1. What is the projected Compound Annual Growth Rate (CAGR) of the Eight-sided Film Applicators?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eight-sided Film Applicators

Eight-sided Film ApplicatorsEight-sided Film Applicators by Application (Electronics, Coatings, Others, World Eight-sided Film Applicators Production ), by Type (Minimum Film Thickness: 0.5 mils, Minimum Film Thickness: 1 mils, Minimum Film Thickness: 5 mils, World Eight-sided Film Applicators Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

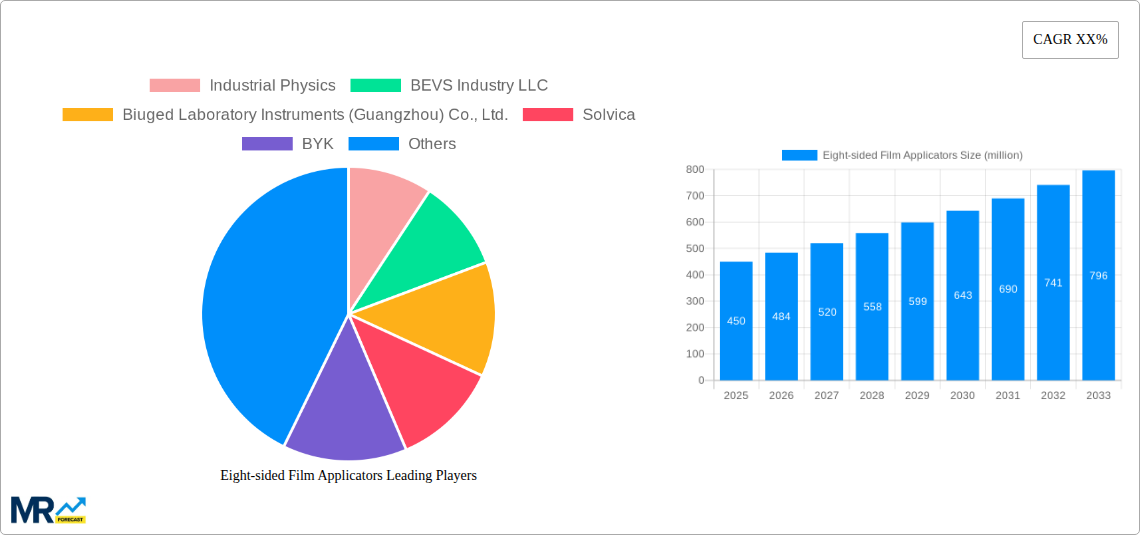

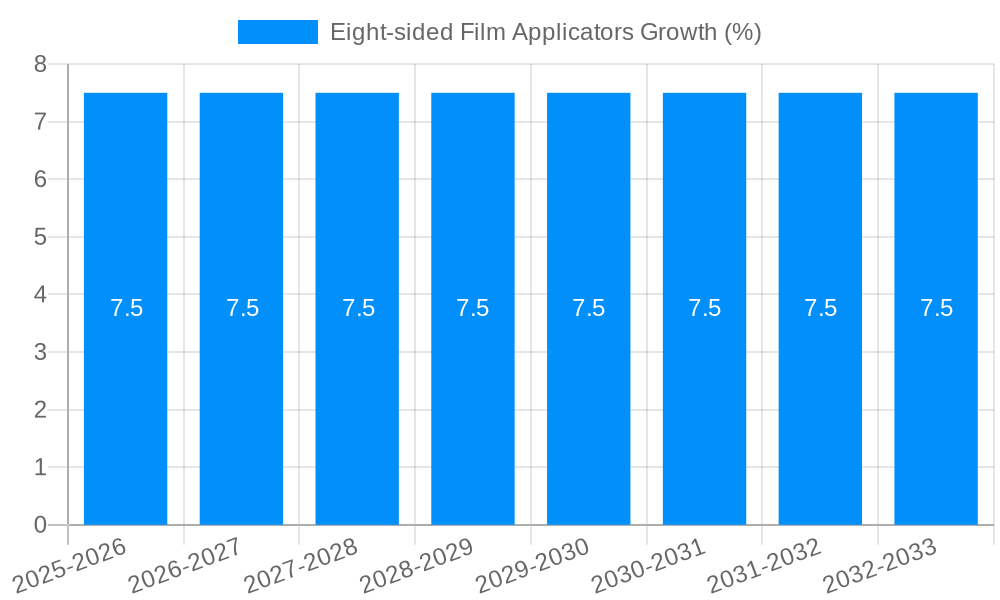

The global market for Eight-sided Film Applicators is poised for significant expansion, projected to reach an estimated market size of \$450 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by the burgeoning demand from the Electronics and Coatings industries, where precise and consistent film application is critical for product quality and performance. The increasing complexity of electronic components and the rising standards in protective and decorative coatings are driving the adoption of advanced application solutions like eight-sided film applicators. These tools offer superior control over film thickness, ranging from ultra-thin applications of 0.5 mils to thicker layers of 5 mils, catering to a wide spectrum of industrial requirements. The market is further propelled by technological advancements in applicator design and materials, ensuring enhanced durability and ease of use for end-users.

The market's trajectory is supported by several key drivers, including the continuous innovation in material science leading to new coating formulations, and the growing emphasis on quality control and standardization across manufacturing sectors. The increasing disposable incomes and industrialization in emerging economies, particularly in the Asia Pacific region, are also contributing to market expansion by driving demand for high-quality finished goods that rely on precise film application. However, the market faces some restraints, such as the initial investment cost for advanced applicators and the availability of alternative application methods, though the superior performance and consistency offered by eight-sided applicators often outweigh these concerns. Key players like Industrial Physics, BEVS Industry LLC, and BYK are actively engaged in research and development, introducing new product variations and expanding their geographical reach to capitalize on these market dynamics. The competitive landscape is characterized by a focus on product innovation, strategic partnerships, and market penetration in high-growth regions.

This comprehensive report delves into the dynamic global market for Eight-sided Film Applicators, providing an in-depth analysis of its trajectory from 2019 to 2033. The study meticulously examines historical trends, current market conditions, and future projections, with a base year of 2025 and a forecast period spanning 2025-2033. We project a significant market size, with World Eight-sided Film Applicators Production anticipated to reach several million units by the end of the forecast period, driven by advancements in precision coating technologies and the expanding needs of various high-tech industries.

The report will scrutinize market dynamics across key segments, including:

We will also investigate significant industry developments and identify the leading companies shaping the market, such as Industrial Physics, BEVS Industry LLC, Biuged Laboratory Instruments (Guangzhou) Co., Ltd., Solvica, BYK, and Caltech Instruments Pvt Ltd. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of precision film application.

The global Eight-sided Film Applicators market is experiencing a robust upward trajectory, fueled by an escalating demand for precise and consistent thin-film deposition across a myriad of industries. In the Historical Period (2019-2024), the market witnessed steady growth, driven primarily by the burgeoning electronics sector's need for ultra-thin, high-performance coatings in components like semiconductors and displays. The Study Period (2019-2033), with the Base Year (2025) serving as a critical reference point, will illuminate a market poised for accelerated expansion. Current trends indicate a significant push towards applicators capable of achieving finer film thicknesses, particularly in the 0.5 mils and 1 mils categories, as technological advancements necessitate increasingly precise material application. The Estimated Year (2025) is expected to show a substantial increase in World Eight-sided Film Applicators Production, likely reaching the tens of millions of units, reflecting widespread adoption.

Beyond the technological imperative for thinner films, the market is also being shaped by a diversification of applications. While electronics remain a dominant force, the Coatings segment is witnessing increased uptake for specialized applications such as anti-corrosion coatings, advanced paints, and functional surface treatments for automotive and aerospace industries. The "Others" category, encompassing areas like medical devices and research laboratories, is also contributing to market growth, albeit at a slower pace. Furthermore, the global production landscape is becoming more concentrated in regions with strong manufacturing bases and significant R&D investments, leading to a more efficient and cost-effective supply chain. The continuous pursuit of enhanced product performance, reduced material wastage, and improved manufacturing efficiency are the overarching themes that will continue to define the market's evolution throughout the Forecast Period (2025-2033). This sustained innovation and demand will undoubtedly translate into further substantial growth in World Eight-sided Film Applicators Production, underscoring the critical role these tools play in modern industrial processes.

The surge in demand for Eight-sided Film Applicators is intrinsically linked to the relentless pursuit of miniaturization and enhanced performance in the electronics industry. As electronic devices become smaller and more sophisticated, the need for highly precise and consistent application of ultra-thin films – whether for insulation, conductivity, or protective layers – becomes paramount. This has directly translated into an increased requirement for applicators capable of achieving film thicknesses in the 0.5 mils and 1 mils ranges, driving innovation and market expansion. Furthermore, the advancements in material science have opened up new avenues for utilizing Eight-sided Film Applicators in creating specialized coatings for diverse applications. The coatings sector, encompassing everything from high-performance industrial paints to advanced surface treatments, benefits immensely from the uniform and controllable deposition offered by these applicators, leading to improved durability, functionality, and aesthetics.

Another significant driving force is the growing emphasis on quality control and consistency in manufacturing processes across various industries. Eight-sided Film Applicators offer a level of precision that minimizes batch-to-batch variations and reduces material waste, thereby enhancing overall production efficiency and reducing operational costs. This focus on sustainability and resource optimization further fuels the adoption of these advanced tools. The increasing research and development activities in areas like flexible electronics, advanced battery technologies, and biomedical devices are also creating new application niches and expanding the market’s scope. As these nascent technologies mature and move towards commercialization, the demand for precise film deposition techniques, and consequently for Eight-sided Film Applicators, is expected to rise exponentially. The projected growth in World Eight-sided Film Applicators Production by millions of units is a testament to these powerful underlying market drivers.

Despite the promising growth trajectory, the Eight-sided Film Applicators market is not without its hurdles. A significant challenge revolves around the high initial investment cost associated with sophisticated Eight-sided Film Applicators, particularly those capable of achieving sub-mil film thicknesses. This can be a deterrent for smaller enterprises or those in emerging economies with limited capital expenditure budgets, potentially slowing down the adoption rate. Furthermore, the need for specialized training and skilled personnel to operate and maintain these precise instruments presents another significant barrier. Improper calibration or operation can lead to suboptimal film quality, rendering the investment less effective and potentially causing production issues.

The market also faces the challenge of developing and adapting applicators for an ever-evolving range of substrate materials and coating formulations. As new advanced materials are introduced in industries like electronics and aerospace, the applicators need to be compatible with these novel substances, which often require unique application parameters and techniques. This necessitates continuous research and development efforts from manufacturers, adding to their operational costs and the complexity of product development. Moreover, stringent regulatory standards concerning material usage and environmental impact in certain industries can also pose a challenge, requiring manufacturers to ensure their applicators facilitate compliant coating processes. The availability of alternative, albeit less precise, coating methods, especially for less demanding applications, can also act as a restraint, as some industries may opt for more economical but less sophisticated solutions. The intricate interplay of these factors will influence the pace of World Eight-sided Film Applicators Production and market penetration throughout the Study Period (2019-2033).

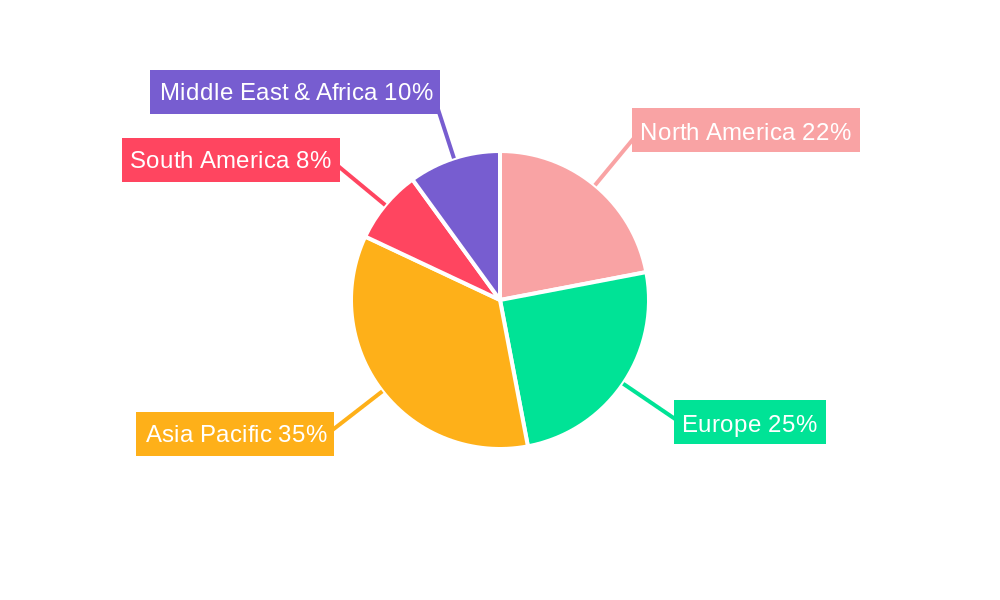

The global Eight-sided Film Applicators market is characterized by a dynamic interplay of regional strengths and segment dominance. In terms of World Eight-sided Film Applicators Production, a significant portion of both manufacturing and consumption is concentrated in Asia-Pacific, particularly in countries like China, South Korea, Japan, and Taiwan. This dominance stems from several factors:

Conversely, North America (primarily the United States) and Europe (particularly Germany and the UK) are significant markets driven by their strong presence in specialized industries requiring high-precision coatings, such as aerospace, medical devices, and advanced research laboratories. The Others application segment sees considerable traction in these regions, alongside the high-end electronics and specialized coatings markets.

In terms of product type, the demand for applicators capable of achieving Minimum Film Thickness: 0.5 mils and Minimum Film Thickness: 1 mils is set to dominate the market's future growth. This is a direct consequence of the relentless drive towards miniaturization and enhanced performance in the electronics sector, where even microns of film thickness can critically impact device functionality. The ability to deposit ultra-thin, uniform films is essential for creating advanced semiconductor layers, micro-displays, and next-generation battery components. While Minimum Film Thickness: 5 mils applicators will continue to serve established markets in traditional coatings and industrial applications, the growth momentum will increasingly be driven by the more precise capabilities. This shift in demand directly influences the direction of World Eight-sided Film Applicators Production, prompting manufacturers to invest in R&D and production lines that cater to these finer deposition requirements. The overall market will thus see a significant portion of its volume and value attributed to the advanced precision applicators.

The Eight-sided Film Applicators market is propelled by several key growth catalysts. The relentless advancement in the electronics sector, particularly the trend towards miniaturization and higher functionality in devices like smartphones, wearables, and advanced displays, is a primary driver. This necessitates the use of applicators capable of depositing extremely thin and uniform films, such as those in the 0.5 mils and 1 mils categories. Furthermore, the growing demand for high-performance coatings in industries such as automotive, aerospace, and medical devices, where enhanced durability, specific functionalities (e.g., anti-corrosion, biocompatibility), and aesthetic appeal are critical, is significantly boosting adoption. The increasing focus on research and development in emerging technologies, including flexible electronics, advanced battery technologies, and specialized sensors, is also creating new application niches and expanding the market's scope, thereby fueling the demand for precise film application solutions.

This report offers a holistic examination of the Eight-sided Film Applicators market, providing unparalleled insights into its present and future trajectory. We meticulously dissect market dynamics, including historical performance from 2019-2024 and projected growth through 2033, anchored by the Base Year (2025). The analysis encompasses key application segments such as Electronics, Coatings, and Others, alongside a granular understanding of product types based on Minimum Film Thickness (0.5 mils, 1 mils, 5 mils). We present robust forecasts for World Eight-sided Film Applicators Production, projecting millions of units in output. The report delves into the driving forces, challenges, regional dominance, and critical growth catalysts, alongside a comprehensive overview of leading companies and significant industry developments. This exhaustive coverage ensures stakeholders are equipped with the knowledge to navigate and capitalize on this vital industrial sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Industrial Physics, BEVS Industry LLC, Biuged Laboratory Instruments (Guangzhou) Co., Ltd., Solvica, BYK, Caltech Instruments Pvt Ltd..

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Eight-sided Film Applicators," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eight-sided Film Applicators, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.