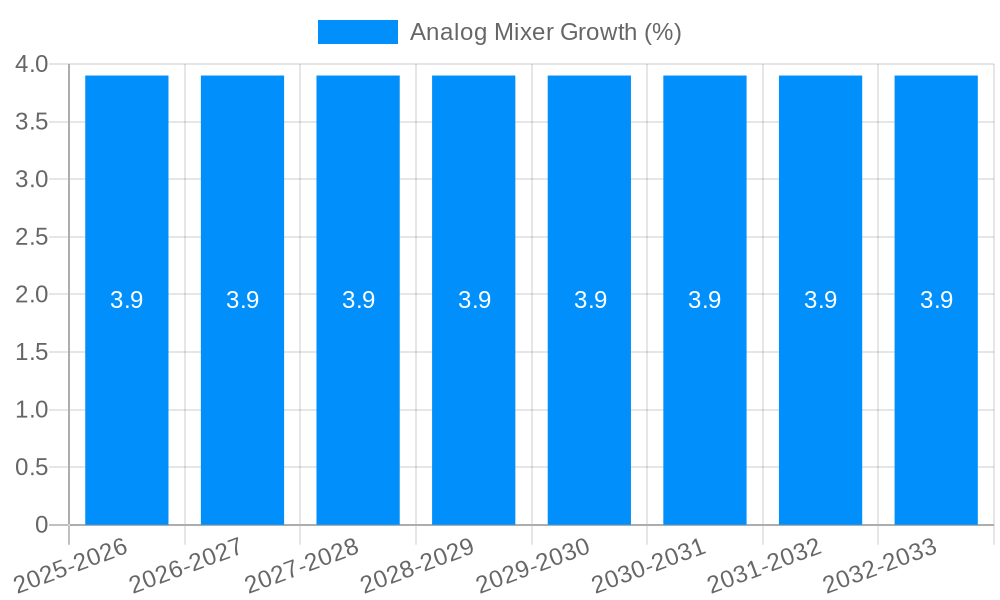

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog Mixer?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Analog Mixer

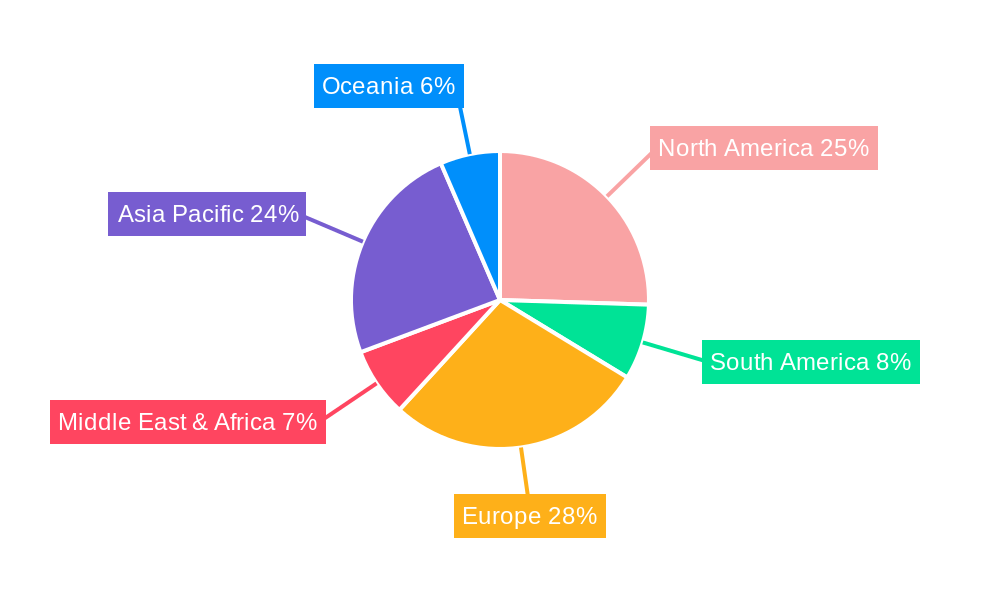

Analog MixerAnalog Mixer by Type (Channel:0-20, Channel:More than 20), by Application (Commercial, Personal use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

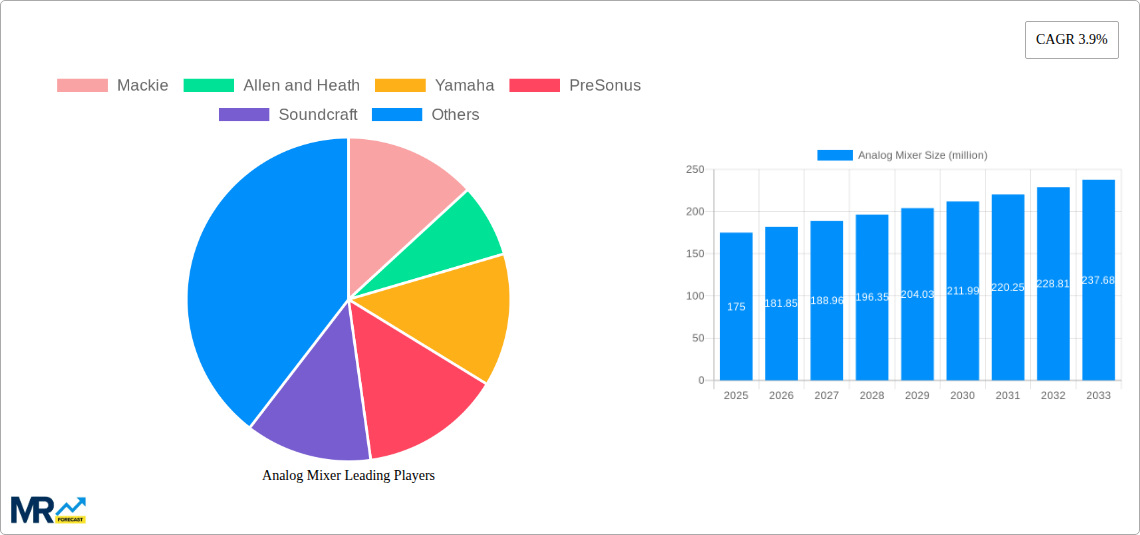

The global analog mixer market is poised for steady growth, projected to reach an estimated market size of $175 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.9% anticipated throughout the forecast period of 2025-2033. This sustained expansion is largely driven by the enduring appeal of analog sound quality, its intuitive user interface, and its robustness in demanding live sound environments. While digital mixers have gained significant traction, analog mixers continue to hold a strong niche, particularly among audio professionals who value the tactile control, the warmth and character of analog circuitry, and the often simpler troubleshooting process. The market is segmented by channel count, with mixers featuring 0-20 channels and those exceeding 20 channels both contributing to market demand, catering to a wide spectrum of user needs from small studios to large-scale live productions. Furthermore, both commercial and personal use applications represent significant market segments, underscoring the versatility of analog mixers.

Key trends shaping the analog mixer market include a growing demand for compact, portable analog mixers with advanced routing capabilities and built-in effects, appealing to musicians, podcasters, and small venue operators. The resurgence of vinyl and analog recording techniques in certain music production circles also fuels demand for high-quality analog mixing consoles. Restraints, such as the increasing affordability and advanced features of digital alternatives, and the perceived complexity of analog signal chains for newer users, are present but do not overshadow the fundamental advantages analog technology offers. Major players like Mackie, Allen & Heath, Yamaha, and PreSonus continue to innovate, offering a diverse range of products that cater to both budget-conscious and professional users, ensuring the continued relevance and growth of the analog mixer market across various applications and regions.

This comprehensive report delves into the dynamic landscape of the analog mixer market, providing an in-depth analysis of market trends, driving forces, challenges, and future growth projections. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers invaluable insights for stakeholders across various segments. The market is meticulously segmented by type, channel count (0-20 and more than 20), and application (commercial and personal use). Historical data from 2019-2024, coupled with an estimated outlook for 2025 and a robust forecast for 2025-2033, ensures a complete understanding of market trajectories. The global analog mixer market, valued in the millions of USD, is meticulously examined, identifying key regions, dominant segments, and influential industry developments. Leading players such as Mackie, Allen and Heath, Yamaha, PreSonus, Soundcraft, Behringer, Ashly Audio, Neve, MIDAS, Phonic, and Alice are thoroughly analyzed, providing a clear picture of the competitive ecosystem.

The global analog mixer market, estimated to be valued in the hundreds of millions of USD in the base year of 2025, is experiencing a nuanced evolution that belies its perceived obsolescence. While digital technology has undeniably made significant inroads, analog mixers continue to hold a strong niche, particularly among audio professionals and hobbyists who value their distinct sonic characteristics, tactile control, and inherent reliability. The historical period of 2019-2024 saw a steady demand, driven by established studios, live sound engineers, and broadcast facilities that rely on the proven workflows and the warm, often sought-after, analog sound. Moving into the forecast period of 2025-2033, we anticipate a sustained, albeit potentially moderate, growth trajectory for the analog mixer market. This growth will be fueled by a segment of users who prioritize the "hands-on" experience and the perceived sonic superiority of analog circuitry, often described as having a certain "mojo" or "glue" that digital processing can struggle to replicate authentically. Furthermore, the increasing affordability of certain analog mixer models, coupled with advancements in manufacturing that improve both quality and cost-effectiveness, will broaden accessibility. The "Channel: 0-20" segment, particularly for smaller studios, home setups, and live performance venues, is expected to remain a robust area of demand. These compact yet capable mixers offer a straightforward, intuitive interface that appeals to users who may find complex digital workflows overwhelming. The "Commercial Application" segment, encompassing live sound reinforcement, broadcast studios, and fixed installations, will continue to be a significant driver, with a focus on reliability, durability, and the ability to handle demanding audio environments. While the "Channel: More than 20" segment may see more competition from digital consoles in large-scale productions, the demand for high-channel-count analog mixers persists for specific applications where analog warmth and precise control are paramount, such as in high-fidelity recording studios and certain live concert settings. The market will also witness a continued emphasis on hybrid solutions, where analog mixers are integrated with digital processing and recording capabilities, offering the best of both worlds.

The sustained appeal and continued demand for analog mixers, estimated to be a market worth hundreds of millions of USD within the forecast period of 2025-2033, are propelled by a confluence of factors that resonate deeply within the audio production and live sound communities. Foremost among these is the inherent sonic character that analog circuitry imparts. Many engineers and musicians cite a perceived warmth, depth, and "glue" that analog signal processing provides, which is often described as a desirable sonic signature that digital systems can struggle to replicate with the same organic feel. This preference for a specific sonic aesthetic is a powerful driver, particularly in genres where such characteristics are highly valued, such as rock, blues, and jazz. The tactile and intuitive nature of analog mixers also plays a crucial role. The physical knobs, faders, and buttons offer immediate, hands-on control over every parameter, fostering a direct and immersive workflow that many find more engaging and efficient than navigating digital menus and software interfaces. This hands-on approach is particularly beneficial in live sound environments where quick adjustments and immediate feedback are essential. Furthermore, the reliability and robustness of analog equipment are significant advantages. With fewer moving parts and a simpler architecture compared to complex digital systems, analog mixers are often perceived as being more durable and less prone to software glitches or system crashes, making them a dependable choice for mission-critical applications in live venues and broadcast studios. The historical period of 2019-2024 showcased this enduring demand, and this trend is projected to continue into the forecast period, supported by the continued production of high-quality, feature-rich analog consoles.

Despite their enduring strengths, the analog mixer market, while still valued in the millions of USD, faces several significant challenges and restraints that influence its growth trajectory, particularly during the forecast period of 2025-2033. The most prominent challenge stems from the rapid advancements and increasing affordability of digital mixing consoles. Digital solutions offer a plethora of advantages, including extensive onboard processing, recallable settings, multi-track recording capabilities directly from the console, and often a smaller physical footprint for equivalent channel counts. This makes digital mixers highly attractive for many modern production workflows, especially for those seeking flexibility and advanced features. The perceived complexity and learning curve associated with digital systems can sometimes deter users, but the sheer power and convenience they offer are undeniable competitive forces. Another restraint is the perception of obsolescence, particularly among younger generations of audio engineers who may have grown up with predominantly digital tools. While analog sound quality remains prized, the technological advancements in digital signal processing are constantly narrowing the perceived sonic gap. Furthermore, the cost of high-end analog components and the manual labor involved in their construction can make premium analog mixers significantly more expensive than comparable digital counterparts, limiting their accessibility for budget-conscious users and smaller operations. The "Channel: More than 20" segment, in particular, faces stiff competition from feature-rich digital consoles that offer more sophisticated routing, automation, and integrated effects at competitive price points. The need for ongoing maintenance and potential for component wear and tear also present a challenge compared to the often more software-driven maintenance of digital systems, adding to the total cost of ownership for some analog setups.

The global analog mixer market, projected to reach hundreds of millions of USD by the forecast period of 2025-2033, exhibits a distinct dominance within specific regions and segments, driven by varying adoption rates and entrenched user preferences.

Dominant Segments:

Dominant Regions/Countries:

Several key catalysts are poised to propel the growth of the analog mixer industry, ensuring its continued relevance and value in the market projected to be in the millions of USD during the forecast period of 2025-2033. The enduring appeal of analog's distinct sonic warmth and character remains a primary driver, with many audio professionals and enthusiasts actively seeking this unique sound. Furthermore, the increasing affordability of certain analog models, coupled with a focus on robust build quality and user-friendly interfaces, is expanding accessibility to a wider audience, including emerging artists and smaller production setups. The demand for reliable and intuitive control, especially in live sound environments where tactile feedback is crucial, continues to favor analog solutions.

This report provides a holistic view of the analog mixer market, encompassing its historical trajectory from 2019 to 2024, an estimated outlook for 2025, and a comprehensive forecast for the period of 2025-2033. The market, valued in the millions of USD, is dissected by key segments including type, channel count (0-20 and more than 20), and application (commercial and personal use). A thorough examination of the driving forces, challenges, and growth catalysts will equip readers with a deep understanding of the market dynamics. Regional analysis highlights dominant areas of consumption and production, while an in-depth look at leading players and significant industry developments offers strategic insights into the competitive landscape and future trends.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

Key companies in the market include Mackie, Allen and Heath, Yamaha, PreSonus, Soundcraft, Behringer, Ashly Audio, Neve, MIDAS, Phonic, Alice.

The market segments include Type, Application.

The market size is estimated to be USD 175 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Analog Mixer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Analog Mixer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.