1. What is the projected Compound Annual Growth Rate (CAGR) of the 6 Inches Conductive SiC Wafer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

6 Inches Conductive SiC Wafer

6 Inches Conductive SiC Wafer6 Inches Conductive SiC Wafer by Type (Warpage ≤ 40μm, Warpage 40- 60μm, Other), by Application (New Energy Vehicles, Charging Piles, Photovoltaic and Wind Power, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

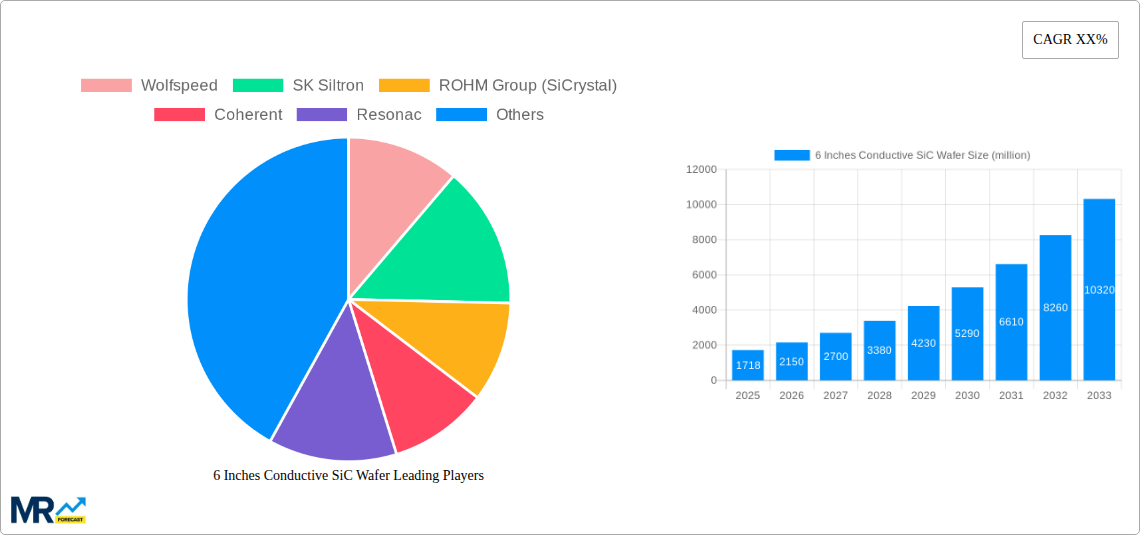

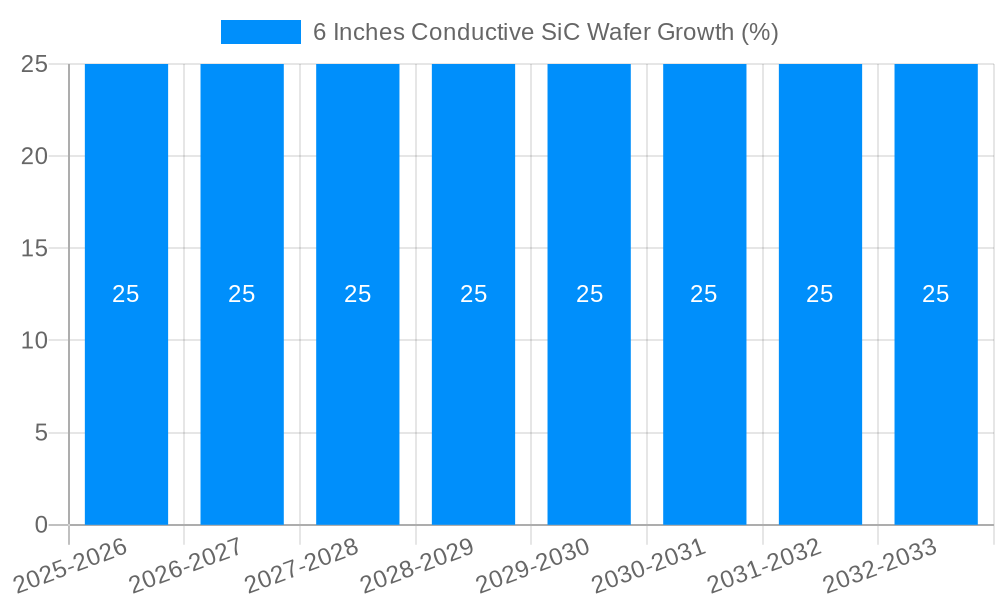

The global 6 Inches Conductive SiC Wafer market is poised for significant expansion, projected to reach a valuation of approximately USD 1718 million by 2025. This growth is fueled by the accelerating adoption of electric vehicles, the expansion of renewable energy infrastructure including charging piles and photovoltaic/wind power systems, and the increasing demand for high-performance electronic components. The compound annual growth rate (CAGR) for this market is estimated to be robust, likely in the range of 20-25%, driven by technological advancements and the continuous need for more efficient and reliable semiconductor materials. Early adoption in new energy applications, where the superior properties of SiC wafers – such as high-temperature resistance, high breakdown voltage, and high thermal conductivity – are paramount, will be a primary catalyst. Furthermore, ongoing research and development efforts to enhance wafer quality and reduce production costs are expected to broaden the market's reach into other advanced electronics sectors.

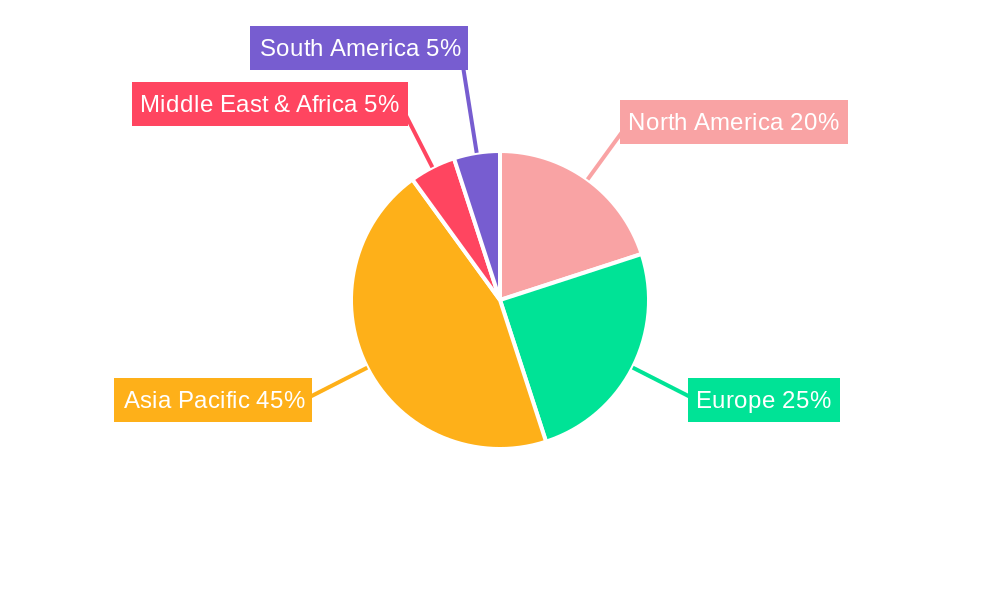

The market segmentation reveals a nuanced landscape, with wafers exhibiting warpage of ≤ 40μm likely commanding a premium due to their suitability for high-precision applications. The dominant applications currently lie within the new energy sector, encompassing electric vehicles and renewable energy generation. However, the forecast period is expected to witness increased penetration into other areas that benefit from SiC's unique characteristics. Key players such as Wolfspeed, SK Siltron, and ROHM Group (SiCrystal) are at the forefront of innovation, driving supply and capacity expansion. Geographically, Asia Pacific, particularly China, is anticipated to lead market growth due to its strong manufacturing base and significant investments in electric vehicles and renewable energy. North America and Europe are also expected to show substantial growth, driven by supportive government policies and increasing consumer demand for sustainable technologies. The continued integration of SiC technology across a wider range of high-power and high-frequency applications will be a critical determinant of the market's long-term trajectory, with a steady increase in demand for wafers with tighter warpage tolerances.

Here's a unique report description for 6 Inches Conductive SiC Wafer, incorporating your specified details:

The global 6-inch conductive Silicon Carbide (SiC) wafer market is poised for remarkable expansion, driven by an insatiable demand for high-performance power electronics. From a market size estimated in the low hundreds of millions of US dollars in the historical period (2019-2024), projections indicate a surge to several billion US dollars by the end of the forecast period (2025-2033). This trajectory is underpinned by fundamental shifts in energy infrastructure and transportation. The transition towards electric vehicles (EVs) is a colossal catalyst, with SiC wafers being instrumental in enabling more efficient inverters and onboard chargers, thereby extending range and reducing charging times. The burgeoning renewable energy sector, particularly solar and wind power, also relies heavily on SiC for its superior voltage handling and reduced power loss in inverters. Charging infrastructure for EVs is another critical area, demanding robust and high-efficiency components that SiC readily provides. The market is witnessing a steady increase in the adoption of wafers with stringent warpage specifications, particularly those exhibiting warpage less than or equal to 40μm. This preference stems from the need for precise semiconductor fabrication and the shrinking feature sizes in advanced power devices. Companies are investing heavily in R&D to improve crystal growth techniques, reduce defect densities, and enhance wafer uniformity, all contributing to a more reliable and cost-effective supply chain. The base year of 2025 marks a significant inflection point, with exponential growth anticipated in the subsequent years. The estimated year of 2025 reflects a strong current demand, setting the stage for sustained advancements throughout the study period (2019-2033). The market's evolution is characterized by a continuous pursuit of higher purity, larger diameter wafers, and increasingly sophisticated doping profiles to meet the ever-growing performance requirements of next-generation electronic systems.

The relentless drive for energy efficiency and decarbonization across the globe is the primary engine propelling the 6-inch conductive SiC wafer market. The imperative to reduce greenhouse gas emissions is directly fueling the expansion of electric vehicles, which are critically dependent on SiC for their powertrain components. These wafers enable substantial improvements in power conversion efficiency, translating to longer EV driving ranges and faster charging capabilities, thereby addressing key consumer concerns. Beyond transportation, the global push towards renewable energy sources like solar and wind power necessitates high-performance power electronics for grid integration and energy management. SiC's inherent advantages in handling high voltages, high temperatures, and high frequencies make it the material of choice for inverters and power modules in these applications, contributing to a cleaner and more sustainable energy future. Furthermore, the development of advanced charging infrastructure for EVs, including fast chargers and inductive charging systems, requires components that can withstand high power densities and operate reliably. SiC wafers are integral to the design of these efficient and robust charging solutions. The increasing complexity and miniaturization of electronic devices also demand materials that can offer superior performance and thermal management, further solidifying SiC's position as a critical component in the modern electronics landscape.

Despite the robust growth trajectory, the 6-inch conductive SiC wafer market faces several significant hurdles. The high manufacturing cost of SiC wafers remains a primary restraint. The complex and energy-intensive crystal growth processes, coupled with lower yields compared to silicon, contribute to a substantial price premium. This cost factor can slow down the widespread adoption of SiC-based devices in cost-sensitive applications, even where performance benefits are evident. Limited production capacity is another critical challenge. While major players are investing heavily in expanding their facilities, the current supply chain struggles to keep pace with the escalating demand. This imbalance can lead to extended lead times and price volatility, impacting the downstream device manufacturers. Technical challenges in wafer processing, such as achieving extremely low warpage (e.g., maintaining warpage ≤ 40μm consistently across large batches) and minimizing defect densities, require continuous innovation and sophisticated manufacturing techniques. The development of reliable and scalable processes for doping, etching, and epitaxy on SiC substrates is an ongoing area of research. Furthermore, the competition from silicon-based solutions in certain applications, especially those where cost is a dominant factor, presents a continuous challenge, although SiC's performance advantages are gradually widening the gap in high-power segments.

The Asia-Pacific region, particularly China, is emerging as the dominant force in both the production and consumption of 6-inch conductive SiC wafers. This regional ascendancy is fueled by a confluence of factors, including substantial government support for the semiconductor industry, a rapidly expanding electric vehicle market, and a burgeoning renewable energy sector. China has set ambitious targets for EV adoption and renewable energy integration, creating a massive domestic demand for SiC components. Major Chinese manufacturers are also making significant investments in expanding their SiC wafer production capabilities, aiming for self-sufficiency and global competitiveness.

Within the application segments, New Energy Vehicles (NEVs) are undoubtedly the primary growth driver and will likely continue to dominate the market. The electrification of transportation is a global megatrend, and SiC's role in enhancing EV efficiency and performance is irreplaceable. This segment is expected to consume a significant portion of the 6-inch conductive SiC wafer output.

The Charging Piles segment is intrinsically linked to the NEV revolution. As the global charging infrastructure expands to support the growing EV fleet, the demand for high-efficiency and reliable charging solutions, powered by SiC, will surge. This segment represents a substantial and rapidly growing market for SiC wafers.

The Photovoltaic and Wind Power segments, while significant, might see a slightly slower growth rate compared to NEVs in the immediate forecast period. However, the long-term commitment to renewable energy sources globally ensures a steady and increasing demand for SiC wafers in inverters and other power conversion systems essential for grid integration.

Considering the wafer types, the segment characterized by Warpage ≤ 40μm is set to witness the most accelerated growth. As the semiconductor industry pushes for higher integration densities and finer lithographic processes in power devices, tighter warpage control becomes paramount for successful wafer fabrication and device yield. Manufacturers are increasingly prioritizing wafers that meet these stringent specifications, driving innovation and investment in advanced manufacturing techniques to achieve and maintain such low warpage levels. While wafers with Warpage 40-60μm will still find applications, the trend towards higher precision will naturally favor the lower warpage category. The "Other" warpage category will encompass specialized applications with less demanding requirements, but its market share is expected to be comparatively smaller as the industry standard shifts towards stricter quality control. The demand for consistency and reliability in high-power applications necessitates the highest quality wafers, making the ≤ 40μm warpage segment a critical indicator of market sophistication and technological advancement.

The 6-inch conductive SiC wafer industry is experiencing accelerated growth due to several powerful catalysts. The escalating global demand for electric vehicles, driven by environmental concerns and government mandates, is a primary driver. SiC's superior efficiency in power electronics directly translates to longer EV ranges and faster charging times. Furthermore, the aggressive expansion of renewable energy infrastructure, including solar and wind farms, necessitates high-performance inverters that benefit immensely from SiC technology. Government incentives and policies aimed at promoting electrification and decarbonization globally are further accelerating adoption. Continuous technological advancements in SiC crystal growth and wafer processing are also improving yield and reducing costs, making SiC more accessible.

This report offers an exhaustive examination of the 6-inch conductive SiC wafer market, providing in-depth analysis across the study period (2019-2033). It delves into the intricate dynamics shaping the market, from technological innovations in wafer fabrication to the evolving demands of end-user industries. The report meticulously forecasts market size and growth rates, identifying key drivers and restraints that will influence the industry's trajectory. It also offers a granular breakdown of the market by wafer type, application, and region, with a particular focus on segments like Warpage ≤ 40μm and the dominant application of New Energy Vehicles. Furthermore, the report includes comprehensive profiles of leading market players, outlining their strategies and contributions to the SiC ecosystem, alongside a detailed analysis of significant developments and future trends.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Wolfspeed, SK Siltron, ROHM Group (SiCrystal), Coherent, Resonac, STMicroelectronics, TankeBlue, SICC, Hebei Synlight Crystal, CETC, San'an Optoelectronics.

The market segments include Type, Application.

The market size is estimated to be USD 1718 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "6 Inches Conductive SiC Wafer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 6 Inches Conductive SiC Wafer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.