatic Three-Temperature Test Probe Station Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

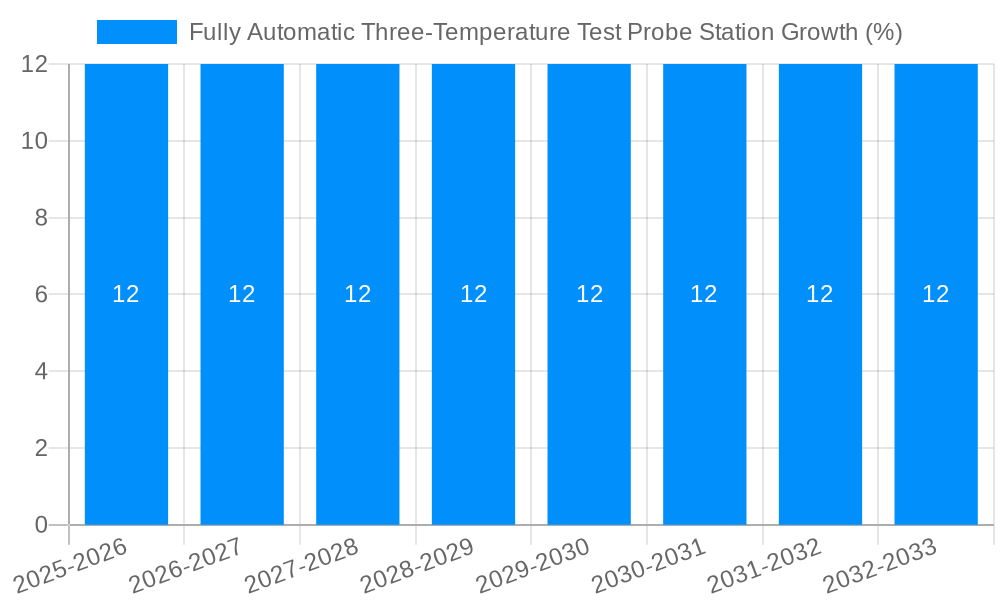

The global Fully Automatic Three-Temperature Test Probe Station market is poised for robust expansion, driven by the escalating demand for advanced semiconductor testing solutions. With a projected market size of approximately $1.5 billion in 2025, the industry is set to experience a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This growth is significantly fueled by the burgeoning semiconductor industry, characterized by increasing chip complexity, miniaturization, and the relentless pursuit of higher performance and reliability. Key drivers include the rapid adoption of 5G technology, the proliferation of Artificial Intelligence (AI) and Machine Learning (ML) applications, the expansion of the Internet of Things (IoT) ecosystem, and the continuous innovation in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), all of which necessitate rigorous and efficient semiconductor testing at multiple temperature points. The ability of these probe stations to accurately assess device performance under extreme thermal conditions is paramount for ensuring quality and preventing failures in demanding environments.

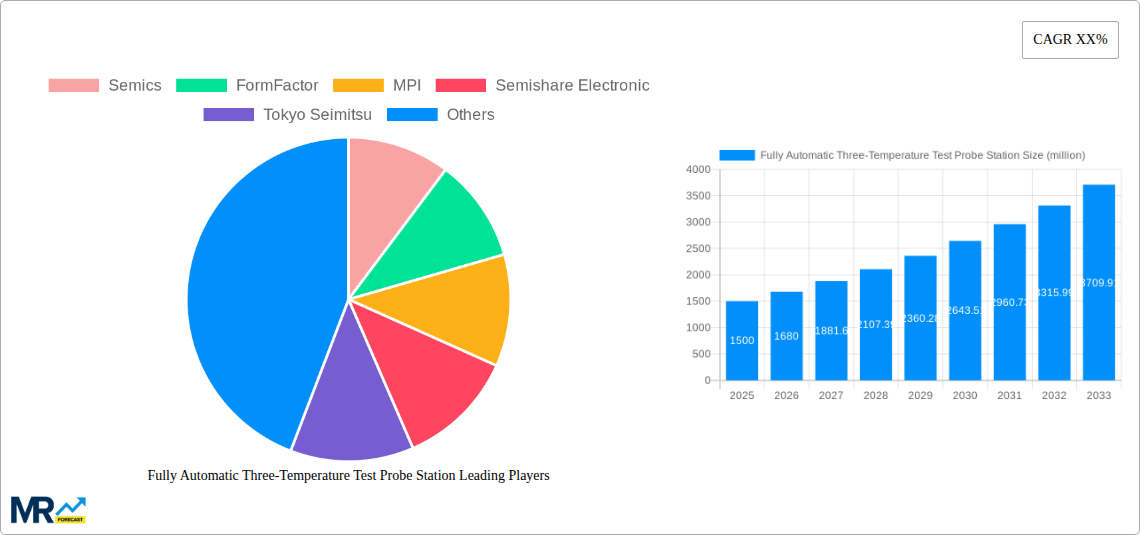

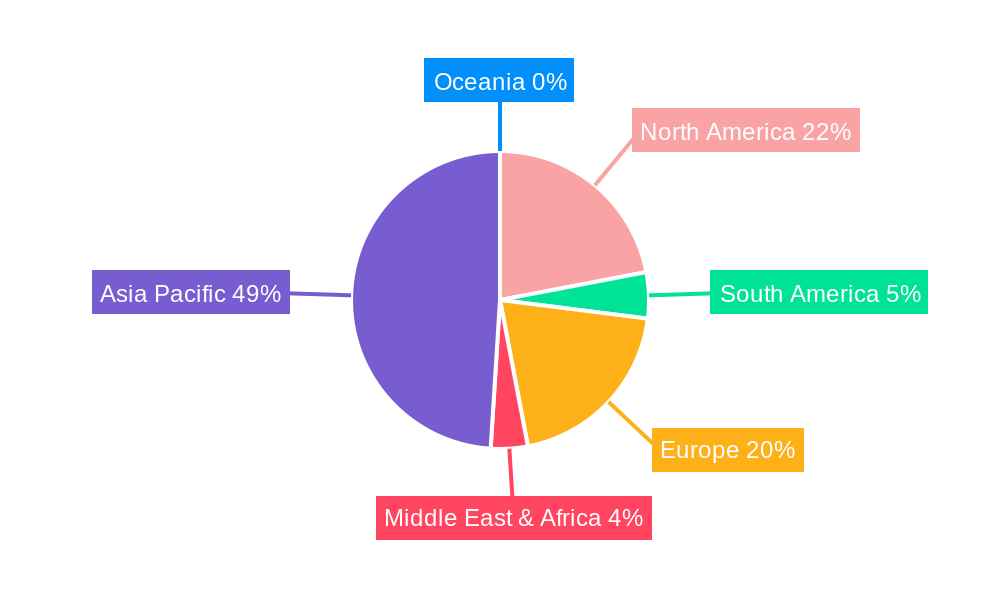

The market is segmented by probe station type, with 8-Inch and 12-Inch Three-Temperature Probe Stations commanding significant shares, catering to the diverse needs of semiconductor manufacturers. The "Others" category, likely encompassing specialized or next-generation probe station variants, is also expected to grow. On the application front, Integrated Device Manufacturers (IDMs) and Outsourced Semiconductor Assembly and Test (OSAT) providers are the primary end-users, relying on these stations for crucial wafer-level testing. Emerging applications, though smaller in current market share, represent significant growth potential. Geographically, Asia Pacific, led by China and South Korea, is anticipated to be the largest and fastest-growing market, owing to its dominance in semiconductor manufacturing. North America and Europe also represent substantial markets, driven by technological advancements and a strong presence of leading semiconductor companies like Semics, FormFactor, and MPI. Restraints, such as the high initial investment cost and the need for skilled labor to operate and maintain these sophisticated systems, are present but are expected to be mitigated by the overwhelming demand for advanced testing capabilities.

This comprehensive report delves into the global Fully Automatic Three-Temperature Test Probe Station market, providing an in-depth analysis of its trends, drivers, challenges, and future outlook. Spanning a study period from 2019 to 2033, with a base year of 2025, the report meticulously examines historical data (2019-2024) and offers precise forecasts for the period 2025-2033. The market is segmented by Type, including the dominant 8-Inch and 12-Inch Three-Temperature Probe Stations, as well as the burgeoning "Others" category, encompassing next-generation and specialized systems. It also scrutinizes production volumes, potentially reaching hundreds of millions of units. Applications are analyzed across key industry segments such as Integrated Device Manufacturers (IDMs) and Outsourced Semiconductor Assembly and Test (OSAT) providers, as well as other crucial players in the semiconductor ecosystem. This report is an essential resource for stakeholders seeking to understand the dynamics of this critical segment of semiconductor testing, with a market valuation projected to exceed billions of dollars.

The global Fully Automatic Three-Temperature Test Probe Station market is undergoing a significant evolution, driven by the insatiable demand for advanced semiconductor devices and the increasing complexity of their manufacturing processes. Over the historical period of 2019-2024, we witnessed a steady upward trajectory, fueled by the rapid expansion of the Internet of Things (IoT), 5G deployment, artificial intelligence (AI), and high-performance computing (HPC). These applications necessitate chips that operate reliably across a wide spectrum of temperatures, from extreme cold to high heat, a capability that only advanced three-temperature probe stations can effectively test. The base year of 2025 marks a pivotal point, where the market is expected to solidify its growth path, with projections indicating continued expansion throughout the forecast period of 2025-2033. The proliferation of wafer-level testing methodologies, coupled with the need for higher throughput and greater accuracy in testing, has propelled the adoption of fully automatic systems. These systems not only minimize human error but also significantly reduce testing time, thereby lowering the overall cost of production. The transition towards smaller node technologies, such as sub-10nm processes, presents new challenges in terms of probe contact and signal integrity at extreme temperatures, further emphasizing the critical role of sophisticated three-temperature probe stations. Market insights suggest that advancements in XYZ motion control, probe card management, and environmental chamber technology are key trends shaping product development. Furthermore, the increasing need for data analysis and integration with factory automation systems is driving the demand for probe stations with enhanced software capabilities and connectivity. The market value, projected to reach hundreds of millions of dollars, is a testament to the indispensable nature of these testing solutions in ensuring the quality and performance of modern semiconductors. The industry is also seeing a trend towards modular and scalable probe station designs, allowing manufacturers to adapt to evolving testing needs and wafer sizes.

The Fully Automatic Three-Temperature Test Probe Station market is experiencing robust growth, propelled by a confluence of powerful forces shaping the semiconductor industry. The relentless miniaturization and increasing sophistication of semiconductor chips, especially those designed for demanding applications like AI, automotive electronics, and high-frequency communication (5G/6G), are paramount drivers. These advanced chips must perform flawlessly across a broad temperature range, from the frigid environments of space applications or industrial machinery to the high heat generated during intensive computations. Fully automatic three-temperature probe stations are indispensable for verifying this critical performance characteristic, ensuring reliability and preventing costly field failures. The surge in demand for these advanced chips across various sectors, including consumer electronics, data centers, and the burgeoning electric vehicle (EV) market, directly translates into a higher demand for the testing infrastructure required to produce them at scale. Furthermore, the shift towards wafer-level testing, a more efficient and cost-effective method compared to individual die testing, further amplifies the need for highly automated and precise probe station solutions. The drive for increased manufacturing efficiency and reduced operational costs within the semiconductor industry also plays a significant role. Fully automatic systems streamline the testing process, reduce manual intervention, minimize human error, and thereby enhance throughput and yield. As the global semiconductor manufacturing base continues to expand, particularly in Asia, the demand for advanced testing equipment, including three-temperature probe stations, is expected to surge. The continuous innovation in probe technology, environmental control systems, and data analysis capabilities within these probe stations is also a key factor sustaining market momentum.

Despite the promising growth trajectory, the Fully Automatic Three-Temperature Test Probe Station market faces several significant challenges and restraints that could temper its expansion. The most prominent constraint is the exceptionally high capital investment required for these sophisticated pieces of equipment. Fully automatic three-temperature probe stations represent a substantial financial outlay, often running into millions of dollars per unit. This high cost can be a significant barrier for smaller or emerging semiconductor manufacturers, limiting their access to cutting-edge testing capabilities and potentially widening the gap between industry leaders and smaller players. Moreover, the technical complexity of these systems necessitates highly skilled personnel for operation, maintenance, and calibration. The shortage of such specialized technicians in some regions can impede efficient deployment and utilization, leading to underperformance or increased downtime. The rapid pace of technological advancement in semiconductor manufacturing also poses a challenge. As wafer sizes increase (e.g., from 8-inch to 12-inch and beyond) and chip designs become more intricate, probe stations need continuous upgrades or replacements to remain compatible and effective. This rapid obsolescence cycle adds to the overall cost of ownership. Geopolitical factors and supply chain disruptions can also impact the availability of critical components and the timely delivery of these complex machines, potentially leading to production delays and increased lead times. Furthermore, while automation is a key driver, the integration of these probe stations into existing fab environments can be complex and require significant infrastructure modifications, adding to the implementation hurdles. The stringent quality and reliability requirements of the semiconductor industry also mean that development and validation cycles for new probe station technologies can be lengthy, potentially delaying market introduction.

The global Fully Automatic Three-Temperature Test Probe Station market is poised for significant growth, with the 12-Inch Three-Temperature Probe Station segment expected to emerge as a dominant force, driven by the ongoing migration towards larger wafer formats in semiconductor manufacturing. This segment's ascendancy is intrinsically linked to the evolving landscape of chip production. As the industry increasingly adopts 12-inch (300mm) wafer processing for higher efficiency and economies of scale, the demand for probe stations capable of handling these larger wafers at extreme temperatures will naturally skyrocket. These larger wafers allow for more chips to be processed simultaneously, leading to a substantial reduction in per-unit manufacturing costs and an increase in overall production volume, potentially reaching hundreds of millions of units. The semiconductor giants, including Integrated Device Manufacturers (IDMs) and leading Outsourced Semiconductor Assembly and Test (OSAT) providers, are heavily investing in 12-inch fabrication facilities. Consequently, these entities will be the primary consumers of 12-inch three-temperature probe stations, driving substantial market share within this segment.

12-Inch Three-Temperature Probe Station: This segment is projected to witness the most significant growth and market dominance. The industry's continuous push towards larger wafer diameters for improved cost-effectiveness and higher yields directly fuels the demand for 12-inch probe stations. These systems are essential for testing the latest generations of semiconductor devices that are manufactured on these larger wafers. The intricate design and advanced functionality of chips intended for applications like AI, advanced networking, and high-performance computing require rigorous testing across a wide temperature spectrum, a capability that 12-inch three-temperature probe stations are specifically designed to provide. The increasing complexity of semiconductor geometries and the demand for higher reliability under diverse operating conditions further underscore the importance of this segment.

Asia-Pacific Region: This region is anticipated to be the leading market for Fully Automatic Three-Temperature Test Probe Stations, primarily due to the concentration of major semiconductor manufacturing hubs. Countries such as Taiwan, South Korea, China, and Japan are home to a vast number of IDMs and OSAT companies that are at the forefront of semiconductor innovation and production. The extensive investments in advanced manufacturing facilities, particularly those dedicated to 12-inch wafer processing, directly translate into a high demand for sophisticated testing equipment. The rapid growth of the electronics industry in Asia, driven by consumer demand for smartphones, smart devices, and automotive electronics, further necessitates a robust semiconductor supply chain, thus boosting the market for probe stations. The region's significant production capacities, aiming for hundreds of millions of units annually, require efficient and reliable testing solutions. The presence of global players like Tokyo Seimitsu and Tokyo Electron, with their strong manufacturing and R&D capabilities within Asia, also contributes to the region's dominance. The ongoing push by countries like China to achieve self-sufficiency in semiconductor manufacturing further amplifies the demand for advanced testing equipment.

The combination of the technological shift towards 12-inch wafers and the geographic concentration of semiconductor manufacturing in the Asia-Pacific region solidifies their position as the key drivers and dominators of the Fully Automatic Three-Temperature Test Probe Station market. The market value in this region is expected to represent a significant portion of the global market's hundreds of millions of dollars.

The Fully Automatic Three-Temperature Test Probe Station industry is being propelled by several key growth catalysts. The burgeoning demand for semiconductors in high-growth sectors like AI, 5G, IoT, and autonomous driving necessitates chips capable of operating reliably under extreme temperature conditions, directly fueling the need for advanced three-temperature testing. Furthermore, the global push towards electric vehicles (EVs) and their increasingly complex power electronics and battery management systems requires extensive temperature-stress testing, a critical function of these probe stations. The ongoing technological advancements in wafer processing, leading to smaller and more complex chip architectures, also demand more sophisticated and precise testing solutions, thereby spurring innovation and adoption. The increasing focus on product reliability and yield improvement across the semiconductor value chain, from IDMs to OSAT providers, further underscores the importance of robust temperature testing.

This comprehensive report provides an exhaustive analysis of the Fully Automatic Three-Temperature Test Probe Station market, offering invaluable insights for stakeholders. It delves into the intricate dynamics shaping the industry, including the technological advancements driving product innovation and the macroeconomic factors influencing market growth. The report details the production landscape, identifying key manufacturers and their market shares, and explores the application spectrum across critical segments like IDMs and OSATs. With detailed historical data from 2019-2024 and precise forecasts for 2025-2033, it offers a robust outlook on market size, segmentation, and regional dominance. The analysis of driving forces, challenges, and growth catalysts provides a holistic understanding of the market's potential and the obstacles it may encounter. This report serves as an indispensable tool for strategic decision-making, investment planning, and competitive analysis within the global semiconductor testing ecosystem, with projected market values in the hundreds of millions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Semics, FormFactor, MPI, Semishare Electronic, Tokyo Seimitsu, Tokyo Electron, MarTek (Electroglas), Wentworth Laboratories, ESDEMC Technology, Shen Zhen Sidea, FitTech, Hangzhou Changchuan Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fully Automatic Three-Temperature Test Probe Station," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fully Automatic Three-Temperature Test Probe Station, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.