1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking Wearable Devices?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Banking Wearable Devices

Banking Wearable DevicesBanking Wearable Devices by Type (/> Wristbands, Watches, Payment Processing Rings, Glasses, Others), by Application (/> Payment Transactions, Personal Banking, Stock Purchasing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

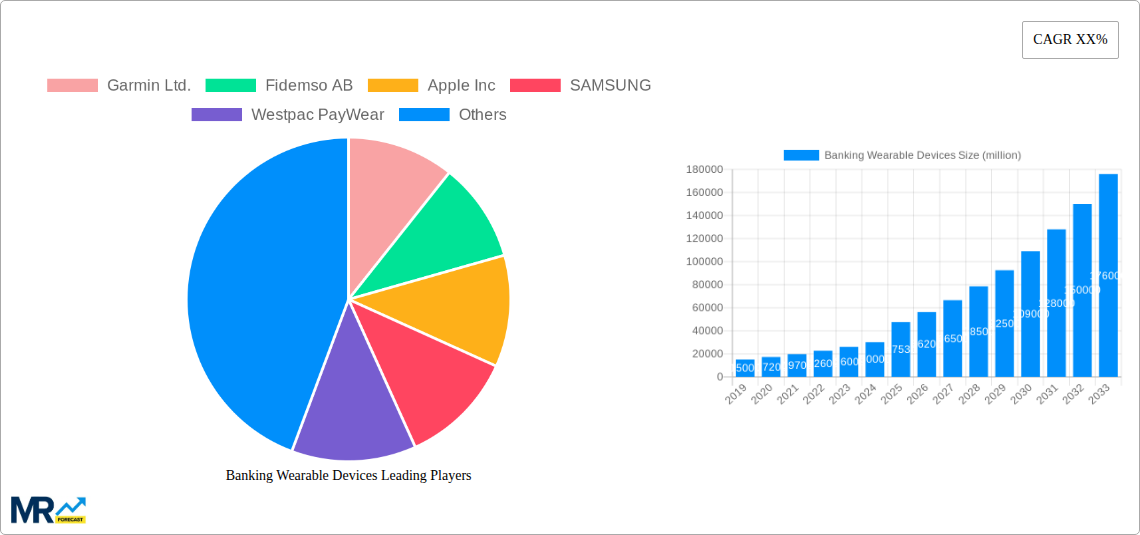

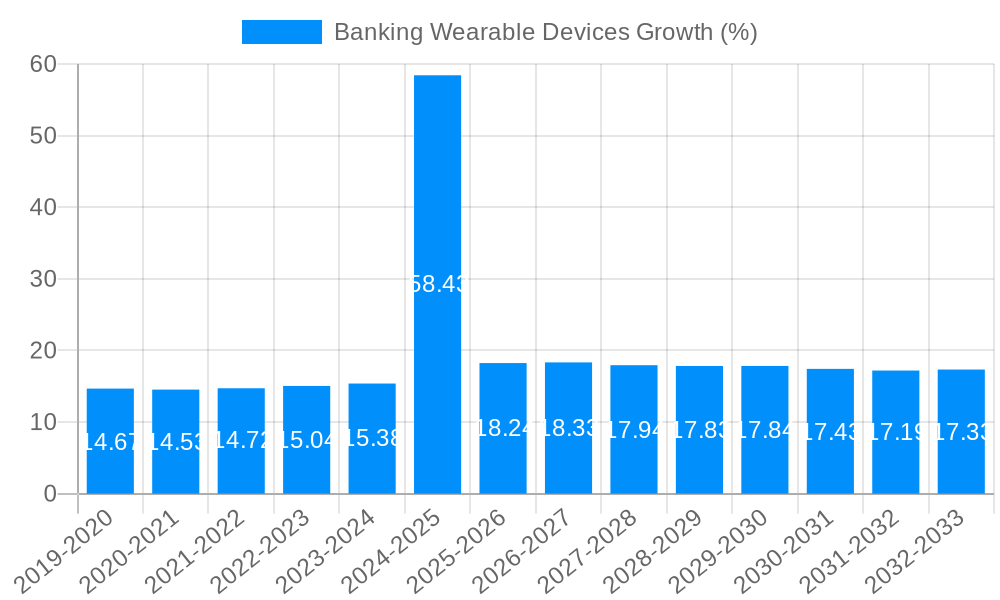

The global market for Banking Wearable Devices is poised for substantial growth, projected to reach a market size of $47.53 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 18.5% anticipated through 2033. This expansion is primarily fueled by the increasing consumer adoption of contactless payment solutions and a growing demand for integrated financial services within everyday wearable technology. Key drivers include the convenience and security offered by wearable payment devices, a rising awareness of the benefits of seamless transactions, and continuous innovation in wearable technology by major players like Apple, Samsung, and Garmin. The market is witnessing a surge in demand for wristbands and watches equipped with advanced payment processing capabilities, enabling users to make transactions with a simple tap. The evolution of personal banking applications integrated into wearables, allowing for account management and even stock purchasing, further propels market expansion. Emerging trends such as the integration of biometric authentication for enhanced security and the development of more sophisticated payment rings and glasses are set to redefine user experience and drive further market penetration.

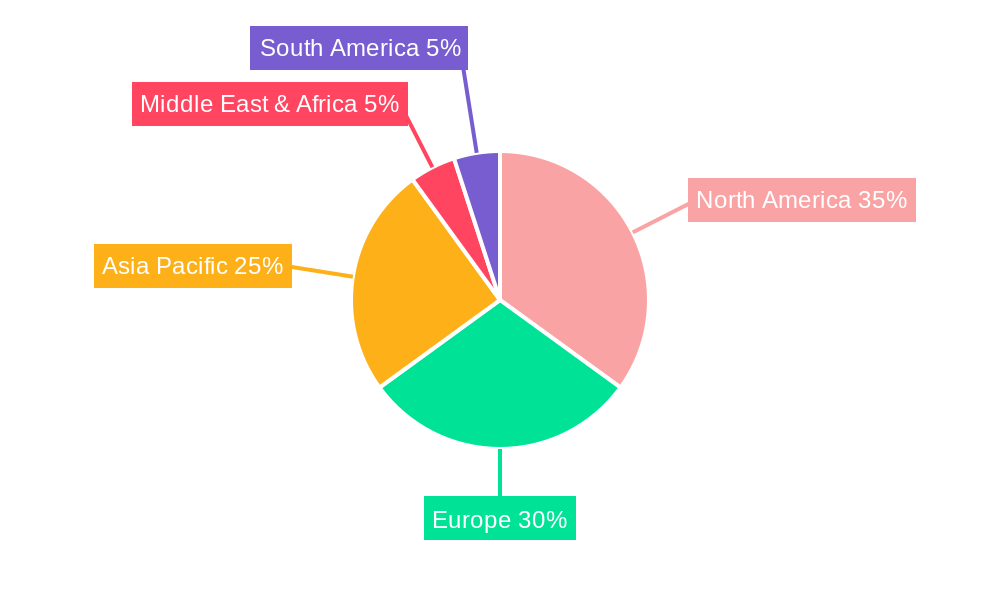

Despite the promising outlook, certain restraints could temper the growth trajectory. These include lingering consumer concerns regarding data security and privacy, the initial cost of advanced wearable devices, and the need for greater standardization and interoperability across different payment networks and wearable platforms. However, the overwhelming trend towards a cashless society, coupled with the increasing integration of financial technology (FinTech) into our daily lives, suggests these challenges will be progressively overcome. The market is segmented by type into wristbands, watches, payment processing rings, glasses, and others, with wristbands and watches dominating current adoption. Applications range from simple payment transactions and personal banking to more specialized uses like stock purchasing. Geographically, North America and Europe are leading the charge in adoption, driven by advanced infrastructure and high consumer disposable income, with Asia Pacific showing significant growth potential due to its rapidly expanding digital economy and tech-savvy population.

The banking wearable devices market is poised for a significant evolution, moving beyond mere novelty to become an integral part of daily financial life. During the study period of 2019-2033, with a base and estimated year of 2025, this sector is projected to witness substantial growth, driven by increasing consumer adoption of connected devices and the inherent convenience they offer. Historically, the period from 2019-2024 laid the groundwork, with early iterations focusing on basic payment functionalities. However, the forecast period of 2025-2033 anticipates a more sophisticated integration of personal banking services, stock purchasing capabilities, and even advanced security features directly within wearables.

Key Market Insights:

The market is not just about making payments; it's about creating a more integrated and intelligent financial ecosystem. Consumers are increasingly seeking ways to manage their finances effortlessly, and wearable devices are emerging as the ideal conduit for this. From instant transaction notifications to real-time budget tracking, the capabilities are expanding rapidly. The confluence of advancing biometric security, ubiquitous connectivity, and a growing consumer appetite for frictionless financial services paints a picture of a rapidly maturing and incredibly promising market. The innovation pipeline is strong, with companies continually pushing the boundaries of what a wearable device can do in the financial realm.

Several potent forces are converging to propel the banking wearable devices market into a new era of widespread adoption and innovation. Foremost among these is the relentless advancement in connectivity and miniaturization of technology. This allows for sophisticated banking functionalities to be embedded into increasingly sleeker and more power-efficient devices. The pervasive adoption of contactless payment infrastructure globally has also been a critical enabler, creating a readily available ecosystem where wearable payments can thrive. Consumers have grown accustomed to the ease and speed of tap-to-pay, making the transition to wearable-based payments a natural and logical progression. Furthermore, the growing consumer demand for convenience and personalization in all aspects of their lives, including financial management, is a significant propellant. People are actively seeking ways to streamline their daily routines, and being able to make payments, check balances, or even manage investments with a flick of the wrist aligns perfectly with this desire. The increasing focus on security and biometrics by both technology providers and financial institutions is also a key driver, addressing early concerns about the safety of financial transactions on wearable devices. Innovations in fingerprint sensors, facial recognition, and unique physiological markers are building consumer trust. Finally, strategic partnerships between financial institutions, technology giants, and wearable manufacturers are crucial, fostering the development of integrated solutions and expanding the reach of banking services to a wider audience.

Despite the burgeoning potential, the banking wearable devices market faces a distinct set of challenges and restraints that could temper its growth trajectory. Security and privacy concerns remain a paramount hurdle. While advancements in biometrics are encouraging, the inherent nature of wearable devices, often worn publicly and constantly connected, raises apprehension about data breaches and unauthorized access to sensitive financial information. Establishing robust and universally trusted security protocols is critical. User adoption and habit formation also present a significant challenge. Many consumers, particularly older demographics, are accustomed to traditional banking methods and may require substantial education and reassurance to fully embrace wearable-based financial services. Shifting deeply ingrained habits takes time and consistent positive reinforcement. Interoperability and standardization issues can also create friction. A fragmented ecosystem where different devices and payment networks do not seamlessly communicate can hinder widespread adoption. A unified approach is essential for a smooth user experience across various wearable platforms and financial service providers. The cost of advanced wearable devices that integrate comprehensive banking features can be a barrier for a significant segment of the population, limiting market penetration in price-sensitive regions. Furthermore, regulatory complexities and compliance requirements across different jurisdictions can slow down the rollout of new banking functionalities on wearables, requiring financial institutions to navigate a labyrinth of legal frameworks.

The dominance in the banking wearable devices market is anticipated to be a multifaceted phenomenon, driven by a confluence of technological adoption, economic prosperity, and consumer behavior. While no single entity will hold absolute sway, several regions and specific segments are poised to lead the charge.

Dominating Segments:

Key Regions/Countries Leading the Charge:

The dominance will be a result of these regions and segments capitalizing on the trend towards frictionless financial interactions. As wearable technology becomes more deeply embedded in the fabric of daily life, the seamless integration of banking services will become a key differentiator, driving adoption and market expansion. The interplay between advanced device types and the most sought-after applications will shape the future landscape.

Several key factors are acting as catalysts, igniting rapid growth within the banking wearable devices industry. The pervasive advancement in biometric authentication is a significant driver, enhancing security and building consumer trust for financial transactions. Furthermore, the increasing proliferation of 5G networks is enabling faster and more reliable data transfer, crucial for real-time banking operations on wearables. Strategic partnerships between fintech companies and wearable manufacturers are crucial for developing innovative and integrated solutions that cater to evolving consumer needs. Finally, the growing demand for personalized financial management tools is pushing the development of wearables that offer more than just payments, encompassing budgeting, investment tracking, and financial advice.

This report offers a comprehensive analysis of the banking wearable devices market, providing in-depth insights into trends, driving forces, challenges, and future projections. It delves into the intricate details of market segmentation, examining the dominance of specific device types like watches and applications such as payment transactions, while also highlighting key regions and countries spearheading market growth. The report extensively covers the catalytic factors propelling the industry forward, including advancements in biometric authentication and the expansion of 5G networks, while also acknowledging the restraints such as security concerns and user adoption hurdles. With a detailed examination of leading players and significant developments throughout the study period of 2019-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the transformative potential of banking wearable devices.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Garmin Ltd., Fidemso AB, Apple Inc, SAMSUNG, Westpac PayWear, Fitbit Inc, BioTelemetry Inc, Nike Inc., Nymi Inc, Gemalto NV, Xiaomi Corporation, Google LLC, Wirecard, Fidesmo, Thales, Visa Inc.

The market segments include Type, Application.

The market size is estimated to be USD 47530 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Banking Wearable Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Banking Wearable Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.