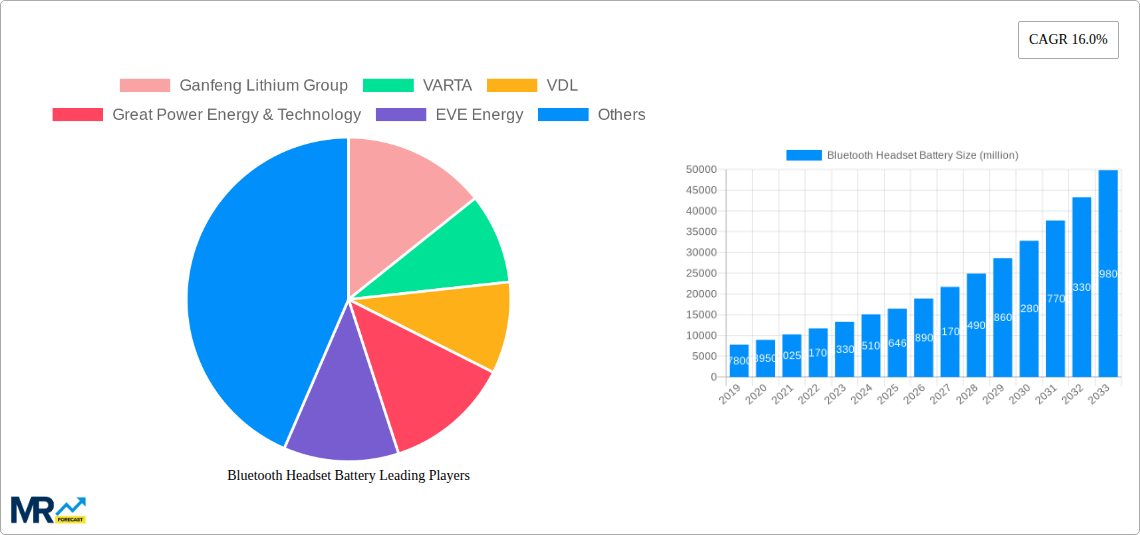

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bluetooth Headset Battery?

The projected CAGR is approximately 16.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bluetooth Headset Battery

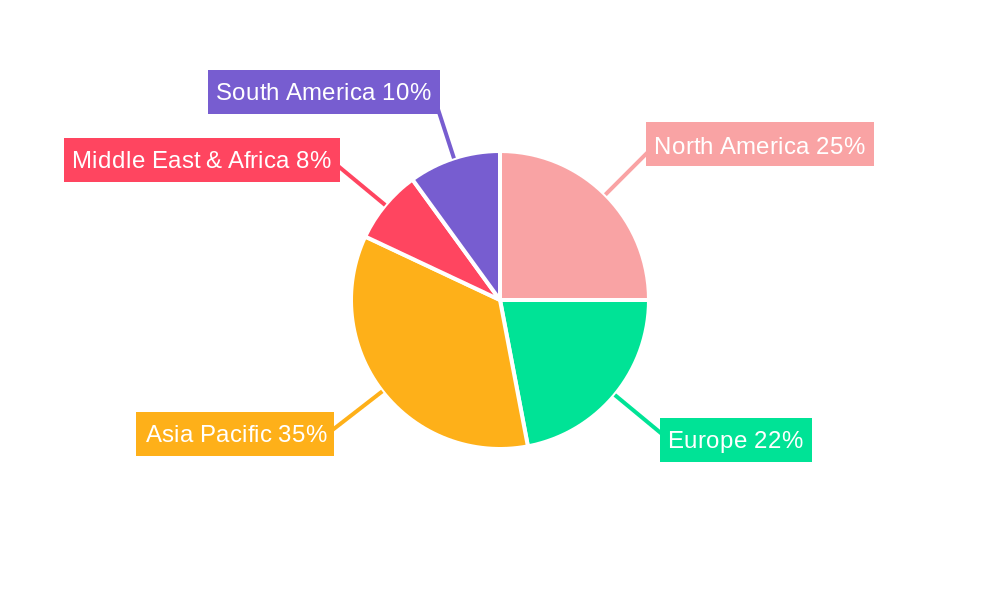

Bluetooth Headset BatteryBluetooth Headset Battery by Type (Button Cell, Soft Pack Battery, Others), by Application (Traditional Bluetooth Headphone, TWS Bluetooth Headphone), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

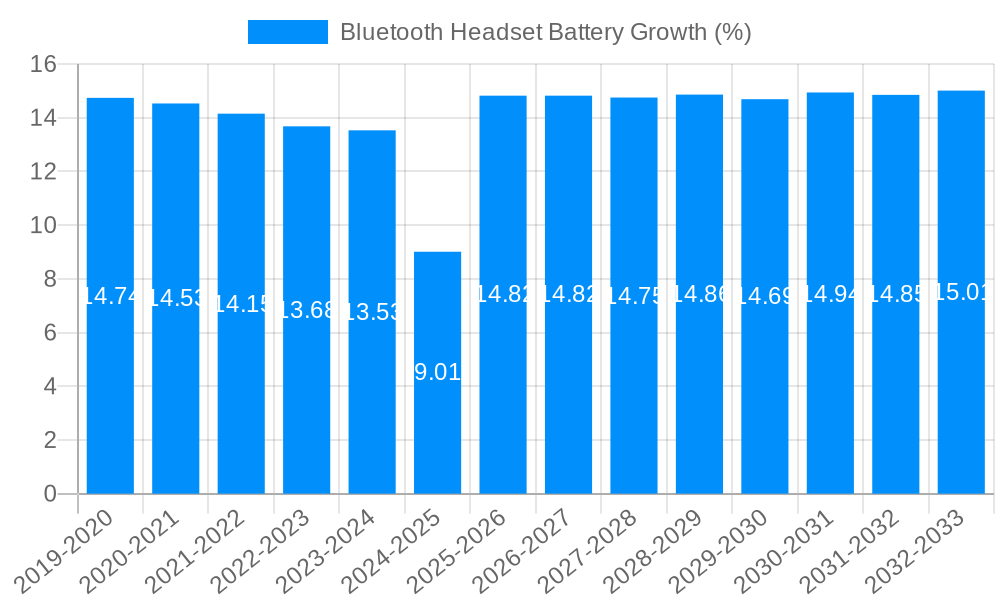

The global Bluetooth Headset Battery market is poised for significant expansion, projected to reach an impressive market size of $16,460 million by 2025. This substantial growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 16.0% anticipated from 2019 to 2033. The primary drivers behind this surge include the escalating demand for wireless audio devices, particularly True Wireless Stereo (TWS) Bluetooth headphones, which have become mainstream due to their convenience and improving audio quality. Advancements in battery technology, leading to longer battery life, faster charging capabilities, and smaller form factors, are also critical enablers. Furthermore, the increasing disposable income globally and the growing trend of integrating smart features into audio accessories further bolster market prospects. The market's dynamism is also shaped by evolving consumer preferences for premium audio experiences and the continuous innovation by key players in developing more efficient and durable battery solutions.

The market segmentation reveals a clear preference towards specific battery types and applications. While button cell batteries continue to hold a significant share, soft pack batteries are gaining traction due to their flexibility in design and suitability for compact TWS earbuds. The application segment is overwhelmingly dominated by TWS Bluetooth headphones, reflecting their soaring popularity. Traditional Bluetooth headphones, though still relevant, represent a smaller portion of the market. Geographically, the Asia Pacific region, led by China, is expected to be the largest and fastest-growing market, owing to its robust electronics manufacturing ecosystem and a vast consumer base. North America and Europe are also significant markets, driven by early adoption of wireless audio technology and a strong presence of premium headphone brands. Emerging economies in these regions present further opportunities for market players. Challenges, such as intense competition, fluctuating raw material prices (especially lithium), and the need for continuous technological innovation to keep pace with device miniaturization and power demands, are factors that market participants must strategically navigate to capitalize on the extensive growth potential.

Here's a unique report description on Bluetooth Headset Batteries, incorporating your specified elements:

This in-depth report delves into the dynamic and rapidly evolving Bluetooth headset battery market, offering a granular analysis of trends, drivers, challenges, and future projections. The study encompasses the historical period from 2019 to 2024, with a base year of 2025, and extends through an extensive forecast period up to 2033. We project market figures in the millions, providing a clear quantitative understanding of the industry's scale and growth trajectory.

The Bluetooth headset battery market is experiencing a profound transformation, driven by relentless innovation and escalating consumer demand for enhanced user experiences. During the study period of 2019-2033, with a specific focus on the estimated year of 2025, we observe a significant shift towards smaller, more energy-dense battery solutions. The proliferation of True Wireless Stereo (TWS) Bluetooth headphones, a segment that has surged in popularity, is a primary catalyst, demanding miniaturized yet powerful battery components. This trend necessitates a move away from larger, traditional battery chemistries towards advanced solutions capable of delivering extended playback times within extremely compact form factors. The "Others" battery type, encompassing novel materials and designs optimized for micro-electronics, is therefore expected to witness substantial growth. Furthermore, a key insight is the increasing emphasis on rapid charging capabilities, as consumers seek to minimize downtime. This is directly influencing battery development, pushing manufacturers to integrate faster charging technologies without compromising battery longevity or safety. The report highlights that the demand for batteries that can withstand a greater number of charge cycles while retaining their capacity is also on the rise, reflecting a consumer preference for durable and long-lasting devices. The integration of artificial intelligence within battery management systems to optimize power consumption and prolong battery life is another emergent trend. The sheer volume of Bluetooth headsets projected to enter the market in the coming years, estimated to reach millions, underscores the critical importance of these battery innovations. The transition from older battery technologies to more efficient and environmentally friendly alternatives is also a significant trend, aligning with global sustainability initiatives. The report details how advancements in battery material science are playing a crucial role in achieving these breakthroughs, enabling smaller batteries with higher energy densities and improved performance characteristics, all while catering to the growing millions of global users adopting these sophisticated audio devices. The market's trajectory indicates a move towards highly specialized battery solutions, tailored to the unique power requirements and physical constraints of increasingly sophisticated Bluetooth headset designs.

The market for Bluetooth headset batteries is propelled by a confluence of powerful forces, chief among them being the unyielding demand for wireless audio freedom. The pervasive adoption of smartphones, now ubiquitous across the globe and reaching hundreds of millions, has cemented the smartphone as the primary audio source for a vast consumer base. This has, in turn, fueled an insatiable appetite for accessories that enhance the mobile experience, with Bluetooth headphones standing at the forefront. The rapid evolution of TWS Bluetooth headphone technology has been a monumental driver, transforming the audio landscape. These compact and convenient devices require increasingly sophisticated and miniaturized battery solutions that can deliver extended listening times without compromising on comfort or portability. The industry's ability to deliver millions of these devices annually directly translates to a substantial and growing demand for the batteries that power them. Moreover, the burgeoning entertainment and media consumption habits, encompassing music streaming, podcast listening, and mobile gaming, have significantly increased the average daily usage time of Bluetooth headsets. This continuous engagement necessitates batteries that offer superior longevity and reliable performance, pushing manufacturers to innovate relentlessly. The increasing disposable income in many emerging economies is also contributing to the growth, enabling a larger segment of the population to access these advanced audio devices and their essential battery components, further boosting the millions in market value.

Despite the robust growth, the Bluetooth headset battery sector faces several significant challenges and restraints that can impede its unhindered expansion. Foremost among these is the inherent limitation of current battery technologies in terms of energy density versus physical size. The relentless pursuit of ever-smaller and more discreet Bluetooth headphones, particularly TWS models, places immense pressure on battery manufacturers to deliver more power within shrinking footprints. This often leads to trade-offs in battery lifespan, charging speed, or overall capacity, presenting a persistent technical hurdle that can affect millions of potential devices. Another critical restraint is the escalating cost of raw materials, particularly lithium, cobalt, and nickel, which are fundamental to the production of high-performance batteries. Fluctuations in the global supply chain and geopolitical factors can lead to price volatility, impacting manufacturing costs and potentially affecting the affordability of Bluetooth headsets for millions of consumers worldwide. Furthermore, battery safety and thermal management remain paramount concerns. As battery capacities increase and charging speeds accelerate, ensuring the safety and preventing overheating of these small, integrated power sources becomes increasingly complex, requiring rigorous testing and advanced engineering to protect millions of users. Environmental regulations and the disposal of spent batteries also present a growing challenge, demanding sustainable solutions for manufacturing and recycling processes that affect the entire ecosystem supporting the millions of devices in use. The constant need for innovation also means that companies must invest heavily in research and development, a factor that can be a restraint for smaller players in the market.

The Bluetooth headset battery market is poised for significant dominance by specific regions and segments, driven by technological adoption, manufacturing prowess, and consumer demand.

Segment Dominance: TWS Bluetooth Headphone Batteries and Soft Pack Battery Type

TWS Bluetooth Headphone Application: The TWS Bluetooth Headphone application segment is unequivocally set to dominate the market. The meteoric rise of TWS earbuds, characterized by their true wireless convenience, compact design, and sophisticated features, has reshaped consumer audio preferences. This segment has witnessed exponential growth over the historical period (2019-2024) and is projected to continue its upward trajectory through the forecast period (2025-2033). The demand for millions of TWS units annually translates directly into a colossal requirement for specialized batteries. These batteries must be exceptionally small, lightweight, and capable of delivering sufficient power for extended listening sessions, often requiring multiple recharges from a compact charging case. The design constraints of TWS earbuds, which leave minimal internal space, necessitate highly efficient battery solutions that have seen significant investment and development from leading companies. The market for these batteries, in the millions of units, is directly correlated with the sales figures of TWS devices themselves.

Soft Pack Battery Type: Within the Type of battery, the Soft Pack Battery segment is expected to lead the charge. While button cells are crucial for certain miniaturized applications, the increasing power demands and size requirements of TWS Bluetooth headphones are making soft pack batteries the preferred choice. Soft pack batteries, often utilizing polymer electrolyte technology, offer greater design flexibility in terms of shape and size compared to rigid cylindrical cells. This adaptability is crucial for fitting into the ergonomically designed casings of modern Bluetooth headsets. Furthermore, soft pack batteries generally offer a higher energy density per unit volume, enabling manufacturers to pack more power into smaller spaces, thus extending battery life. The ability to customize the form factor of soft pack batteries also allows for optimal utilization of the limited internal real estate within Bluetooth headsets and their charging cases. The advancements in soft pack battery technology, including improved safety features and faster charging capabilities, further solidify their dominance in this rapidly expanding market segment, catering to the millions of devices being produced. The report analyzes how companies are investing in advanced manufacturing techniques for soft pack batteries to meet the ever-increasing demand from the millions of TWS units entering the market.

Regional Dominance: Asia Pacific (APAC)

The Bluetooth headset battery industry is experiencing significant growth catalysts, primarily driven by the relentless evolution of wireless audio technology. The increasing miniaturization of Bluetooth headsets, especially TWS models, necessitates smaller yet more powerful batteries. This demand fuels innovation in battery chemistries and design, pushing for higher energy densities and improved charge cycle longevity. Furthermore, the pervasive adoption of 5G technology is enhancing Bluetooth connectivity, leading to richer audio experiences and increased headset usage, thus directly boosting battery demand. The growing consumer focus on health and fitness has also spurred the development of specialized Bluetooth headsets for sports, requiring batteries with enhanced durability and sweat resistance, creating niche growth opportunities.

This comprehensive report provides an exhaustive analysis of the Bluetooth headset battery market, offering unparalleled insights into its present landscape and future trajectory. Covering the study period from 2019 to 2033, with detailed breakdowns for the historical period (2019-2024) and a forward-looking forecast (2025-2033), it leverages a base year of 2025 to provide a clear benchmark for market estimations. The report meticulously examines key segments, including battery types such as Button Cell, Soft Pack Battery, and Others, and their application in Traditional Bluetooth Headphones and TWS Bluetooth Headphones. Industry developments, crucial regional analyses, and the strategic positioning of leading players are all explored in depth. This report is an essential resource for stakeholders seeking to understand the complex dynamics, growth catalysts, challenges, and vast opportunities within the multi-million dollar Bluetooth headset battery industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.0%.

Key companies in the market include Ganfeng Lithium Group, VARTA, VDL, Great Power Energy & Technology, EVE Energy, Sunwoda Electronic, Guoguang Electric, Sony Mobile, LG Chem, ATL, EEMB, Panasonic, Shenzhen Desay Battery Technology, Grepow Battery, Mitacbatter Technology, PATL.

The market segments include Type, Application.

The market size is estimated to be USD 16460 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bluetooth Headset Battery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bluetooth Headset Battery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.