1. What is the projected Compound Annual Growth Rate (CAGR) of the AR Glasses MicroDisplay?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

AR Glasses MicroDisplay

AR Glasses MicroDisplayAR Glasses MicroDisplay by Type (LED Microdisplay, LCD Microdisplay, LCOS Microdisplay, World AR Glasses MicroDisplay Production ), by Application (Monocular AR Glasses, Binocular AR Glasses, World AR Glasses MicroDisplay Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

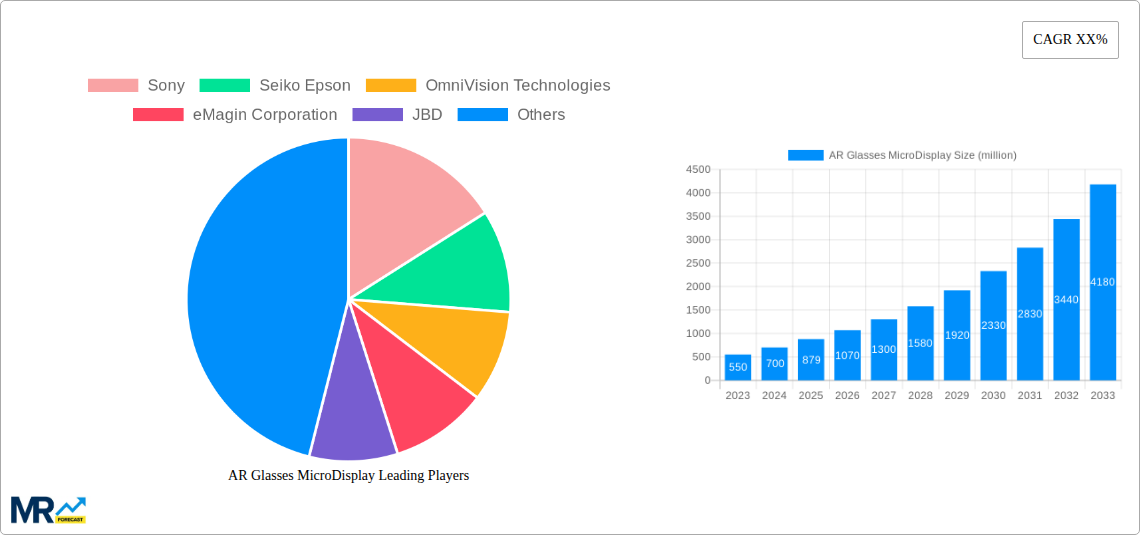

The global Augmented Reality (AR) glasses microdisplay market is experiencing robust growth, projected to reach approximately $879 million by 2025. This expansion is primarily fueled by the accelerating adoption of AR technology across diverse sectors, including gaming, entertainment, industrial applications, and enterprise solutions. The increasing demand for more immersive and interactive visual experiences is a significant driver, pushing manufacturers to innovate and develop advanced microdisplay technologies. The market is segmented by type, with LCOS (Liquid Crystal on Silicon) microdisplays currently holding a dominant share due to their established performance and cost-effectiveness, though LED and LCD microdisplays are rapidly gaining traction with advancements in brightness, resolution, and power efficiency. In terms of application, binocular AR glasses are expected to drive significant market expansion as consumer-grade AR devices become more sophisticated and accessible, alongside continued growth in monocular AR glasses for specialized professional use.

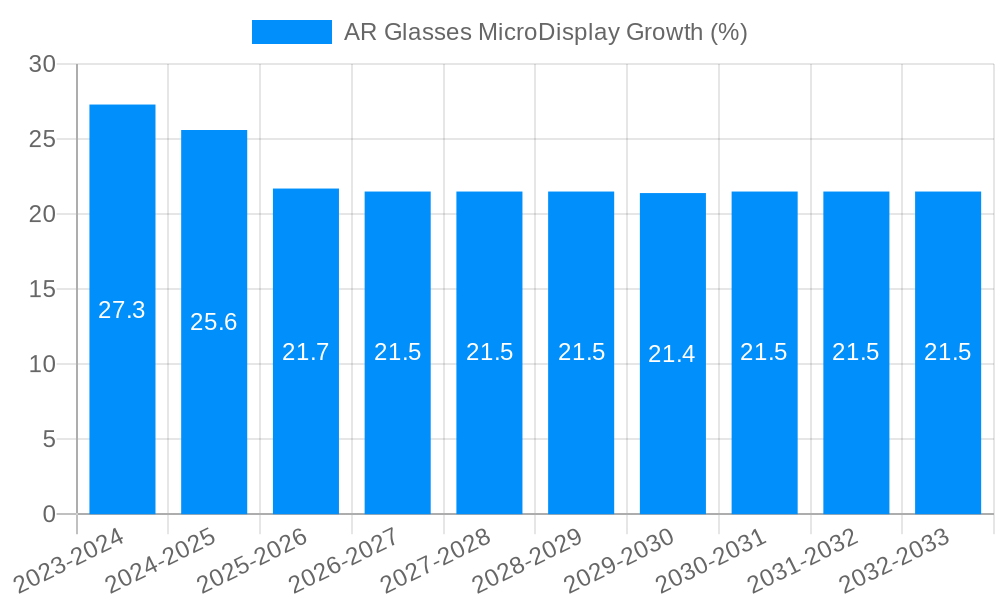

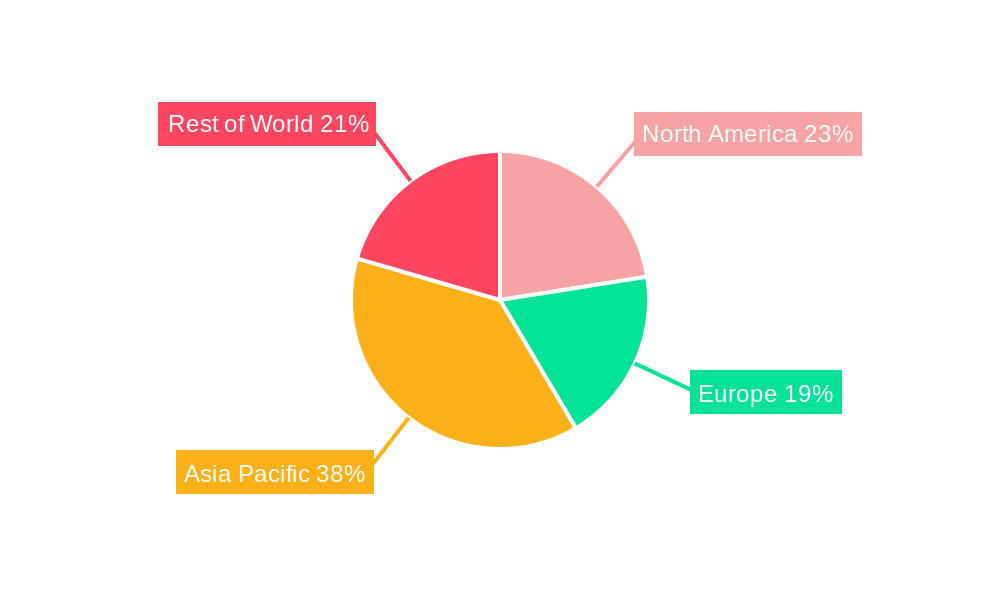

The projected Compound Annual Growth Rate (CAGR) for the AR glasses microdisplay market is estimated to be around 22%, indicating a dynamic and rapidly evolving landscape. This strong growth trajectory is supported by ongoing research and development in areas such as higher pixel densities, wider fields of view, and improved color reproduction, all crucial for delivering truly compelling AR experiences. Key players like Sony, Seiko Epson, OmniVision Technologies, and eMagin Corporation are at the forefront of these innovations, investing heavily in next-generation microdisplay solutions. Restraints in the market include the high cost of advanced microdisplays, challenges in miniaturization for comfortable and stylish AR glasses, and the need for widespread consumer education and acceptance of AR technology. However, these challenges are being addressed through technological advancements and strategic partnerships, paving the way for substantial market penetration in the coming years, with Asia Pacific anticipated to lead in production and adoption due to its strong manufacturing base and growing tech-savvy population.

The augmented reality (AR) glasses microdisplay market is on the cusp of a significant expansion, projected to witness a compound annual growth rate (CAGR) of XX% from 2025 to 2033. The study period encompasses 2019-2033, with 2025 serving as both the base and estimated year. The historical period 2019-2024 has laid the groundwork for this surge, driven by relentless technological advancements and an increasing demand for immersive experiences. The global AR Glasses MicroDisplay production is estimated to reach $XX million in 2025 and is expected to skyrocket to $YY million by 2033. This remarkable growth is underpinned by the continuous refinement of microdisplay technologies, crucial for delivering crisp, vibrant, and efficient visual experiences in compact AR devices.

The market is characterized by a dynamic interplay of innovation and application, with various microdisplay types catering to diverse AR functionalities. From the compact and power-efficient LED microdisplays to the high-resolution LCOS (Liquid Crystal on Silicon) variants, each technology offers unique advantages for monocular and binocular AR glasses. The increasing adoption of AR in enterprise solutions, consumer entertainment, and industrial sectors is a key driver, pushing the boundaries of what AR glasses can achieve. The evolution of processing power, sensor integration, and battery life within AR devices further fuels the demand for sophisticated microdisplays that can handle complex visual data with minimal latency and power consumption. The competitive landscape is populated by established technology giants and innovative startups, all vying to capture market share through superior performance, cost-effectiveness, and novel form factors.

The AR glasses microdisplay market is undergoing a transformative phase, marked by several key trends that are shaping its trajectory over the 2019-2033 study period. The most prominent trend is the relentless pursuit of higher resolutions and increased pixel densities. As AR applications become more sophisticated, demanding greater visual fidelity for tasks ranging from detailed industrial inspections to realistic gaming experiences, the need for microdisplays capable of rendering sharp, lifelike images is paramount. This has led to significant investments in technologies like MicroLED, which offer exceptional brightness, contrast ratios, and pixel density, making them ideal for outdoor AR applications and energy-constrained devices. The transition towards smaller, lighter, and more power-efficient microdisplays is also a critical trend. Manufacturers are striving to reduce the form factor of AR glasses, making them more comfortable and unobtrusive for extended wear. This directly influences microdisplay design, pushing for smaller die sizes and lower power consumption without compromising on visual performance. Furthermore, the growing emphasis on color accuracy and wider color gamuts is another significant trend. As AR content becomes more visually rich, the ability of microdisplays to accurately reproduce a broad spectrum of colors is essential for an immersive and engaging user experience. This is particularly important for applications that rely on accurate color representation, such as medical visualization or product design. The integration of advanced optical technologies, such as waveguide displays, is also driving innovation in the microdisplay sector. These optical components work in conjunction with microdisplays to project images effectively into the user's field of view, requiring microdisplays with specific optical characteristics and extremely high brightness levels to overcome ambient light conditions. The market is also witnessing a diversification in the types of microdisplays employed. While LCOS (Liquid Crystal on Silicon) and LCD (Liquid Crystal Display) have been prevalent, LED and particularly MicroLED technologies are gaining considerable traction due to their superior performance characteristics, especially in terms of brightness and energy efficiency. This evolution in display technology is directly enabling the development of more advanced and user-friendly AR glasses, moving them closer to mainstream adoption. The forecast period (2025-2033) is expected to see accelerated adoption of these advanced microdisplay solutions, driven by continuous R&D and increasing consumer and enterprise demand.

The augmented reality glasses microdisplay market is experiencing robust growth, propelled by a confluence of powerful driving forces. Foremost among these is the burgeoning demand for immersive and interactive experiences across various sectors. The consumer electronics market is witnessing a surge in interest for AR-enabled gaming, entertainment, and social media applications, all of which rely heavily on high-quality microdisplays to deliver compelling visual content. Similarly, the enterprise sector is a significant growth engine, with industries such as manufacturing, healthcare, and logistics adopting AR for training, remote assistance, and complex task execution. These professional applications require microdisplays that offer exceptional clarity, accuracy, and durability. The continuous advancements in underlying display technologies are also a critical propellant. Innovations in materials science, semiconductor manufacturing, and optical engineering are leading to the development of microdisplays that are smaller, lighter, more power-efficient, and capable of higher resolutions and refresh rates. This technological evolution directly translates to improved performance and reduced cost for AR glasses, making them more accessible and appealing to a wider audience. Furthermore, the growing ecosystem of AR content creators and developers is contributing significantly to market expansion. As more compelling AR applications and experiences become available, the demand for AR hardware, and consequently, its core microdisplay components, naturally increases. The strategic investments by major technology companies in AR research and development, including their exploration of microdisplay technologies, are also playing a crucial role in driving innovation and accelerating market growth. These investments are not only funding technological breakthroughs but also creating strategic partnerships and collaborations that are essential for scaling production and adoption.

Despite the promising outlook, the AR glasses microdisplay market faces several significant challenges and restraints that could temper its growth. A primary hurdle is the cost of production. High-performance microdisplays, especially cutting-edge technologies like MicroLED, are currently expensive to manufacture at scale. This high cost directly impacts the retail price of AR glasses, making them less affordable for the average consumer and limiting widespread adoption. The power consumption of microdisplays, particularly for high-brightness applications required for outdoor use, remains a concern. AR glasses need to be compact and lightweight, which necessitates efficient power management. Microdisplays that consume excessive power can lead to shorter battery life, a significant deterrent for users, and can also generate heat, impacting comfort. Miniaturization and integration complexities also present a challenge. Packing sophisticated microdisplays, along with other optical components, sensors, and processing units, into a slim and lightweight form factor for AR glasses is an ongoing engineering feat. Achieving this without compromising on performance or durability requires significant innovation. Supply chain limitations for specialized components and manufacturing processes can also pose a bottleneck, especially as demand scales rapidly. Ensuring a consistent and high-quality supply of critical materials and sub-components is crucial for sustained production growth. Technical limitations in achieving extremely high resolutions with perfect color accuracy and contrast simultaneously, especially in bright ambient light conditions, continue to be an area of active research and development. Finally, the development of compelling and widely adopted AR applications is crucial. While the technology is advancing, a “killer app” that drives mass consumer adoption of AR glasses is still emerging, and without it, the demand for advanced microdisplays may be slower than anticipated, particularly in the consumer segment.

The global AR glasses microdisplay market is poised for significant growth, with certain regions and segments expected to lead this expansion. The Asia-Pacific region, particularly China, is projected to emerge as a dominant force in both production and consumption of AR glasses microdisplays. This dominance is fueled by several key factors. Firstly, China's robust manufacturing infrastructure and its leading position in the global semiconductor and display industries provide a fertile ground for microdisplay production. Companies like JBD, Nanjing SmartVision Electronics, Yunnan OLiGHTEK Opto-Electronic Technology, SeeYA Technology, Semiconductor Integrated Display Technology, Lakeside optoelectronics technology, Shenzhen BCDTEK Semiconductor Technology, and Nanjing Lumicore Technology are actively developing and producing microdisplay technologies, catering to both domestic and international markets. The strong presence of AR device manufacturers and a rapidly growing consumer base interested in cutting-edge technology further solidify China's position. The region's commitment to R&D and government support for advanced display technologies are also critical contributors to its market leadership.

Within the segmentation of AR Glasses MicroDisplay Production, the LCOS Microdisplay segment is expected to play a pivotal role in the market's dominance, especially in the 2025-2033 forecast period. LCOS technology offers a compelling balance of high resolution, contrast, and cost-effectiveness, making it a preferred choice for a wide range of AR applications. Companies such as Sony, Seiko Epson, OmniVision Technologies, eMagin Corporation, Kopin Corporation, Microoled, and HOLOEYE Photonics AG are key players in this segment, continually innovating to enhance performance and reduce manufacturing costs. The LCOS segment's ability to deliver detailed and vibrant imagery is crucial for both monocular and binocular AR glasses, supporting applications from industrial and professional use to consumer entertainment. Its maturity in manufacturing processes allows for more predictable scaling of production, aligning with the increasing global demand for AR glasses.

Furthermore, the Binocular AR Glasses segment, under the Application category, is anticipated to be a significant driver of market growth. While monocular AR glasses have found niche applications, the immersive and naturalistic experiences offered by binocular AR glasses are more aligned with the long-term vision of widespread AR adoption. These devices offer a wider field of view and a more profound sense of presence, making them suitable for a broader spectrum of use cases. The technological advancements in microdisplays, particularly in achieving higher resolutions and wider fields of view, are directly enabling the development of more capable and appealing binocular AR glasses. As the technology matures and costs decrease, binocular AR glasses are expected to become the preferred form factor for both consumers and professionals, thereby fueling the demand for the advanced microdisplays required to power them. The synergy between advancements in LCOS technology and the growing demand for binocular AR glasses will be a key characteristic of the market's trajectory, with the Asia-Pacific region, led by China, being the epicenter of this evolution.

Several key factors are acting as significant growth catalysts for the AR glasses microdisplay industry. The relentless pursuit of enhanced visual fidelity in AR experiences is a primary driver, pushing the demand for microdisplays with higher resolutions and greater pixel densities. Furthermore, the increasing adoption of AR across diverse industrial and enterprise applications, such as training, remote assistance, and design visualization, is creating a substantial market for robust and high-performance microdisplays. The continuous technological advancements, particularly in areas like MicroLED and advanced LCOS technologies, are leading to smaller, more power-efficient, and cost-effective microdisplays, thereby lowering the barrier to entry for AR device manufacturers and consumers.

The AR glasses microdisplay market is characterized by the presence of innovative companies driving technological advancements and shaping the industry's future. Key players include:

The AR glasses microdisplay sector has witnessed several pivotal developments throughout the 2019-2033 study period, shaping its current landscape and future trajectory:

This report offers a comprehensive analysis of the AR glasses microdisplay market, providing in-depth insights and projections for the 2019-2033 period, with 2025 as the base and estimated year. The study meticulously examines market dynamics, including key trends, driving forces, and restraining factors, to offer a holistic understanding of the industry's landscape. It delves into the competitive environment, profiling leading players and their strategic initiatives, while also highlighting significant technological developments and their impact on market evolution. The report meticulously analyzes the market by segment, detailing the performance of LED, LCD, and LCOS microdisplays, as well as examining the growth trajectory of monocular and binocular AR glasses applications. Furthermore, it provides a granular view of regional market contributions, identifying key countries and regions poised for dominance. This extensive coverage equips stakeholders with the critical intelligence needed to navigate the complexities of the AR glasses microdisplay market and capitalize on its burgeoning opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony, Seiko Epson, OmniVision Technologies, eMagin Corporation, JBD, Nanjing SmartVision Electronics, Oriscape, Yunnan OLiGHTEK Opto-Electronic Technology, Kopin Corporation, Microoled, RAONTECH, Dresden Microdisplay GmbH, Syndiant, HOLOEYE Photonics AG, SeeYA Technology, Semiconductor Integrated Display Technology, Lakeside optoelectronics technology, Shenzhen BCDTEK Semiconductor Technology, Nanjing Lumicore Technology.

The market segments include Type, Application.

The market size is estimated to be USD 879 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "AR Glasses MicroDisplay," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the AR Glasses MicroDisplay, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.