1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Spirit Packaging?

The projected CAGR is approximately 6.1%.

Luxury Spirit Packaging

Luxury Spirit PackagingLuxury Spirit Packaging by Type (Bag-in-box, Pouch, Glass Bottles, World Luxury Spirit Packaging Production ), by Application (Whiskey, Vodka, Tequila, Rum, Gin, Brandy, World Luxury Spirit Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

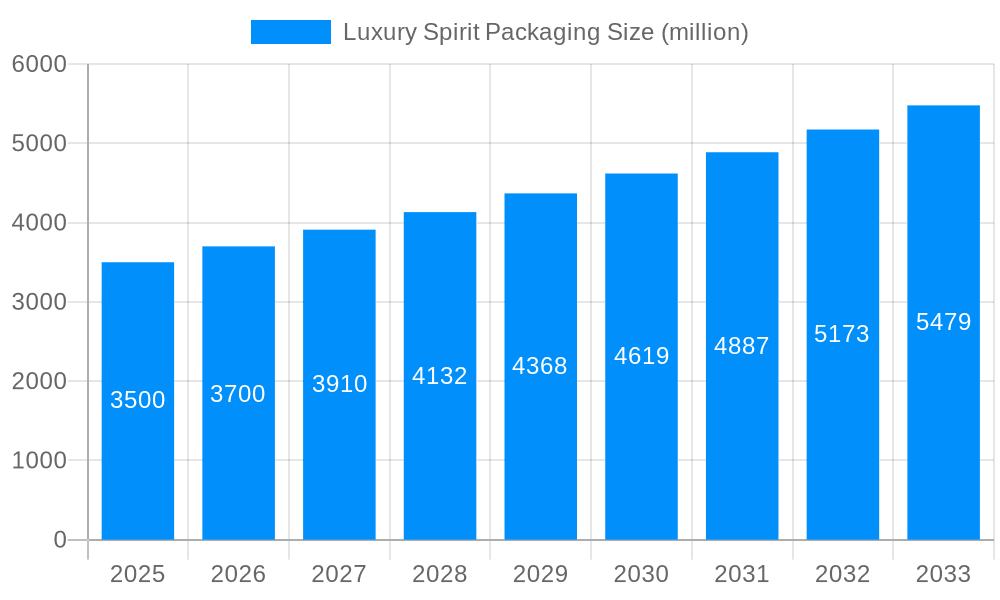

The global luxury spirit packaging market is poised for robust growth, estimated at a market size of approximately USD 3,500 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 5.5% over the forecast period of 2025-2033. This expansion is driven by a confluence of factors, including the rising disposable incomes of consumers, a growing appreciation for premium and artisanal spirits, and the increasing demand for visually appealing and sustainable packaging solutions. The market is experiencing a significant shift towards innovative materials and designs that enhance brand prestige and consumer experience. Key applications like whiskey, vodka, and gin are leading the charge, with consumers increasingly seeking out unique and aesthetically pleasing bottles that reflect the exclusivity of the spirit within. The "premiumization" trend, where consumers are willing to spend more on higher-quality goods, is a fundamental driver, directly benefiting the luxury spirit packaging sector. Furthermore, the burgeoning e-commerce channels for alcoholic beverages are also spurring innovation in packaging to ensure product integrity and visual appeal during transit.

The competitive landscape is characterized by a dynamic interplay between established packaging giants and specialized design firms, all vying to cater to the discerning needs of the luxury spirit industry. Key players are investing heavily in research and development to incorporate sustainable materials, advanced printing techniques, and smart packaging features. While the demand for traditional glass bottles remains strong, there's a noticeable surge in interest for alternative formats like bag-in-box and pouches, especially for larger formats and in markets with stricter regulations on glass. This diversification reflects a growing consumer preference for convenience and sustainability without compromising on the luxury appeal. However, the market also faces restraints such as the fluctuating raw material costs, particularly for glass and specialized printing inks, and the stringent regulatory frameworks surrounding alcohol packaging in various regions. Despite these challenges, the overarching trend of consumer aspiration towards premium experiences ensures a bright outlook for luxury spirit packaging, with continuous innovation and strategic collaborations expected to shape its future trajectory.

This comprehensive report delves into the dynamic and evolving landscape of the Luxury Spirit Packaging market, offering an in-depth analysis from the historical period of 2019-2024 through to an extensive forecast period of 2025-2033, with a base year estimation for 2025. The report meticulously examines production volumes in millions of units, providing granular insights into market trends, driving forces, challenges, and key growth catalysts. It investigates the intricate interplay of packaging types, including the burgeoning Bag-in-box, sophisticated Pouch formats, and the enduring elegance of Glass Bottles, across a spectrum of luxury spirit applications such as Whiskey, Vodka, Tequila, Rum, Gin, and Brandy.

XXX The global Luxury Spirit Packaging market is witnessing a profound transformation, driven by a confluence of evolving consumer preferences, technological advancements, and a heightened focus on sustainability and premiumization. During the study period of 2019-2033, and particularly in the estimated year of 2025, the market's trajectory is marked by a growing demand for packaging that not only protects and preserves the spirit but also serves as a powerful brand differentiator and a symbol of luxury. Consumers are increasingly seeking experiences that extend beyond the liquid itself, with the packaging playing a pivotal role in shaping perceptions of quality, heritage, and exclusivity. This has led to an increased adoption of innovative materials and design aesthetics that evoke a sense of sophistication and artisanal craftsmanship. The rise of direct-to-consumer (DTC) sales models, further amplified in recent years, has also necessitated packaging solutions that are both visually appealing for e-commerce platforms and robust enough for direct shipment.

Furthermore, the report identifies a significant trend towards experiential packaging. This includes interactive elements, augmented reality (AR) integration, and personalized embellishments that allow consumers to connect with the brand on a deeper, more engaging level. The desire for unique and memorable unboxing experiences is a key driver, pushing manufacturers to explore novel shapes, textures, and finishes. Sustainability, once a secondary consideration, has firmly cemented its position as a primary driver of innovation. Brands are actively seeking eco-friendly materials, such as recycled glass, biodegradable plastics, and responsibly sourced paperboard, to align with growing consumer environmental consciousness. The market is also seeing a surge in lightweight yet durable packaging solutions, particularly in the Bag-in-box and Pouch segments, which offer significant logistical advantages and reduced carbon footprints compared to traditional heavy glass. The interplay between tradition and modernity is evident, with classic glass bottles still holding sway for established luxury brands, but with an increasing emphasis on intricate detailing, premium closures, and unique color palettes to maintain their allure. This dynamic evolution signifies a market poised for continued growth and innovation, where packaging is no longer merely a container but an integral component of the luxury spirit narrative.

The luxury spirit packaging market is experiencing robust growth, propelled by several interconnected driving forces that are reshaping consumer expectations and brand strategies. A primary catalyst is the escalating global demand for premium and super-premium spirits, fueled by rising disposable incomes, a growing middle class in emerging economies, and a consumer desire for indulgence and sophisticated experiences. As consumers trade up, they increasingly seek products that reflect their status and discerning taste, and the packaging is the first tangible representation of this premium offering. Furthermore, the rise of e-commerce and direct-to-consumer (DTC) channels has created new avenues for brands to connect with their target audience. This necessitates packaging that is not only visually striking for online representation but also durable enough to withstand the rigors of direct shipping, thereby influencing the adoption of innovative and secure packaging solutions.

The increasing emphasis on brand storytelling and heritage also plays a crucial role. Consumers are drawn to spirits with a rich history and provenance, and packaging design is instrumental in conveying this narrative. Elaborate designs, embossed logos, premium materials, and intricate details all contribute to building an aura of exclusivity and authenticity. Moreover, the growing trend of gifting sophisticated alcoholic beverages for special occasions drives demand for aesthetically pleasing and gift-ready packaging. This includes the development of premium gift boxes, sets, and limited-edition designs that enhance the perceived value of the product. Finally, the ongoing pursuit of innovation in materials and design by packaging manufacturers is continually pushing the boundaries of what is possible, offering brands new ways to differentiate themselves in a competitive market.

Despite the promising growth, the luxury spirit packaging market faces a unique set of challenges and restraints that influence its trajectory. A significant hurdle is the inherent cost associated with premium materials and intricate designs. The use of high-quality glass, specialized finishes, elaborate printing techniques, and custom-molded components significantly increases production costs, which can be a limiting factor, especially for smaller brands or during periods of economic uncertainty. Furthermore, the luxury spirit industry is heavily regulated, with stringent rules governing labeling, material safety, and marketing. Navigating these complex and often country-specific regulations can be a time-consuming and costly endeavor for packaging developers and spirit producers alike.

Another considerable challenge lies in balancing innovation with tradition. While consumers desire novelty and premium experiences, established luxury spirit brands often rely on their heritage and iconic packaging to maintain their identity and appeal. Introducing radical new packaging formats or materials can sometimes risk alienating a loyal customer base accustomed to traditional aesthetics. Supply chain disruptions, as witnessed in recent years, also pose a significant threat. The availability and cost of specialized raw materials, such as high-grade glass or unique decorative elements, can be volatile, impacting production schedules and profitability. Moreover, the increasing focus on sustainability, while a driver for innovation, also presents challenges. The transition to more eco-friendly materials may require significant investment in new manufacturing processes and can sometimes be perceived as a compromise on the perceived luxury or durability of the packaging. Finally, the counterfeit market remains a persistent concern, necessitating the development of sophisticated anti-counterfeiting measures within packaging, which adds another layer of complexity and cost.

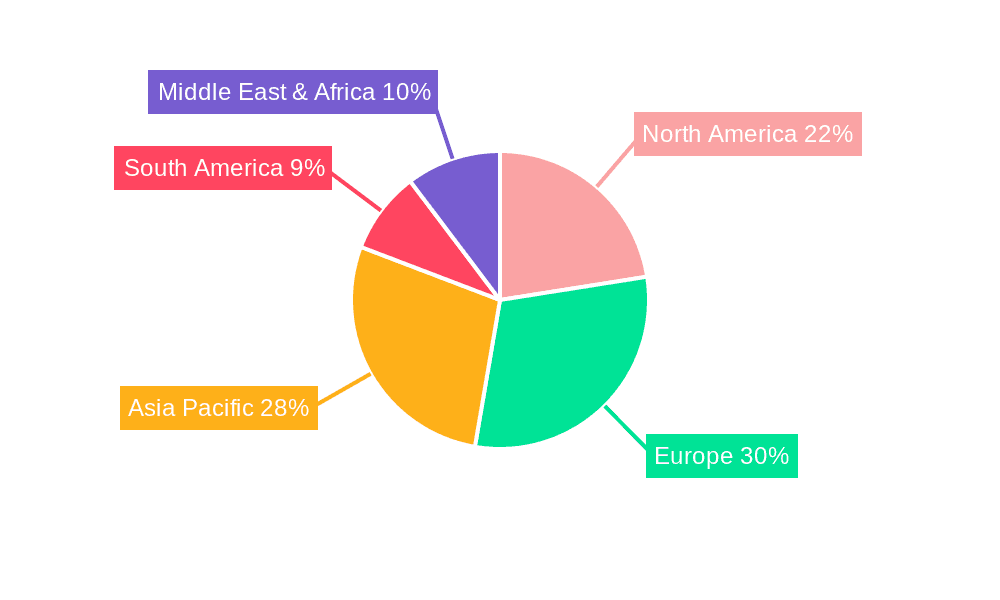

The global Luxury Spirit Packaging market is a complex ecosystem with distinct regional strengths and segment dominance, highlighting varied consumer preferences and market dynamics.

North America (USA & Canada): This region is a powerhouse, driven by a high per capita consumption of premium spirits, particularly Whiskey (Bourbon and Rye) and Vodka. The affluent consumer base in the USA actively seeks out high-quality, aesthetically pleasing packaging that signifies luxury and craftsmanship. The demand for unique Glass Bottles, often with intricate embossing, premium stoppers, and elaborate label designs, remains exceptionally strong. Companies like United Bottles and Packaging and LiDestri Spirits are key players here, catering to the established brands and emerging craft distilleries alike. The Bag-in-box segment is also seeing a steady, albeit more niche, growth for premium wines and potentially for certain types of spirits aiming for convenience and extended shelf-life after opening, though its luxury perception is still evolving.

Europe (UK, France, and Western Europe): Europe, with its deep-rooted traditions in spirits like Brandy, Gin, and Whiskey, presents a mature and sophisticated market. The UK, in particular, is a significant market for Gin, with a strong emphasis on innovative and collectible packaging. Brands like Pernod-Ricard and LVMH, with their extensive portfolios and global reach, are heavily invested in this region. The demand for premium Glass Bottles is paramount, often featuring artisanal detailing and sustainable materials, reflecting a growing consumer awareness of environmental impact. Pouch packaging, while still nascent in the ultra-luxury segment, is gaining traction for some ready-to-drink (RTD) premium spirit-based beverages and for smaller-format, single-serve premium options, particularly in convenience-oriented markets. Companies like Stranger and Stranger excel in creating distinctive brand identities through packaging design in this region.

Asia-Pacific (China, Japan, and India): This region is a rapidly expanding frontier for luxury spirit packaging. China, with its burgeoning middle class and increasing demand for premium Whiskey and Vodka, is a key growth engine. Japan, renowned for its meticulous craftsmanship, influences the design and quality of packaging across the globe, particularly for Whiskey and premium sake. While Glass Bottles dominate the premium segment, there's a growing interest in more sustainable and innovative formats. The Bag-in-box segment is showing significant promise, especially for entry-level premium spirits and for markets where larger format consumption is prevalent. Kirin Holdings, Suntory, and ITO EN Group are significant entities here, focusing on both domestic and international markets. The potential for Pouch packaging in this region, particularly for flavored spirits and RTDs, is substantial due to their convenience and cost-effectiveness.

Dominant Segments:

The interplay of these regions and segments dictates the overall market performance, with North America and Europe leading in established premium demand, while Asia-Pacific presents the most significant growth potential, influencing packaging innovation towards both luxury and convenience.

The luxury spirit packaging industry's growth is significantly fueled by a rising global disposable income, leading to increased demand for premium and super-premium spirits. Consumers' desire for status, self-indulgence, and unique gifting options also drives the need for visually appealing and high-quality packaging. Furthermore, the proliferation of e-commerce and direct-to-consumer (DTC) sales channels encourages brands to invest in packaging that enhances the unboxing experience and ensures product integrity during shipping. The increasing emphasis on sustainability is also a major catalyst, pushing for innovative eco-friendly materials and designs that appeal to environmentally conscious consumers.

(Note: Danone Group and ITO EN Group are primarily associated with beverages other than spirits, and have been excluded from this list of luxury spirit packaging players as their core business does not align with the luxury spirit segment as defined in this report.)

This report provides an exhaustive examination of the luxury spirit packaging market, offering critical insights for stakeholders seeking to understand its intricate dynamics. It covers the entire value chain, from raw material sourcing and manufacturing processes to the final consumer's perception of premiumization and sustainability. The analysis includes detailed market sizing and forecasts in millions of units for the study period of 2019-2033, with a specific focus on the base and estimated year of 2025. Key segments like Bag-in-box, Pouch, and Glass Bottles are thoroughly evaluated, alongside their application in Whiskey, Vodka, Tequila, Rum, Gin, and Brandy. Industry developments and the strategic initiatives of leading companies like United Bottles and Packaging, Stranger and Stranger, Pernod-Ricard, and LVMH are meticulously documented, providing a holistic view of market trends and future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

Key companies in the market include United Bottles and Packaging, Stranger and Stranger, Pernod-Ricard, LVMH, Danone Group, Suntory, Kirin Holdings, ITO EN Group, Heineken, Jacobs Douwe Egberts, Scholle IPN, Saxon Packaging, BIG SKY PACKAGING, LiDestri Spirits, AstraPouch, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Spirit Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Spirit Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.