1. What is the projected Compound Annual Growth Rate (CAGR) of the Forest Fire Prevention Video Surveillance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Forest Fire Prevention Video Surveillance

Forest Fire Prevention Video SurveillanceForest Fire Prevention Video Surveillance by Type (Thermal Imaging Surveillance Camera, Infrared Surveillance Camera, Visible Light Surveillance Camera, Others), by Application (Mountainous Area and Forest Area, Nature Reserve, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

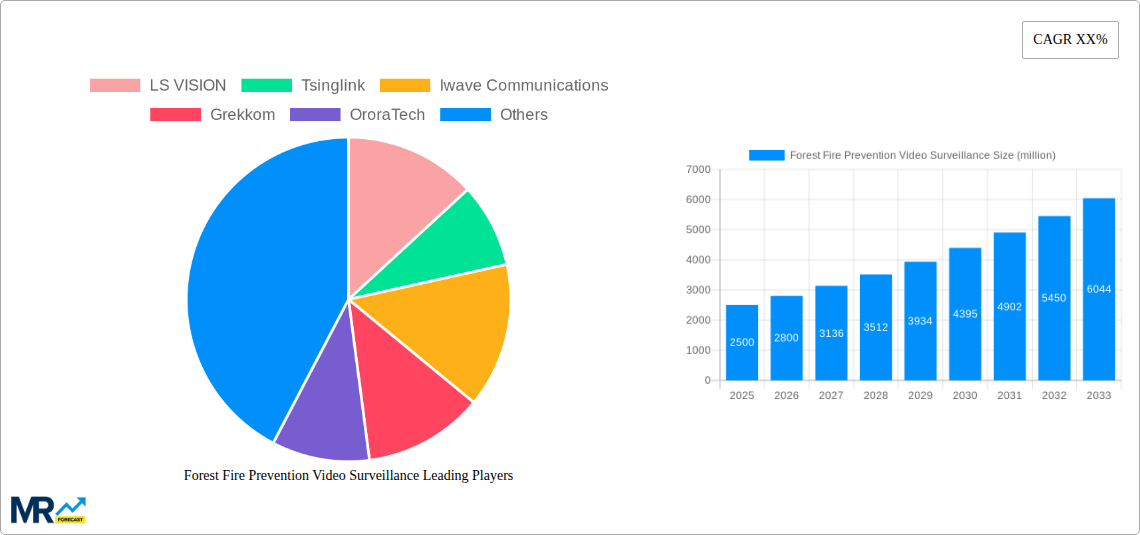

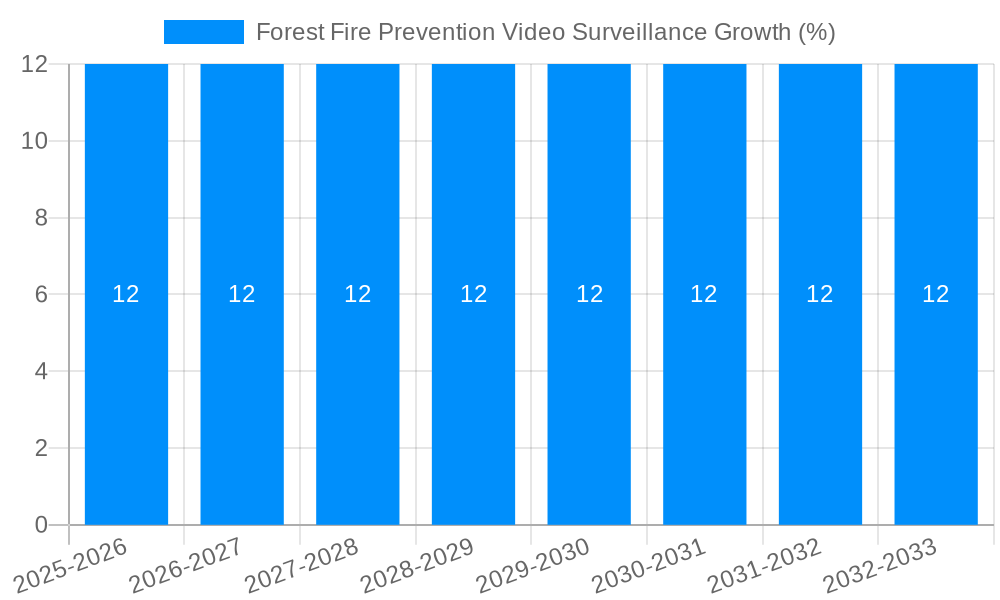

The global Forest Fire Prevention Video Surveillance market is poised for substantial growth, projected to reach approximately $2.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This expansion is primarily driven by escalating concerns over the frequency and severity of wildfires globally, coupled with increasing government investments in advanced fire detection and prevention technologies. The critical role of surveillance systems in early detection, real-time monitoring, and rapid response to mitigate damage and save lives is a paramount driver. Technological advancements, particularly in thermal imaging and AI-powered analytics, are enhancing the precision and efficiency of these systems, making them indispensable for environmental protection agencies and forestry departments. The market is segmented into thermal imaging surveillance cameras, infrared surveillance cameras, and visible light surveillance cameras, with thermal and infrared technologies leading due to their superior performance in low-light and adverse weather conditions, crucial for forest environments.

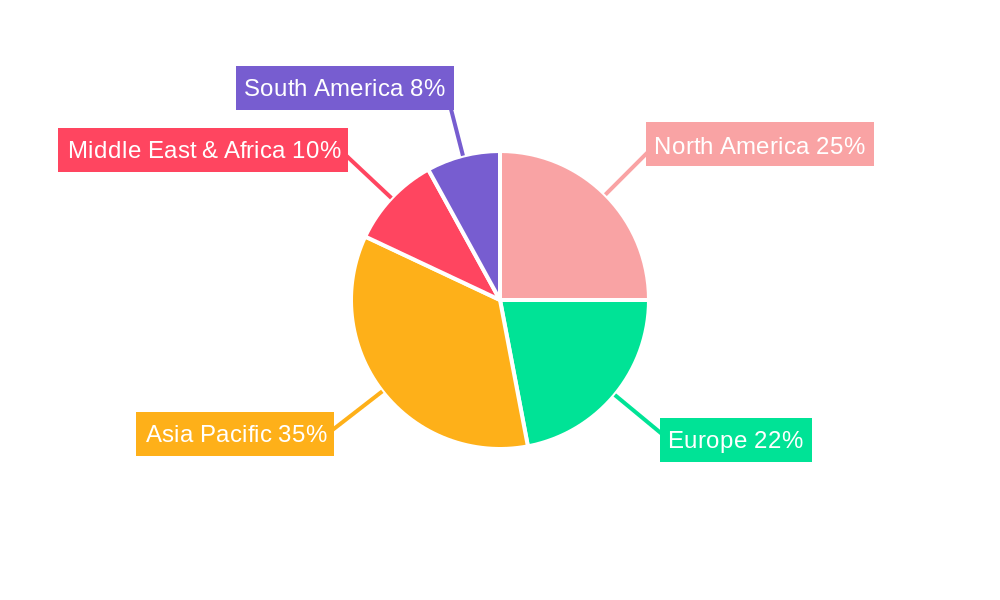

Geographically, the Asia Pacific region is expected to witness the fastest growth, driven by significant investments in fire prevention infrastructure, particularly in countries like China and India, which face considerable wildfire risks. North America and Europe are established markets with a strong focus on upgrading existing surveillance systems and integrating AI for predictive analysis. Restraints in the market include the high initial cost of advanced surveillance equipment and the challenges associated with deploying and maintaining these systems in remote and vast forest areas, requiring robust infrastructure and skilled personnel. However, the increasing adoption of cloud-based solutions and the development of more cost-effective, durable hardware are expected to overcome these limitations. Key players such as Hikvision, LS VISION, and OroraTech are actively innovating, offering integrated solutions that combine advanced imaging with data analytics to provide comprehensive forest fire prevention capabilities. The market’s trajectory indicates a strong future, driven by the imperative to safeguard natural resources and communities from the devastating impact of wildfires.

Here's a unique report description for Forest Fire Prevention Video Surveillance, incorporating your specified elements:

This in-depth report provides a meticulous analysis of the global Forest Fire Prevention Video Surveillance market, projecting a significant compound annual growth rate (CAGR) that will see market valuations surge from an estimated $2,500 million in 2025 to over $7,000 million by 2033. The study encompasses a comprehensive Study Period from 2019 to 2033, with a deep dive into the Historical Period (2019-2024), a detailed examination of the Base Year (2025), and an astute Estimated Year projection (2025), followed by a robust Forecast Period (2025-2033). We meticulously dissect key market drivers, emerging trends, and critical challenges, offering actionable insights for stakeholders across the value chain.

XXX The global forest fire prevention video surveillance market is witnessing an unprecedented surge, driven by increasing awareness of wildfire devastating impacts and the proactive adoption of advanced monitoring technologies. During the Study Period of 2019-2033, the market has transitioned from basic visual observation to sophisticated, AI-powered threat detection systems. The Base Year of 2025 marks a pivotal point where investments in smart surveillance solutions have solidified, with an estimated market size of approximately $2,500 million. This growth is further propelled by the escalating frequency and intensity of wildfires, particularly in Mountainous Area and Forest Area environments, which are highly susceptible to ignition. The integration of Thermal Imaging Surveillance Camera and Infrared Surveillance Camera technologies is no longer a niche application but a critical component of modern fire prevention strategies. These cameras can detect heat signatures invisible to the human eye, allowing for early identification of smoldering fires or hot spots before they escalate into full-blown infernos. Furthermore, the advancements in sensor technology and data analytics are enabling real-time alerts and predictive modeling, helping authorities to deploy resources more efficiently. The Forecast Period (2025-2033) is expected to witness an even more rapid expansion, with market valuations potentially exceeding $7,000 million. This exponential growth will be fueled by continued technological innovation, including the integration of drones, satellite imagery, and advanced AI algorithms for anomaly detection and trajectory prediction. The increasing adoption of these technologies in Nature Reserve areas, where ecological preservation is paramount, further underscores the market's expanding scope. As governments and private organizations globally prioritize climate change adaptation and mitigation, the demand for reliable and sophisticated forest fire prevention video surveillance systems will only intensify, making this a highly dynamic and strategically important market.

The expansion of the forest fire prevention video surveillance market is fundamentally propelled by an intensified global focus on mitigating the catastrophic economic, environmental, and social impacts of wildfires. The Historical Period (2019-2024) saw a marked increase in awareness following several severe wildfire seasons, underscoring the inadequacy of traditional response methods. This has translated into significant government and private sector investment, with the market expected to reach an estimated $2,500 million in Base Year 2025. A primary driver is the increasing frequency and severity of wildfires, directly linked to climate change and its exacerbating effects like prolonged droughts and higher temperatures. This necessitates proactive, round-the-clock monitoring, which video surveillance systems effectively provide. Furthermore, technological advancements, particularly in Thermal Imaging Surveillance Camera and AI-powered analytics, have made early detection and response far more achievable. These systems can identify heat signatures and smoke plumes with remarkable accuracy, even in challenging weather conditions or at long distances, enabling faster deployment of resources and potentially saving millions in damage costs. The growing adoption of these solutions in critical areas like Mountainous Area and Forest Area and Nature Reserve further solidifies this market's growth trajectory.

Despite the promising growth trajectory, the forest fire prevention video surveillance market faces several inherent challenges and restraints that could temper its expansion. One significant hurdle is the substantial initial capital investment required for comprehensive surveillance infrastructure, especially in vast and remote Mountainous Area and Forest Area terrains. Deploying and maintaining a network of high-resolution Thermal Imaging Surveillance Camera and Visible Light Surveillance Camera systems, along with the necessary power and connectivity, can be prohibitively expensive for some regions, particularly those with limited budgets. Furthermore, the operational costs associated with data storage, processing, and the constant need for system maintenance and upgrades also pose a considerable challenge. Another restraint is the technological complexity and the requirement for skilled personnel to operate and interpret the data generated by these advanced systems. In many areas prone to wildfires, there might be a lack of adequately trained technicians and analysts, leading to underutilization of the deployed technology. Additionally, environmental factors like extreme weather conditions, dust, and humidity can impact the performance and longevity of surveillance equipment, necessitating more robust and weather-resistant designs, which further adds to the cost. Regulatory hurdles and data privacy concerns in some regions might also slow down the widespread adoption of sophisticated surveillance networks.

The forest fire prevention video surveillance market is poised for significant growth across various regions and segments, with a pronounced dominance anticipated in specific areas and technological applications. North America, particularly the western United States and Canada, is expected to lead the market share in the Base Year of 2025, with an estimated market value contribution exceeding $800 million. This dominance is driven by the persistent threat of large-scale wildfires in regions like California, Oregon, and British Columbia, coupled with substantial government funding and a robust technological adoption rate. Similarly, Europe, specifically countries with extensive forest cover and a history of forest fires such as Spain, Portugal, and Scandinavia, will represent a significant market, projected to contribute over $600 million by 2025. The increasing adoption of advanced surveillance technologies in these regions is a direct response to climate change impacts, leading to more frequent and intense fire seasons.

Within the Segments:

Type: The Thermal Imaging Surveillance Camera segment is projected to be the most dominant, capturing an estimated market share of over 40% by 2025, valued at approximately $1,000 million. This is due to its unparalleled ability to detect heat signatures invisible to the naked eye, crucial for early fire detection, especially in low-visibility conditions or at night. Following closely will be the Infrared Surveillance Camera segment, accounting for around 30% of the market, valued at approximately $750 million, offering similar benefits for heat detection. Visible Light Surveillance Camera will constitute a substantial portion of the remaining market, valued at around $500 million, providing essential visual confirmation and situational awareness.

Application: The Mountainous Area and Forest Area application segment will undoubtedly be the largest, projected to command over 60% of the market by 2025, with an estimated value exceeding $1,500 million. These areas are inherently more prone to wildfires due to factors like dry vegetation, strong winds, and difficult terrain that hinders traditional response methods. Nature Reserve areas will also show considerable growth, representing approximately 25% of the market, valued at around $625 million, driven by the critical need for environmental protection and the preservation of biodiversity. The Others segment, encompassing industrial areas bordering forests and critical infrastructure, will fill the remaining market share.

The Forecast Period (2025-2033) is expected to see these trends solidify, with further market penetration of advanced technologies and expanding applications across emerging economies in Asia-Pacific and South America, as they increasingly adopt proactive fire management strategies.

Several key factors are acting as significant growth catalysts for the forest fire prevention video surveillance industry. The escalating frequency and intensity of wildfires globally, directly attributable to climate change and adverse weather patterns, are creating an urgent demand for effective detection and monitoring solutions. Advancements in sensor technology, particularly in thermal and infrared imaging, coupled with the integration of Artificial Intelligence (AI) for early detection and predictive analytics, are making surveillance systems more accurate and proactive. Government initiatives and increased public awareness regarding the devastating economic and environmental consequences of wildfires are also driving investments in advanced prevention technologies. Furthermore, the expanding deployment of these systems in remote and challenging terrains like Mountainous Area and Forest Area is opening up new market opportunities.

This comprehensive report offers a panoramic view of the forest fire prevention video surveillance market, projecting its valuation to grow from an estimated $2,500 million in Base Year 2025 to over $7,000 million by the end of the Forecast Period in 2033. It delves into the intricate interplay of market dynamics, technological advancements, and regulatory landscapes throughout the Study Period (2019-2033), with a granular analysis of the Historical Period (2019-2024). The report highlights critical trends, such as the increasing reliance on Thermal Imaging Surveillance Camera and AI-driven analytics for early detection, particularly in vulnerable Mountainous Area and Forest Area. It also dissects the driving forces, including the escalating impact of climate change on wildfire frequency and severity, and the growing government and private sector investments in proactive prevention measures. Furthermore, the report addresses the inherent challenges, such as high implementation costs and the need for skilled personnel, while identifying key regions like North America and segments like Thermal Imaging Cameras as dominant forces. Ultimately, this report serves as an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LS VISION, Tsinglink, Iwave Communications, Grekkom, OroraTech, Vexiza, Amplicam, PARATRONIC, Hikvision, HRT(HUARUICOM), Dali Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Forest Fire Prevention Video Surveillance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Forest Fire Prevention Video Surveillance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.