1. What is the projected Compound Annual Growth Rate (CAGR) of the Automatic Spectrophotometer Tape Machine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automatic Spectrophotometer Tape Machine

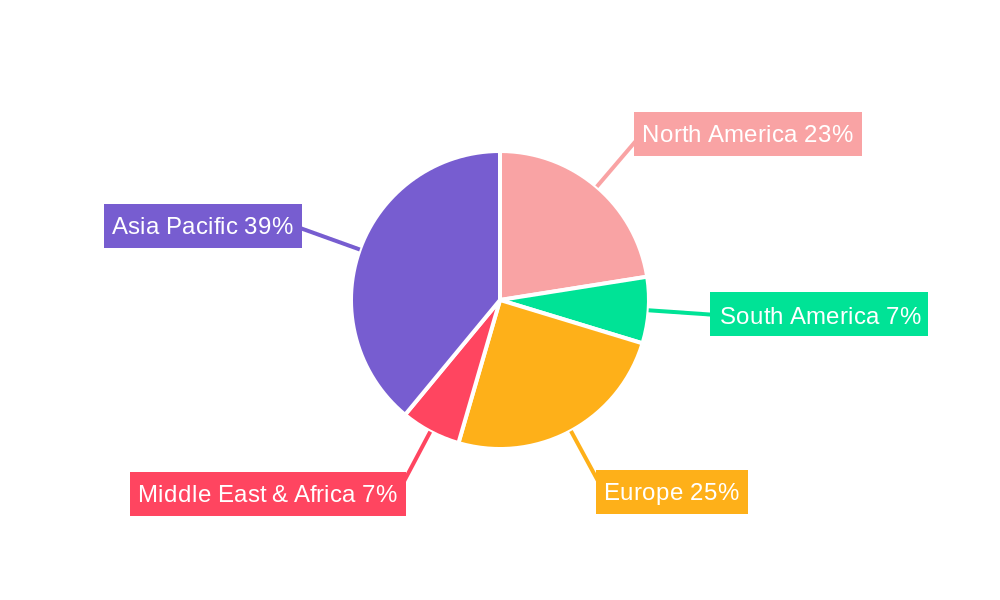

Automatic Spectrophotometer Tape MachineAutomatic Spectrophotometer Tape Machine by Type (Fully Automatic, Semi-Automatic), by Application (Semiconductor, LED, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

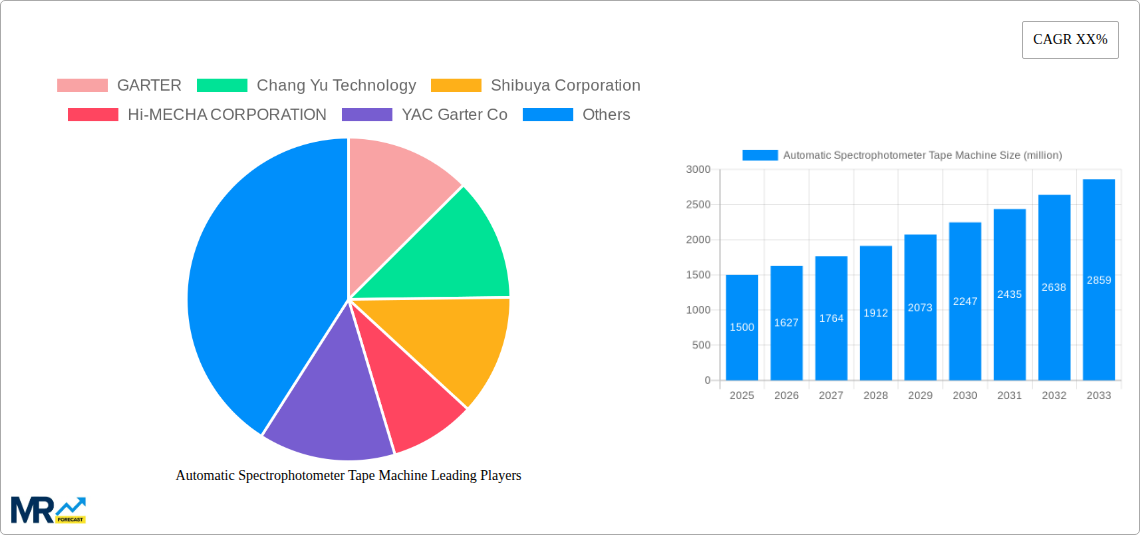

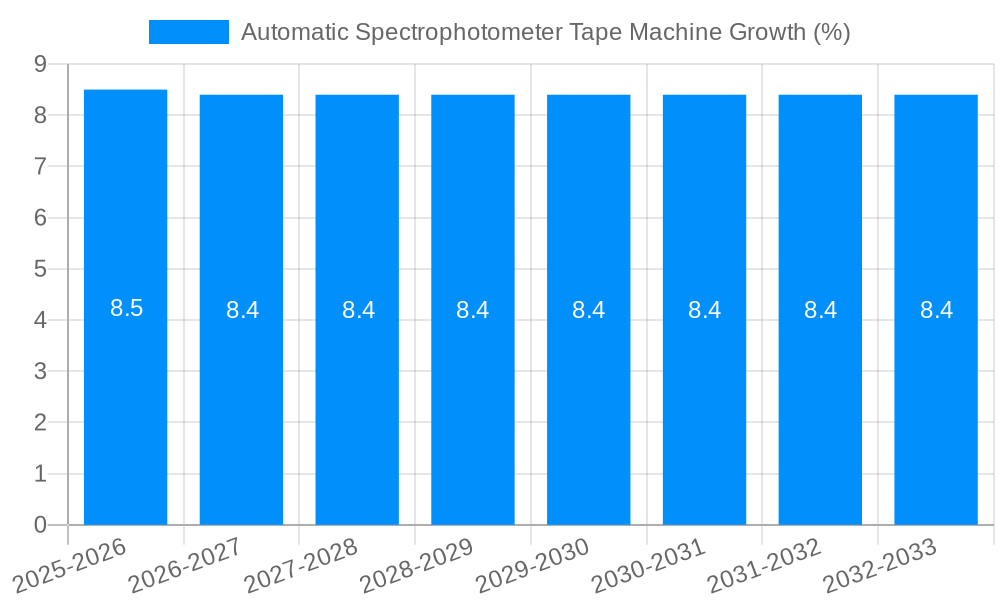

The Automatic Spectrophotometer Tape Machine market is poised for significant expansion, projected to reach an estimated market size of USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% anticipated over the forecast period extending to 2033. This growth is primarily fueled by the burgeoning demand from the semiconductor and LED manufacturing sectors. The increasing complexity and miniaturization of electronic components necessitate highly precise and automated processes for quality control, where spectrophotometer tape machines play a crucial role in ensuring color consistency, accuracy, and defect detection. Furthermore, the continuous drive for enhanced production efficiency and reduced human error in high-volume manufacturing environments further propels the adoption of these advanced automated systems. The market is segmented into Fully Automatic and Semi-Automatic types, with the Fully Automatic segment expected to dominate due to its superior throughput and precision capabilities, essential for meeting the stringent requirements of modern electronics manufacturing.

The market's growth trajectory is further supported by a dynamic landscape of technological advancements and increasing investments in research and development by key players. Innovations in spectrophotometry, coupled with advancements in robotics and artificial intelligence, are leading to the development of more sophisticated and intelligent tape machines capable of real-time data analysis and predictive maintenance. While the market is largely driven by the aforementioned applications, emerging uses in other specialized industries are also contributing to its expansion. However, the market may face certain restraints, including the high initial investment cost of sophisticated automated equipment and the need for skilled personnel to operate and maintain these systems. Geographically, the Asia Pacific region, particularly China, is expected to lead the market due to its substantial manufacturing base for semiconductors and LEDs, followed by North America and Europe, which are also significant hubs for advanced electronics production and innovation.

This report delves into the intricate dynamics of the global Automatic Spectrophotometer Tape Machine market, a critical component in the manufacturing processes of various high-tech industries. Spanning a comprehensive study period from 2019 to 2033, with a detailed analysis focused on the Base Year (2025) and the Forecast Period (2025-2033), this report provides invaluable insights for stakeholders. The Historical Period of 2019-2024 has been thoroughly examined to understand the market's trajectory and evolution, setting the stage for accurate estimations for the Estimated Year of 2025. The market size, projected to reach tens of millions of dollars, is analyzed across key segments and regions, highlighting growth opportunities and potential challenges.

The Automatic Spectrophotometer Tape Machine market is undergoing a transformative phase, driven by the escalating demand for precision and efficiency in sophisticated manufacturing environments. Throughout the Historical Period (2019-2024), we observed a steady ascent in the adoption of these machines, primarily fueled by the burgeoning semiconductor and LED industries. The Base Year (2025) represents a pivotal point, where the market is projected to stabilize and then embark on a more aggressive growth trajectory during the Forecast Period (2025-2033). A key trend is the increasing sophistication of these machines, moving beyond basic color matching to incorporate advanced spectral analysis capabilities for quality control and material characterization. The integration of artificial intelligence and machine learning algorithms is also becoming a significant development, enabling predictive maintenance, real-time process optimization, and enhanced defect detection. This evolution caters to the stringent quality requirements of modern electronics, where even minor color deviations can have substantial impacts on product performance and longevity. Furthermore, the demand for customized solutions is on the rise, with manufacturers seeking machines tailored to specific material types, production volumes, and spectral analysis needs. This trend is particularly evident in niche applications within the "Others" segment, where specialized spectral requirements are paramount. The increasing focus on automation and Industry 4.0 principles is also a driving force, pushing for seamless integration of spectrophotometer tape machines into broader manufacturing workflows, thereby reducing human error and improving overall throughput. The global market is projected to witness significant expansion, with revenue figures expected to climb into the tens of millions of dollars by the end of the study period, reflecting the growing indispensability of these advanced technological solutions.

The rapid advancement and adoption of Automatic Spectrophotometer Tape Machines are propelled by a confluence of powerful market forces. Foremost among these is the relentless pursuit of enhanced product quality and consistency within the semiconductor and LED sectors. These industries operate under exceptionally demanding specifications, where precise color fidelity and spectral properties are not merely desirable but absolutely critical for the optimal functioning and aesthetic appeal of their final products. As the complexity of electronic components and display technologies continues to escalate, the need for highly accurate and automated spectral analysis solutions becomes increasingly pronounced. Furthermore, the growing emphasis on operational efficiency and cost reduction across manufacturing floors is a significant catalyst. By automating the process of spectral measurement and tape application, companies can dramatically reduce labor costs, minimize human error, and accelerate production cycles. This boost in efficiency translates directly into improved profitability and a stronger competitive edge in the marketplace. The expanding global market for electronic devices, including smartphones, advanced displays, and specialized lighting solutions, inherently fuels the demand for the underlying manufacturing equipment. As production volumes rise, so does the requirement for reliable and high-throughput machines capable of meeting these demands. The continuous innovation in material science, leading to the development of new substrates and coating technologies, also necessitates the evolution of spectrophotometer tape machines to accommodate these novel materials and their unique spectral characteristics.

Despite the robust growth trajectory, the Automatic Spectrophotometer Tape Machine market is not without its hurdles. A primary challenge lies in the high initial investment required for acquiring these sophisticated machines. The advanced technology and precision engineering involved translate into significant capital expenditure, which can be a deterrent for small and medium-sized enterprises (SMEs) or those operating in price-sensitive markets. The complexity of operation and maintenance also presents a significant restraint. These machines require skilled personnel for their operation, calibration, and routine maintenance, leading to ongoing operational costs and potential downtime if qualified technicians are not readily available. Rapid technological advancements, while a driver of innovation, can also be a double-edged sword. The constant evolution of spectral analysis technology and automation capabilities can lead to a perceived obsolescence of existing equipment, prompting manufacturers to consider frequent upgrades, which further escalates costs. Furthermore, standardization issues within the industry can pose challenges. The lack of universally adopted standards for spectral data formats and machine interoperability can create integration complexities and hinder seamless data exchange between different systems and across diverse manufacturing environments. Global supply chain disruptions, as witnessed in recent years, can also impact the availability of critical components and the timely delivery of these machines, leading to production delays and increased lead times for end-users. Finally, stringent regulatory compliance in certain regions, particularly concerning material handling and environmental impact, might necessitate additional modifications or certifications for these machines, adding to both complexity and cost.

The Semiconductor segment is poised to be a dominant force in the Automatic Spectrophotometer Tape Machine market, driven by its inherent need for extreme precision and quality control. This dominance is further amplified by the concentration of advanced semiconductor manufacturing facilities in key regions.

Region/Country:

Segment:

The synergy between the advanced manufacturing capabilities in East Asia and the high-precision demands of the semiconductor application, particularly within the fully automatic operational framework, creates a powerful engine for market dominance.

The Automatic Spectrophotometer Tape Machine industry is experiencing significant growth fueled by several key catalysts. The escalating demand for miniaturized and high-performance electronic components in consumer electronics, automotive, and industrial sectors necessitates increasingly precise manufacturing processes. This drives the adoption of automated spectral analysis for stringent quality control. Furthermore, the rapid expansion of the LED lighting market, with its focus on color accuracy, energy efficiency, and longevity, requires sophisticated machines to ensure product consistency. Government initiatives supporting domestic semiconductor manufacturing and advanced technology development in various countries also play a crucial role. Finally, continuous technological advancements in areas like AI-driven process optimization and multi-spectral analysis are enhancing the capabilities of these machines, making them indispensable tools for innovation.

This report offers a thorough examination of the Automatic Spectrophotometer Tape Machine market, providing a holistic view of its present landscape and future potential. It meticulously analyzes market trends, dissects the driving forces behind its growth, and identifies the inherent challenges and restraints that might impede its progress. Furthermore, the report highlights key regions and dominant segments, offering a deep dive into why they are leading the market. It also pinpoints crucial growth catalysts that are shaping the industry's trajectory and presents a comprehensive list of leading players. With detailed insights into significant sector developments, this report equips stakeholders with the necessary intelligence to make informed strategic decisions and capitalize on emerging opportunities within this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GARTER, Chang Yu Technology, Shibuya Corporation, Hi-MECHA CORPORATION, YAC Garter Co, Nihon Garter, V-TEK Inc, Ultra-Pak Industries, AKIM Corporation, Tokyo Weld, Shenzhen Biaopu Semiconductor Technology, Shenzhen Hi-Test Semiconductor Equipment, Shenzhen Sanyilianguang Intelligent Equipments, Dongguan Taigong Elecronic and Mechanical Tochnology, Shenzhen TEC-PHO.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automatic Spectrophotometer Tape Machine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automatic Spectrophotometer Tape Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.