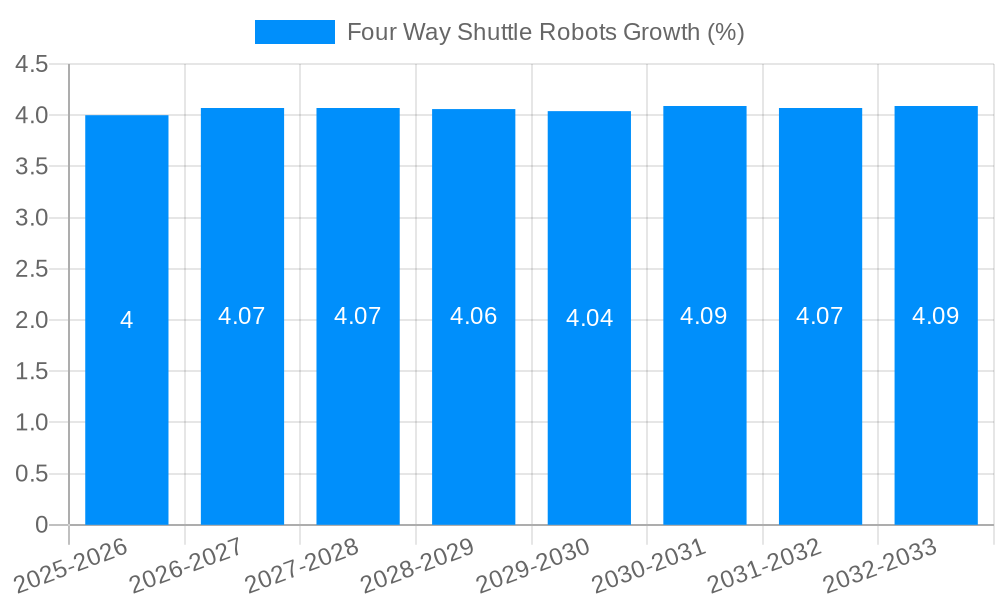

1. What is the projected Compound Annual Growth Rate (CAGR) of the Four Way Shuttle Robots?

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Four Way Shuttle Robots

Four Way Shuttle RobotsFour Way Shuttle Robots by Type (Single Layer, Multi Layer), by Application (Pharmaceuticals, Chemicals, Food, Electronics and Semiconductors, Cold chain, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

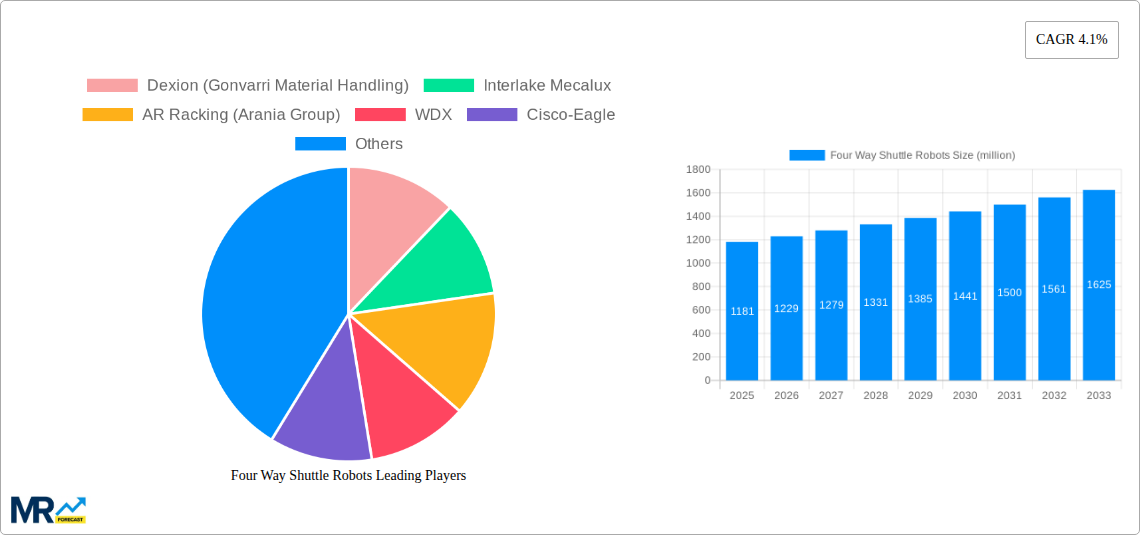

The global market for Four Way Shuttle Robots is poised for substantial growth, projected to reach approximately \$1,181 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This upward trajectory is propelled by a confluence of factors, primarily driven by the escalating demand for sophisticated automation solutions across diverse industries. Key among these drivers is the imperative for enhanced operational efficiency, reduced labor costs, and improved accuracy in warehousing and logistics operations. Industries like pharmaceuticals, chemicals, and food & beverages are increasingly adopting these robots to streamline their supply chains, manage inventory more effectively, and ensure the integrity of their products, especially within cold chain applications. The inherent flexibility and scalability of four-way shuttle robots, allowing for movement in four directions within aisles, make them an attractive investment for businesses looking to optimize space utilization and adapt to dynamic market demands.

Further fueling this market expansion are emerging trends such as the rise of e-commerce, which necessitates faster order fulfillment and more efficient inventory management, and the broader industrial automation revolution. The integration of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) into these robotic systems enhances their capabilities, enabling real-time data analysis, predictive maintenance, and seamless integration with other warehouse management systems. While the market benefits from these powerful drivers, it also faces certain restraints. High initial investment costs for deploying these advanced robotic systems can be a deterrent for smaller enterprises. Additionally, the need for skilled personnel to operate and maintain these sophisticated machines, along with potential integration challenges with existing infrastructure, present hurdles that manufacturers and solution providers are actively addressing through more user-friendly interfaces and comprehensive support services. The competitive landscape features a robust presence of both established players and emerging innovators, all vying to capture market share through technological advancements and strategic partnerships.

This report provides a comprehensive analysis of the global Four Way Shuttle Robots market, offering insights into market trends, driving forces, challenges, regional dominance, and key players. The study covers the historical period from 2019 to 2024, with the base year and estimated year set for 2025. The forecast period extends from 2025 to 2033, projecting the market's trajectory over the next decade. The report utilizes data in the million unit for its market size estimations and forecasts.

The global Four Way Shuttle Robots market is poised for significant expansion, driven by an escalating demand for sophisticated and efficient automated storage and retrieval systems (AS/RS). As businesses across various sectors grapple with the need to optimize warehouse operations, enhance throughput, and minimize human error, the adoption of four-way shuttle robots is witnessing an unprecedented surge. This trend is further amplified by the increasing complexity of supply chains and the growing emphasis on real-time inventory management. The evolution of robotics technology, including advancements in artificial intelligence, machine learning, and sensor technology, is directly contributing to the enhanced capabilities of four-way shuttle robots, making them more versatile, intelligent, and adaptable to diverse operational environments. The transition towards Industry 4.0 principles, characterized by interconnected systems and data-driven decision-making, is a pivotal factor underpinning the market's growth. Warehouses are increasingly being reimagined as smart hubs, and four-way shuttle robots are at the forefront of this transformation, offering seamless integration with other warehouse automation solutions like Automated Guided Vehicles (AGVs) and Warehouse Management Systems (WMS).

The market is also experiencing a diversification in product offerings. While multi-layer shuttle systems continue to dominate due to their high-density storage capabilities, there is a growing interest in single-layer solutions for specific applications where vertical space is limited or accessibility needs are paramount. The ongoing development of customized shuttle solutions tailored to the unique requirements of different industries, such as pharmaceuticals and cold chain logistics, is further broadening the market's appeal. This includes specialized robots designed to handle temperature-sensitive goods, hazardous chemicals, or fragile electronic components with utmost precision and safety. The increasing investment in research and development by leading manufacturers is leading to the introduction of robots with improved navigation capabilities, enhanced payload capacities, and superior energy efficiency. Furthermore, the growing trend of e-commerce and the subsequent rise in order fulfillment complexities are creating a fertile ground for the widespread adoption of four-way shuttle robots. Their ability to navigate in multiple directions and access any storage location within a grid system makes them ideal for high-mix, high-volume operations, thereby driving efficiency and reducing labor costs. The market is also seeing a geographic shift, with Asia-Pacific emerging as a dominant region due to rapid industrialization and substantial investments in automation infrastructure. The focus on sustainability and energy conservation within the logistics sector is also influencing the design and development of four-way shuttle robots, with manufacturers exploring more energy-efficient designs and operational strategies to reduce the carbon footprint of warehouse operations.

The global Four Way Shuttle Robots market is experiencing robust growth fueled by a confluence of powerful driving forces that are reshaping warehouse and logistics operations worldwide. A primary catalyst is the relentless pursuit of operational efficiency and productivity gains. Businesses are under immense pressure to reduce costs, accelerate order fulfillment times, and minimize errors. Four-way shuttle robots, with their ability to move in any direction within a dense storage grid, offer unparalleled flexibility and speed in retrieving and storing goods, significantly boosting throughput and optimizing space utilization. This is particularly crucial in industries facing high demand and complex inventory management, such as e-commerce, where rapid order processing is a key competitive differentiator.

Furthermore, the escalating labor costs and the persistent shortage of skilled warehouse workers are compelling companies to invest in automation. Four-way shuttle robots can perform repetitive and labor-intensive tasks with greater precision and consistency than human operators, thereby alleviating reliance on manual labor and mitigating the risks associated with workforce shortages. The inherent flexibility of these robots to adapt to varying warehouse layouts and storage needs, coupled with their ability to operate 24/7 with minimal downtime, further solidifies their position as a critical component of modern logistics. The increasing adoption of Industry 4.0 principles and the broader digitalization of supply chains are also playing a significant role. As warehouses become more interconnected and data-driven, the integration of four-way shuttle robots with Warehouse Management Systems (WMS) and other intelligent automation solutions allows for real-time tracking, advanced analytics, and proactive decision-making, leading to a more agile and responsive supply chain. The continuous advancements in robotics technology, including enhanced AI capabilities for navigation and obstacle avoidance, as well as improved sensor technologies for precise item identification, are making four-way shuttle robots more sophisticated and capable of handling a wider range of applications, thereby expanding their market reach.

Despite the promising growth trajectory, the Four Way Shuttle Robots market is not without its challenges and restraints that could impede its widespread adoption. One of the most significant hurdles is the substantial upfront investment required for the implementation of these advanced automation systems. The initial cost of purchasing the shuttle robots, along with the necessary infrastructure modifications, software integration, and installation, can be prohibitive for small and medium-sized enterprises (SMEs), limiting their access to this transformative technology. This capital-intensive nature of deployment often necessitates a thorough return on investment (ROI) analysis, which can be a lengthy and complex process.

Another key challenge is the technical complexity associated with the integration and maintenance of these sophisticated systems. Ensuring seamless compatibility with existing warehouse management systems (WMS) and other operational technologies requires specialized expertise. Furthermore, the ongoing maintenance, repair, and potential upgrades of these robotic systems necessitate a skilled technical workforce, which can be scarce and expensive to procure. Cybersecurity threats also pose a considerable risk. As these robots are connected to networks, they are vulnerable to cyberattacks that could disrupt operations, compromise sensitive data, or even lead to physical damage. Implementing robust cybersecurity measures adds another layer of complexity and cost to the deployment. Moreover, the adaptability of four-way shuttle robots to highly dynamic and unstructured warehouse environments can be a concern. While they excel in structured grid systems, operations involving highly variable product sizes, frequent layout changes, or exceptionally dense packing may present unique challenges that require custom solutions or may not be ideally suited for current shuttle robot capabilities. The need for a highly organized and standardized approach to inventory management and warehouse layout is also a prerequisite, which can be a significant organizational shift for many businesses. Finally, resistance to change from the existing workforce and the need for comprehensive training programs to upskill employees in operating and managing these new technologies can also present a significant implementation hurdle.

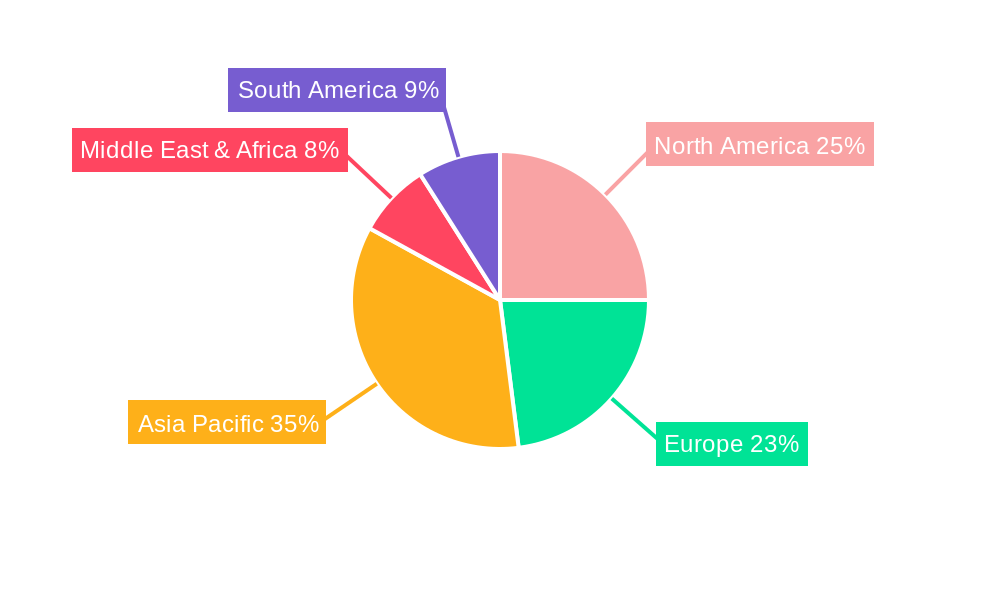

The Asia-Pacific region is projected to emerge as the dominant force in the global Four Way Shuttle Robots market, driven by a confluence of rapid industrialization, substantial investments in automation, and a burgeoning e-commerce sector. Countries like China, Japan, South Korea, and India are at the forefront of this growth, with governments actively promoting the adoption of advanced manufacturing and logistics technologies. China, in particular, stands out as a key player, not only as a significant consumer of four-way shuttle robots but also as an increasingly influential manufacturer and exporter of these systems. The country's vast manufacturing base, coupled with its ambitious "Made in China 2025" initiative, which emphasizes technological self-reliance and automation, has created a fertile ground for the widespread deployment of robotic solutions in warehouses and distribution centers. The sheer scale of China's logistics network, supporting both domestic consumption and global trade, necessitates highly efficient and scalable automation solutions like four-way shuttle robots to manage the immense volume of goods.

Furthermore, the rapid growth of e-commerce in Asia-Pacific, propelled by a large and increasingly tech-savvy population, is a critical factor driving demand. Online retail giants are heavily investing in optimizing their fulfillment operations, and four-way shuttle robots are proving to be indispensable for high-throughput, order-picking accuracy, and efficient space utilization in their distribution centers. The region's focus on smart city initiatives and the development of intelligent infrastructure also plays a role in fostering the adoption of advanced logistics automation.

Among the various segments, Multi Layer shuttle systems are anticipated to command a significant market share, particularly within the Food and Electronics and Semiconductors industries.

Multi Layer Shuttle Systems: These systems are designed for high-density storage, allowing for the stacking of shuttles across multiple levels within a warehouse. This maximizes vertical space utilization, which is crucial for industries dealing with a large volume of SKUs or requiring extensive storage capacity. The ability to efficiently access any item on any level, combined with the speed and accuracy of four-way navigation, makes multi-layer systems ideal for large-scale distribution centers and manufacturing facilities.

Food Industry Application: The food sector is increasingly adopting four-way shuttle robots, especially multi-layer systems, to manage its diverse inventory, maintain strict temperature control, and ensure rapid order fulfillment for both retail and direct-to-consumer channels. The demand for efficient cold chain logistics within this sector further amplifies the need for automated solutions that can operate reliably in challenging temperature environments. Multi-layer systems are particularly beneficial for food processing and distribution centers requiring substantial storage for packaged goods, raw materials, and finished products.

Electronics and Semiconductors Industry Application: The electronics and semiconductor industries are characterized by high-value, often fragile, components and a need for meticulous inventory management and rapid order processing. Multi-layer shuttle systems offer the precision, speed, and space optimization required to handle these demanding requirements. The ability to quickly retrieve specific components for assembly lines or to fulfill high-volume orders for consumer electronics makes these systems a critical investment for manufacturers and distributors in this sector. The stringent quality control and traceability needs of the semiconductor industry also align well with the automated tracking and management capabilities provided by four-way shuttle robots.

While other regions and segments will contribute to market growth, the combination of Asia-Pacific's industrial prowess and the inherent efficiency advantages of multi-layer shuttle systems in high-demand sectors like food and electronics positions them as the key growth drivers for the foreseeable future.

The Four Way Shuttle Robots industry is experiencing robust growth, largely propelled by the increasing imperative for operational efficiency and the relentless drive to optimize warehouse space. The escalating demand for automated solutions to mitigate rising labor costs and address worker shortages is a significant catalyst. Furthermore, the rapid expansion of e-commerce, with its associated complexities in order fulfillment and last-mile delivery, necessitates faster and more accurate picking and retrieval processes, which four-way shuttle robots excel at. Continuous technological advancements in robotics, AI, and sensor technology are enhancing the capabilities and versatility of these systems, making them more attractive for a broader range of applications. The global push towards Industry 4.0 and smart manufacturing is also a major growth driver, as businesses seek to integrate automation into their supply chains for improved visibility and data-driven decision-making.

This report offers a comprehensive overview of the global Four Way Shuttle Robots market, providing in-depth analysis and forecasts. It delves into the intricate dynamics of market trends, examining how technological advancements and evolving industry demands are shaping the landscape. The report meticulously analyzes the key driving forces, such as the quest for enhanced operational efficiency and the impact of e-commerce growth, that are propelling market expansion. Simultaneously, it addresses the significant challenges and restraints, including the high initial investment and integration complexities, that stakeholders need to navigate. Furthermore, the report highlights the dominant regions and key market segments, offering strategic insights into areas poised for substantial growth. It also identifies the leading players in the market and details significant developments and innovations, providing a holistic view of the industry's trajectory from 2019 to 2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include Dexion (Gonvarri Material Handling), Interlake Mecalux, AR Racking (Arania Group), WDX, Cisco-Eagle, Swisslog, Stow Group (Averys), KION Group, SSI Schaefer, Frazier Industrial, Nedcon, Beijing Kuangshi Technology, Hefei Jingsong Intelligent Technology, BlueSword Intelligent Technology, KENGIC Intelligent Technology, Damon-Group, Jiangsu Think Tank Intelligent Technology, Shanghai Zhishi Robot, Guangdong Lisen Automation, Zhixin Technology, SURAY Information Technology, Nanjing Inform Storage Equipment, Zhejiang Huazhang Technology, Shanghai Jingxing Storage Equipment Engineering, Jiangsu Ebil Intelligent Storage Technology, Niuyan Intelligent Logistics Equipment, Guangzhou Hld Logistic Equipment, Shanghai Enfon Robotics.

The market segments include Type, Application.

The market size is estimated to be USD 1181 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Four Way Shuttle Robots," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Four Way Shuttle Robots, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.