1. What is the projected Compound Annual Growth Rate (CAGR) of the 10G-PON Chips?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

10G-PON Chips

10G-PON Chips10G-PON Chips by Type (10G-GPON, 10G-EPON, World 10G-PON Chips Production ), by Application (FTTx, CATV, Corporate Network, World 10G-PON Chips Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global 10G-PON chips market is experiencing robust growth, driven by the escalating demand for high-speed broadband services and the widespread deployment of Fiber-to-the-X (FTTx) networks. With a historical market size estimated in the hundreds of millions in 2019 and a projected growth trajectory indicating a significant expansion by 2025, the market is poised for substantial value creation. This expansion is underpinned by critical factors such as the increasing need for enhanced bandwidth to support video streaming, cloud computing, and the burgeoning Internet of Things (IoT) ecosystem. The widespread adoption of technologies like 10G-GPON and 10G-EPON by telecommunication providers for upgrading their infrastructure is a primary catalyst. Moreover, the growing adoption of 10G-PON chips in CATV networks and enterprise environments further fuels market demand, promising a dynamic and evolving landscape.

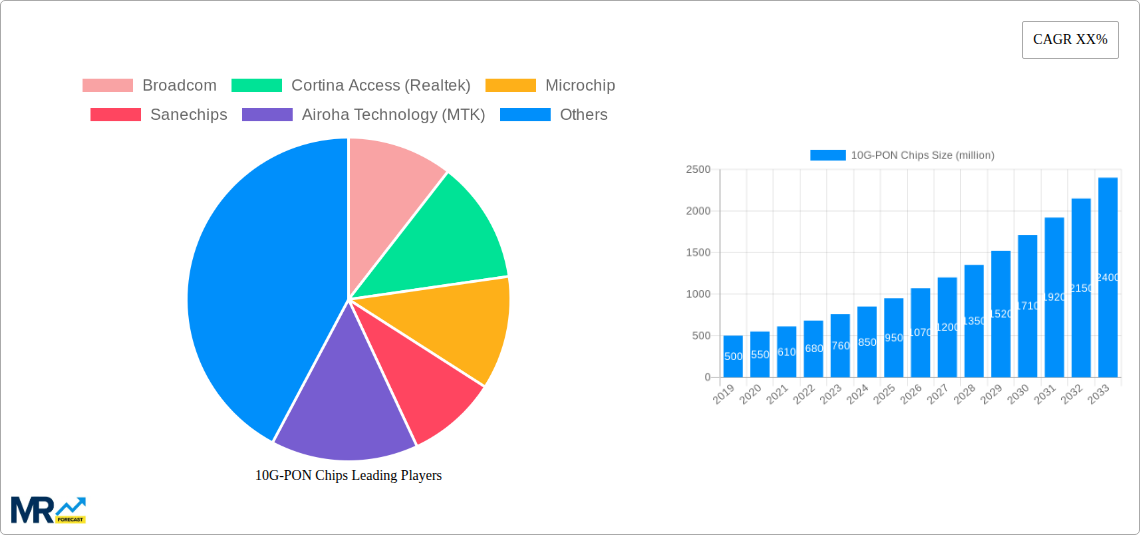

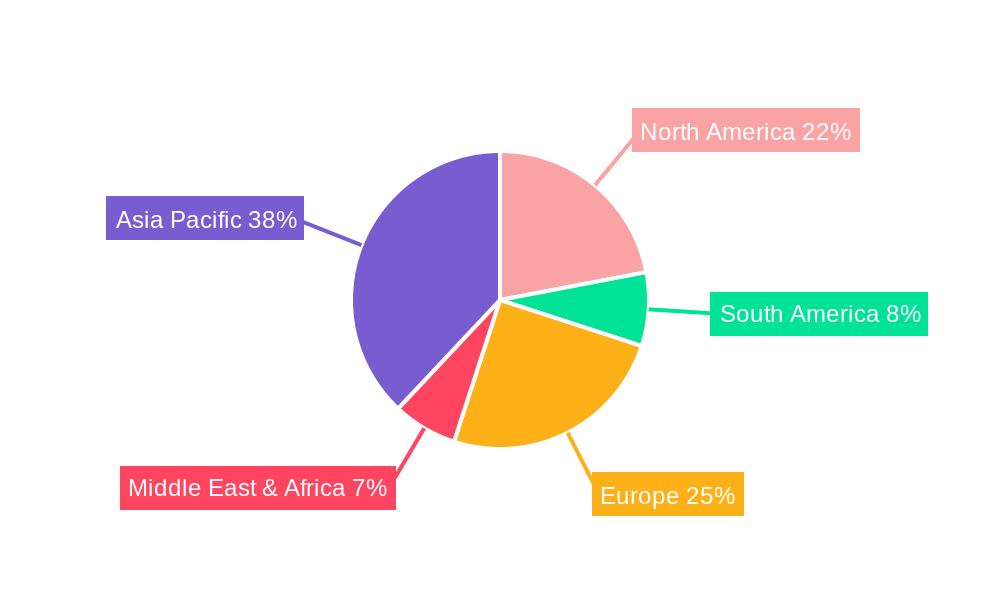

The market is characterized by a competitive environment with key players like Broadcom, Cortina Access (Realtek), and Microchip actively innovating and expanding their product portfolios. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) suggests a consistent upward trend, indicating sustained investment and development within the sector. While drivers are strong, potential restraints might include the high initial cost of infrastructure upgrades for some service providers and the ongoing technological evolution requiring continuous R&D. Geographically, Asia Pacific, particularly China, is expected to dominate due to its extensive fiber deployment and rapid adoption of advanced networking technologies, followed by North America and Europe, which are also witnessing significant investments in broadband infrastructure enhancements.

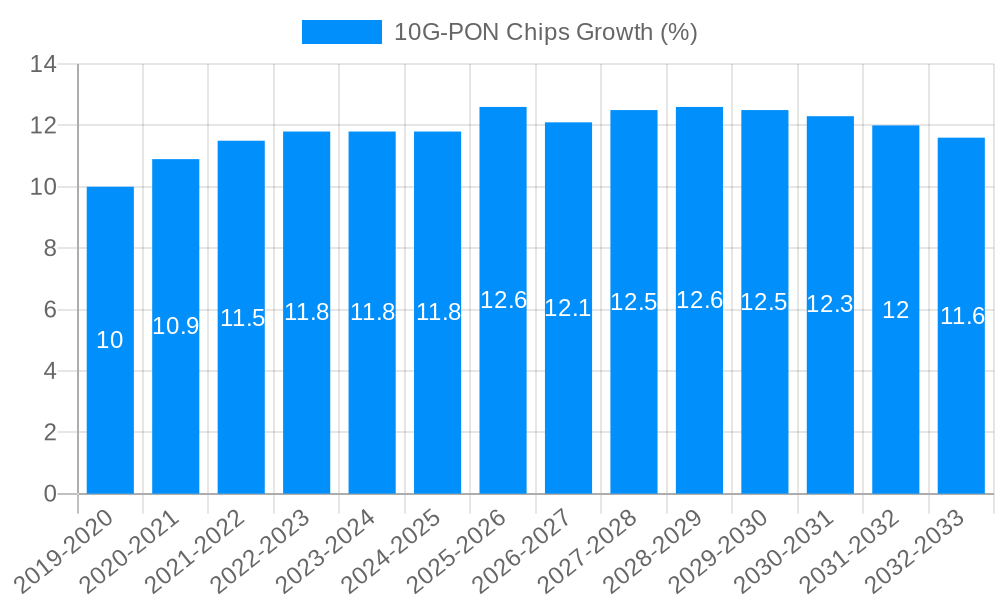

The global market for 10G-PON chips is experiencing a seismic shift, driven by the insatiable demand for higher bandwidth and the ubiquitous rollout of fiber-to-the-home (FTTH) and fiber-to-the-enterprise (FTTE) networks. Our extensive analysis, spanning the historical period of 2019-2024 and projecting forward to 2033, with a base year and estimated year of 2025, reveals a market poised for significant expansion. During the study period, we anticipate the world 10G-PON chips production to witness a Compound Annual Growth Rate (CAGR) exceeding 15%, with market valuations projected to reach several billion dollars by the end of the forecast period. This growth is not merely incremental; it represents a fundamental evolution in broadband infrastructure, enabling a new era of immersive digital experiences, robust enterprise connectivity, and advanced telecommunications services.

Key market insights highlight a growing preference for 10G-GPON technology, particularly in residential deployments, due to its established ecosystem and backward compatibility with existing GPON networks. Conversely, 10G-EPON is carving out a significant niche in enterprise environments and data center interconnects, where symmetrical bandwidth and lower latency are paramount. The world 10G-PON chips production landscape is a dynamic arena, with emerging technologies and increased integration of advanced features like Time Division Multiplexing (TDM) capabilities and enhanced security protocols becoming critical differentiators. Furthermore, the integration of 10G-PON chipsets into a wider array of devices, including customer premises equipment (CPE), optical network units (ONUs), and optical line terminals (OLTs), underscores the expanding application scope. The CATV segment, traditionally reliant on coaxial cable, is also beginning to see the adoption of 10G-PON for delivering ultra-high-definition content and interactive services, further diversifying the market. The trajectory clearly indicates a move towards a unified, high-speed fiber access network, with 10G-PON chips serving as the foundational technology.

The burgeoning demand for 10G-PON chips is being propelled by a confluence of powerful market forces. Foremost among these is the escalating proliferation of bandwidth-intensive applications and services. The widespread adoption of 4K/8K video streaming, cloud gaming, virtual and augmented reality (VR/AR), and the ever-increasing number of connected devices within smart homes and cities are placing unprecedented strain on existing network infrastructures. Consequently, service providers are compelled to upgrade their access networks to meet these evolving consumer and business needs. This upgrade cycle directly translates into a heightened demand for high-performance 10G-PON chipsets that can deliver the necessary multi-gigabit symmetrical bandwidth.

Moreover, government initiatives and investments in broadband infrastructure expansion worldwide are significantly contributing to market growth. Many nations are prioritizing the deployment of fiber optic networks as a critical component of their digital transformation strategies, aiming to bridge the digital divide and foster economic competitiveness. These initiatives often involve substantial subsidies and policy support, incentivizing telecommunications companies to accelerate their FTTH/FTTE deployments, thereby fueling the demand for the underlying 10G-PON silicon. The growing emphasis on enterprise digital transformation, including the adoption of cloud-based services, remote work enablement, and the Internet of Things (IoT), further amplifies the need for robust and high-speed corporate networks, creating a substantial market for 10G-EPON solutions.

Despite the robust growth prospects, the 10G-PON chips market is not without its inherent challenges and restraints that could potentially temper its expansion. A significant hurdle is the considerable cost associated with the deployment and upgrade of fiber optic infrastructure. While the cost of 10G-PON chipsets has been steadily declining, the overall investment required for trenching, cabling, and equipping new fiber networks remains substantial. This capital expenditure can be a deterrent for some service providers, particularly in regions with lower average revenue per user (ARPU) or where the business case for such high-speed deployments is not as compelling.

Another notable restraint is the ongoing competition from alternative high-speed access technologies. While 10G-PON offers superior performance in many scenarios, technologies like DOCSIS 3.1 and future iterations of cable broadband, as well as fixed wireless access (FWA) solutions, continue to evolve and offer viable alternatives for delivering high-speed internet, especially in certain market segments or geographies. The interoperability and standardization efforts, while progressing, can also present complexities. Ensuring seamless compatibility across different vendors' equipment and across various PON standards (GPON, EPON, XG-PON, XGS-PON) requires continuous development and adherence to evolving industry specifications. Furthermore, the availability of skilled labor for fiber deployment and maintenance can also pose a bottleneck in some regions, slowing down the pace of network upgrades.

The global 10G-PON chips market is poised for significant dominance by specific regions and segments, driven by a confluence of technological adoption, investment, and market demand.

Key Segments Dominating the Market:

Type: 10G-GPON: This segment is expected to lead the market, particularly in the residential sector. The extensive installed base of GPON infrastructure globally makes the upgrade path to 10G-GPON a natural and cost-effective evolution for many service providers. Backward compatibility with existing GPON ONTs provides a smoother transition, reducing the risk and investment associated with a complete network overhaul. The sheer volume of residential subscribers globally, coupled with increasing demand for high-speed internet for entertainment and smart home applications, ensures sustained growth for 10G-GPON chipsets. We project the production of 10G-GPON chips to account for over 65% of the total world 10G-PON chips production throughout the forecast period.

Application: FTTx: The Fiber-to-the-X (FTTx) segment, encompassing FTTx (Fiber-to-the-Home), FTTC (Fiber-to-the-Curb), and FTTE (Fiber-to-the-Enterprise), is the primary driver of 10G-PON chip demand. The ongoing global push for high-speed broadband deployment to homes and businesses worldwide underpins the substantial growth in this application segment. As service providers accelerate their FTTH rollouts to cater to the escalating bandwidth requirements of consumers and enterprises, the demand for 10G-PON chipsets for both OLTs and ONUs within these networks will remain exceptionally strong. The FTTx segment alone is anticipated to contribute over 70% of the total market revenue during the study period.

Key Regions and Countries Dominating the Market:

Asia-Pacific: This region is a powerhouse in the 10G-PON chips market and is expected to maintain its lead throughout the forecast period.

North America: This region is also a significant contributor to the market, driven by strong demand for high-speed internet from both residential and enterprise sectors.

Europe: Europe presents a mixed but growing market for 10G-PON chips.

The dominance of these regions and segments is further underscored by the continuous technological advancements and the strategic partnerships forming within the ecosystem, all aimed at delivering superior connectivity experiences.

Several factors are acting as potent growth catalysts for the 10G-PON chips industry. The escalating demand for bandwidth-intensive services like 4K/8K streaming, cloud gaming, and VR/AR applications is fundamentally pushing the need for faster internet speeds. Furthermore, government initiatives worldwide aimed at expanding broadband access and bridging the digital divide are driving massive fiber optic deployments, directly boosting the consumption of 10G-PON chipsets. The increasing adoption of smart home technologies and the growing prevalence of IoT devices also necessitate a more robust and higher-capacity network infrastructure, further fueling growth. The growing realization among enterprises of the benefits of high-speed, low-latency connectivity for cloud computing, data analytics, and remote collaboration is also a significant catalyst, especially for 10G-EPON solutions.

This report provides an exhaustive analysis of the global 10G-PON chips market, covering the period from 2019 to 2033, with a specific focus on the base year of 2025 and the forecast period of 2025-2033. It delves into the intricate details of market segmentation by type (10G-GPON, 10G-EPON) and application (FTTx, CATV, Corporate Network), offering detailed production volume forecasts in the millions of units for world 10G-PON chips production. The analysis encompasses a thorough examination of the driving forces, challenges, and growth catalysts shaping the industry. It also identifies the leading players and their contributions, alongside a timeline of significant developments. This comprehensive coverage ensures stakeholders gain invaluable insights into market dynamics, emerging trends, and future opportunities within the rapidly evolving 10G-PON chips sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Broadcom, Cortina Access (Realtek), Microchip, Sanechips, Airoha Technology (MTK), Fisilink (Fiberhome), Semtech, MaxLinear.

The market segments include Type, Application.

The market size is estimated to be USD 1941 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "10G-PON Chips," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 10G-PON Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.