1. What is the projected Compound Annual Growth Rate (CAGR) of the Custom Gain Chip?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Custom Gain Chip

Custom Gain ChipCustom Gain Chip by Type (600nm-800nm, 800nm-1000nm, More Than 1000nm), by Application (Semiconductor, Electronic Equipment, Communication, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

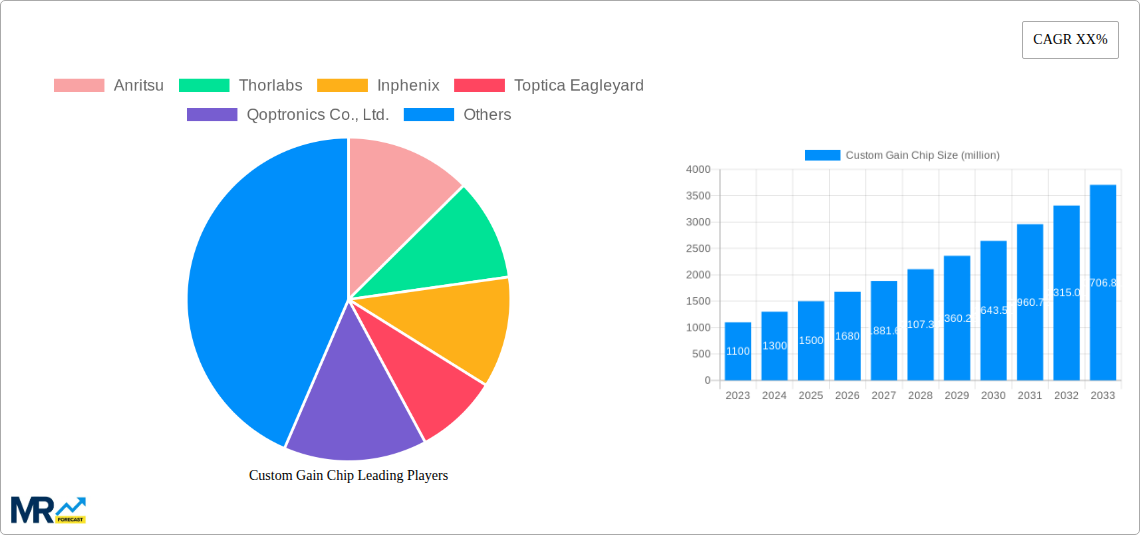

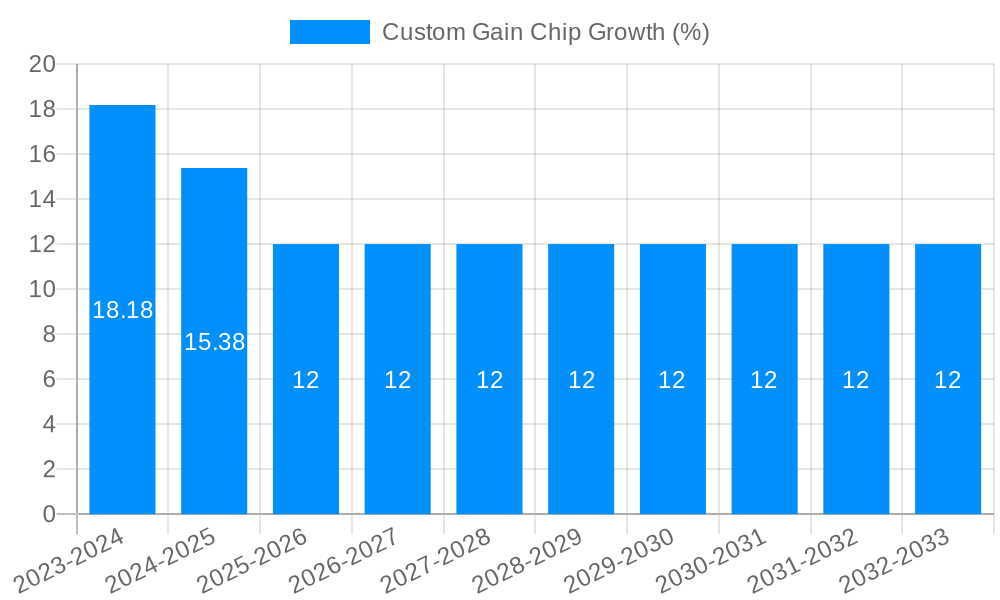

The global Custom Gain Chip market is poised for significant expansion, projected to reach approximately USD 1,500 million by 2025 and demonstrate robust growth through 2033. This surge is underpinned by an estimated Compound Annual Growth Rate (CAGR) of 12% from 2025 onwards, indicating a dynamic and evolving landscape. The market's upward trajectory is propelled by the escalating demand for advanced semiconductor components across a myriad of high-tech industries. Specifically, the burgeoning needs within the semiconductor manufacturing process itself, coupled with the relentless innovation in electronic equipment and communication technologies, are primary drivers. As miniaturization and performance enhancements become paramount, custom gain chips, offering tailored amplification characteristics, are becoming indispensable for optimizing signal integrity and functionality in complex systems.

Further fueling this market growth are key trends such as the increasing integration of artificial intelligence and machine learning, which necessitate highly specialized and efficient signal processing capabilities. The development of next-generation communication networks, including 5G and beyond, also demands sophisticated amplification solutions that can be precisely engineered for specific wavelength ranges, such as 600nm-800nm and 800nm-1000nm, to meet stringent performance criteria. While the market exhibits strong growth potential, potential restraints may include the high cost of research and development for highly customized solutions and the intricate manufacturing processes involved. However, the value proposition of bespoke amplification for critical applications, especially within the high-growth segments of semiconductors and advanced electronics, is expected to outweigh these challenges, solidifying the market's positive outlook.

This report offers a deep dive into the dynamic Custom Gain Chip market, providing in-depth analysis and forecasting for the period of 2019-2033. With a base year of 2025, the report meticulously dissects market trends, key drivers, prevailing challenges, and promising growth avenues. It features an exhaustive examination of leading companies and their innovative contributions, along with a detailed breakdown of market segmentation by type and application. The report aims to equip stakeholders with the critical insights needed to navigate this evolving landscape and capitalize on future opportunities.

The global Custom Gain Chip market is poised for significant expansion, projected to reach an estimated market value of over 500 million USD by 2033. The study period, encompassing 2019-2033, with a base year of 2025, highlights a compound annual growth rate (CAGR) that reflects increasing demand across various sophisticated applications. During the historical period (2019-2024), the market demonstrated steady growth, fueled by early adoption in specialized sectors. The estimated year of 2025 serves as a crucial benchmark for forecasting the trajectory, with the forecast period of 2025-2033 expecting accelerated growth. Key trends include a pronounced shift towards higher bandwidth and lower noise amplification requirements, driven by advancements in telecommunications and sensing technologies. Furthermore, the miniaturization and integration of these chips into complex systems are becoming paramount, enabling more compact and power-efficient devices. The increasing adoption of custom gain chips in next-generation semiconductor manufacturing processes and advanced electronic equipment signifies a growing reliance on tailored performance solutions. The report will delve into the nuances of these trends, providing granular data and qualitative assessments to illuminate the market's path forward, including a growing emphasis on material innovations and design methodologies to achieve unprecedented levels of performance and efficiency. The demand for specialized gain profiles for niche applications, such as high-frequency trading platforms and advanced medical imaging, is also a significant contributing trend.

The burgeoning Custom Gain Chip market is propelled by an array of powerful driving forces, chief among them being the insatiable demand for enhanced performance and efficiency in modern electronic systems. The relentless pursuit of higher data transmission speeds in communication networks necessitates sophisticated amplification solutions, making custom gain chips indispensable for achieving desired signal integrity and bandwidth. Similarly, the rapid evolution of the semiconductor industry, with its focus on smaller, more powerful, and energy-efficient components, creates a fertile ground for tailored gain solutions. Furthermore, the increasing complexity of electronic equipment, ranging from advanced consumer electronics to critical industrial machinery, requires specialized amplification that off-the-shelf components simply cannot provide. The growth in areas like artificial intelligence and machine learning, which rely on high-speed data processing and sophisticated sensor integration, also fuels the demand for custom gain chips that can precisely amplify delicate signals without distortion. This continuous push for innovation and performance optimization across these diverse sectors forms the bedrock of the market's robust growth trajectory. The need for reduced noise figures and improved linearity in signal amplification also plays a crucial role, especially in sensitive applications like scientific instrumentation and medical devices.

Despite its promising outlook, the Custom Gain Chip market faces several significant challenges and restraints that could impede its growth. One primary obstacle is the inherently high cost associated with custom design and manufacturing. Developing a unique gain chip requires significant research and development investment, specialized fabrication processes, and rigorous testing, leading to a higher unit cost compared to standard components. This cost factor can be a deterrent for smaller enterprises or applications with tight budget constraints. Another considerable challenge lies in the complexity of the design and fabrication process itself. Achieving the precise gain characteristics demanded by specific applications often involves intricate circuit design and the use of advanced materials, demanding highly skilled engineering expertise and sophisticated manufacturing infrastructure. This can lead to longer development cycles and potential delays in product realization. Furthermore, the niche nature of many custom gain chip applications means that the overall market volume for any single custom design might be relatively small, making economies of scale difficult to achieve. The intellectual property protection surrounding custom designs also presents a challenge, as companies invest heavily in proprietary solutions and seek to prevent unauthorized replication. Finally, the availability of highly capable, albeit generic, amplifier solutions can sometimes satisfy a broader range of applications, posing a competitive threat to highly specialized custom designs.

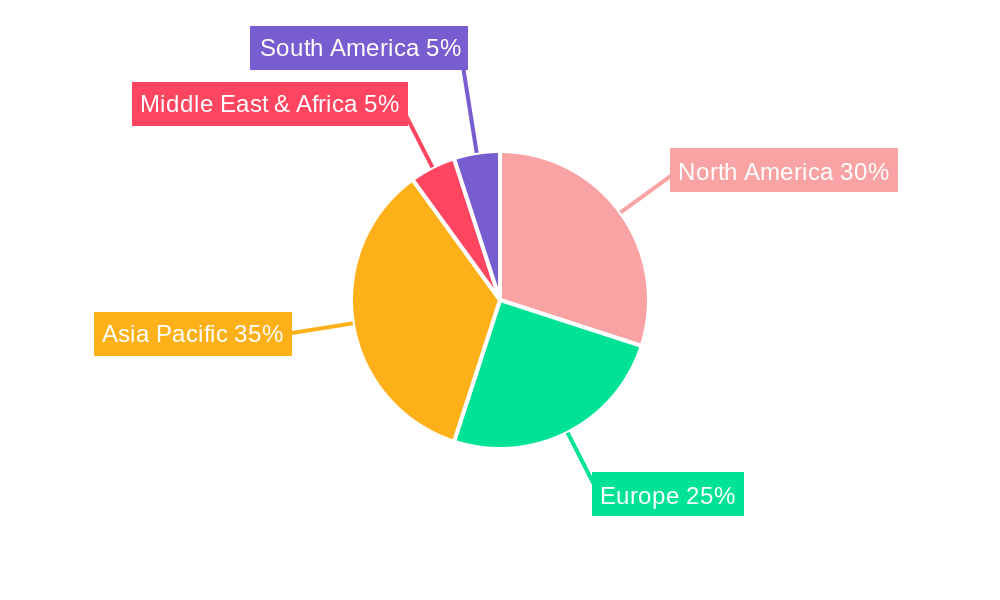

The global Custom Gain Chip market is characterized by a strong regional and segmental dominance, with Asia-Pacific and North America emerging as key powerhouses. Within these regions, the Communication segment, particularly for applications utilizing wavelengths More Than 1000nm, is projected to exhibit substantial growth and dominance.

Asia-Pacific Region:

North America Region:

Dominant Segments:

Segment: Communication (Application):

Segment: More Than 1000nm (Type):

The confluence of robust regional industrial ecosystems and the specific demands of the communication sector, particularly for longer wavelengths, positions these as the dominant forces shaping the custom gain chip market. The synergistic growth between these regions and segments will continue to define the market's expansion trajectory.

Several key growth catalysts are fueling the expansion of the Custom Gain Chip industry. The escalating global demand for high-speed data transmission and advanced connectivity in the communication sector is a primary driver. This includes the continuous rollout of 5G networks and the development of future wireless technologies. Furthermore, the increasing sophistication and miniaturization of electronic equipment across various applications, from consumer electronics to industrial automation, necessitate specialized and efficient amplification solutions that only custom gain chips can provide. The burgeoning fields of artificial intelligence, machine learning, and the Internet of Things (IoT) rely heavily on precise signal processing and amplification, creating new avenues for custom gain chip adoption. Finally, advancements in material science and fabrication technologies are enabling the development of more powerful, energy-efficient, and cost-effective custom gain chips, further stimulating market growth.

This comprehensive report offers an unparalleled analysis of the Custom Gain Chip market, extending from the historical period of 2019-2024 through to an extensive forecast until 2033, with 2025 serving as the crucial base and estimated year. It meticulously details market trends, dissects the driving forces behind its growth, and critically examines the challenges and restraints that stakeholders may encounter. The report provides a granular segmentation of the market by type (600nm-800nm, 800nm-1000nm, More Than 1000nm) and application (Semiconductor, Electronic Equipment, Communication, Others), highlighting dominant segments and regions with an estimated market value exceeding 500 million USD. Furthermore, it identifies key growth catalysts and provides an exhaustive list of leading players, alongside a timeline of significant developments. This report serves as an indispensable resource for anyone seeking to understand and capitalize on the evolving landscape of the custom gain chip industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Anritsu, Thorlabs, Inphenix, Toptica Eagleyard, Qoptronics Co., Ltd., Innoluume, Suzhou Bonphot Optoelectronic, DenseLight Semiconductors, Photodigm.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Custom Gain Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Custom Gain Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.