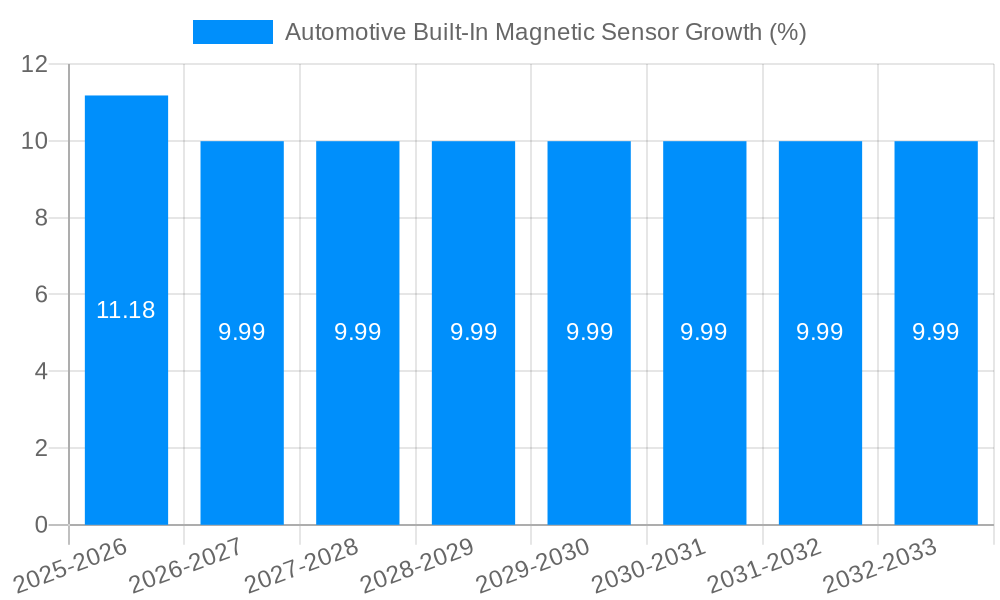

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Built-In Magnetic Sensor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Built-In Magnetic Sensor

Automotive Built-In Magnetic SensorAutomotive Built-In Magnetic Sensor by Type (Analog Signal Sensor, Digital Signal Sensor), by Application (Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Automotive Built-In Magnetic Sensor market is poised for significant expansion, projected to reach a substantial XXX million in market size by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This impressive growth is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS), electric vehicle (EV) integration, and enhanced vehicle safety features. Magnetic sensors play a pivotal role in enabling functionalities such as accurate position sensing for steering, braking, and throttle control, as well as in the sophisticated battery management systems of EVs. The increasing complexity of automotive electronics and the continuous drive for greater automation and connectivity within vehicles are key accelerators for this market. Furthermore, the growing emphasis on in-cabin comfort and user experience, with magnetic sensors contributing to features like seat position memory and climate control, adds another layer of demand.

Despite a promising outlook, the market faces certain restraints. The high cost associated with advanced magnetic sensor technology and the stringent regulatory compliance required for automotive components can pose challenges for widespread adoption, particularly in cost-sensitive segments. Additionally, the intricate supply chain and the need for specialized manufacturing processes contribute to market complexities. Nevertheless, the overarching trend towards smarter, safer, and more efficient vehicles, driven by both consumer expectations and regulatory mandates, is expected to outweigh these limitations. The market segmentation reveals a strong demand across various vehicle types, from passenger cars to heavy-duty trucks and buses, indicating a broad applicability of these sensors. Continuous innovation in sensor technology, focusing on miniaturization, improved accuracy, and lower power consumption, will be crucial for manufacturers to capitalize on the burgeoning opportunities within this dynamic automotive sector.

The global market for automotive built-in magnetic sensors is experiencing a robust expansion, driven by the ever-increasing integration of advanced functionalities within vehicles. The market size, projected to reach an estimated $3,XXX million in 2025, is anticipated to witness significant growth throughout the study period of 2019-2033. This upward trajectory is fundamentally supported by the burgeoning demand for enhanced safety, comfort, and efficiency in modern automobiles. Magnetic sensors, owing to their reliability, precision, and non-contact operation, have become indispensable components across a multitude of automotive systems. From critical engine management and transmission control to advanced driver-assistance systems (ADAS) and infotainment, these sensors play a pivotal role in data acquisition and system control.

The historical period (2019-2024) has laid a strong foundation for this market, characterized by continuous innovation and increasing adoption rates, particularly in passenger cars. As vehicles become more electrified and automated, the reliance on accurate and responsive sensors intensifies. The base year of 2025 marks a crucial point where sophisticated sensor technologies are moving from premium segments to mainstream applications. The forecast period (2025-2033) is expected to witness a CAGR of approximately X% as the automotive industry embraces a future of connected and autonomous mobility. This growth is further bolstered by the increasing average number of magnetic sensors per vehicle, which has been steadily rising from a few units to potentially tens of units in advanced vehicle architectures. The development of miniaturized, highly sensitive, and cost-effective magnetic sensors by leading manufacturers is a key enabler of this widespread integration. The report analyzes the intricate interplay of these factors, providing a comprehensive outlook on the market dynamics.

The automotive built-in magnetic sensor market is propelled by a confluence of powerful drivers, primarily stemming from the evolving automotive landscape. The relentless pursuit of enhanced vehicle safety features, such as anti-lock braking systems (ABS), electronic stability control (ESC), and sophisticated ADAS, necessitates the accurate detection of wheel speed, steering angle, and other critical parameters. Magnetic sensors, with their inherent robustness and precision, are perfectly suited for these demanding applications. Furthermore, the increasing complexity of vehicle powertrains, including the widespread adoption of electric and hybrid powertrains, demands precise monitoring of motor speed, position, and current. This is where magnetic sensors excel, providing essential data for optimal performance and energy efficiency. The growing emphasis on driver comfort and convenience, with features like keyless entry, powered seats, and advanced climate control systems, also contributes to the demand for these sensors.

The trend towards vehicle autonomy is another significant propellant. As vehicles progress towards higher levels of automation, the need for an intricate network of sensors to perceive the environment and control vehicle dynamics becomes paramount. Magnetic sensors are integral to systems that detect the proximity of other vehicles, monitor the vehicle's position and orientation, and ensure precise actuation of control surfaces. The continuous miniaturization and cost reduction of magnetic sensor technology are making them increasingly viable for integration into a wider array of automotive applications, thereby expanding their market reach.

Despite the robust growth trajectory, the automotive built-in magnetic sensor market is not without its challenges and restraints. One of the primary concerns is the increasing electromagnetic interference (EMI) within vehicles. The proliferation of electronic components, high-frequency switching power supplies, and complex communication systems can generate EMI that can interfere with the accurate functioning of magnetic sensors. Ensuring adequate shielding and robust sensor design to mitigate these effects is crucial, but it adds to the complexity and cost of implementation. Another significant challenge is the stringent regulatory requirements and quality standards in the automotive industry. Magnetic sensors must meet rigorous specifications for reliability, durability, and safety, necessitating extensive testing and validation processes, which can be time-consuming and expensive.

The fluctuating raw material costs, particularly for rare earth elements and other specialized materials used in some magnetic sensor technologies, can impact the overall cost-effectiveness of these components. Moreover, the rapid pace of technological advancements requires continuous investment in research and development to stay competitive. Companies face the challenge of balancing innovation with cost-effectiveness to ensure their products are adopted by a wide range of vehicle manufacturers. Finally, supply chain disruptions, as experienced in recent years, can affect the availability of critical components and raw materials, potentially hindering production and market growth.

The Passenger Cars segment, both in terms of type and application, is projected to continue its dominance in the automotive built-in magnetic sensor market throughout the study period. This is largely attributed to the sheer volume of passenger vehicles produced globally and their increasing adoption of advanced technologies.

Dominant Segments:

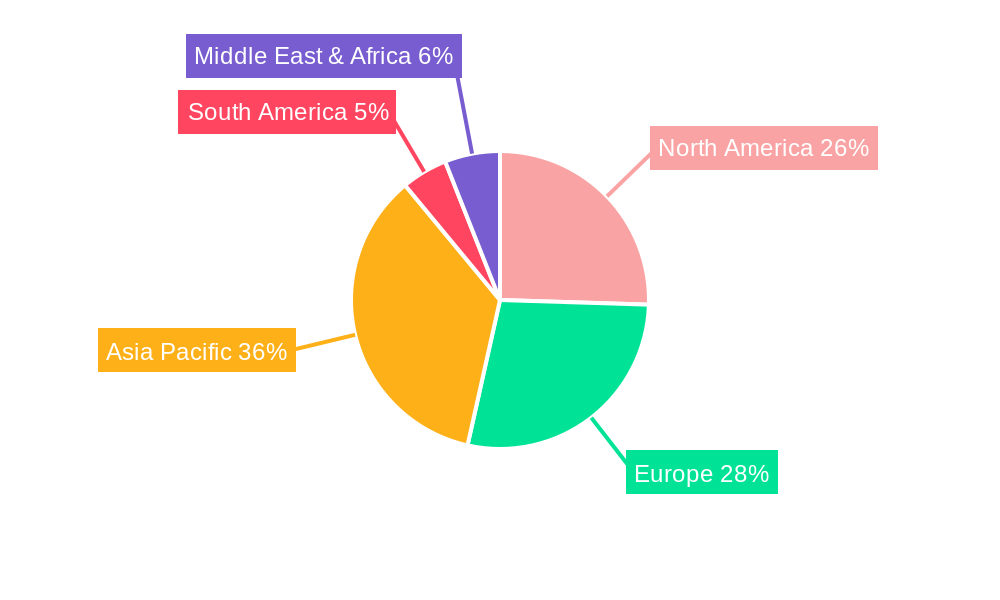

Regional Dominance: Asia-Pacific is expected to be the leading region, driven by the massive automotive manufacturing hubs in countries like China, Japan, South Korea, and India. The region's rapidly growing middle class, increasing disposable incomes, and government initiatives to promote electric vehicles and smart mobility are significant growth catalysts.

Segmental Analysis:

Passenger Cars: This segment will remain the largest contributor due to its high production volumes and the continuous integration of magnetic sensors for safety features (e.g., ABS, ESC), powertrain management, body electronics (e.g., door locks, seat adjustment), and infotainment systems. The increasing trend of semi-autonomous and autonomous driving features further bolsters demand for precise and reliable magnetic sensors in passenger cars. The shift towards electrification in passenger cars also necessitates more sophisticated magnetic sensors for battery management, motor control, and charging systems.

Digital Signal Sensors: While Analog Signal Sensors have traditionally played a crucial role, Digital Signal Sensors are gaining significant traction. Their inherent advantages in terms of noise immunity, ease of integration with microcontrollers, and advanced diagnostics make them increasingly preferred for complex control systems. Features like Hall effect sensors with integrated digital outputs are becoming standard for applications such as position sensing, speed detection, and current monitoring. The development of highly integrated digital magnetic sensor ICs is further accelerating their adoption.

Light Commercial Vehicles (LCVs): LCVs represent another substantial segment. As logistics and e-commerce grow, the demand for LCVs equipped with advanced features for efficiency and safety increases. Magnetic sensors are crucial for engine and transmission control, as well as for various comfort and convenience features in these vehicles.

Analog Signal Sensors: Despite the rise of digital solutions, Analog Signal Sensors will continue to hold a significant market share, especially in applications where cost-effectiveness and simpler signal processing are prioritized. Their ability to provide a continuous output signal makes them suitable for applications like precise angular position sensing and current measurement in less complex systems.

The dominance of passenger cars is underpinned by continuous technological advancements that make magnetic sensors more affordable and feature-rich, enabling their widespread deployment. The proactive adoption of new automotive technologies in the Asia-Pacific region, coupled with a strong manufacturing base, positions it as the undisputed leader.

The automotive built-in magnetic sensor industry is being significantly catalyzed by the accelerating trend of vehicle electrification and automation. The growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) necessitates a greater number and variety of magnetic sensors for precise motor control, battery management systems, and charging infrastructure. Furthermore, the continuous evolution of Advanced Driver-Assistance Systems (ADAS) and the push towards autonomous driving are creating a substantial demand for highly accurate and reliable magnetic sensors for applications like lane keeping assist, adaptive cruise control, and parking assist. The miniaturization and increasing cost-effectiveness of these sensors are also key growth catalysts, enabling their integration into more diverse and cost-sensitive vehicle models.

This comprehensive report delves into the intricate workings and future trajectory of the automotive built-in magnetic sensor market. It provides an in-depth analysis of market trends, crucial driving forces, and prevailing challenges that shape the industry's landscape. The report meticulously examines key regional and country-specific market dynamics, alongside a detailed breakdown of dominant market segments by sensor type and application. Furthermore, it highlights critical growth catalysts that are poised to accelerate market expansion and identifies the leading players who are at the forefront of innovation. The report also details significant recent and projected developments within the sector, offering a forward-looking perspective on technological advancements and market evolution. With a study period spanning from 2019 to 2033, encompassing historical data, a base year of 2025, and a detailed forecast period, this report offers unparalleled insights for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the automotive built-in magnetic sensor market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ABLIC, Allegro MicroSystems, Alps Alpine, Analog Devices, Asahi Kasei Microdevices Corporation, Diodes Incorporated, Honeywell International, Infineon Technologies AG, Magnetic Sensors Corporation, Monolithic Power Systems, Murata Manufacturing, NXP Semiconductors, STMicroelectronics N.V., TDK Corporation, TE Connectivity Ltd., Texas Instruments.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Built-In Magnetic Sensor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Built-In Magnetic Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.