1. What is the projected Compound Annual Growth Rate (CAGR) of the Charging Management Chip?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Charging Management Chip

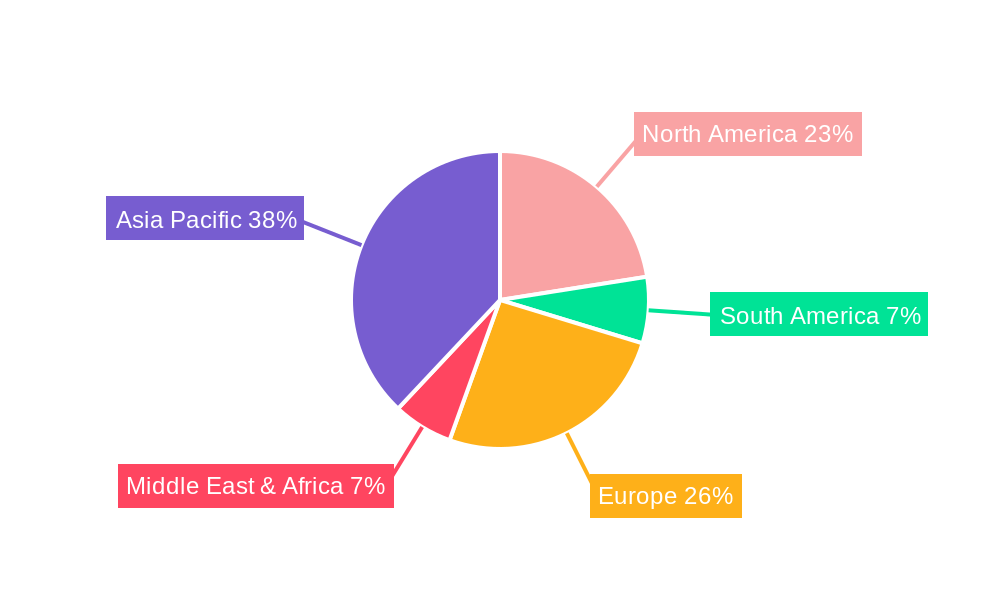

Charging Management ChipCharging Management Chip by Type (Single Battery Charging Management Chip, Multi-battery Charging Management Chip, Wireless Charging Management Chip, World Charging Management Chip Production ), by Application (Smartphones, Wearable Devices, Power Tools, Others, World Charging Management Chip Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

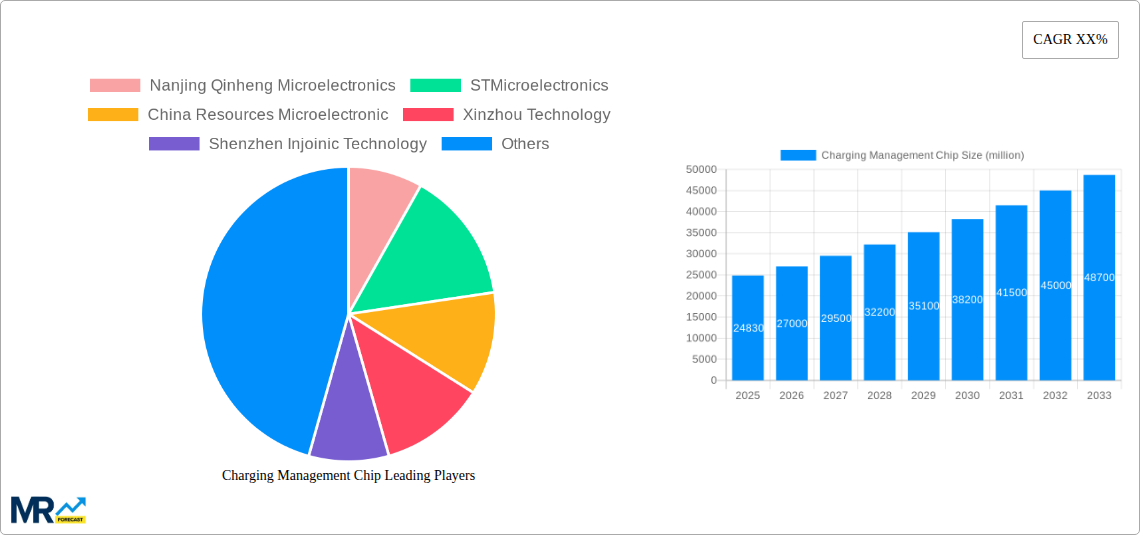

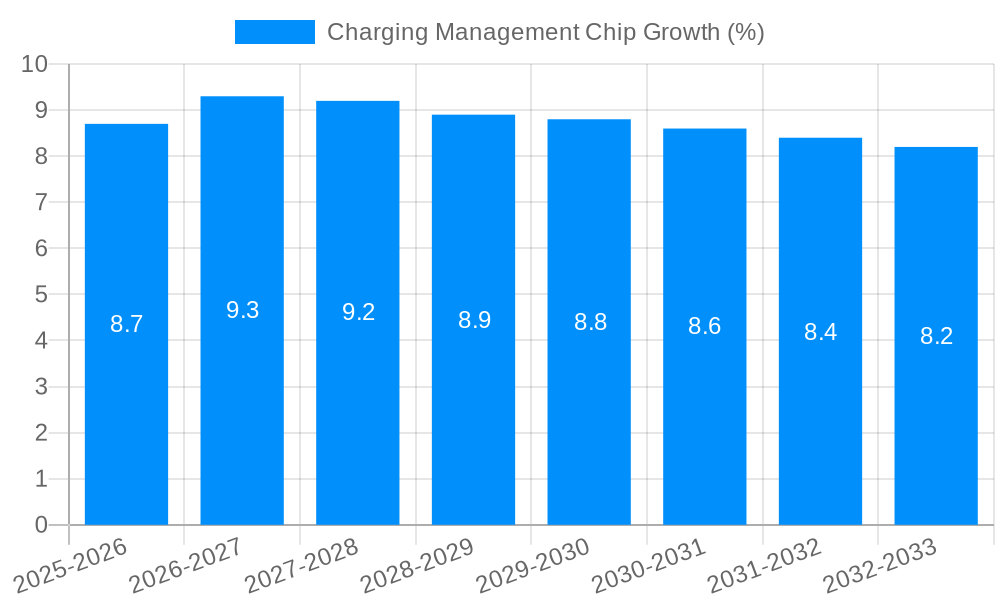

The global charging management chip market is poised for significant expansion, estimated at $24,830 million. This robust growth is fueled by an increasing demand for portable electronic devices, electric vehicles, and the burgeoning Internet of Things (IoT) ecosystem, all of which rely heavily on efficient and reliable charging solutions. The market's Compound Annual Growth Rate (CAGR) is projected to be substantial, driven by advancements in charging technologies such as fast charging, wireless charging, and intelligent power management. The proliferation of smartphones and wearable devices continues to be a primary volume driver, with consumers increasingly seeking quicker charging times and longer battery life. Furthermore, the electrification of transportation and the growing adoption of electric power tools are opening up new avenues for charging management chip manufacturers. The Asia Pacific region, particularly China, is expected to lead both production and consumption due to its strong manufacturing base for electronics and the rapid adoption of new technologies.

Despite the promising outlook, the market faces certain restraints. The high cost of research and development for advanced charging technologies and the increasing complexity of power management systems can pose challenges. Moreover, stringent regulatory standards related to power efficiency and safety could impact development cycles. However, the industry is witnessing a strong trend towards miniaturization, higher integration, and enhanced safety features within charging management chips. Innovations in multi-battery charging systems, designed for applications requiring multiple power sources, and the widespread adoption of wireless charging solutions for consumer electronics are key trends shaping the market. Companies like STMicroelectronics, Texas Instruments, and Analog Devices are actively investing in R&D to introduce next-generation chips that offer improved performance, energy efficiency, and cost-effectiveness, ensuring the market's continued upward trajectory.

This report provides an in-depth analysis of the global Charging Management Chip market, a critical component in the rapidly evolving landscape of portable electronics and electric mobility. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this research offers a detailed examination of historical trends (2019-2024) and forecasts future market dynamics through 2033. The report delves into the intricate workings of charging management chips, their technological advancements, market drivers, challenges, and the competitive ecosystem.

The global Charging Management Chip market is experiencing a robust surge, driven by the insatiable demand for portable and increasingly sophisticated electronic devices. In the historical period of 2019-2024, the market witnessed significant growth, with unit shipments projected to exceed 500 million units by 2024. Looking ahead to the estimated year of 2025, this trajectory is expected to accelerate, with unit production anticipated to reach approximately 650 million units. The forecast period of 2025-2033 paints an even more optimistic picture, with the market poised for substantial expansion, potentially surpassing 1.2 billion units by 2033. This remarkable growth is fueled by several interconnected trends. Firstly, the proliferation of smartphones and the ever-increasing integration of advanced features, demanding more efficient and faster charging solutions, continue to be a primary driver. Secondly, the burgeoning wearable devices segment, from smartwatches to fitness trackers, relies heavily on compact and power-efficient charging management chips. Furthermore, the growing adoption of electric vehicles (EVs) and the associated charging infrastructure are creating a new and significant demand stream for more robust and specialized multi-battery charging management solutions. The rise of wireless charging technology, a convenience factor that consumers increasingly expect, is also a key trend, prompting innovation and market growth in this specific segment. Moreover, the continuous push for miniaturization, improved power conversion efficiency, and enhanced safety features within charging management chips are pushing technological boundaries and opening up new application avenues, contributing to the overall market expansion. The market's evolution is also being shaped by the increasing complexity of battery chemistries and the need for intelligent battery management systems that optimize charging cycles, prolong battery lifespan, and ensure user safety.

The Charging Management Chip market is propelled by a confluence of powerful technological and consumer-driven forces. The relentless evolution of battery technology, particularly the shift towards higher energy densities and faster charging capabilities in lithium-ion batteries, necessitates sophisticated charging management solutions that can efficiently and safely harness these advancements. Furthermore, the ubiquitous adoption of smartphones across all demographics, coupled with the increasing demand for features like fast charging and wireless charging, directly translates into a higher volume of charging management chip production. The burgeoning Internet of Things (IoT) ecosystem, encompassing a vast array of connected devices, from smart home appliances to industrial sensors, each requiring optimized power management, significantly contributes to this growth. The rapid expansion of the electric vehicle (EV) market is another monumental driver. As more consumers embrace EVs, the demand for advanced multi-battery charging management chips, capable of handling complex charging architectures and high power levels, is soaring. This trend is further amplified by government incentives and increasing environmental consciousness, accelerating EV adoption and, consequently, the need for robust charging solutions. The relentless pursuit of energy efficiency across all electronic devices, driven by both cost savings and environmental concerns, pushes manufacturers to develop charging management chips that minimize power loss during the charging process.

Despite the robust growth, the Charging Management Chip market is not without its hurdles. One of the primary challenges lies in the intense price competition, particularly in the high-volume smartphone segment, forcing manufacturers to constantly innovate while maintaining cost-effectiveness. The rapid pace of technological evolution also presents a challenge, as companies must continually invest in research and development to keep up with emerging standards and consumer expectations for faster and more efficient charging. Supply chain disruptions, as witnessed in recent years, can impact the availability of essential raw materials and components, leading to production delays and increased costs. The increasing complexity of battery management systems, driven by diverse battery chemistries and safety regulations, requires highly specialized expertise and advanced design capabilities, which can be a barrier for smaller players. Furthermore, the global push towards standardization in charging protocols, while beneficial in the long run, can also lead to fragmentation and compatibility issues during the transition phases, requiring adaptability from chip manufacturers. The stringent safety regulations surrounding battery charging, particularly in applications like electric vehicles and medical devices, necessitate rigorous testing and certification processes, adding to development time and cost.

The Asia-Pacific region, particularly China, is poised to dominate the global Charging Management Chip market, driven by its unparalleled manufacturing capabilities, burgeoning consumer electronics industry, and significant investments in electric vehicle technology. Within this region, China stands out as a critical hub, housing a substantial number of leading charging management chip manufacturers, including Nanjing Qinheng Microelectronics, China Resources Microelectronic, Xinzhou Technology, Shenzhen Injoinic Technology, Southchip Semiconductor Technology, Chipsea Technologies, NuVolta Technologies, Xiamen Newyea Microelectronics Technology, Zhuhai iSmartware Technology, and Shenzhen Chipsvision Microelectronics. This concentration of domestic players, coupled with the presence of global giants like STMicroelectronics and NXP Semiconductors establishing significant operations, creates a highly competitive and innovative ecosystem.

In terms of Segments, the Application segment of Smartphones is a dominant force, consistently accounting for the largest share of the market due to the sheer volume of devices produced globally. The demand for fast charging, wireless charging, and improved battery life in smartphones directly fuels the need for advanced single-battery and multi-battery charging management chips. The Wearable Devices segment is another rapidly growing area, with the increasing popularity of smartwatches, fitness trackers, and other personal electronics creating a significant demand for compact and power-efficient charging solutions.

However, the World Charging Management Chip Production itself represents a broader, overarching segment that is central to understanding market dominance. China's overwhelming position in global electronics manufacturing directly translates into its leadership in the production of charging management chips. This production dominance is further bolstered by its robust domestic demand across various application segments.

Looking at the Type of charging management chips, the Single Battery Charging Management Chip is expected to continue its dominance in the near to medium term due to the widespread use of single-cell batteries in a vast array of consumer electronics. Nevertheless, the Multi-battery Charging Management Chip segment is experiencing accelerated growth, primarily driven by the burgeoning electric vehicle market, which utilizes complex multi-cell battery architectures. The Wireless Charging Management Chip segment is also a significant growth engine, fueled by consumer demand for convenience and the increasing integration of wireless charging capabilities into a wider range of devices, from smartphones to laptops and even furniture. The development of advanced wireless charging technologies with higher power transfer capabilities and improved efficiency is further solidifying its market position.

The dominance of Asia-Pacific, and specifically China, in this market is a multifaceted phenomenon. It encompasses not only the manufacturing prowess but also a significant consumer base that drives demand, a supportive government ecosystem for technological advancement, and a strong research and development infrastructure that fosters innovation. The region's ability to produce high volumes at competitive prices, coupled with a rapid adoption rate of new technologies, positions it as the undisputed leader in both the production and consumption of charging management chips.

The Charging Management Chip industry's growth is significantly catalyzed by the relentless innovation in battery technology, leading to higher energy densities and faster charging capabilities. The explosive growth of the electric vehicle (EV) market, demanding sophisticated multi-battery charging solutions, is a monumental catalyst. Furthermore, the increasing adoption of wireless charging technology across a wider array of consumer electronics, driven by user convenience, provides a substantial growth impetus. The expanding Internet of Things (IoT) ecosystem, with its diverse array of connected devices requiring efficient power management, also acts as a significant growth catalyst.

This comprehensive report delves into the intricate dynamics of the global Charging Management Chip market. It meticulously analyzes market trends, including the proliferation of smartphones and wearables, alongside the transformative impact of electric vehicles. The report identifies key drivers such as technological advancements in battery technology and the growing demand for energy efficiency. It also scrutinizes the inherent challenges, including price competition and supply chain volatility. Furthermore, it highlights the dominant position of the Asia-Pacific region, with a particular focus on China, and analyzes the significance of segments like smartphones and single-battery charging management chips, while also acknowledging the rapid ascent of multi-battery and wireless charging solutions. This detailed examination provides invaluable insights for stakeholders seeking to navigate and capitalize on the future of charging management chip technology.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nanjing Qinheng Microelectronics, STMicroelectronics, China Resources Microelectronic, Xinzhou Technology, Shenzhen Injoinic Technology, NXP Semiconductors, Southchip Semiconductor Technology, Chipsea Technologies, NuVolta Technologies, Renesas Electronics, Xiamen Newyea Microelectronics Technology, Zhuhai iSmartware Technology, Shenzhen Chipsvision Microelectronics, Analog Devices, Texas Instruments, Microchip, ON Semiconductor.

The market segments include Type, Application.

The market size is estimated to be USD 24830 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Charging Management Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Charging Management Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.