1. What is the projected Compound Annual Growth Rate (CAGR) of the CMP Materials for Wafers?

The projected CAGR is approximately 6.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CMP Materials for Wafers

CMP Materials for WafersCMP Materials for Wafers by Type (CMP Slurry, CMP Pads, CMP Pad Conditioners, CMP POU Slurry Filters, CMP PVA Brushes, CMP Retaining Rings), by Application (300mm Wafers, 200mm Wafers, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

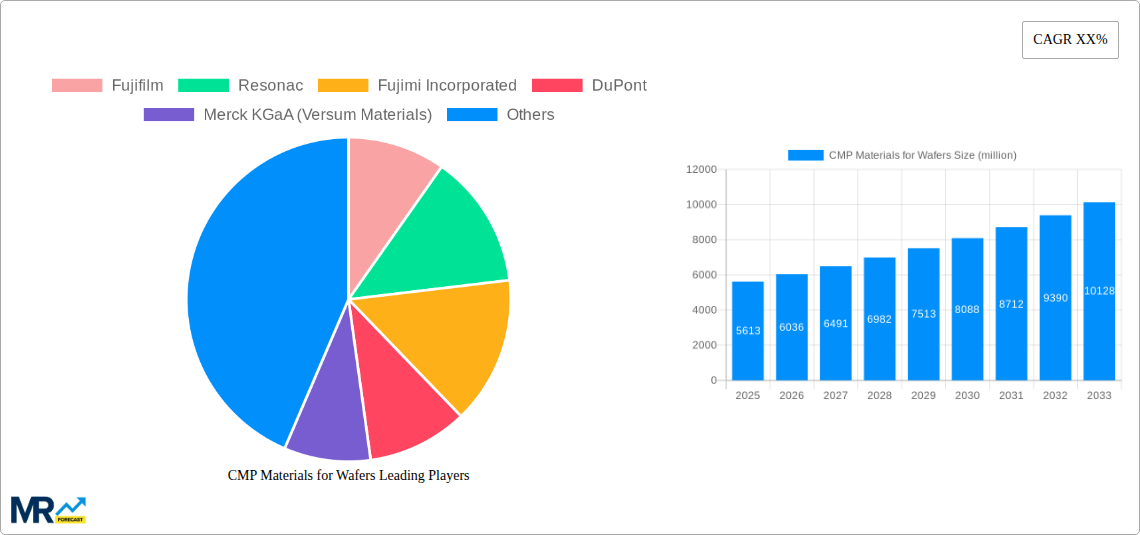

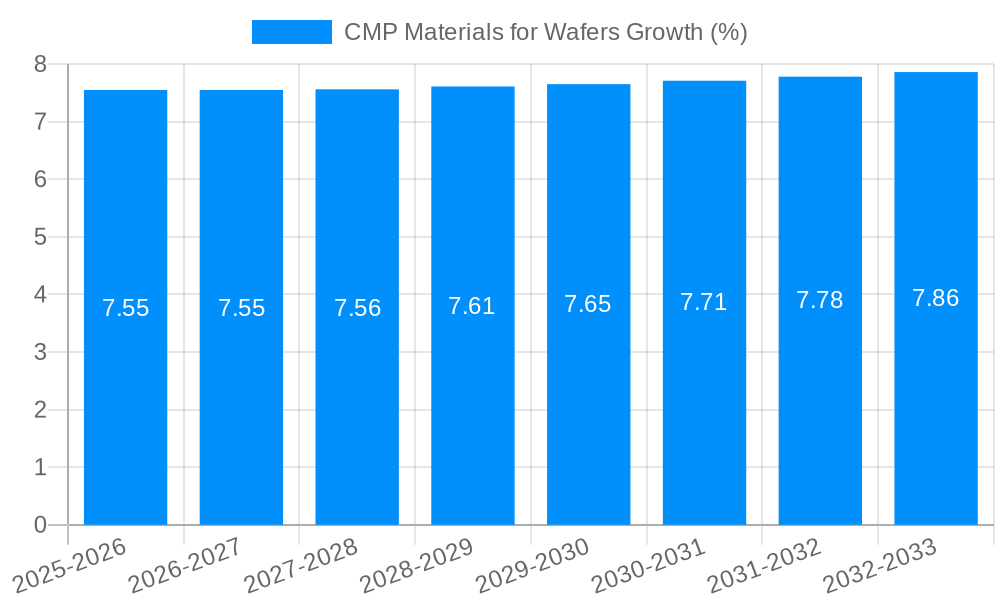

The CMP (Chemical Mechanical Planarization) Materials for Wafers market is a significant segment within the semiconductor industry, exhibiting robust growth. With a 2025 market size of $5,613 million and a Compound Annual Growth Rate (CAGR) of 6.7% from 2019 to 2033, the market is projected to reach approximately $10,000 million by 2033. This growth is fueled by increasing demand for advanced semiconductor devices, particularly in high-growth sectors such as 5G, artificial intelligence, and the Internet of Things (IoT). The rising complexity and density of integrated circuits necessitate the use of CMP materials to achieve the required surface planarity for optimal device performance. Key drivers include the continuous miniaturization of transistors, the adoption of advanced packaging technologies, and the growing need for high-performance computing. Competitive dynamics are influenced by the presence of both established multinational corporations and specialized chemical manufacturers. Innovation in slurry chemistry, pad technology, and equipment is crucial for maintaining market competitiveness and meeting the evolving needs of chip manufacturers. Challenges include the need for environmentally friendly materials, escalating raw material costs, and the complexity of regulating CMP processes.

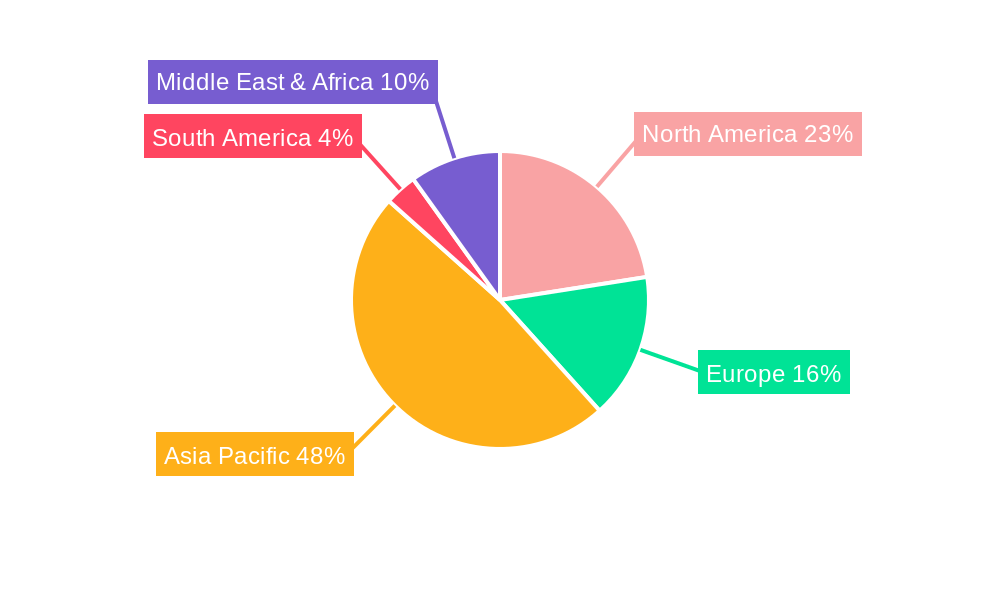

The market segmentation, although not explicitly provided, can be inferred to include various CMP slurry types (e.g., silica, alumina, diamond), pad types (e.g., polyurethane, modified polyurethane), and different wafer sizes. Regional market share is likely distributed among key regions, including North America, Asia-Pacific (dominated by Taiwan, South Korea, and China), Europe, and other regions. The continuous advancements in semiconductor technology, particularly the shift towards advanced nodes (e.g., 3nm, 5nm), necessitate constant improvements in CMP materials to address the stringent requirements of these cutting-edge processes. Future market growth will be closely linked to the expansion of semiconductor manufacturing capacity globally, technological innovations in materials science, and increasing investment in research and development.

The global CMP (Chemical Mechanical Planarization) materials market for wafers experienced significant growth during the historical period (2019-2024), driven primarily by the increasing demand for advanced semiconductor devices. The market size exceeded several billion units in 2024, and is projected to continue its upward trajectory, reaching an estimated value of [Insert Estimated Value in Millions of Units] in 2025. This robust growth is fueled by several factors, including the miniaturization of integrated circuits (ICs), the proliferation of high-performance computing (HPC), and the expanding adoption of 5G and AI technologies. The forecast period (2025-2033) anticipates further expansion, with a Compound Annual Growth Rate (CAGR) projected to be [Insert Projected CAGR]. This growth, however, is expected to be somewhat moderated by fluctuating raw material prices and the cyclical nature of the semiconductor industry. Furthermore, the market is witnessing a shift towards advanced CMP slurries and pads that can effectively polish increasingly intricate wafer geometries, particularly those associated with advanced node technologies. This necessitates continuous innovation within the industry, requiring substantial investment in R&D to meet the evolving demands of semiconductor manufacturers. The competition within the CMP materials market is intense, with numerous established players and emerging companies vying for market share. The market is also characterized by a high degree of vertical integration, with some semiconductor manufacturers producing their own CMP materials or establishing close partnerships with material suppliers. The continuous drive towards improved polishing performance, reduced material costs, and enhanced environmental sustainability is shaping the future direction of the CMP materials industry. Overall, the market is poised for sustained growth but will be subject to cyclical swings and the ongoing technological advancements within the semiconductor sector. This creates both opportunities and challenges for existing players and new entrants in the market.

The relentless miniaturization of semiconductor chips is a key driver of growth in the CMP materials market. As transistors become smaller and more densely packed, the need for precise planarization becomes crucial to ensure optimal device performance. The increasing demand for high-performance computing (HPC) applications, such as artificial intelligence (AI) and machine learning, further fuels this demand. These applications require advanced chips with higher processing power, necessitating more sophisticated CMP processes. The expansion of 5G networks and the Internet of Things (IoT) also contribute significantly to the growth of the CMP materials market as they drive the demand for higher-performance and smaller-size devices. Furthermore, the growing adoption of advanced packaging technologies, such as 3D stacking, requires specialized CMP materials that can handle the complexity of these processes. The development of new semiconductor materials, such as advanced silicon and compound semiconductors, also necessitates innovative CMP slurries and pads optimized for their unique properties. Government initiatives and industry collaborations focusing on strengthening domestic semiconductor manufacturing capabilities in various countries further stimulate investment and demand within this market. This collective push for technological advancement and increased production capacity ensures continued growth in the CMP materials segment for the foreseeable future.

Despite the promising growth outlook, several challenges hinder the CMP materials market. Fluctuations in the prices of raw materials, such as abrasives and chemicals, can significantly impact the profitability of CMP material manufacturers. The semiconductor industry is inherently cyclical, and economic downturns or reduced demand for electronics can lead to decreased demand for CMP materials. Environmental regulations concerning the disposal of CMP slurries are increasingly stringent, requiring manufacturers to adopt more sustainable practices and potentially increasing production costs. The development and qualification of new CMP materials for advanced nodes require significant investment in research and development (R&D), which can be a barrier for smaller companies. Competition within the market is fierce, with established players and new entrants vying for market share, leading to price pressures. Moreover, achieving optimal performance in CMP processes necessitates close collaboration between material suppliers and equipment manufacturers, requiring strong partnerships and efficient communication channels. The continuous advancement in semiconductor manufacturing technologies creates a need for ongoing innovation in CMP materials to address ever-more demanding requirements in terms of precision and efficiency. These challenges demand that companies prioritize innovation, sustainability, and cost efficiency to maintain competitiveness in the market.

Asia-Pacific (Specifically, Taiwan, South Korea, and China): This region dominates the CMP materials market due to its high concentration of semiconductor manufacturing facilities. The robust growth of the electronics industry in these countries and the significant investment in advanced semiconductor manufacturing capabilities drives demand. Taiwan’s leading position in advanced semiconductor manufacturing, particularly in leading-edge nodes, makes it a pivotal market. South Korea's strength in memory manufacturing contributes significantly to its importance in CMP materials consumption. China's ambitious goal of becoming a major player in semiconductor manufacturing is also driving growth in demand. These countries' substantial investments in R&D and technological advancements solidify their dominance in this sector.

North America: While possessing a smaller market share compared to the Asia-Pacific region, North America remains an important player, with significant presence of key semiconductor manufacturers and CMP materials suppliers. This market is characterized by a strong focus on technological innovation and advanced materials.

Europe: While not as dominant as the Asia-Pacific region, Europe represents a significant market, characterized by strong research and development activities and a notable presence of specialized materials suppliers.

Segments: The advanced node CMP materials segment, serving the manufacturing needs of chips with increasingly intricate designs and smaller dimensions, is experiencing the fastest growth. This is driven by the expanding demands of HPC, 5G, and AI applications. The slurry segment holds a substantial market share, while pads and other materials also contribute significantly. The shift towards environmentally friendly, low-impact slurries and pads is also creating opportunities for specialized material suppliers. The market is experiencing a transition toward sustainable and cost-effective solutions, which will further influence segmental growth in the coming years.

The CMP materials industry is experiencing significant growth driven by the unrelenting demand for smaller, faster, and more energy-efficient semiconductor devices. This surge is fueled by the proliferation of smartphones, high-performance computing (HPC), the growth of 5G networks, and the expansion of the Internet of Things (IoT). Furthermore, advancements in chip manufacturing techniques, such as advanced packaging and 3D integration, further necessitate the development of specialized CMP materials, driving market expansion. Government incentives and investments in domestic semiconductor manufacturing capabilities in several countries are also fostering growth and supporting the innovation within the sector.

This report provides a detailed analysis of the CMP materials market for wafers, covering market size, growth trends, key drivers, challenges, and leading players. It offers a comprehensive overview of the industry, including segment analysis, regional insights, and future outlook. The report is a valuable resource for industry professionals, investors, and researchers seeking to understand the dynamics and future potential of this crucial market segment within the semiconductor industry. The study period covers 2019-2033, with 2025 as the base year and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report's in-depth analysis provides valuable insights for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.7%.

Key companies in the market include Fujifilm, Resonac, Fujimi Incorporated, DuPont, Merck KGaA (Versum Materials), Fujifilm, AGC, KC Tech, JSR Corporation, Anjimirco Shanghai, Soulbrain, Saint-Gobain, Ace Nanochem, Dongjin Semichem, Vibrantz (Ferro), WEC Group, SKC (SK Enpulse), Shanghai Xinanna Electronic Technology, Hubei Dinglong, Beijing Hangtian Saide, Fujibo Group, 3M, FNS TECH, IVT Technologies Co, Ltd., TWI Incorporated, KPX Chemical, Engis Corporation, TOPPAN INFOMEDIA, Samsung SDI, Entegris, Pall, Cobetter, Kinik Company, Saesol Diamond, EHWA DIAMOND, Nippon Steel & Sumikin Materials, Shinhan Diamond, BEST Engineered Surface Technologies, Willbe S&T, CALITECH, Cnus Co., Ltd., UIS Technologies, Euroshore, PTC, Inc., AKT Components Sdn Bhd, Ensinger, CHUANYAN, Zhuhai Cornerstone Technologies, Konfoong Materials International, Tianjin Helen, Shenzhen Angshite Technology, Advanced Nano Products Co.,Ltd, Zhejiang Bolai Narun Electronic Materials, Xiamen Chia Ping Diamond Industrial.

The market segments include Type, Application.

The market size is estimated to be USD 5613 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "CMP Materials for Wafers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CMP Materials for Wafers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.