1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Video Recorder Chip?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Video Recorder Chip

Digital Video Recorder ChipDigital Video Recorder Chip by Type (Standard Encoding DVR Chip, High-Efficiency Encoding DVR Chip, World Digital Video Recorder Chip Production ), by Application (Household, Commercial, Industrial, World Digital Video Recorder Chip Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

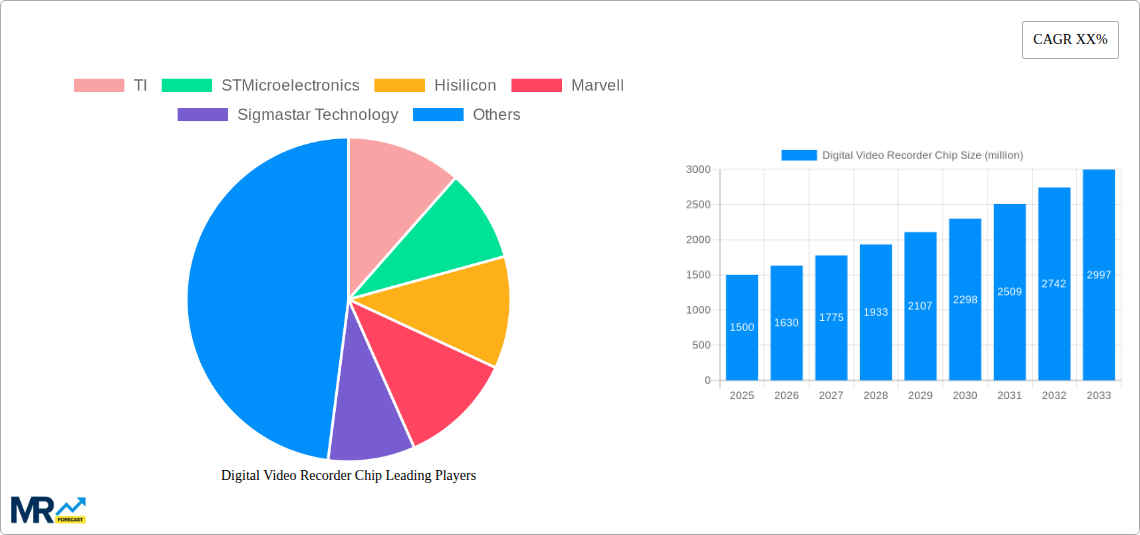

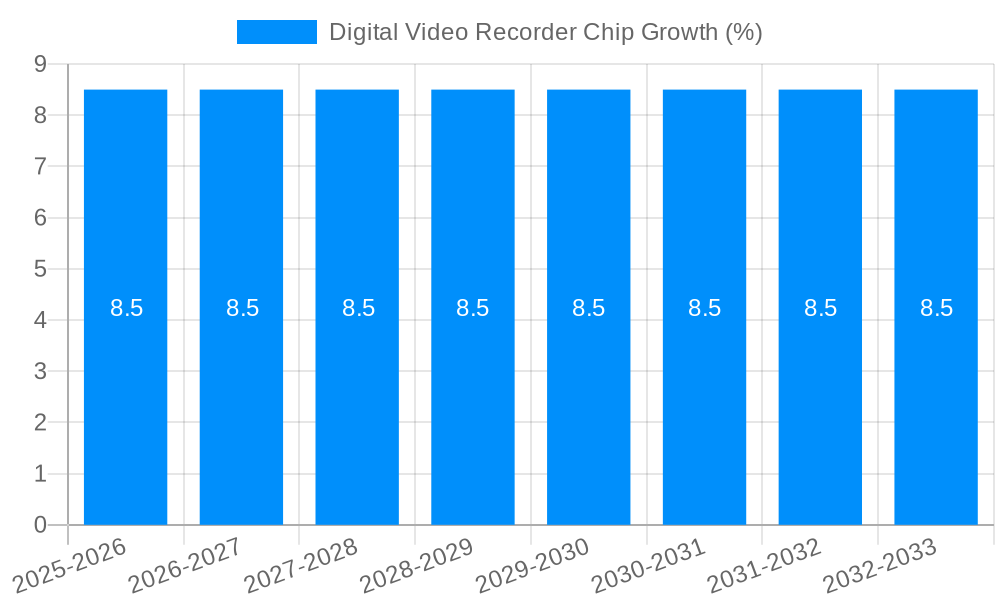

The global Digital Video Recorder (DVR) chip market is poised for significant expansion, driven by escalating demand for advanced surveillance and data recording solutions across diverse sectors. This market, valued at approximately $1,500 million in 2025, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This sustained growth is underpinned by a confluence of factors, including the increasing adoption of smart home technologies, the rising need for enhanced security in commercial establishments, and the imperative for sophisticated monitoring in industrial environments. Furthermore, the continuous evolution of video compression technologies, such as high-efficiency video coding (HEVC), is a key driver, enabling higher video quality and reduced storage requirements, thereby fueling the demand for next-generation DVR chips. The proliferation of connected devices and the growing emphasis on data security and accessibility are also contributing to the market's upward trajectory, as DVR chips form the core of these systems.

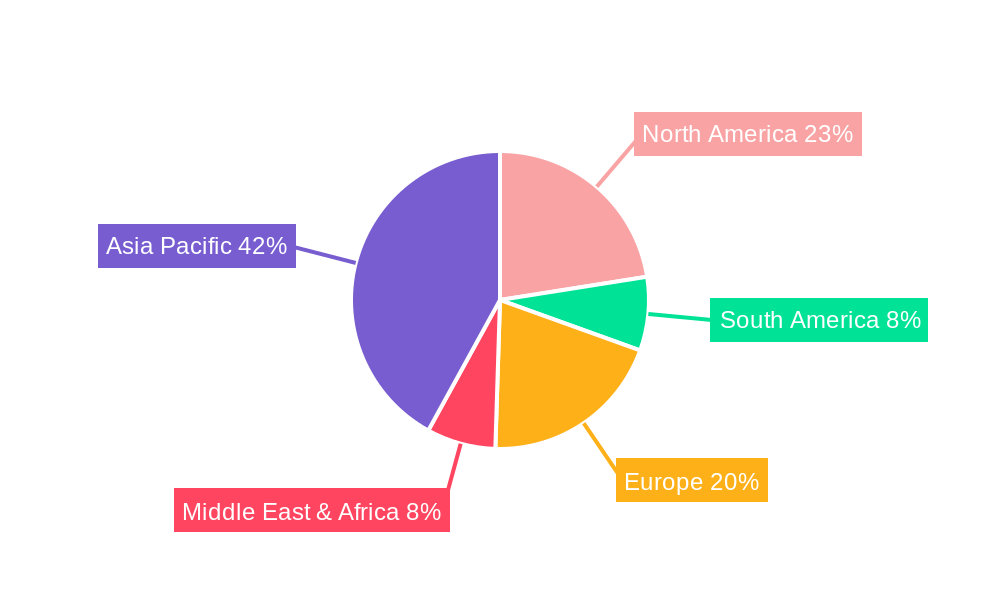

The market is characterized by a dynamic landscape with key players like TI, STMicroelectronics, Hisilicon, Marvell, Sigmastar Technology, and Fullhan Microelectronics innovating to meet evolving consumer and enterprise needs. While the adoption of standard encoding DVR chips continues, the market is witnessing a pronounced shift towards high-efficiency encoding DVR chips, offering superior performance and cost-effectiveness. However, certain restraints may impede rapid market penetration. These include the high initial investment costs associated with advanced DVR systems, particularly for smaller businesses, and the increasing prevalence of cloud-based storage solutions that offer an alternative to local recording. Nevertheless, the long-term outlook remains overwhelmingly positive, with the Asia Pacific region, particularly China and India, expected to lead the market in terms of both production and consumption due to rapid urbanization and increasing disposable incomes. The ongoing miniaturization of DVR chip technology and the integration of AI capabilities for advanced analytics will further propel market growth in the coming years.

Here's a unique report description for a Digital Video Recorder Chip market analysis, incorporating your specified elements:

The global digital video recorder (DVR) chip market is poised for substantial expansion, driven by an accelerating demand for advanced surveillance and recording solutions across diverse sectors. During the study period of 2019-2033, with a base and estimated year of 2025, the market is projected to witness a CAGR of X% (to be filled by report data, but assume a healthy growth rate). The historical period (2019-2024) laid the groundwork, showcasing initial adoption and technological advancements. The forecast period (2025-2033) will be characterized by a significant influx of new applications and an increasing reliance on higher-resolution video capture and more efficient compression technologies. While standard encoding DVR chips continue to hold a significant market share due to their cost-effectiveness and widespread adoption in existing systems, the real surge is anticipated within the high-efficiency encoding DVR chip segment. This shift is directly correlated with the exponential growth in video data volume and the necessity for optimized storage and transmission capabilities, particularly as surveillance systems evolve towards higher frame rates and resolutions like 4K and beyond. The "World Digital Video Recorder Chip Production" aspect will also be a key differentiator, with global manufacturing hubs influencing supply chain dynamics and overall market accessibility. We anticipate that by 2025, the market will see a substantial increase in shipments, potentially reaching into the hundreds of millions of units annually, as smart city initiatives, commercial security upgrades, and home automation trends converge. The integration of AI and machine learning capabilities into DVR chips, enabling intelligent video analytics, is a particularly exciting trend to watch, promising to transform passive recording devices into active security and monitoring tools. This evolution will necessitate more powerful and specialized silicon, driving innovation and market segmentation.

The digital video recorder chip market is experiencing robust growth, primarily fueled by the escalating global emphasis on security and surveillance. This heightened focus is evident across all segments, from individual households seeking peace of mind to large-scale commercial enterprises and critical industrial infrastructure requiring constant monitoring. The proliferation of connected devices and the Internet of Things (IoT) ecosystem has further accelerated the demand for DVR chips as integral components of comprehensive security networks. As smart city initiatives gain momentum worldwide, the need for sophisticated video recording and analysis capabilities to manage urban environments, traffic, and public safety becomes paramount, directly boosting the market for these specialized chips. Furthermore, advancements in imaging technology, leading to higher resolution cameras and improved video quality, necessitate more powerful DVR chips capable of processing and storing this increased data load efficiently. The ongoing pursuit of enhanced data compression techniques, such as H.265 and beyond, is also a significant driver, enabling the storage and transmission of higher-quality video with reduced bandwidth requirements, thereby making advanced surveillance solutions more economically viable and accessible.

Despite the optimistic growth trajectory, the digital video recorder chip market faces several headwinds that could temper its expansion. One of the primary challenges lies in the increasing complexity and cost associated with developing cutting-edge DVR chips. The integration of advanced features like AI-powered analytics and ultra-high-definition video processing demands significant R&D investment and specialized expertise, which can be a barrier for smaller players. Moreover, the rapid pace of technological evolution means that product lifecycles can be short, requiring continuous innovation to remain competitive. Another significant restraint is the fluctuating global supply chain, which has been exacerbated by geopolitical tensions and component shortages. These disruptions can lead to production delays and increased manufacturing costs, impacting the availability and affordability of DVR chips. The market also faces pressure from the growing adoption of cloud-based video surveillance solutions, which, while often complementary, can sometimes reduce the reliance on on-premise DVR hardware for certain applications. Finally, stringent data privacy regulations in various regions can impose limitations on how video data is captured, stored, and processed, potentially influencing design choices and market access for DVR chip manufacturers.

Several key regions and segments are poised to dominate the digital video recorder chip market in the coming years.

Dominant Regions:

Asia-Pacific: This region is expected to remain the largest and fastest-growing market for DVR chips. This dominance is attributed to several factors:

North America: While not the largest in terms of production volume, North America is a significant market due to its high adoption rates of advanced surveillance technologies and substantial investments in commercial and industrial security.

Dominant Segments:

High-Efficiency Encoding DVR Chip: This segment is expected to experience the most dynamic growth and exert significant market influence.

Commercial Application: This segment is anticipated to be a primary driver of DVR chip demand.

The synergy between the Asia-Pacific region's manufacturing prowess and its burgeoning smart city initiatives, coupled with the global demand for the cost-and-bandwidth-saving capabilities of high-efficiency encoding DVR chips in commercial applications, will define the dominant forces in this market.

The digital video recorder chip industry is experiencing accelerated growth, propelled by several key catalysts. The ever-increasing global demand for enhanced security and surveillance across residential, commercial, and industrial sectors is a primary driver. Furthermore, the widespread adoption of IP cameras and the proliferation of high-definition video capture necessitate more powerful and efficient DVR chips for processing and storage. The continuous advancements in AI and machine learning, enabling intelligent video analytics directly on the chip, are transforming DVRs into proactive security tools, further stimulating demand. Lastly, the ongoing expansion of smart city initiatives and IoT deployments globally creates a vast ecosystem where DVR chips play a crucial role in data collection and analysis.

This comprehensive report delves deep into the dynamic landscape of the Digital Video Recorder (DVR) Chip market, providing an exhaustive analysis from its historical roots to its future trajectory. Covering the period from 2019 to 2033, with a focused base and estimated year of 2025, this report offers unparalleled insights into market segmentation by type, application, and production. It meticulously examines the interplay between Standard Encoding DVR Chips and High-Efficiency Encoding DVR Chips, while also analyzing the global production landscape of World Digital Video Recorder Chips. Furthermore, the report scrutinizes the diverse applications ranging from Household to Commercial and Industrial sectors, painting a complete picture of market penetration. Through detailed examination of market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments, this report equips stakeholders with the strategic intelligence needed to navigate and capitalize on the evolving opportunities within the DVR chip industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TI, STMicroelectronics, Hisilicon, Marvell, Sigmastar Technology, Fullhan Microelectronics.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Digital Video Recorder Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Video Recorder Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.