1. What is the projected Compound Annual Growth Rate (CAGR) of the Ammonia Gas Sensing ISE?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ammonia Gas Sensing ISE

Ammonia Gas Sensing ISEAmmonia Gas Sensing ISE by Type (Combined Electrode, Half-Cell Electrode), by Application (Water Quality, Agriculture, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

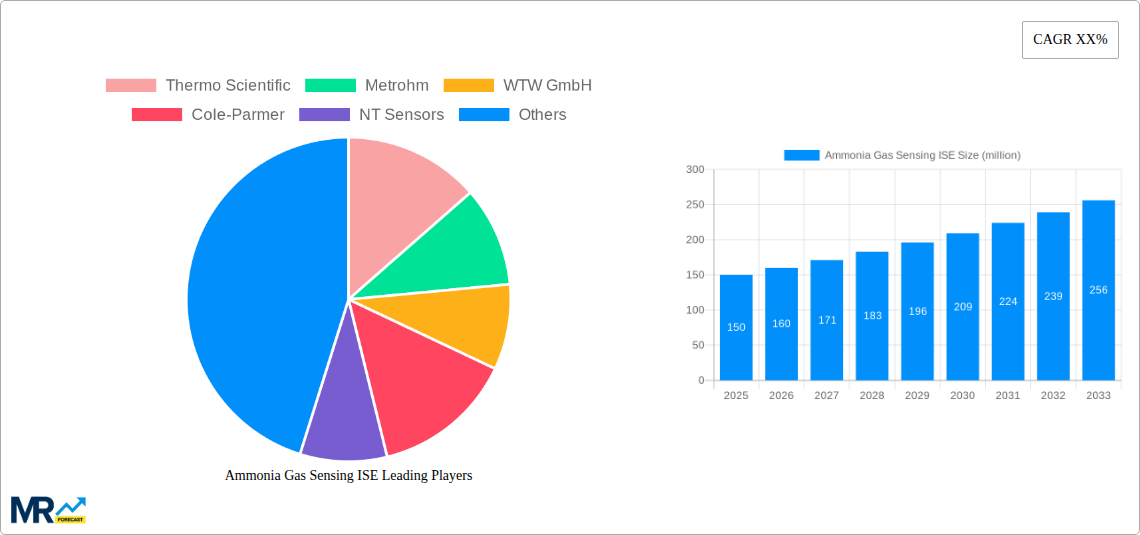

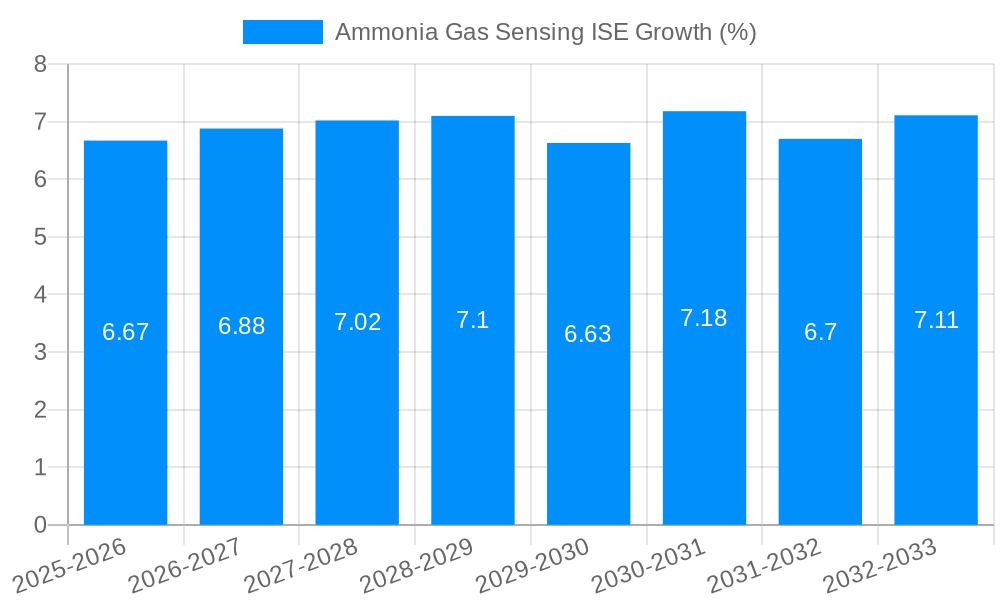

The global market for Ammonia Gas Sensing Ion-Selective Electrodes (ISEs) is poised for robust growth, projected to reach approximately $150 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 6.5% throughout the forecast period extending to 2033. This expansion is primarily fueled by increasing stringent regulations concerning environmental monitoring and industrial safety, particularly in water quality management and agricultural applications where ammonia detection is critical. The growing need for accurate and real-time ammonia monitoring in wastewater treatment plants, aquaculture, and fertilizer production is a significant driver. Furthermore, advancements in sensor technology, leading to more sensitive, selective, and cost-effective ISEs, are enhancing their adoption across various sectors. The combined electrode segment is expected to dominate the market, offering convenience and integrated functionality, while half-cell electrodes will cater to specialized research and development needs.

The market is also experiencing a surge in demand from industrial applications beyond traditional water treatment, including the chemical and petrochemical industries for process control and leak detection, as well as in the burgeoning field of renewable energy, such as monitoring ammonia slip in selective catalytic reduction (SCR) systems. Despite this positive outlook, certain factors could restrain the market's full potential. High initial investment costs for advanced sensing systems and the need for skilled personnel for calibration and maintenance may pose challenges for smaller enterprises. However, the overarching trend towards digitalization and the Industrial Internet of Things (IIoT) is expected to drive the integration of ammonia sensing ISEs into smart monitoring networks, offering remote access and data analytics capabilities, thereby overcoming some of these limitations and driving further market penetration, especially in developed regions like North America and Europe.

This comprehensive report delves into the global Ammonia Gas Sensing Ion-Selective Electrode (ISE) market, offering a detailed analysis of trends, drivers, challenges, and growth opportunities. The study leverages robust market intelligence gathered over the historical period of 2019-2024, with a base year of 2025 and a comprehensive forecast extending from 2025 to 2033. The report is meticulously structured to provide actionable insights for stakeholders, ranging from market participants to investors. The estimated market size in the base year of 2025 is projected to be in the hundreds of millions of dollars, with significant growth anticipated over the forecast period.

The global Ammonia Gas Sensing ISE market is experiencing a significant surge, driven by escalating demand for precise and real-time ammonia monitoring across a multitude of applications. A key trend is the increasing adoption of these sensors in environmental monitoring, particularly for water quality assessment, where ammonia is a critical indicator of pollution and eutrophication. This trend is bolstered by stringent regulatory frameworks globally that mandate strict ammonia discharge limits for industrial facilities and municipal wastewater treatment plants. The market is also witnessing a steady rise in the deployment of Ammonia Gas Sensing ISEs within the agricultural sector. Farmers are increasingly utilizing these sensors for optimizing fertilizer application, thereby reducing environmental impact and improving crop yields. The demand for advanced sensor technologies that offer enhanced sensitivity, selectivity, and longevity is also a defining trend, pushing manufacturers towards innovation. Furthermore, the "Industrial Internet of Things" (IIoT) paradigm is playing a pivotal role, integrating Ammonia Gas Sensing ISEs into connected systems for remote monitoring and data analytics. This facilitates proactive maintenance, early detection of leaks, and improved process control in various industrial settings. The market is also observing a growing preference for combined electrode configurations due to their user-friendliness and integrated functionality, simplifying installation and operation for end-users. The growing emphasis on workplace safety in industries where ammonia is handled, such as refrigeration and chemical manufacturing, further fuels the demand for reliable gas sensing solutions. Overall, the market is characterized by a dynamic interplay of regulatory pressures, technological advancements, and evolving industry needs, all converging to create a robust growth trajectory. The estimated market value in the hundreds of millions of dollars is expected to witness a compound annual growth rate (CAGR) that will significantly increase its overall valuation by the end of the forecast period.

The propulsion of the Ammonia Gas Sensing ISE market is fundamentally rooted in a confluence of critical factors. Foremost among these is the escalating global concern for environmental protection and public health. Ammonia, a potent pollutant, poses significant risks to aquatic ecosystems, contributing to eutrophication and oxygen depletion, and can also be detrimental to human respiratory health. Consequently, stringent environmental regulations worldwide, aimed at controlling ammonia emissions and discharge, are a primary driver for the adoption of accurate and reliable ammonia sensing technologies. Industries are compelled to invest in these solutions to ensure compliance and mitigate potential penalties. Secondly, the rapid expansion of the agricultural sector, particularly in developing economies, is a significant propellant. Optimized fertilizer management is crucial for sustainable agriculture, and Ammonia Gas Sensing ISEs play a vital role in monitoring soil and atmospheric ammonia levels, enabling precise application of nitrogen-based fertilizers. This not only enhances crop productivity but also reduces fertilizer runoff, minimizing environmental contamination. Thirdly, advancements in sensor technology, including miniaturization, increased sensitivity, and improved durability, are making Ammonia Gas Sensing ISEs more accessible and cost-effective for a broader range of applications. The integration of these sensors with smart technologies and IoT platforms further amplifies their utility, enabling real-time data acquisition, remote monitoring, and predictive analytics.

Despite the promising growth trajectory, the Ammonia Gas Sensing ISE market is not without its inherent challenges and restraints. A significant hurdle is the potential for cross-sensitivity from other alkaline gases and interfering ions present in the sample matrix. This can lead to inaccurate readings and necessitate complex calibration procedures or the use of guard solutions, increasing operational costs and complexity for end-users. Furthermore, the long-term stability and lifespan of Ammonia Gas Sensing ISEs can be a concern, particularly in harsh industrial environments or continuous monitoring applications. Factors such as membrane fouling, electrolyte depletion, and electrode drift can impact accuracy over time, requiring regular maintenance and eventual replacement. The initial cost of high-performance Ammonia Gas Sensing ISEs, especially those offering superior accuracy and selectivity, can also be a barrier to adoption for smaller enterprises or in price-sensitive markets. While costs are declining due to technological advancements, the upfront investment remains a consideration. Moreover, the availability of skilled personnel for the proper operation, calibration, and maintenance of these sophisticated sensing devices can be limited in certain regions, hindering their widespread implementation. The need for specialized training and technical expertise adds another layer of complexity for potential users. Finally, fluctuating raw material prices and supply chain disruptions can also pose a restraint, impacting the manufacturing costs and availability of key components for Ammonia Gas Sensing ISE production, potentially affecting market stability and pricing.

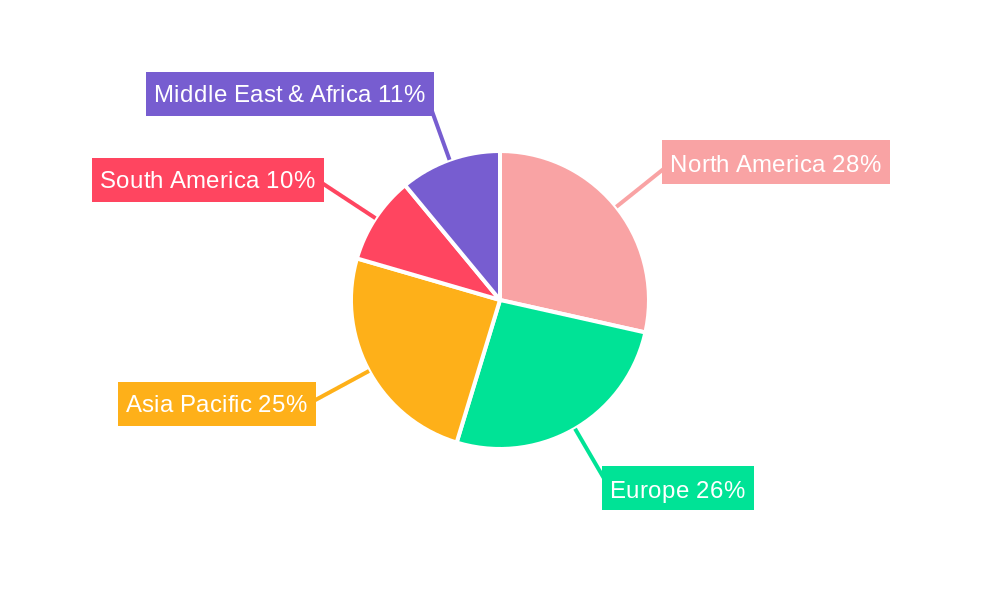

The global Ammonia Gas Sensing ISE market is anticipated to witness significant dominance from North America and Asia Pacific, particularly in terms of revenue and market share.

North America: This region, encompassing the United States and Canada, is a powerhouse in the Ammonia Gas Sensing ISE market due to several factors:

Asia Pacific: This dynamic region, including China, Japan, South Korea, India, and Southeast Asian nations, is poised for substantial growth and is expected to become a major contributor to market expansion.

Dominant Segment: Among the various segments, Combined Electrode technology is anticipated to dominate the market. This is primarily due to their inherent advantages in terms of ease of use, simplified installation, and integrated functionality, making them highly attractive for a wide array of applications, from routine water quality testing to complex industrial process monitoring.

The Ammonia Gas Sensing ISE industry is experiencing robust growth fueled by several key catalysts. Escalating environmental regulations worldwide, mandating stricter control over ammonia emissions and water contamination, are a primary driver. The burgeoning agricultural sector's adoption of precision farming techniques to optimize fertilizer usage and enhance crop yields also significantly boosts demand. Furthermore, advancements in sensor technology, leading to increased accuracy, sensitivity, and miniaturization, make these devices more versatile and accessible. The integration of Ammonia Gas Sensing ISEs with IoT platforms and data analytics solutions is unlocking new possibilities for real-time monitoring, predictive maintenance, and smart process control across various industries.

This comprehensive report provides an in-depth analysis of the global Ammonia Gas Sensing ISE market, meticulously covering historical data from 2019-2024 and forecasting market trends up to 2033, with 2025 serving as the base year. It delves into critical market dynamics, including key drivers, restraints, and emerging opportunities. The report meticulously details regional market landscapes, with a particular focus on the dominant regions of North America and Asia Pacific, and analyzes the impact of key segments, such as Combined Electrode technology. Furthermore, it highlights significant industry developments and profiles leading market players, offering a holistic view of the competitive landscape. The estimated market value in the base year of 2025 is presented in the millions, with projections indicating substantial growth throughout the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thermo Scientific, Metrohm, WTW GmbH, Cole-Parmer, NT Sensors, Endress+Hauser, Horiba, HACH, Hanna Instruments, Mettler Toledo.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ammonia Gas Sensing ISE," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ammonia Gas Sensing ISE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.