1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Large Format Display Signage?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Large Format Display Signage

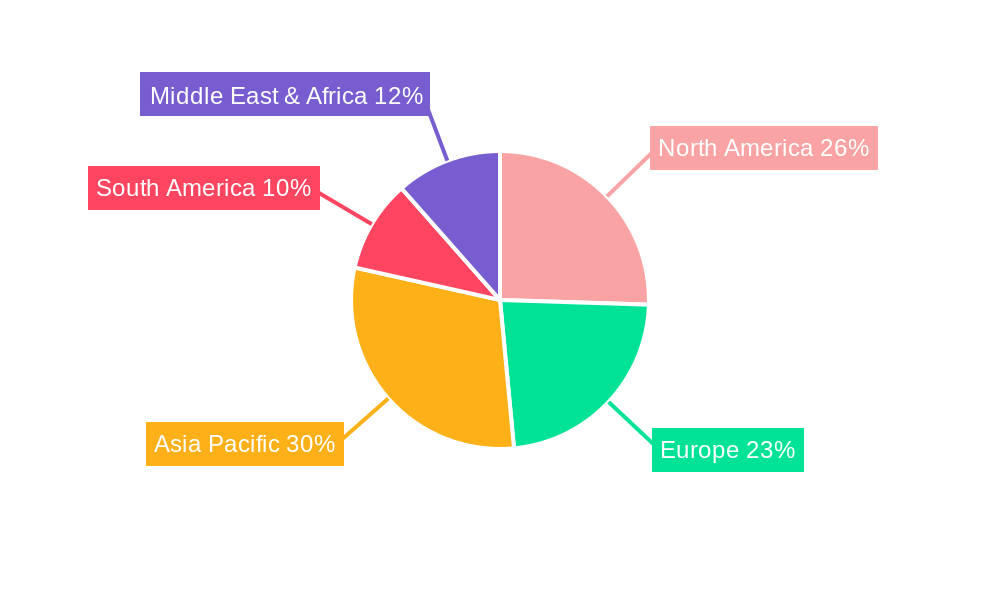

Commercial Large Format Display SignageCommercial Large Format Display Signage by Type (Hardware, Software), by Application (Shopping Malls, Airports, Sports Arenas, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

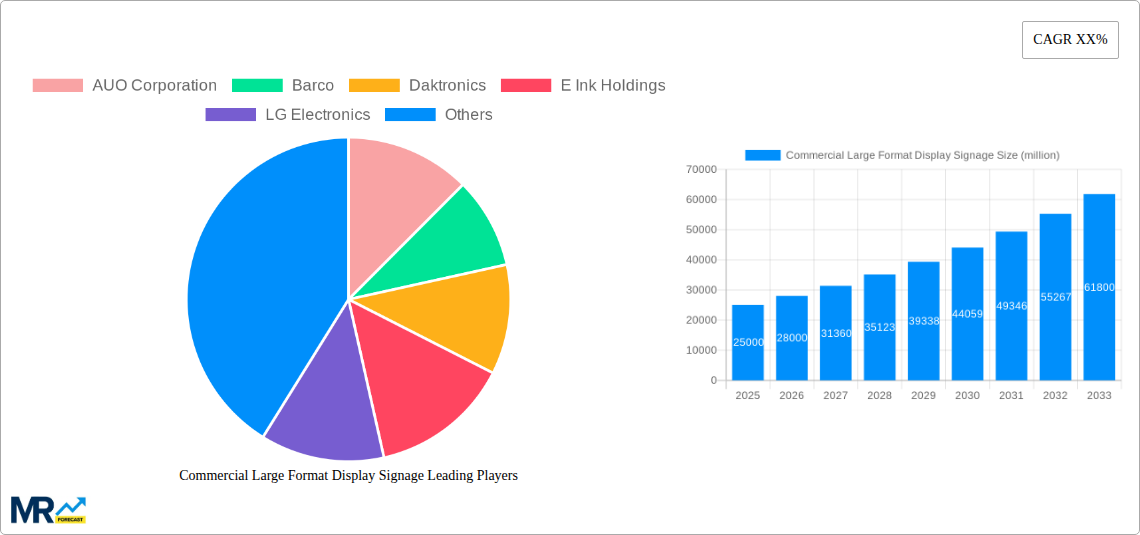

The global Commercial Large Format Display (LFD) Signage market is projected for robust expansion, driven by an estimated market size of $25,000 million in 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12% anticipated through 2033. This significant growth is propelled by the increasing adoption of digital signage across diverse commercial sectors seeking enhanced customer engagement, dynamic content delivery, and operational efficiency. Key drivers include the escalating demand for high-impact visual advertising in retail environments, the need for real-time information dissemination in transportation hubs like airports, and the immersive experiences sought in sports arenas and entertainment venues. Furthermore, the proliferation of smart city initiatives and the growing integration of LFDs with IoT technologies are creating new avenues for market penetration and innovation, further solidifying its upward trajectory.

The market is characterized by a dynamic interplay of hardware and software advancements, with a growing emphasis on interactive displays, AI-powered content management, and energy-efficient solutions. While the hardware segment, encompassing cutting-edge LED and LCD technologies, forms the foundational element, the software segment is witnessing rapid evolution with sophisticated content creation, deployment, and analytics platforms. Emerging trends such as transparent displays, ultra-high definition (UHD) resolutions, and modular display systems are shaping product development. However, certain restraints, including the high initial investment costs for premium solutions and concerns surrounding content piracy and data security, may temper growth in specific applications. Despite these challenges, the ongoing digital transformation across industries and the undeniable effectiveness of visual communication ensure a bright outlook for the Commercial Large Format Display Signage market.

This comprehensive report provides an in-depth analysis of the global Commercial Large Format Display (LFD) Signage market, spanning the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending to 2033. The market is poised for substantial growth, with an estimated 5.2 million units expected to be shipped in the base year of 2025. This study delves into the intricate dynamics of the LFD signage ecosystem, examining key trends, driving forces, challenges, and growth catalysts that will shape its trajectory. It also offers a granular breakdown of the market by segment, including Type (Hardware, Software), Application (Shopping Malls, Airports, Sports Arenas, Others), and critically analyzes the dominant regions and countries. Furthermore, the report profiles leading industry players, highlights significant developments, and provides a strategic overview of the market's future prospects.

XXX The Commercial Large Format Display (LFD) signage market is undergoing a significant evolution, driven by a confluence of technological advancements and shifting consumer engagement strategies. From 2019 to 2024, the market witnessed a steady climb, propelled by the increasing adoption of digital signage in retail and out-of-home advertising. Looking ahead, the forecast period from 2025 to 2033 promises even more dynamic growth, with an estimated 5.2 million units projected for shipment in 2025, underscoring the escalating demand. A key trend is the relentless pursuit of higher resolution and brighter displays, with 4K and even 8K technologies becoming increasingly prevalent, offering unparalleled visual clarity that captivates audiences in diverse environments. The integration of advanced functionalities such as interactive touchscreens and augmented reality (AR) overlays is transforming static advertisements into immersive experiences, fostering deeper customer engagement and brand recall, particularly within high-traffic areas like shopping malls and airports.

Furthermore, the proliferation of smart signage, powered by Artificial Intelligence (AI) and the Internet of Things (IoT), is a defining characteristic of the current market landscape. These intelligent displays can dynamically adjust content based on real-time data, such as foot traffic, time of day, and even individual viewer demographics through facial recognition (with appropriate privacy considerations), allowing for highly personalized advertising and dynamic information dissemination. The rise of LED video walls, offering seamless, modular installations and vibrant, impactful visuals, is another prominent trend, finding widespread application in sports arenas and large public spaces where visual spectacle is paramount. The growing emphasis on energy efficiency and sustainable display technologies, such as those utilizing E Ink for certain static or low-refresh-rate applications, is also gaining traction as businesses increasingly prioritize environmental responsibility. The convergence of hardware innovation and sophisticated software solutions, enabling content management, analytics, and remote monitoring, is creating a more integrated and efficient LFD signage ecosystem. The shift towards programmatic advertising for digital out-of-home (DOOH) is also influencing LFD deployment, with a greater demand for networked displays that can be controlled and optimized remotely, further enhancing the value proposition for advertisers and businesses. The overall trend indicates a move towards more intelligent, interactive, and immersive digital display solutions that deliver measurable ROI and enhanced customer experiences.

The commercial large format display (LFD) signage market is experiencing robust growth, propelled by several interconnected driving forces. The escalating demand for dynamic and engaging advertising solutions in retail environments is a primary catalyst. Businesses are increasingly recognizing the power of LFDs to attract customer attention, convey promotional messages effectively, and enhance the overall shopping experience. The shift from static to digital advertising is significant, offering greater flexibility in content updates and personalization. Furthermore, the burgeoning growth of sectors such as airports and sports arenas, where conveying information and creating a captivating atmosphere are critical, is fueling the adoption of LFD signage. These venues require high-impact visual displays for wayfinding, real-time updates, and immersive fan engagement.

The continuous technological advancements in display technology, including higher resolutions, improved brightness, and increased durability, are making LFDs more attractive and cost-effective for a wider range of applications. The development of interactive features, such as touchscreens and gesture control, is transforming passive displays into engaging platforms for customer interaction, driving deeper brand engagement and data collection. The increasing adoption of AI and IoT in signage solutions is another significant driver. Smart LFDs can analyze viewer behavior, optimize content delivery in real-time, and integrate with other smart systems, offering unparalleled capabilities for targeted marketing and operational efficiency. The expansion of network infrastructure and the development of sophisticated content management systems (CMS) are also crucial, enabling remote management and seamless deployment of content across multiple LFDs, thereby reducing operational costs and increasing scalability. The rising trend of digitalization across various industries, coupled with the need for impactful visual communication, continues to create fertile ground for the growth of the LFD signage market.

Despite its promising growth trajectory, the commercial large format display (LFD) signage market encounters several challenges and restraints that can impede its widespread adoption. A significant hurdle remains the substantial upfront investment required for high-quality LFD hardware, particularly for larger installations and higher-resolution displays. This cost factor can be prohibitive for smaller businesses or organizations with limited capital, leading to a slower adoption rate in certain segments. The complexity of installation and maintenance, especially for large-scale deployments and intricate LED video walls, often necessitates specialized technical expertise, adding to the overall cost and logistical challenges.

The rapid pace of technological obsolescence presents another concern. As display technologies evolve at an accelerated rate, there is a risk of current installations becoming outdated sooner than anticipated, leading to a higher total cost of ownership. Ensuring consistent and reliable connectivity for networked LFDs, especially in remote or challenging environments, can also be a significant operational challenge, impacting the ability to deliver dynamic and real-time content. The evolving landscape of privacy regulations and concerns surrounding data collection, particularly with interactive and AI-powered signage, can create hesitancy for businesses due to potential compliance issues and reputational risks. Furthermore, the availability of skilled personnel for content creation, management, and technical support for LFD systems can be a limiting factor in certain regions, hindering efficient deployment and utilization. Lastly, the intense competition within the market, with numerous hardware and software providers, can sometimes lead to price wars, potentially impacting profit margins and the ability of smaller players to innovate and sustain their operations.

The global Commercial Large Format Display (LFD) Signage market is characterized by a dynamic interplay of regional strengths and segment dominance. Based on the historical period (2019-2024) and projected trends leading into the forecast period (2025-2033), Asia Pacific is poised to emerge as a dominant region, largely driven by China's substantial manufacturing capabilities and its rapidly expanding digital infrastructure and adoption of advanced technologies. The region's significant investments in smart city initiatives, modernization of retail spaces, and extensive transportation networks, including airports and public transit, contribute to a vast and growing demand for LFD solutions. Countries like South Korea, Japan, and Southeast Asian nations are also witnessing increased adoption due to their burgeoning economies and a strong emphasis on customer experience and digital transformation across various industries.

Within this dominant region, and globally, the Hardware segment is expected to continue its lead, particularly in terms of revenue and unit shipments. As of the base year 2025, an estimated 5.2 million units are projected to be shipped, with the hardware comprising the core of any LFD signage solution. This dominance is fueled by continuous innovation in display technologies from companies like Samsung, LG Electronics, AUO Corporation, and Sharp NEC Display Solutions. The demand for higher resolution (4K/8K), brighter, and more energy-efficient displays, including advanced LED and OLED technologies, remains a primary driver. The increasing affordability and modularity of LED video walls further bolster the hardware segment's growth.

However, the Application segment of Shopping Malls is anticipated to be a key area of dominance. As e-commerce continues to evolve, brick-and-mortar retailers are investing heavily in creating engaging and immersive in-store experiences to attract and retain customers. LFDs play a crucial role in this strategy, enabling dynamic promotions, interactive product displays, digital directories, and atmospheric content that enhances the overall brand perception and drives sales. The sheer volume of shopping malls globally, coupled with their ongoing modernization efforts, creates a consistent and substantial demand for LFD signage.

Airports also represent a rapidly growing application segment, driven by the need for efficient passenger information systems, advertising opportunities, and enhancing the passenger experience. The increasing global air travel and the expansion of airport infrastructure globally are directly translating into higher demand for LFD solutions for wayfinding, flight information displays (FIDs), and digital advertising.

The Software segment, while perhaps not matching the unit volume of hardware, is experiencing substantial growth in value and strategic importance. Companies are increasingly seeking integrated software solutions for content management, analytics, and remote network management. The development of AI-powered software that enables personalized content delivery and data insights is becoming a critical differentiator, driving a significant portion of the market's value and future innovation. The interplay between advanced hardware and sophisticated software is essential for unlocking the full potential of LFD signage, creating a symbiotic growth dynamic across segments.

Several factors are acting as significant growth catalysts for the commercial LFD signage industry. The increasing demand for immersive and interactive advertising experiences is a primary driver, pushing businesses to adopt LFDs for enhanced customer engagement. Technological advancements, including higher resolutions, improved LED technologies, and the integration of AI and IoT capabilities, are making LFDs more versatile and cost-effective. The burgeoning digital transformation across various sectors, from retail to transportation, necessitates impactful visual communication solutions. Furthermore, the growing emphasis on creating memorable brand experiences and providing real-time information in public spaces is creating substantial opportunities for LFD deployment.

This report offers a holistic and comprehensive analysis of the Commercial Large Format Display (LFD) Signage market, going beyond mere statistics to provide actionable insights. It delves into the intricate details of market segmentation, exploring the nuances of hardware advancements, sophisticated software solutions, and the diverse application landscapes of shopping malls, airports, sports arenas, and other niche sectors. The study provides a forward-looking perspective, examining industry developments, growth catalysts, and the strategic positioning of leading players from 2019 through to the projected landscape of 2033. By meticulously analyzing market trends, driving forces, and potential restraints, this report equips stakeholders with the knowledge necessary to navigate this dynamic industry, identify emerging opportunities, and make informed investment and strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AUO Corporation, Barco, Daktronics, E Ink Holdings, LG Electronics, Mitsubishi Electric, Panasonic, Samsung, Sharp NEC Display Solutions, Shenzhen Eastar Electronic, Sony, TPV Technology, ViewSonic Corporation, Zhejiang Dahua Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commercial Large Format Display Signage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Large Format Display Signage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.