1. What is the projected Compound Annual Growth Rate (CAGR) of the Transport Vials?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Transport Vials

Transport VialsTransport Vials by Type (2ml to 5ml, 5ml to 10ml, 10ml to 20ml, >20ml, World Transport Vials Production ), by Application (Research Laboratory, Hospitals, Pharmaceutical Companies, Educational Institutes, Others, World Transport Vials Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

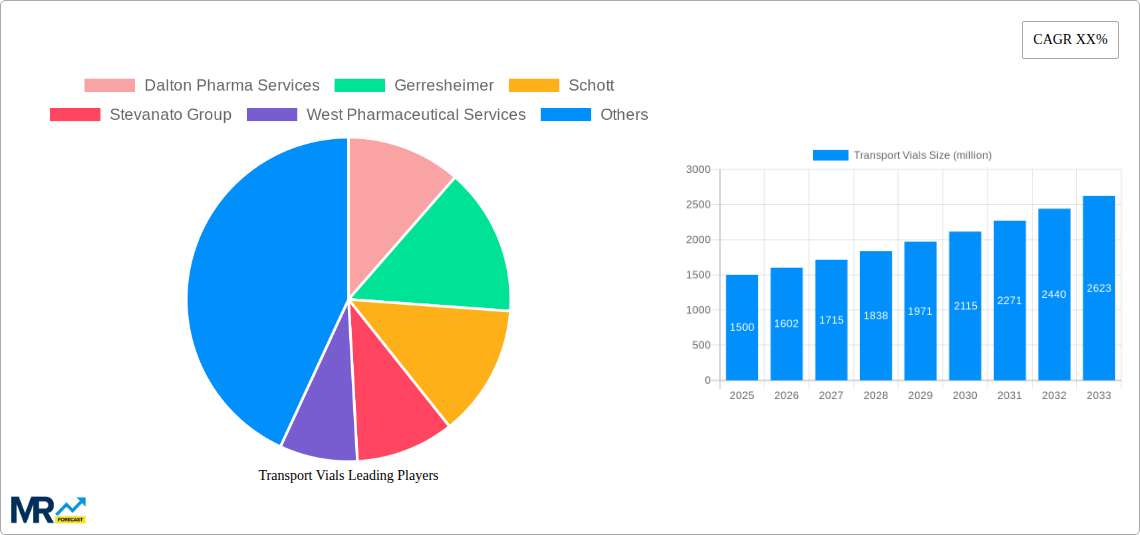

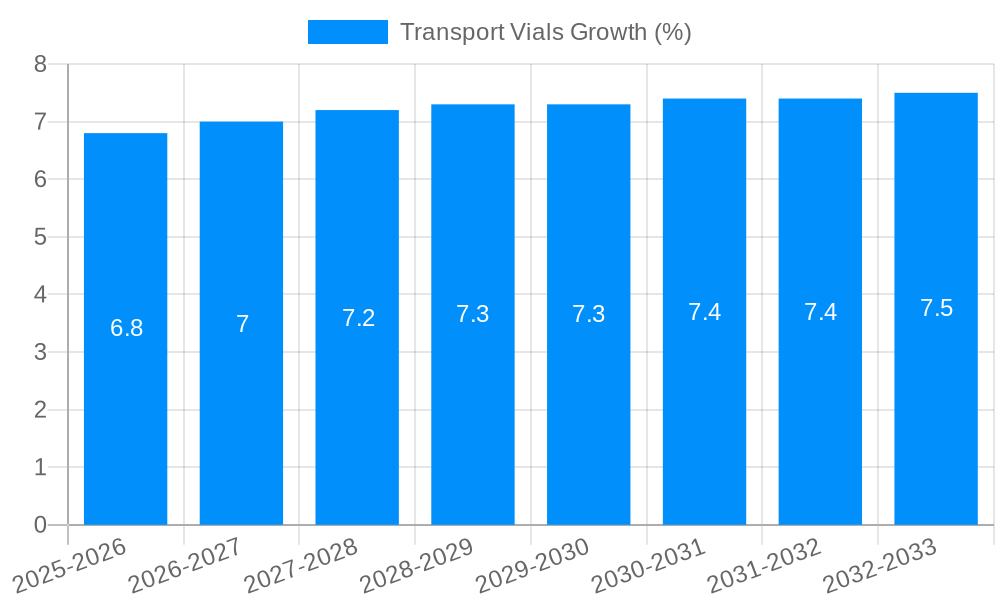

The global Transport Vials market is poised for significant expansion, projected to reach an estimated market size of approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.8% anticipated over the forecast period of 2025-2033. This substantial growth is primarily fueled by the escalating demand for safe and reliable sample transportation across diverse sectors, including pharmaceutical research, clinical diagnostics, and academic institutions. The increasing prevalence of chronic diseases and the subsequent surge in drug discovery and development initiatives worldwide are directly contributing to the heightened need for specialized vials designed to maintain sample integrity during transit. Furthermore, advancements in vial manufacturing technologies, leading to improved material properties, sealing mechanisms, and shatter resistance, are also playing a crucial role in driving market adoption. The expansion of global healthcare infrastructure, particularly in emerging economies, is creating new avenues for market penetration, as an increasing number of laboratories and research facilities are established to meet growing healthcare demands.

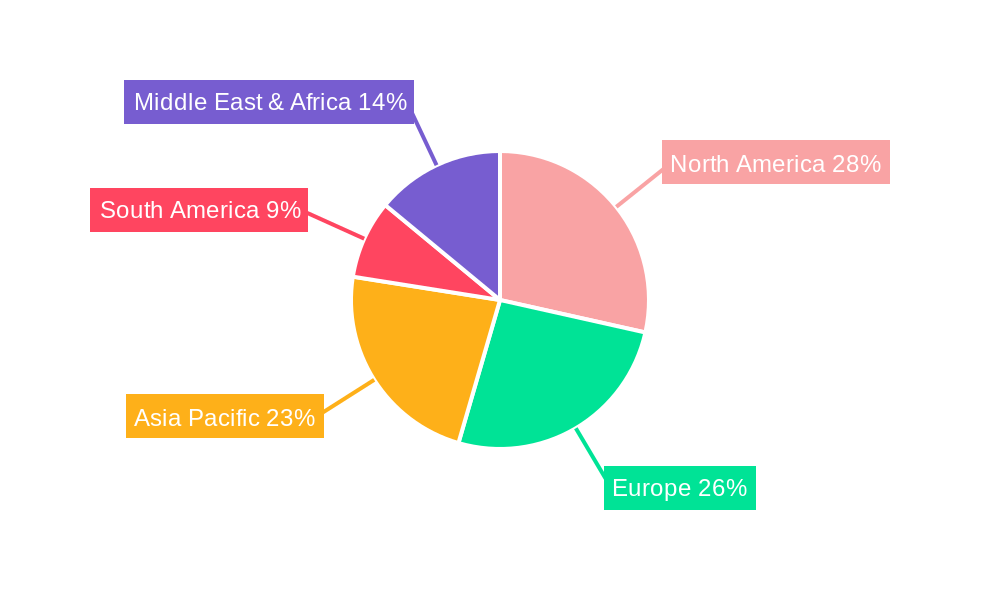

The market segmentation reveals a dynamic landscape, with the 5ml to 10ml vial segment expected to lead in terms of volume due to its widespread application in routine sample collection and analysis. The Pharmaceutical Companies segment is identified as the largest application area, reflecting the industry's critical reliance on secure vial solutions for drug development, quality control, and clinical trial sample management. Geographically, the Asia Pacific region is anticipated to witness the fastest growth, driven by a burgeoning pharmaceutical industry in countries like China and India, coupled with increasing government investments in healthcare and research. Conversely, North America and Europe will continue to hold significant market share, characterized by established pharmaceutical giants, advanced research ecosystems, and stringent regulatory standards for sample handling. Key industry players such as Gerresheimer, Schott, and West Pharmaceutical Services are actively innovating and expanding their product portfolios to cater to evolving market needs, focusing on enhanced containment, traceability, and user-friendly designs.

The global transport vials market is poised for significant expansion, with projections indicating a substantial CAGR from 2025 to 2033. This growth is underpinned by a confluence of factors, including the escalating demand for safe and reliable containment solutions for pharmaceuticals, biologics, and diagnostic samples. The historical period of 2019-2024 witnessed steady progress, driven by the increasing complexity of drug development and the necessity for stringent sample integrity throughout the supply chain. The base year of 2025 sets the stage for an accelerated trajectory, with the estimated market size reflecting a robust upward trend. Key market insights reveal a growing preference for specialized vials designed to maintain the efficacy of sensitive medications and advanced therapeutic agents. The rising prevalence of chronic diseases and an aging global population are directly contributing to a higher volume of pharmaceutical production and, consequently, an increased need for transport vials. Furthermore, advancements in material science are leading to the development of more inert and shatter-resistant vials, offering enhanced protection against environmental factors and accidental damage during transit. The market is also experiencing a shift towards sustainable packaging solutions, with manufacturers exploring eco-friendly materials and designs. The research laboratory segment, in particular, is a significant contributor, requiring a constant supply of high-quality vials for sample collection, storage, and transportation for various analytical and experimental purposes. Similarly, hospitals and diagnostic centers rely heavily on these vials for the safe transfer of patient specimens, playing a critical role in accurate disease diagnosis and treatment monitoring. The pharmaceutical industry's relentless pursuit of innovation, involving the development of novel vaccines, gene therapies, and personalized medicines, further amplifies the demand for specialized transport vials that can preserve the delicate nature of these groundbreaking products. The <20ml segment, encompassing volumes such as 2ml to 5ml and 5ml to 10ml, is expected to witness consistent demand due to its widespread application in drug formulation, clinical trials, and small-volume diagnostic testing. The continuous evolution of regulatory landscapes, emphasizing stringent quality control and traceability, also pushes manufacturers to innovate and deliver vials that meet the highest international standards, further solidifying the market's positive outlook.

The transport vials market is experiencing a powerful upward momentum, primarily fueled by the burgeoning pharmaceutical and biotechnology sectors. The relentless pace of drug discovery and development, particularly in areas like biologics, vaccines, and personalized medicine, necessitates robust and reliable containment solutions for the safe transportation of these invaluable substances. As new and increasingly sensitive therapeutic agents enter the market, the demand for vials that can maintain their stability, purity, and efficacy throughout the intricate cold chain and distribution networks intensifies. The World Health Organization's increasing focus on global health initiatives and disease eradication programs further translates into a greater need for the secure transport of vaccines and other essential medicines to remote and diverse geographical locations. The expanding healthcare infrastructure, especially in emerging economies, is also a significant driver, leading to increased accessibility and utilization of diagnostic services, which in turn requires a consistent supply of transport vials for patient sample collection and analysis. Moreover, the growing trend of outsourcing pharmaceutical manufacturing and research activities contributes to a higher volume of inter-facility and international shipments of drugs and samples, thereby bolstering the demand for dependable transport vials. The evolving regulatory frameworks worldwide, which emphasize enhanced product integrity and safety, compel manufacturers to produce high-quality vials that adhere to stringent international standards, further stimulating market growth. The proactive approach by regulatory bodies in ensuring the integrity of pharmaceutical products from manufacturing to end-user consumption directly translates into a higher demand for specialized and certified transport vials.

Despite the promising growth trajectory, the transport vials market is not without its hurdles. One of the primary challenges lies in the increasing stringency of regulatory requirements globally. Manufacturers must continuously invest in advanced quality control measures, validation processes, and compliance certifications to meet the ever-evolving standards set by bodies like the FDA, EMA, and others. This can lead to higher production costs and extended lead times. Furthermore, the fluctuating raw material prices, particularly for borosilicate glass and specialized polymers, can impact the profitability and pricing strategies of manufacturers. Supply chain disruptions, as witnessed in recent global events, can also pose a significant threat, affecting the availability of essential components and the timely delivery of finished products. The counterfeit market for pharmaceutical packaging, including vials, is another concern that requires constant vigilance and technological advancements to combat. The development of sophisticated anti-counterfeiting features adds to the cost of production. Moreover, the growing emphasis on environmental sustainability presents a challenge for traditional manufacturing processes. While there is a push for eco-friendly materials and recyclable options, the high performance and reliability requirements of pharmaceutical transport can sometimes limit the adoption of certain sustainable alternatives, requiring innovative solutions. The initial capital investment required for establishing state-of-the-art manufacturing facilities equipped to produce high-quality vials that meet stringent pharmaceutical standards can also be a barrier to entry for new players. The specialized nature of some pharmaceutical products necessitates custom-designed vials, adding complexity and cost to the production process.

The North America region is projected to hold a significant market share in the global transport vials market, driven by its well-established pharmaceutical and biotechnology industries, robust research and development infrastructure, and stringent regulatory landscape. The region's high prevalence of chronic diseases and its advanced healthcare system contribute to a substantial demand for pharmaceuticals and diagnostic services, directly translating into a continuous need for transport vials. The United States, in particular, is a global leader in pharmaceutical innovation and manufacturing, necessitating a vast quantity of high-quality vials for the packaging and transportation of a wide array of drug products, including biologics, vaccines, and small molecules. Furthermore, the presence of numerous leading pharmaceutical companies and research institutions in North America fuels continuous demand for specialized vials for clinical trials, drug discovery, and sample management. The region's focus on advanced therapies and personalized medicine also necessitates the use of sophisticated containment solutions that can maintain the integrity of these sensitive and high-value products. The established distribution networks and a strong emphasis on supply chain security further bolster the demand for reliable transport vials.

Within the segment analysis, the >20ml segment is expected to witness substantial growth, although the 2ml to 5ml and 5ml to 10ml segments will continue to be the largest in terms of volume.

>20ml Segment: This segment is driven by the increasing production of large-volume parenteral drugs, bulk biologics, and specialized diagnostic reagents. As pharmaceutical companies scale up their manufacturing processes for blockbuster drugs and advanced therapies, the demand for larger-capacity vials for primary packaging and bulk transport will rise. The growth in the production of cell and gene therapies, which often require larger volumes for formulation and administration, will also contribute significantly to the demand in this segment. Furthermore, the need for bulk sample storage and transport in large-scale research and manufacturing facilities will further propel the growth of the >20ml segment. The development of novel drug delivery systems that utilize larger volumes will also be a key factor. The increasing complexity of drug formulations and the trend towards combination therapies can also lead to a requirement for larger vials to accommodate multiple active ingredients or higher dosages.

2ml to 5ml and 5ml to 10ml Segments: These segments are consistently strong due to their ubiquitous application in a vast number of pharmaceutical formulations, particularly for single-dose medications, vaccines, and diagnostic kits. They are also heavily utilized in clinical laboratories for the collection and transport of blood, urine, and other biological samples. The continuous pipeline of new drug approvals across various therapeutic areas, many of which are administered in smaller doses, ensures sustained demand for these smaller vial sizes. Educational institutions and research facilities also contribute significantly to the demand in these segments for experimental purposes and routine sample handling. The convenience and cost-effectiveness of these smaller vial sizes for specific applications ensure their continued dominance in terms of unit volume. The growing demand for personalized medicine, where treatments are tailored to individual patients, often involves the use of smaller, precisely dosed vials, further solidifying the importance of these segments.

Several factors are acting as potent growth catalysts for the transport vials industry. The escalating global demand for pharmaceuticals and biologics, driven by an aging population and the rising incidence of chronic diseases, is a primary driver. Advancements in drug formulation and the development of novel therapeutic modalities, such as gene and cell therapies, necessitate specialized and high-integrity containment solutions. The increasing outsourcing of pharmaceutical manufacturing and research activities further amplifies the need for secure and compliant transport vials for inter-facility and international shipments.

This comprehensive report delves into the intricate dynamics of the global transport vials market. It provides a meticulous analysis of market trends, forecasting significant growth from 2025 to 2033, building upon the historical period of 2019-2024. The report dissects the key driving forces, including the expanding pharmaceutical and biotechnology sectors, the imperative for safe containment of biologics and vaccines, and the increasing healthcare infrastructure in emerging economies. Simultaneously, it addresses the inherent challenges and restraints, such as stringent regulatory landscapes, raw material price volatility, and the growing demand for sustainable packaging. The report also highlights dominant regions and segments, with a particular focus on North America and the >20ml vial segment, while acknowledging the sustained importance of smaller vial sizes. Growth catalysts, leading industry players, and significant sector developments are also comprehensively covered, offering a holistic view of this vital market segment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dalton Pharma Services, Gerresheimer, Schott, Stevanato Group, West Pharmaceutical Services, Phoenix Glass, Pacific Vial Manufacturing, Shandong Pharmaceutical Glass, Anhui Huaxin Medicinal Glass Products, Pioneer Impex, SGD Pharma Group, PGP Glass Company.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Transport Vials," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Transport Vials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.