1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Grade SiC Power Module?

The projected CAGR is approximately 23.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Grade SiC Power Module

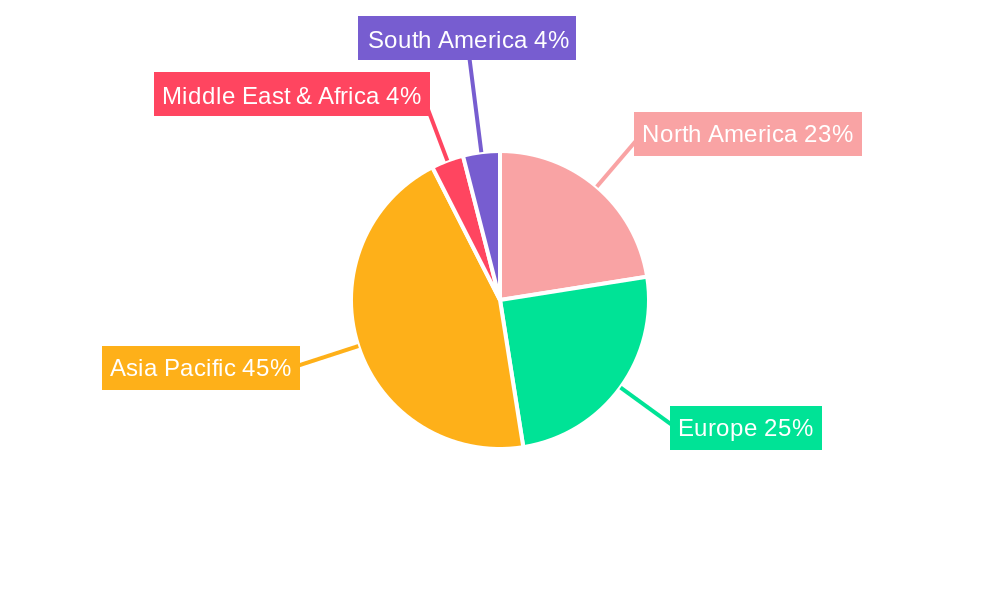

Automotive Grade SiC Power ModuleAutomotive Grade SiC Power Module by Type (1200V碳化硅模块, 750V和900V碳化硅模块), by Application (EV Main Inverter, EV Charging, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

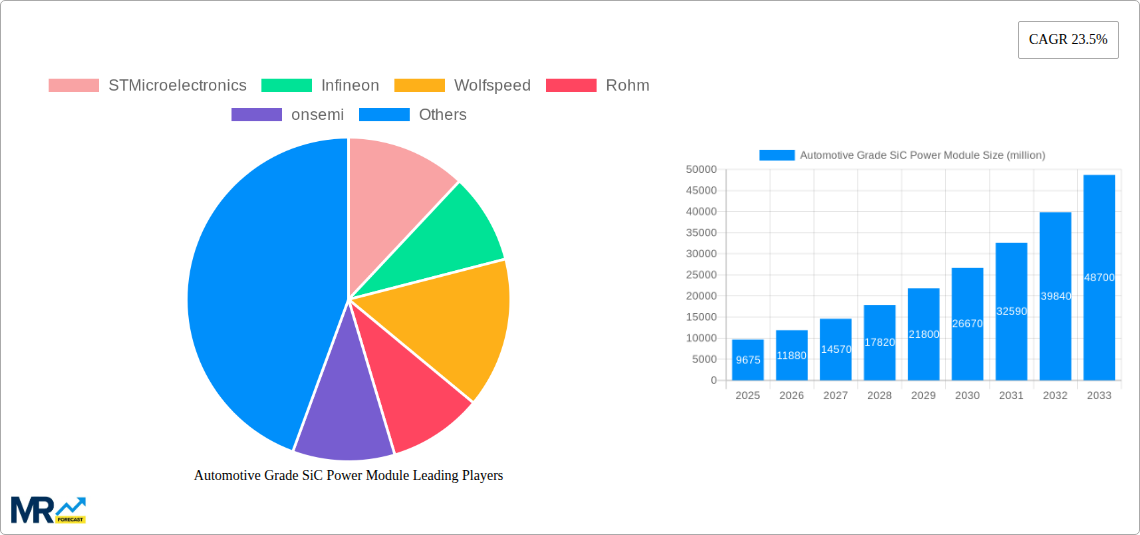

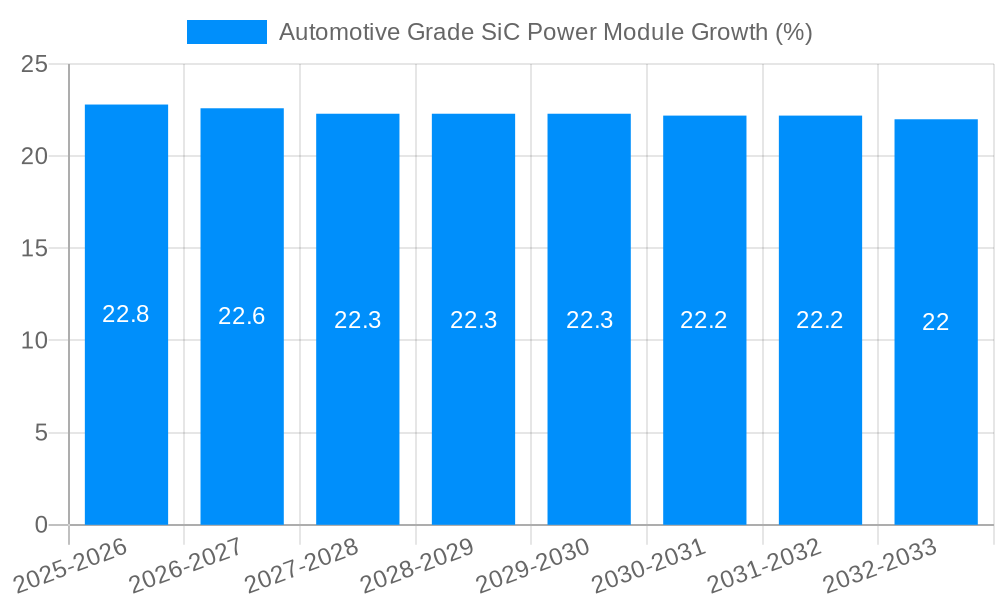

The Automotive Grade SiC Power Module market is poised for exceptional growth, with a projected market size of $9,675 million and a remarkable Compound Annual Growth Rate (CAGR) of 23.5%. This surge is primarily driven by the accelerating adoption of electric vehicles (EVs), which increasingly rely on Silicon Carbide (SiC) technology for enhanced power efficiency, performance, and range. The shift towards higher voltage architectures in EVs, specifically 1200V SiC modules, is a dominant trend, offering significant advantages in terms of reduced energy losses and improved thermal management compared to traditional silicon-based components. Furthermore, the expansion of EV charging infrastructure is directly fueling demand for these advanced power modules.

While the market is predominantly shaped by the EV sector, including main inverters and charging systems, other emerging applications are also contributing to the growth trajectory. The continued investment in research and development by key players like STMicroelectronics, Infineon, Wolfspeed, and BYD Semiconductor is crucial for innovation and cost reduction, further stimulating market penetration. Challenges such as the initial higher cost of SiC devices and the need for robust supply chain development are being addressed through technological advancements and strategic partnerships. Geographically, Asia Pacific, led by China, is expected to dominate the market due to its leading position in EV manufacturing and consumption. North America and Europe are also significant contributors, driven by stringent emission regulations and government incentives supporting EV adoption.

The automotive industry's insatiable demand for enhanced performance, extended range, and faster charging for electric vehicles (EVs) is fundamentally reshaping the power electronics landscape. At the forefront of this revolution lies the Automotive Grade Silicon Carbide (SiC) Power Module market, a sector poised for exponential growth. The study period of 2019-2033, with a base year of 2025, highlights the rapid evolution and projected trajectory of this critical component. By 2025, the market is expected to witness a significant surge in adoption, driven by the inherent advantages of SiC technology over traditional silicon. The historical period (2019-2024) laid the groundwork, showcasing initial adoption and technological maturation. The forecast period (2025-2033) anticipates this momentum to translate into widespread integration across diverse automotive applications.

The increasing emphasis on higher voltage architectures, particularly the widespread adoption of 1200V SiC modules, is a defining trend. This voltage class is becoming the de facto standard for EV main inverters, enabling greater efficiency and power density. Concurrently, the demand for 750V and 900V SiC modules remains robust, catering to specific charging infrastructure and auxiliary system requirements. The EV Main Inverter segment is by far the most dominant application, directly benefiting from SiC's ability to handle higher power levels with reduced energy losses. This translates to tangible improvements in vehicle range and charging speeds, directly addressing consumer pain points. The EV Charging segment is also a significant growth driver, as charging stations increasingly adopt SiC technology for faster and more efficient power conversion. While "Others" encompasses a broad spectrum of automotive applications, including on-board chargers and DC-DC converters, these are also steadily incorporating SiC for its performance benefits. The market is projected to see module shipments reaching into the tens of millions of units annually by the end of the forecast period, underscoring the scale of this transformation. The strategic importance of this market is further amplified by ongoing industry developments, including advancements in module packaging, improved reliability, and cost reduction initiatives, all aimed at accelerating the transition to a SiC-dominated automotive power electronics ecosystem.

The burgeoning Automotive Grade SiC Power Module market is propelled by a confluence of compelling technological advantages and market demands. Foremost among these is the inherent superiority of Silicon Carbide over conventional silicon in high-power, high-frequency applications. SiC's higher bandgap, thermal conductivity, and critical electric field strength translate directly into substantial performance gains for electric vehicles. This includes significantly reduced energy losses during power conversion, leading to enhanced powertrain efficiency and consequently, extended EV driving range – a paramount concern for consumers. Furthermore, SiC devices can operate at higher switching frequencies, allowing for smaller and lighter passive components (inductors and capacitors) in power electronic systems. This miniaturization contributes to overall vehicle weight reduction and improved space utilization within the chassis. The ongoing global push towards stringent emission regulations and carbon neutrality goals also acts as a powerful catalyst, compelling automakers to adopt more efficient and sustainable technologies like SiC. The rapid expansion of the EV market, characterized by increasing production volumes and a broadening range of EV models across different price points, creates a substantial and growing demand for these advanced power modules.

Despite its promising trajectory, the Automotive Grade SiC Power Module market faces several significant challenges and restraints that could temper its growth. The primary hurdle remains the higher cost of SiC materials and manufacturing processes compared to traditional silicon. While the price gap is narrowing, the initial investment for SiC-based power modules can be a deterrent, especially for cost-sensitive vehicle segments. The reliability and long-term durability of SiC devices in the harsh automotive environment (extreme temperatures, vibrations, and humidity) are also critical concerns that require continuous validation and improvement. Ensuring the robust performance of these modules over the entire lifespan of a vehicle, often exceeding 15 years, is paramount for widespread adoption. Furthermore, supply chain complexities and potential bottlenecks in the production of high-quality SiC wafers and advanced packaging solutions can impact availability and pricing. The specialized nature of SiC manufacturing requires significant capital investment and expertise, leading to a concentrated supplier base. The lack of standardized testing and qualification procedures for SiC components across the entire automotive industry can also create uncertainty for Tier 1 suppliers and OEMs. Finally, the need for significant R&D investment by both material suppliers and module manufacturers to further optimize performance, reduce costs, and develop next-generation SiC technologies presents a continuous challenge.

The 1200V碳化硅模块 (1200V Silicon Carbide Module) segment is unequivocally poised to dominate the Automotive Grade SiC Power Module market, largely driven by its critical role in EV Main Inverter applications. This dominance is expected to be particularly pronounced in regions and countries that are at the vanguard of electric vehicle adoption and advanced automotive manufacturing.

Dominant Segment: 1200V SiC Modules for EV Main Inverters

Dominant Regions/Countries:

The synergy between the superior performance of 1200V SiC modules and the massive demand from EV main inverters, coupled with the concentrated manufacturing and adoption efforts in leading automotive economies like China and Europe, solidifies this segment and these regions as the primary drivers of the Automotive Grade SiC Power Module market growth.

The rapid growth of the Automotive Grade SiC Power Module industry is fueled by several powerful catalysts. The relentless pursuit of extended EV range and faster charging capabilities by consumers and regulators alike directly translates into demand for SiC's superior efficiency. Furthermore, the increasing adoption of higher voltage EV architectures (800V and above) necessitates the use of SiC for its higher voltage handling capabilities. Aggressive government mandates and incentives for EV adoption and emission reduction are creating a favorable market environment. Finally, advancements in SiC manufacturing technologies and economies of scale are progressively reducing costs, making SiC more competitive with traditional silicon.

This comprehensive report offers an in-depth analysis of the Automotive Grade SiC Power Module market, encompassing a detailed examination of market trends, driving forces, challenges, and key growth catalysts. It provides granular insights into regional dynamics and segment dominance, particularly highlighting the pivotal role of 1200V SiC modules in EV main inverters. The report meticulously profiles leading industry players and outlines significant historical and future developments. With a study period spanning 2019-2033 and a base year of 2025, the analysis offers a robust forecast for the sector, aiding stakeholders in making informed strategic decisions. The report also delves into the competitive landscape and provides market estimations in the millions of units for module shipments.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 23.5%.

Key companies in the market include STMicroelectronics, Infineon, Wolfspeed, Rohm, onsemi, BYD Semiconductor, Microchip (Microsemi), Mitsubishi Electric (Vincotech), Semikron Danfoss, Fuji Electric, Toshiba, CETC 55, BASiC Semiconductor, SemiQ, SanRex, Bosch, GE Aerospace, Zhuzhou CRRC Times Electric, StarPower, Guangdong AccoPower Semiconductor, Cissoid, United Nova Technology, Hebei Sinopack Electronic Technology, InventChip Technology, ANHI Semiconductor, HAIMOSIC (SHANGHAI), Shenzhen AST Science Technology, Hangzhou Silan Microelectronics, Wuxi Leapers Semiconductor, WeEn Semiconductors, Denso, MacMic Science & Technolog.

The market segments include Type, Application.

The market size is estimated to be USD 9675 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Grade SiC Power Module," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Grade SiC Power Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.