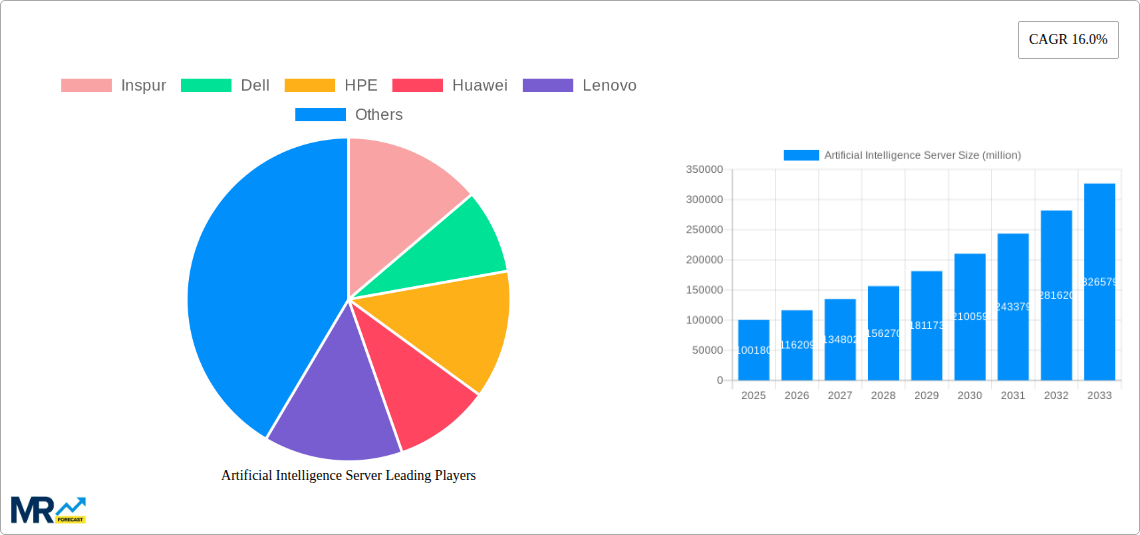

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence Server?

The projected CAGR is approximately 16.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Artificial Intelligence Server

Artificial Intelligence ServerArtificial Intelligence Server by Type (CPU+GPU, CPU+FPGA, CPU+ASIC, Other), by Application (Internet, Telecommunications, Government, Healthcare, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Artificial Intelligence (AI) Server market is poised for significant expansion, projected to reach an impressive USD 100,180 million by 2025. This robust growth is driven by a substantial Compound Annual Growth Rate (CAGR) of 16.0%, indicating a dynamic and rapidly evolving landscape. The demand for sophisticated AI servers is being propelled by the increasing integration of AI across various industries, fueled by the need for enhanced data processing, machine learning, and deep learning capabilities. Key applications driving this demand include the Internet sector, which leverages AI for enhanced user experiences and data analytics, and the Telecommunications industry, where AI is crucial for network optimization and service delivery. Furthermore, government initiatives for smart cities and defense, alongside the burgeoning healthcare sector's adoption of AI for diagnostics and drug discovery, are significant contributors to market expansion.

The market segmentation reveals a strong preference for integrated solutions, with CPU+GPU configurations leading the pack due to their unparalleled parallel processing power essential for AI workloads. CPU+FPGA and CPU+ASIC segments are also gaining traction as specialized hardware solutions cater to specific AI computational demands. Geographically, the Asia Pacific region, particularly China and India, is expected to be a major growth engine, driven by substantial investments in AI research and development and a large, tech-savvy population. North America and Europe are also established markets with significant adoption rates, backed by strong technological infrastructure and R&D activities. Emerging trends like the development of specialized AI accelerators, edge AI computing, and the increasing demand for hyperscale AI data centers are further shaping the market. While the market is experiencing strong tailwinds, challenges such as the high cost of specialized hardware and the need for skilled talent to manage and optimize AI infrastructure could present moderate restraints to its otherwise explosive growth trajectory.

Here's a unique report description on Artificial Intelligence Servers, incorporating the requested elements and values.

This report offers an in-depth analysis of the global Artificial Intelligence (AI) Server market, projecting a significant expansion from an estimated $XX million in 2025 to reach an astounding $YY million by 2033. The study encompasses a comprehensive historical review from 2019-2024, providing a robust foundation for understanding current market dynamics and future projections.

The Artificial Intelligence Server market is undergoing a transformative evolution, characterized by a relentless pursuit of computational power and specialized architectures. The CPU+GPU segment is currently the undisputed leader, commanding a substantial market share estimated to be in the hundreds of millions of dollars in 2025. This dominance stems from the inherent parallel processing capabilities of GPUs, which are ideally suited for the massive data computations required by deep learning and machine learning algorithms. However, the landscape is rapidly diversifying. We are witnessing a significant surge in the adoption of CPU+ASIC (Application-Specific Integrated Circuit) solutions, particularly in hyperscale data centers and for specific inference tasks where optimized performance and power efficiency are paramount. The market for these specialized accelerators is projected to grow at a remarkable CAGR of ZZ% during the forecast period. CPU+FPGA (Field-Programmable Gate Array) solutions, while representing a smaller segment, are carving out a niche in applications demanding high flexibility and real-time processing, such as advanced networking and scientific simulations, with an estimated market size of $AA million in 2025. The "Other" segment, encompassing emerging architectures and proprietary solutions, is expected to grow at a dynamic pace as innovation continues. The market is characterized by an increasing demand for high-density compute, advanced cooling technologies, and robust interconnectivity to handle the ever-increasing data volumes and model complexities. The trend towards disaggregated infrastructure and composable hardware is also gaining traction, allowing for more efficient resource allocation and cost optimization. Furthermore, the integration of AI capabilities directly into networking equipment and edge devices is opening up new avenues for growth. The report will delve into the nuanced adoption patterns of these different server types across various industry verticals and geographical regions.

The explosive growth of the AI Server market is propelled by an unprecedented confluence of factors. The sheer volume of data being generated globally, from IoT devices, social media, and scientific research, is creating an insatiable demand for the computational power needed to extract meaningful insights. This data deluge serves as the primary fuel for AI models. Coupled with this is the exponential advancement in AI algorithms themselves. Sophisticated deep learning frameworks and novel neural network architectures are pushing the boundaries of what AI can achieve, from natural language processing and computer vision to autonomous systems and drug discovery. The increasing adoption of AI across a wide spectrum of industries, including Internet, Telecommunications, Government, and Healthcare, is another critical driver. Enterprises are recognizing the tangible benefits of AI in terms of increased efficiency, enhanced customer experiences, and the development of entirely new business models. Moreover, significant investments in AI research and development by both private corporations and governments are fostering continuous innovation in both hardware and software, thereby creating a virtuous cycle of demand and technological advancement. The drive for automation across all sectors further amplifies the need for powerful AI infrastructure.

Despite the robust growth trajectory, the Artificial Intelligence Server market is not without its challenges. The escalating cost of high-performance AI hardware, particularly GPUs and specialized ASICs, can be a significant barrier to entry for smaller organizations and startups, limiting widespread adoption. The complexity of deploying and managing AI infrastructure, requiring specialized expertise in areas like distributed computing, data management, and model optimization, also presents a hurdle. Furthermore, the rapid pace of technological obsolescence necessitates frequent hardware upgrades, leading to substantial ongoing capital expenditures. Power consumption and thermal management remain critical concerns, as AI workloads are notoriously power-intensive, posing challenges for data center operational costs and environmental sustainability. Concerns surrounding data privacy and security are also paramount, as AI systems often process sensitive information, requiring stringent compliance measures and robust security protocols. The availability of skilled AI talent to develop and deploy these complex systems continues to be a bottleneck. Finally, the ethical implications of AI and the potential for bias in algorithms necessitate careful consideration and regulatory frameworks, which can indirectly impact market adoption.

The global Artificial Intelligence Server market is poised for significant regional and segmental dominance, with North America and Asia-Pacific emerging as key powerhouses.

North America, driven by its established technology giants and robust venture capital ecosystem, is expected to maintain a leading position. The presence of major cloud providers, leading research institutions, and a strong appetite for AI adoption across industries like Internet, Healthcare, and Government solidifies its dominance. The region's emphasis on cutting-edge research and development in AI, coupled with substantial government and private sector investments, fuels the demand for high-performance AI servers. Specifically, the CPU+GPU segment is expected to dominate in North America due to the ongoing reliance on these architectures for training large-scale deep learning models prevalent in enterprise AI initiatives. The estimated market size for CPU+GPU servers in North America in 2025 is projected to be in the hundreds of millions of dollars.

Asia-Pacific, particularly China, is experiencing meteoric growth and is set to become a formidable contender, if not surpass North America in certain sub-segments. China's ambitious national AI strategy, coupled with massive investments in digital infrastructure and a burgeoning tech industry, is driving unprecedented demand. The widespread deployment of AI in sectors like Telecommunications, Government, and Internet (e-commerce, social media) is fueling this surge. The region's unique approach, often emphasizing cost-effectiveness and large-scale deployments, is leading to significant adoption of both CPU+GPU and increasingly, CPU+ASIC solutions. The rapid development of domestic AI hardware manufacturers in China further contributes to this regional dominance. The projected market size for AI servers in the Asia-Pacific region in 2025 is estimated to be in the hundreds of millions of dollars, with a significant portion attributed to the rapidly growing ASIC segment for inference workloads.

From a segment perspective, the CPU+GPU type is projected to hold the largest market share globally throughout the forecast period due to its versatility in both training and inference tasks. However, the CPU+ASIC segment is anticipated to exhibit the highest growth rate, driven by the increasing need for power-efficient and specialized hardware for large-scale inference deployments in hyperscale data centers and edge computing scenarios. The Internet application segment is expected to be the largest consumer of AI servers, fueled by the demands of recommendation engines, content moderation, search algorithms, and personalized advertising. Following closely, the Telecommunications sector is leveraging AI servers for network optimization, customer service automation, and predictive maintenance. Government applications, including smart cities, defense, and public safety, are also contributing significantly to market growth. Healthcare is a rapidly expanding application area, with AI servers crucial for medical imaging analysis, drug discovery, and personalized medicine.

Several key growth catalysts are fueling the AI Server industry. The continuous advancements in AI algorithms and the increasing complexity of neural networks necessitate more powerful and specialized hardware. The widespread digital transformation across industries is unlocking vast datasets, which in turn demand robust processing capabilities for AI-driven insights. Government initiatives and investments in AI research and adoption further stimulate market expansion. The growing demand for automation and efficiency across various sectors is also a significant driver. The proliferation of edge computing, requiring localized AI processing, opens new market avenues.

This report provides a comprehensive overview of the Artificial Intelligence Server market, offering granular insights into market size, growth projections, and key trends. It dissects the market by server type (CPU+GPU, CPU+FPGA, CPU+ASIC, Other), application (Internet, Telecommunications, Government, Healthcare, Other), and geographical region. The analysis includes in-depth examinations of driving forces, challenges, growth catalysts, and significant developments, offering a holistic understanding of the industry's trajectory. With detailed historical data from 2019-2024 and future projections up to 2033, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the rapidly evolving AI Server landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.0%.

Key companies in the market include Inspur, Dell, HPE, Huawei, Lenovo, H3C, IBM, Fujitsu, Cisco, Nvidia, Supermicro, Nettrix, Enginetech, Kunqian, PowerLeader, Fii, Digital China, GIGABYTE, ADLINK, xFusion.

The market segments include Type, Application.

The market size is estimated to be USD 100180 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Artificial Intelligence Server," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Artificial Intelligence Server, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.