1. What is the projected Compound Annual Growth Rate (CAGR) of the Encoder?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Encoder

EncoderEncoder by Type (Rotary Encoder, Linear Encoder, World Encoder Production ), by Application (Machine Tools, Robots, Packaging Equipment, Conveyor, Textile Machinery, Construction Mchinery, Medical Equipment, Elevators, Automotive, World Encoder Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

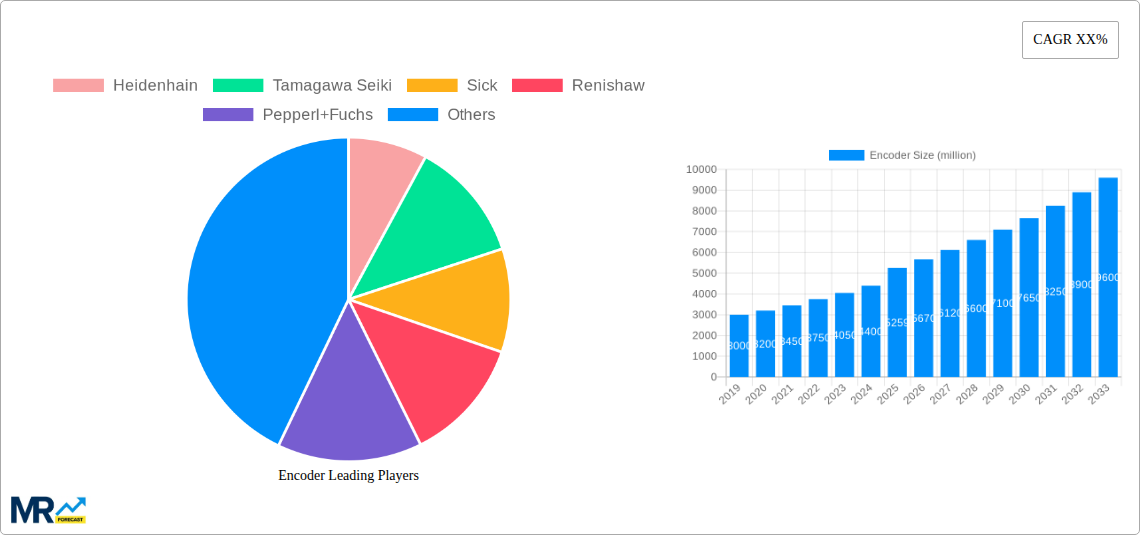

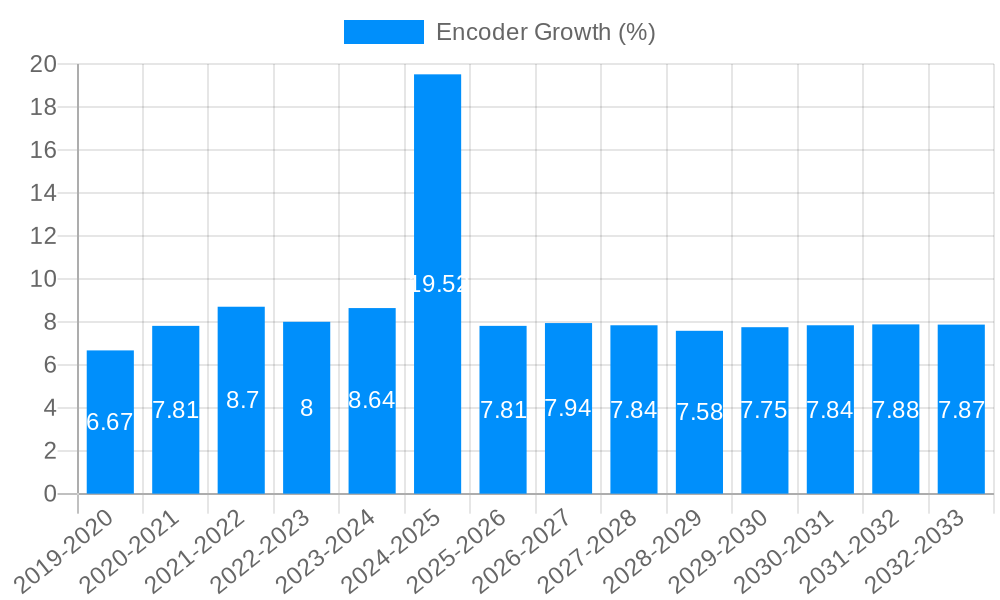

The global encoder market is poised for significant expansion, projected to reach a valuation of $5,259 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% expected over the forecast period of 2025-2033, indicating a dynamic and expanding industry. Key drivers fueling this ascent include the burgeoning demand for automation across diverse sectors, the increasing sophistication of industrial machinery requiring precise motion control, and the rapid adoption of advanced robotics in manufacturing and logistics. Furthermore, the growing implementation of encoders in medical equipment for enhanced diagnostic accuracy and surgical precision, alongside their critical role in the automotive industry for advanced driver-assistance systems (ADAS) and electric vehicle powertrains, are substantial contributors to market momentum. The continuous innovation in encoder technology, focusing on miniaturization, increased resolution, and improved robustness, further propels market penetration.

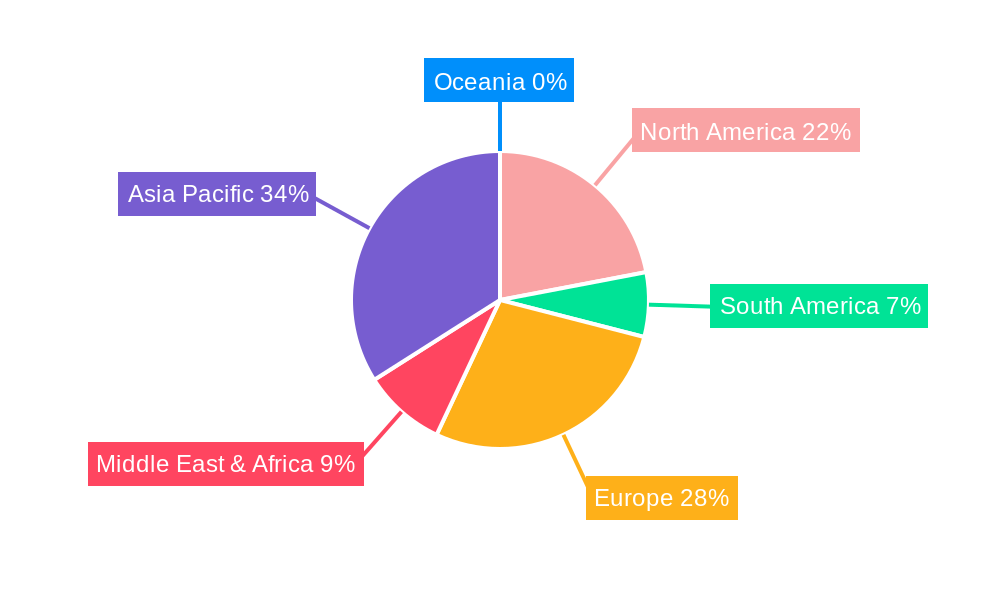

The encoder market is segmented into distinct types, with Rotary Encoders and Linear Encoders dominating global production. Applications are widespread, with Machine Tools, Robots, and Packaging Equipment representing the largest segments due to their high reliance on accurate positional feedback. Other significant application areas include Conveyor Systems, Textile Machinery, Construction Machinery, Medical Equipment, Elevators, and the Automotive sector. Geographically, Asia Pacific is anticipated to be the largest and fastest-growing regional market, driven by China's extensive manufacturing base and substantial investments in automation and Industry 4.0 initiatives. North America and Europe also represent mature yet continuously expanding markets, driven by technological advancements and the ongoing trend of smart manufacturing. Restraints such as the high initial cost of advanced encoder systems and potential cybersecurity concerns in networked applications might temper growth in certain segments, but the overarching trend is one of strong and sustained market expansion.

This report offers an in-depth analysis of the global encoder market, meticulously examining trends, drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with a base year of 2025, providing a robust historical context and a clear forecast for the coming decade. The research meticulously analyzes the market landscape, dissecting it by product type, application, and geographical region, and offers actionable insights for stakeholders navigating this dynamic sector. The estimated market size, valued in the millions, reflects the significant and growing importance of encoders across a multitude of industrial applications. The report leverages detailed data from the historical period (2019-2024) to accurately project the market trajectory for the forecast period (2025-2033), ensuring a reliable outlook on its future performance.

The global encoder market is currently experiencing a robust expansion, driven by the relentless integration of automation and advanced manufacturing processes across diverse industries. The advent of Industry 4.0 has significantly amplified the demand for precise and reliable position and speed feedback solutions, making encoders indispensable components in modern machinery and systems. A key trend observed is the increasing adoption of smart encoders, equipped with advanced diagnostic capabilities, predictive maintenance features, and enhanced connectivity options, facilitating seamless integration into IoT ecosystems. This evolution is not merely about capturing data but about leveraging that data for operational optimization and efficiency gains, a paradigm shift that is reshaping industrial automation. The demand for higher resolution and accuracy in encoders continues to escalate, particularly in applications where even minute deviations can have substantial consequences, such as in robotics, medical equipment, and high-precision machine tools. Furthermore, the market is witnessing a surge in the development and deployment of miniaturized and ruggedized encoders designed to withstand harsh environmental conditions, expanding their applicability into sectors like construction machinery and heavy industries. The shift towards wireless encoders is also gaining traction, offering greater flexibility in installation and reducing cabling complexities, a significant advantage in complex robotic systems and large-scale automated facilities. The growing emphasis on energy efficiency and reduced power consumption is also influencing encoder design, with manufacturers focusing on developing low-power solutions. The market is characterized by a strong underlying growth in emerging economies, where industrialization and the adoption of automated technologies are rapidly accelerating. The continuous innovation in encoder technologies, including advancements in sensing mechanisms and signal processing, ensures that the market remains at the forefront of industrial automation, constantly adapting to meet evolving industry needs and technological frontiers. The projected market valuation, reaching several million units, underscores the substantial economic impact and the indispensable role of encoders in the global manufacturing landscape.

The escalating demand for automation and the relentless pursuit of enhanced operational efficiency across various industries are the primary engines driving the global encoder market. The widespread adoption of Industry 4.0 principles, characterized by interconnected systems, data-driven decision-making, and smart manufacturing, necessitates precise and reliable feedback mechanisms for position, speed, and angle detection. Encoders, by their very nature, provide this critical data, making them foundational components in automated systems. The booming robotics sector, in particular, is a significant contributor, as robotic arms and autonomous mobile robots rely heavily on encoders for accurate movement control and navigation. Similarly, the continuous evolution of machine tools towards greater precision, speed, and automation fuels the demand for high-performance encoders. The growth of sectors like packaging and material handling, which are increasingly reliant on automated conveyor systems and sorting machinery, further bolsters encoder sales. Moreover, the burgeoning medical equipment industry, where precision and reliability are paramount, utilizes encoders in diagnostic imaging, surgical robots, and patient monitoring devices. The automotive industry's transition towards electric vehicles and advanced driver-assistance systems (ADAS) also contributes, as encoders are integral to steering systems, motor control, and sensor integration. The development of smart factories, where real-time data acquisition and analysis are crucial for optimizing production, is another powerful catalyst. The continuous need for improved product quality, reduced waste, and increased throughput across manufacturing sectors compels companies to invest in advanced automation solutions, with encoders playing a pivotal role in achieving these objectives.

Despite the robust growth trajectory, the global encoder market faces several challenges that could potentially temper its expansion. One significant restraint is the high initial cost associated with advanced, high-precision encoders, which can be a barrier to adoption for small and medium-sized enterprises (SMEs) or in cost-sensitive applications. While the long-term benefits of precision and efficiency are evident, the upfront investment can be substantial. Technological obsolescence is another concern, as the rapid pace of technological advancements can render existing encoder technologies outdated relatively quickly. This necessitates continuous R&D investment from manufacturers and can lead to quicker replacement cycles for end-users, impacting profitability. The increasing complexity of integration with existing systems can also pose a challenge. As encoders become more sophisticated, with advanced communication protocols and diagnostic features, integrating them seamlessly into legacy automation systems requires specialized expertise and can lead to increased installation and commissioning costs. Furthermore, the availability of skilled labor to install, maintain, and troubleshoot advanced encoder systems can be a limiting factor in certain regions. The fluctuations in raw material prices, particularly for rare earth magnets and specialized electronic components, can impact manufacturing costs and, consequently, the final price of encoders, affecting market affordability. Finally, while not a widespread issue, cybersecurity concerns related to connected encoders in networked industrial environments are emerging as a potential restraint, as companies become increasingly vigilant about protecting their operational technology (OT) from cyber threats.

The global encoder market is characterized by a dominant position held by Asia Pacific, particularly China, due to its status as a global manufacturing hub and its rapid industrialization. This region’s dominance is fueled by a confluence of factors, including a large manufacturing base, significant government support for automation initiatives, and a growing adoption of advanced technologies across various sectors. The sheer volume of production for industries such as electronics, automotive, and consumer goods necessitates a massive deployment of encoders for precise control and automation.

Within this dominant region, the Rotary Encoder segment is poised to command a substantial market share. Rotary encoders are fundamental to a vast array of industrial applications, including motor control, robotics, machine tools, and industrial automation. Their versatility and relatively lower cost compared to some linear encoder variants make them a go-to solution for a wide range of position and speed feedback needs. The proliferation of automated manufacturing processes in Asia Pacific, from highly sophisticated robotics in automotive assembly to automated material handling in e-commerce warehouses, relies heavily on the accurate rotational feedback provided by these devices.

Furthermore, the Machine Tools application segment is also a significant contributor to market dominance, both regionally and globally. Modern machine tools are increasingly sophisticated, requiring extremely high precision and speed for operations like CNC machining, milling, and turning. Encoders are critical for maintaining the accuracy and repeatability of these processes. As countries in Asia Pacific, especially China, continue to invest heavily in upgrading their manufacturing capabilities and producing higher-value goods, the demand for advanced machine tools, and consequently, the encoders that enable their precision, will remain exceptionally strong. The push towards Industry 4.0 in these nations further amplifies the need for data-rich feedback from machine tools, where encoders play a central role.

The Automotive application segment is another key driver of market growth, particularly in Asia Pacific. The rapid expansion of the automotive industry, including the significant shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), requires a vast number of encoders for applications like steering systems, motor control in EVs, and various sensor integrations. China, as one of the world’s largest automotive producers, is a key market for automotive encoders.

Geographically, while Asia Pacific leads, Europe also represents a significant market, driven by its advanced manufacturing base and strong emphasis on automation, particularly in Germany. The United States continues to be a major consumer of encoders, driven by its robust industrial sectors, including aerospace, defense, and high-tech manufacturing. However, the sheer volume of manufacturing output and the ongoing push for automation in Asia Pacific, especially China, positions it as the leading region in terms of encoder consumption and market value.

The encoder industry is experiencing robust growth, primarily catalyzed by the pervasive adoption of automation across all industrial sectors. The increasing complexity and sophistication of automated machinery, from intricate robotic arms to high-speed packaging equipment, demand precise feedback for optimal performance. The burgeoning Internet of Things (IoT) ecosystem is another significant catalyst, as smart encoders with enhanced connectivity and diagnostic capabilities are essential for real-time data acquisition and analysis in connected factories. Furthermore, the relentless pursuit of efficiency, quality improvement, and waste reduction in manufacturing environments inherently drives the demand for the accurate positional and speed information that encoders provide. The continuous innovation in encoder technology, leading to smaller, more robust, and higher-resolution devices, expands their applicability into previously inaccessible or challenging environments.

This comprehensive report delves into the intricate details of the global encoder market, providing an exhaustive analysis of its current state and future trajectory. It covers the market from various perspectives, including technological evolution, application-specific demands, and regional market dynamics. The report meticulously examines the impact of emerging trends, such as the widespread adoption of Industry 4.0, the proliferation of robotics, and the increasing sophistication of medical equipment, all of which contribute significantly to market expansion. It also addresses the inherent challenges and restraints, offering a balanced view of the market landscape. The analysis extends to specific segments like Rotary and Linear Encoders, highlighting their respective growth drivers and market penetration. Furthermore, the report provides an in-depth understanding of key application areas, including Machine Tools, Robots, and Automotive, detailing the unique requirements and growth potentials within each. This all-encompassing approach ensures that stakeholders gain a holistic understanding of the encoder market, empowering them to make informed strategic decisions for future investments and business development within this vital industrial sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Heidenhain, Tamagawa Seiki, Sick, Renishaw, Pepperl+Fuchs, Dynapar, Baumer, Sensata Technologies, Broadcom, Omron, TR Electronic, Balluff, Rockwell Automation, Bourns, Zhejiang Reagle Sensing, TE Connectivity, Fagor Automation, Kubler, SIKO, JTEKT Electronics, POSITAL (FRABA), Changchun Yuheng Optics, Lenord+Bauer, Faulhaber, Lika Electronic, Gurley Precision Instruments, Mitutoyo, Citizen Micro Co., Ltd, ELCO Industrie Automation GmbH, Weihai Idencoder Electronic Technology, Autonics Corporation, Precizika Metrology, Givi Misure srl, Advanced Micro Controls Inc (AMCI), Allient Inc, Elap srl, Pilz GmbH & Co. KG, ifm electronic, Encoder Products Company, Quantum Devices, Netzer, Contelec AG, ELGO Electronic GmbH & Co. KG, Beijing KingKong Technology.

The market segments include Type, Application.

The market size is estimated to be USD 5259 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Encoder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Encoder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.