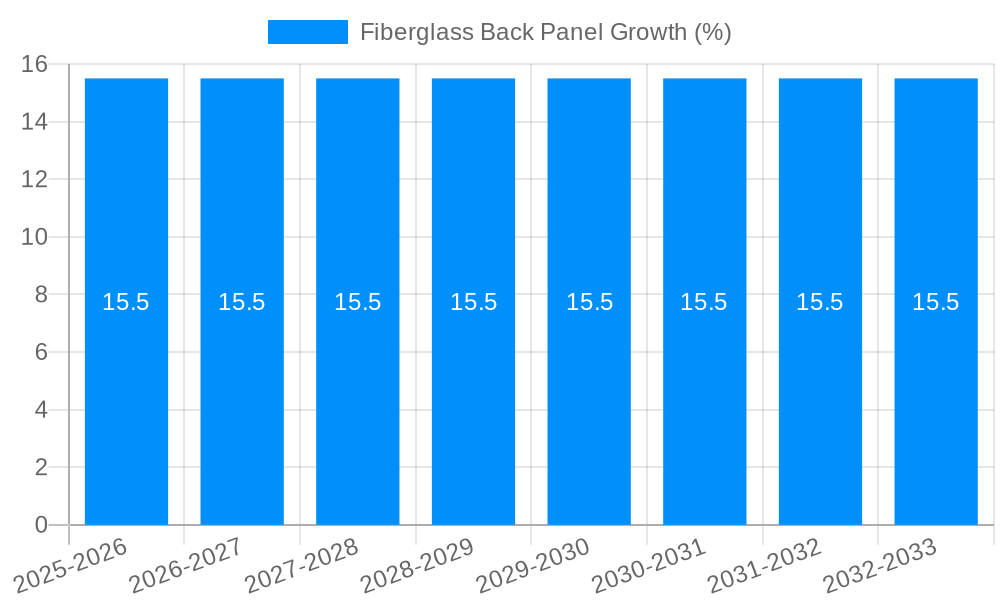

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiberglass Back Panel?

The projected CAGR is approximately 15.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fiberglass Back Panel

Fiberglass Back PanelFiberglass Back Panel by Type (2D Fiberglass Panel, 2.5D Fiberglass Panel, 3D Fiberglass Panel), by Application (Phone Back Panel, Tablet Back Panel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

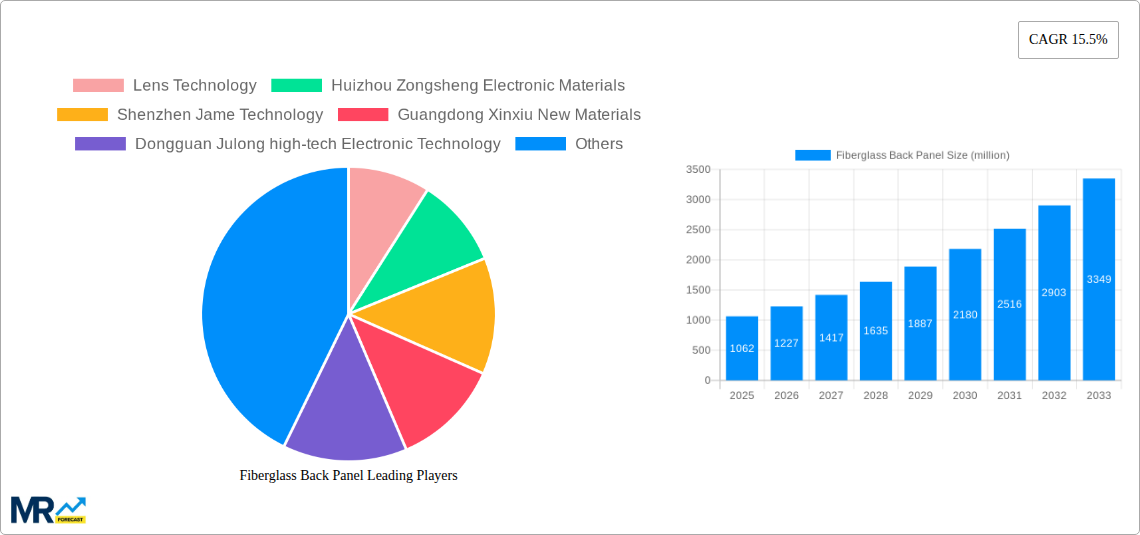

The global Fiberglass Back Panel market is poised for substantial growth, with a current market size valued at approximately $1062 million. Driven by a robust Compound Annual Growth Rate (CAGR) of 15.5%, the market is projected to experience dynamic expansion through 2033. This remarkable growth trajectory is primarily fueled by the escalating demand for lightweight, durable, and aesthetically appealing back panels in consumer electronics, particularly smartphones and tablets. Advancements in manufacturing technologies enabling more sophisticated designs, including 2.5D and 3D finishes, are further stimulating adoption. The increasing focus on material innovation for enhanced impact resistance and premium feel in mobile devices directly contributes to the market's upward momentum. Furthermore, the integration of fiberglass back panels in other electronic devices and emerging applications is expected to broaden the market's scope.

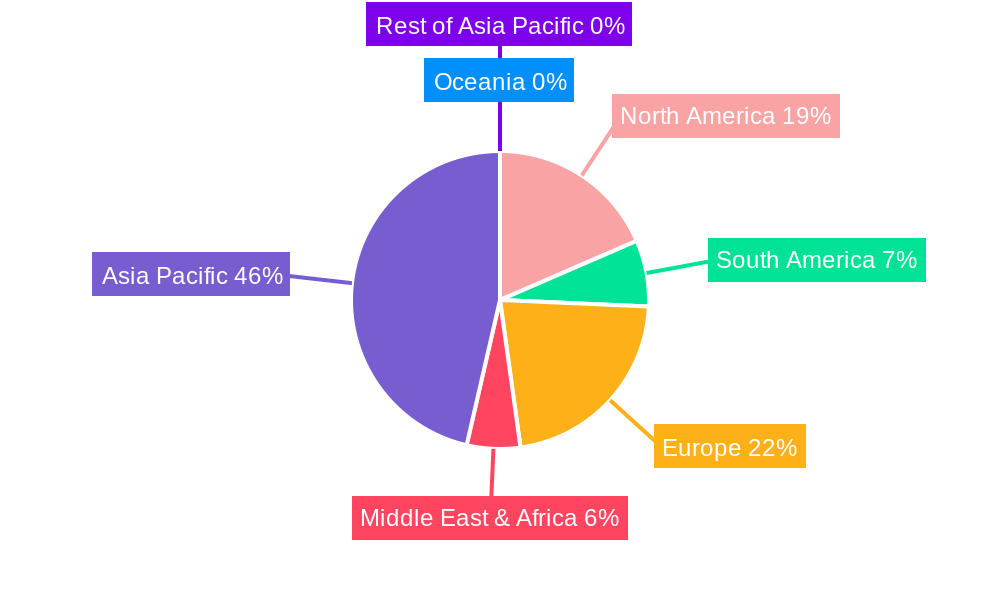

The market is segmented by type and application, with significant opportunities arising from the demand for 3D Fiberglass Panels and their widespread use in Phone Back Panels. Leading companies such as Lens Technology, Huizhou Zongsheng Electronic Materials, and Shenzhen Jame Technology are actively investing in research and development to capture market share. Geographically, the Asia Pacific region, led by China, is anticipated to dominate the market due to its strong manufacturing base and high consumer electronics penetration. However, North America and Europe also present considerable growth potential, driven by technological advancements and a growing consumer preference for premium mobile devices. While the market exhibits strong growth drivers, potential restraints could include fluctuations in raw material prices and the emergence of alternative materials that offer comparable performance and cost-effectiveness. Strategic collaborations and technological innovations will be crucial for market players to navigate these challenges and capitalize on the burgeoning opportunities.

This comprehensive report delves into the dynamic and rapidly evolving global Fiberglass Back Panel market, meticulously analyzing trends, driving forces, challenges, and future projections from 2019 to 2033. The Base Year for this analysis is 2025, with projections extending through the Forecast Period of 2025-2033, building upon insights from the Historical Period of 2019-2024. Our research leverages extensive market data, including revenue figures in the millions of US dollars, to provide a detailed and actionable understanding of this critical component within the electronics and other manufacturing sectors.

The fiberglass back panel market is experiencing a significant upward trajectory, driven by an increasing demand for lightweight, durable, and aesthetically pleasing materials in consumer electronics and beyond. Over the Study Period (2019-2033), the market has witnessed a consistent expansion, fueled by innovation in material science and evolving consumer preferences. In the Estimated Year (2025), the global market is projected to reach substantial figures, reflecting the growing integration of fiberglass back panels across a multitude of devices. This trend is particularly pronounced in the Phone Back Panel application, where the quest for slimmer, more robust, and scratch-resistant designs has made fiberglass a preferred material over traditional glass or metal. The market's growth is not monolithic; it is segmented by Type, with 3D Fiberglass Panels showing particularly robust growth due to their ability to accommodate complex curvatures and intricate designs essential for modern smartphone aesthetics and internal component integration. Furthermore, the Application of Tablet Back Panels also contributes significantly, as manufacturers seek to balance durability with portability. Beyond consumer electronics, the "Others" application segment, encompassing areas like automotive interiors, protective casings for industrial equipment, and even specialized furniture components, is demonstrating emergent potential, hinting at a diversified future for fiberglass back panels. Industry developments, such as advancements in manufacturing processes leading to cost reductions and enhanced material properties, are continuously reshaping the competitive landscape and opening new avenues for market penetration. The overall market sentiment points towards sustained and strong growth, driven by a confluence of technological advancements, shifting consumer demands, and an expanding scope of applications. The estimated market valuation in the millions of US dollars underscores the substantial economic impact and the increasing reliance on this versatile material.

The propelled growth of the fiberglass back panel market is primarily driven by the escalating demand for advanced materials that offer a superior balance of performance, aesthetics, and cost-effectiveness. In the consumer electronics sector, particularly for smartphones and tablets, manufacturers are constantly striving to create devices that are not only thinner and lighter but also more resistant to physical damage like scratches and drops. Fiberglass back panels excel in these areas, offering a robust yet remarkably lightweight alternative to traditional materials. Their inherent strength-to-weight ratio allows for devices that are more durable without compromising on portability, a key purchasing factor for consumers. Furthermore, the ability to mold fiberglass into complex shapes and designs, especially with the rise of 3D Fiberglass Panels, caters to the evolving aesthetic demands for sleek, curved, and visually appealing electronic devices. The technological advancements in manufacturing processes have also played a crucial role, enabling more efficient production and, consequently, more competitive pricing, making fiberglass back panels an increasingly attractive option for a wider range of products.

Despite the promising growth trajectory, the fiberglass back panel market is not without its challenges and restraints. One significant hurdle is the inherent complexity and cost associated with the manufacturing of high-quality fiberglass back panels, particularly for intricate 3D Fiberglass Panel designs. While advancements are being made, the initial investment in specialized machinery and the expertise required can be substantial, potentially limiting the adoption by smaller manufacturers or those with tighter budgets. Another concern revolves around the perception and integration of fiberglass compared to established materials like glass, which often carries a premium perception of sophistication and premium feel. Consumer education and marketing efforts are crucial to bridge this perception gap. Furthermore, while fiberglass offers good scratch resistance, its impact resistance can vary depending on the specific formulation and manufacturing process, leading to concerns about potential cracking or shattering under extreme force. Recycling and environmental disposal of fiberglass composites also present an ongoing challenge, requiring the development of more sustainable end-of-life solutions to align with growing environmental consciousness.

The global Fiberglass Back Panel market is poised for significant dominance by specific regions and segments, driven by concentrated manufacturing capabilities, robust consumer demand, and strategic industry developments.

Dominant Segment by Type: 3D Fiberglass Panel

The 3D Fiberglass Panel segment is projected to be a major growth engine and potential dominator within the market. This dominance stems from its superior design flexibility and its alignment with the latest trends in consumer electronics.

Dominant Segment by Application: Phone Back Panel

The Phone Back Panel application is anticipated to remain the largest and most influential segment within the fiberglass back panel market. This is a direct consequence of the sheer volume of smartphone production globally and the evolving requirements of this ubiquitous device.

Dominant Region/Country: Asia-Pacific (particularly China)

The Asia-Pacific region, with China as its manufacturing powerhouse, is expected to lead the fiberglass back panel market.

The fiberglass back panel industry is being propelled by several key growth catalysts. The relentless pursuit of lighter and more durable electronic devices by manufacturers is a primary driver, as fiberglass offers an excellent strength-to-weight ratio. Advances in composite manufacturing techniques are enhancing the material's aesthetic versatility and reducing production costs, making it a more viable option for a wider range of applications. Furthermore, the increasing demand for premium finishes and customizable designs in consumer electronics, particularly for 3D Fiberglass Panels, is creating significant market opportunities. The expanding use of fiberglass back panels in emerging sectors beyond traditional electronics, such as automotive interiors and protective casings, also acts as a significant growth catalyst.

This report provides an all-encompassing analysis of the global Fiberglass Back Panel market, offering a deep dive into its intricate dynamics. From the granular level of material science and manufacturing processes to the macro-level economic impacts and regional market leadership, every facet is meticulously examined. Our research delves into the historical evolution of the market, establishes a solid foundation with base year data, and extends to robust forecasts for the coming years. By understanding the key trends, driving forces behind market expansion, and the inherent challenges and restraints, stakeholders can gain invaluable insights into the present landscape and future trajectory of this vital industry. The report's comprehensive nature ensures that businesses can make informed strategic decisions, identify potential growth opportunities, and mitigate risks effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.5%.

Key companies in the market include Lens Technology, Huizhou Zongsheng Electronic Materials, Shenzhen Jame Technology, Guangdong Xinxiu New Materials, Dongguan Julong high-tech Electronic Technology, Hochuen Smart Technology, Zhejiang Zhaoyi Technology, Shenzhen Goldenken New Material, Dongguan Shengyi Technology, Dongguan ZhengWei Precision Plastic, Berne Optical, TONGDA GROUP, Huizhou Weibrass Precision Technology, Dongguan Tarry Electronics, Dongguan Haonianjing New Material Technology, Shenzhen Yimingyue Technology, Dongguan Renshan Precision Technology, Dongguan Weiside New Material Technology, Dongguan Houbo Precision Plastic Technology, Guangdong Fastway New Materials.

The market segments include Type, Application.

The market size is estimated to be USD 1062 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fiberglass Back Panel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fiberglass Back Panel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.