1. What is the projected Compound Annual Growth Rate (CAGR) of the Foam Protection Packaging Rolls?

The projected CAGR is approximately 5.45%.

Foam Protection Packaging Rolls

Foam Protection Packaging RollsFoam Protection Packaging Rolls by Type (Expanded Polystyrene, Polyurethane Foam, Expanded Polyethylene, Expanded Polypropylene, Others, World Foam Protection Packaging Rolls Production ), by Application (White Goods and Electronics, Pharmaceutical & Medical Devices, Automotive and Auto Components, Daily Consumer Goods, Food Industry, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

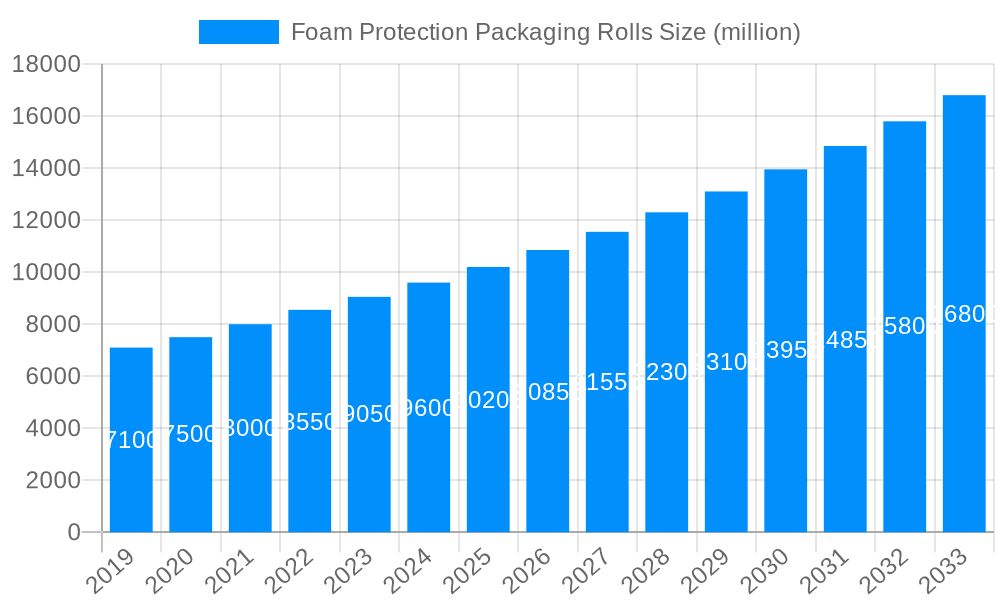

The global Foam Protection Packaging Rolls market is projected for substantial growth, anticipating a market size of $8.44 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.45% through 2033. This expansion is driven by the increasing demand for robust protective packaging across diverse industries. The booming e-commerce sector is a key driver, requiring secure packaging for consumer goods, electronics, and pharmaceuticals during transit. Growing emphasis on product integrity and damage prevention in sectors like white goods, automotive components, and medical devices also fuels market growth. Innovations in foam materials, focusing on enhanced cushioning, reduced weight, and improved sustainability, are further boosting adoption.

Key trends include a strong shift towards eco-friendly and recyclable foam solutions, prompted by environmental awareness and regulatory compliance. Manufacturers are investing in biodegradable and compostable foam alternatives. Diversifying applications, especially in sensitive sectors like pharmaceuticals and medical devices, present significant opportunities. Market restraints include fluctuating raw material costs for petroleum-based derivatives, impacting profitability. The emergence of alternative packaging solutions may also pose competitive challenges. Despite these factors, the inherent protective capabilities and versatility of foam packaging, alongside technological advancements, ensure its continued prominence in supply chain protection.

This report provides an in-depth analysis and precise forecasts for the global Foam Protection Packaging Rolls market from 2019 to 2033, with 2025 as the base year. The study covers the historical period (2019-2024), the estimated year (2025), and a forecast period (2025-2033). The analysis focuses on production dynamics and market trends within this essential sector.

The Foam Protection Packaging Rolls market is currently experiencing a dynamic evolution, driven by an increasing emphasis on product safety, sustainability, and operational efficiency across a multitude of industries. XXX indicates a significant shift towards advanced material compositions, with Expanded Polystyrene (EPS) and Polyurethane Foam (PU) continuing to hold substantial market share due to their cost-effectiveness and proven protective qualities. However, there's a discernible upward trend in the adoption of Expanded Polyethylene (EPE) and Expanded Polypropylene (EPP) for applications demanding superior shock absorption, chemical resistance, and reusability. This surge is fueled by the growing awareness of the environmental impact of single-use packaging and the corresponding demand for recyclable and biodegradable alternatives. The "Others" segment, encompassing innovative bio-based foams and composite materials, is also poised for considerable growth, reflecting ongoing research and development efforts to create more sustainable and high-performance packaging solutions.

The market's trajectory is further shaped by evolving consumer expectations and stringent regulatory landscapes. The rise of e-commerce has significantly amplified the demand for robust packaging that can withstand the riguries of transit, leading to a greater reliance on foam protection rolls for safeguarding a diverse range of products, from delicate electronics to fragile white goods. Moreover, the pharmaceutical and medical device sectors are increasingly adopting specialized foam packaging solutions that offer superior cushioning, temperature control, and sterility assurance, thereby contributing to market expansion. In the automotive industry, the need for lightweight yet impact-resistant foam components for both in-transit protection and within vehicle applications is driving innovation and adoption. The food industry, while traditionally relying on other packaging formats, is exploring foam rolls for specific applications requiring enhanced insulation and protection for perishable goods. This multifaceted demand landscape underscores the resilience and adaptability of the foam protection packaging rolls market, projecting a steady growth trajectory throughout the forecast period. The integration of smart packaging technologies, though nascent, also presents a future trend to monitor, with potential for embedded sensors within foam rolls to track product condition during transit. The market is witnessing a gradual increase in the adoption of customized solutions, moving away from standardized offerings to cater to the unique protection needs of specific products and industries.

Several powerful forces are acting as significant catalysts for the growth of the Foam Protection Packaging Rolls market. Foremost among these is the unyielding demand for enhanced product protection during transit and handling. As supply chains become increasingly complex and globalized, the risk of damage to goods escalates, necessitating robust cushioning solutions. Foam protection rolls, with their inherent shock absorption and impact resistance, are indispensable in minimizing product loss and ensuring customer satisfaction. This is particularly evident in sectors like White Goods and Electronics, where even minor damage can render products unsalable. Furthermore, the meteoric rise of e-commerce has fundamentally altered the packaging landscape. The sheer volume of online orders necessitates efficient, reliable, and cost-effective protective packaging, a role that foam rolls are exceptionally well-suited to fulfill. This surge in online retail translates directly into higher production and consumption of foam packaging materials.

Another crucial driver is the increasing stringency of safety regulations and industry standards, particularly in sensitive sectors like Pharmaceuticals & Medical Devices and the Food Industry. These industries require packaging that not only protects the product but also maintains its integrity, sterility, and in some cases, temperature. Foam packaging, when engineered to meet these specific requirements, offers a reliable and compliant solution. The automotive sector's ongoing commitment to lightweighting and durability also contributes to the market's momentum. Foam protection rolls are employed to safeguard automotive components during shipping and assembly, and their inherent cushioning properties are increasingly being integrated into vehicle designs for noise reduction and vibration dampening. Lastly, the growing global middle class and rising disposable incomes are fueling demand for a wider array of consumer goods, all of which require protection during their journey from manufacturer to consumer, indirectly boosting the foam packaging market.

Despite its robust growth, the Foam Protection Packaging Rolls market faces several significant challenges and restraints that temper its expansion. The most prominent of these is the growing environmental concern surrounding plastic waste and the increasing regulatory pressure for sustainable packaging solutions. Many traditional foam materials, such as EPS, are petroleum-based and can persist in landfills for extended periods, leading to negative ecological impacts. This has spurred a demand for recyclable, biodegradable, or compostable alternatives, which often come at a higher cost or lack the equivalent protective performance of conventional foams. Consequently, manufacturers are facing pressure to innovate and invest in greener materials and production processes, which can incur substantial research and development expenses and potentially increase product pricing.

Another key restraint is the volatility of raw material prices. The primary feedstocks for many foam protection rolls are derived from petrochemicals, making their production costs susceptible to fluctuations in crude oil prices. These price swings can impact profit margins for manufacturers and lead to unpredictable pricing for end-users, potentially driving some businesses to explore alternative, more stable packaging solutions. The cost of specialized foam packaging, particularly for niche applications requiring advanced properties like extreme temperature resistance or high cushioning capabilities, can also be a deterrent for some industries, especially smaller businesses with tighter budgets. Furthermore, the logistical complexities and costs associated with transporting bulky foam packaging rolls, especially over long distances, can add to the overall expense for end-users. The development of efficient and sustainable logistics for packaging materials remains an ongoing challenge. Lastly, the emergence of alternative protective packaging materials, such as molded pulp, advanced paper-based solutions, and air-filled plastic packaging, presents competitive pressure, forcing foam manufacturers to continuously improve their product offerings and cost-effectiveness.

The global Foam Protection Packaging Rolls market is characterized by a dynamic interplay of regional strengths and segment dominance. Analyzing the Type of foam, Expanded Polystyrene (EPS) is projected to maintain a significant market share due to its well-established presence, cost-effectiveness, and wide range of applications, particularly in the protection of White Goods and Electronics, as well as automotive components. Its high cushioning capabilities at a relatively low density make it an attractive option for bulkier items. However, Polyurethane Foam (PU) is anticipated to exhibit robust growth, driven by its superior flexibility, impact absorption, and ability to be molded into complex shapes. This makes it ideal for protecting delicate or irregularly shaped items within the Pharmaceutical & Medical Devices and Daily Consumer Goods segments.

The Expanded Polyethylene (EPE) segment is also poised for substantial expansion. Its excellent resistance to moisture, chemicals, and abrasion, combined with its superior resilience and reusability, makes it increasingly sought after in high-value applications. This includes protecting sensitive electronic components, premium consumer goods, and specialized medical equipment. Expanded Polypropylene (EPP), known for its exceptional durability, resistance to repeated impact, and thermal insulation properties, is expected to witness steady growth, particularly in the Automotive and Auto Components sector, as well as for reusable packaging solutions. The "Others" segment, encompassing bio-based foams and innovative composite materials, while currently smaller, holds significant long-term potential for disruption as sustainability concerns drive research and adoption.

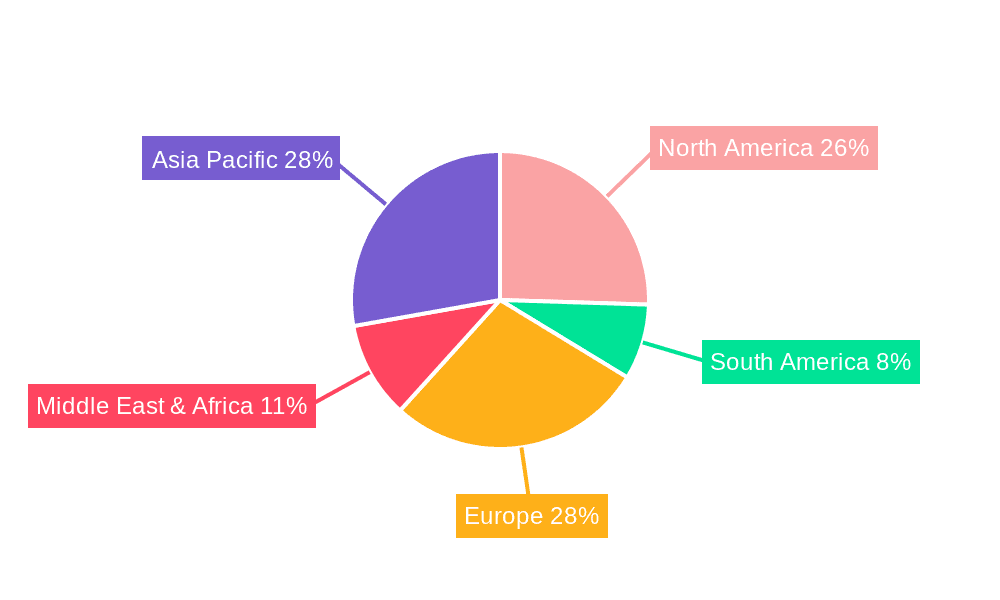

Geographically, Asia Pacific is projected to dominate the Foam Protection Packaging Rolls market in terms of both production and consumption. This dominance is fueled by the region's rapidly expanding manufacturing base across diverse industries, including electronics, automotive, and consumer goods. Countries like China, India, and Southeast Asian nations are experiencing significant growth in e-commerce, further amplifying the demand for protective packaging. The region's large population and increasing disposable incomes contribute to a growing demand for consumer products, all of which require reliable packaging. North America, particularly the United States, will remain a strong contender, driven by a mature e-commerce market, stringent product protection requirements in industries like pharmaceuticals and medical devices, and a proactive approach to adopting advanced packaging technologies. Europe is also a significant market, characterized by a strong emphasis on sustainability and regulatory compliance, which is driving innovation in eco-friendly foam materials and closed-loop recycling systems. The demand in Europe for high-performance foam for sensitive applications within the pharmaceutical and automotive sectors will continue to be a key factor. Latin America and the Middle East & Africa represent emerging markets with considerable growth potential, driven by industrialization, increasing consumerism, and the expansion of e-commerce. The Application segment of White Goods and Electronics will continue to be a dominant force, given the sheer volume of these products manufactured and shipped globally, all requiring robust protection against physical damage. The Pharmaceutical & Medical Devices segment, while smaller in volume, represents a high-value market due to the critical need for sterile, shock-absorbent, and temperature-controlled packaging.

The Foam Protection Packaging Rolls industry is propelled by several key growth catalysts. The unabated surge in e-commerce is a primary driver, demanding robust and cost-effective protective solutions for a vast array of shipped goods. Increasing consumer awareness regarding product integrity and the desire to receive undamaged items directly fuels the need for reliable cushioning. Furthermore, stringent industry regulations, especially in sectors like pharmaceuticals and medical devices, mandate specialized packaging that ensures product safety, sterility, and temperature control, thereby boosting demand for advanced foam solutions. The automotive industry's focus on lightweighting and component protection also contributes significantly.

This report offers a holistic view of the global Foam Protection Packaging Rolls market, meticulously analyzing production trends, consumption patterns, and future projections. It provides an exhaustive breakdown of market segmentation by material type (EPS, PU, EPE, EPP, Others) and application (White Goods & Electronics, Pharmaceutical & Medical Devices, Automotive, Daily Consumer Goods, Food Industry, Other). The analysis delves into the key driving forces, such as e-commerce growth and regulatory compliance, alongside significant challenges, including environmental concerns and raw material price volatility. Furthermore, it highlights regional market dominance, particularly the ascendance of Asia Pacific, and identifies key growth catalysts and leading industry players. This comprehensive coverage ensures stakeholders possess the critical intelligence needed to navigate this evolving market landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.45%.

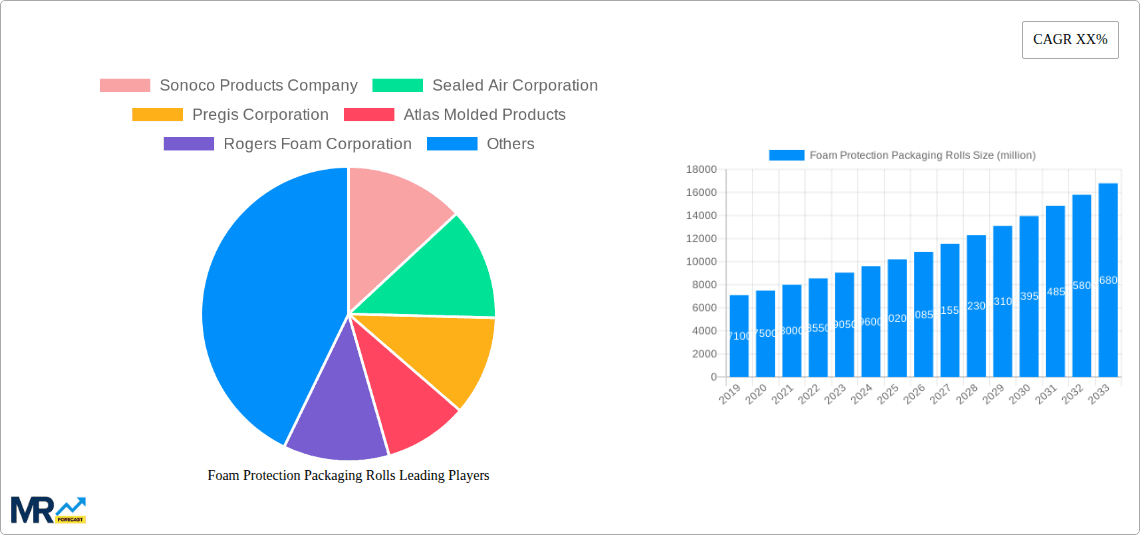

Key companies in the market include Sonoco Products Company, Sealed Air Corporation, Pregis Corporation, Atlas Molded Products, Rogers Foam Corporation, Plymouth Foam, Foam Fabricators, Tucson Container Corporation, Plastifoam Company, Wisconsin Foam Products, Polyfoam Corporation, Woodbridge, Recticel, Jiuding Group, Speed Foam, Teamway, Haijing, .

The market segments include Type, Application.

The market size is estimated to be USD 8.44 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Foam Protection Packaging Rolls," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Foam Protection Packaging Rolls, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.