1. What is the projected Compound Annual Growth Rate (CAGR) of the Point of Sale Display?

The projected CAGR is approximately XX%.

Point of Sale Display

Point of Sale DisplayPoint of Sale Display by Type (/> Paper, Foam, Plastic, Glass, Metal), by Application (/> Food & Beverages, Personal Care, Pharmaceuticals, Electronics, Automotive, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

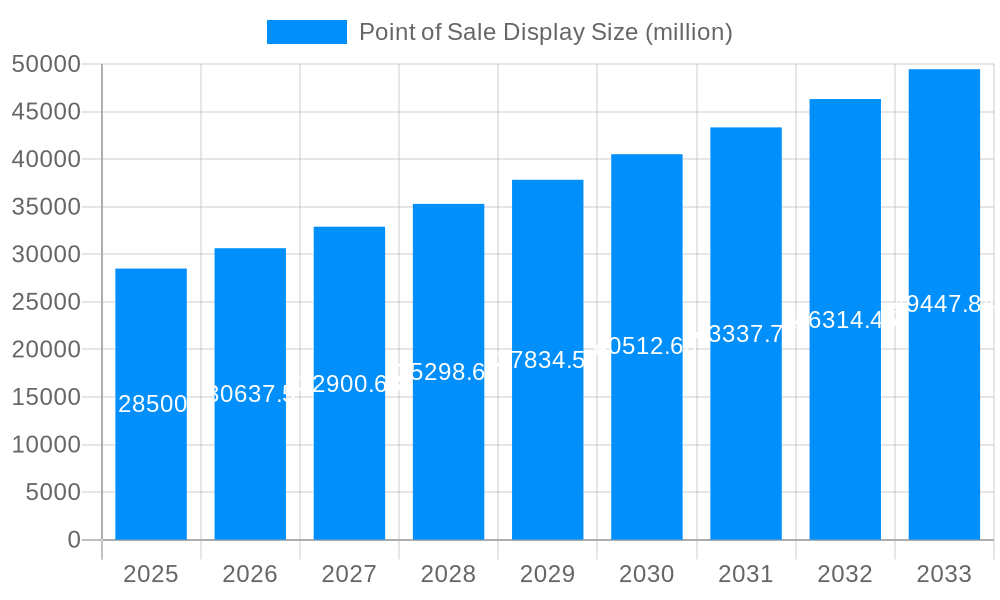

The global Point of Sale (POS) Display market is poised for significant expansion, projected to reach an estimated USD 28,500 million in 2025. This robust growth is fueled by a projected Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033, indicating a dynamic and evolving industry. Key drivers underpinning this surge include the increasing demand for visually appealing and interactive in-store marketing to capture consumer attention in a competitive retail landscape. Retailers are increasingly investing in POS displays to enhance product visibility, promote special offers, and create engaging brand experiences, thereby driving impulse purchases and improving sales performance. The burgeoning e-commerce sector, paradoxically, also contributes to POS display growth as brick-and-mortar stores strive to offer unique in-store advantages that online channels cannot replicate. Furthermore, the growing emphasis on sustainability is prompting a shift towards eco-friendly materials like paper and recycled plastics, presenting new opportunities for innovation and market penetration for manufacturers.

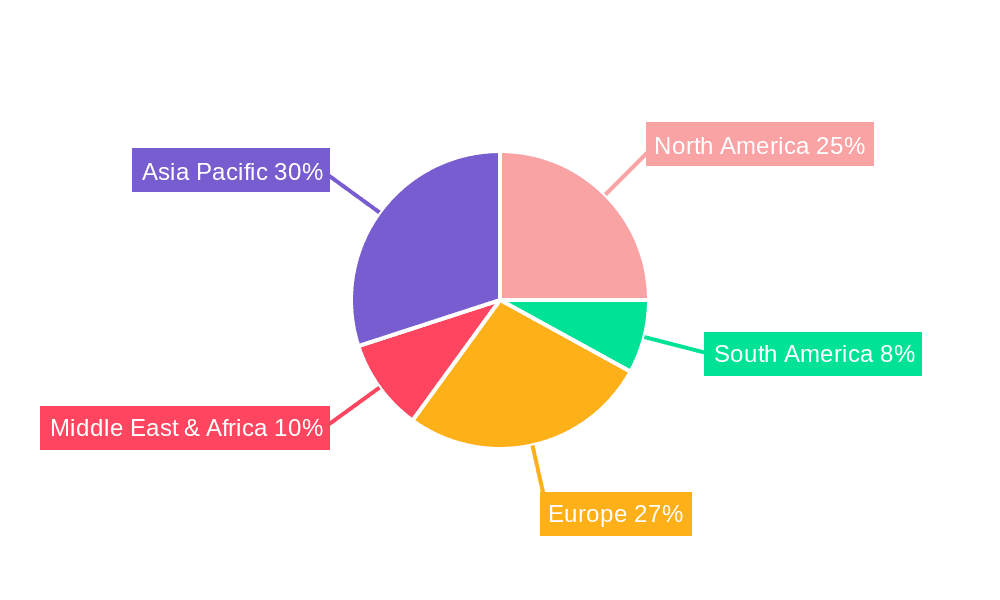

The market is segmented across various material types, with paper and plastic displays dominating due to their versatility, cost-effectiveness, and recyclability. However, there's a growing interest in more durable and premium materials like glass and metal for certain high-end applications. The applications are diverse, with the Food & Beverages sector consistently being the largest contributor, followed closely by Personal Care and Pharmaceuticals, where eye-catching displays are crucial for product differentiation. The Electronics and Automotive sectors also represent significant growth areas, leveraging sophisticated displays for new product launches and brand storytelling. Geographically, Asia Pacific is expected to emerge as a dominant force, driven by rapid urbanization, a growing middle class, and increasing retail infrastructure development in countries like China and India. North America and Europe, while mature markets, continue to be significant contributors, with a strong focus on innovative and experiential POS solutions. Restraints, such as rising material costs and the increasing adoption of digital signage, are being mitigated by advancements in display technology and a renewed appreciation for the tangible impact of physical displays in retail environments.

This comprehensive report delves into the dynamic Point of Sale (POS) display market, offering an in-depth analysis from the historical period of 2019-2024 to a forward-looking forecast extending to 2033. With the base year set at 2025, the study provides granular insights into market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. The report quantifies market opportunities and projected growth in millions of units, making it an invaluable resource for stakeholders seeking to navigate this evolving sector.

The Point of Sale (POS) display market is undergoing a significant transformation, driven by a confluence of technological advancements, evolving consumer behaviors, and the ever-present need for brands to capture attention at the critical purchase juncture. Over the study period from 2019 to 2033, we've observed a clear trajectory towards more engaging, interactive, and sustainable display solutions. A key insight is the increasing adoption of digital POS displays, integrating screens and augmented reality (AR) capabilities to offer richer product information and immersive brand experiences. This shift is particularly pronounced in high-traffic retail environments and for product categories that benefit from detailed explanations or visual demonstrations, such as electronics and personal care. Furthermore, there's a pronounced trend towards customizable and modular POS displays, allowing retailers to adapt to changing product lines and seasonal promotions with greater agility. The focus is moving beyond static, one-size-fits-all solutions to dynamic presentations that can be easily reconfigured. Sustainability is no longer a niche concern but a core consideration, with a growing demand for POS displays made from recycled and recyclable materials, particularly paper-based options. This aligns with broader corporate social responsibility initiatives and growing consumer awareness of environmental impact. The rise of e-commerce has also indirectly influenced the POS display market, prompting brick-and-mortar retailers to invest more heavily in creating compelling in-store experiences that differentiate them from online competitors. This often translates to more elaborate and eye-catching displays designed to draw customers in and encourage impulse purchases. Another significant trend is the increasing use of data analytics in POS display design and placement. Retailers are leveraging in-store traffic data and sales performance metrics to optimize display layouts, product placement, and promotional messaging, ensuring that POS displays are not just aesthetic but strategically functional. The personalization of POS experiences, tailoring displays to specific customer segments or even individual preferences through smart technology, is also emerging as a powerful differentiator. This integration of smart technology and data-driven insights is reshaping the very nature of the POS display, transforming it from a mere product holder into an intelligent marketing tool. The market is witnessing a shift from commodity-driven to value-driven POS solutions, where innovation, customization, and the ability to drive sales are paramount.

The Point of Sale (POS) display market's robust growth is underpinned by several powerful drivers that are reshaping retail landscapes and consumer engagement strategies. A primary impetus is the escalating competition within the retail sector, compelling brands and retailers to invest in POS displays that effectively differentiate their products and attract consumer attention amidst a crowded marketplace. This competition is amplified by the rise of omnichannel retail strategies, where physical stores must offer a compelling experience to complement online channels, making impactful POS displays crucial for driving foot traffic and impulse purchases. Furthermore, the increasing consumer demand for instant gratification and tactile product exploration in physical stores directly fuels the need for well-designed and accessible POS displays. Consumers want to see, touch, and experience products before making a purchase, and POS displays are the primary vehicle for facilitating this. The growing influence of visual merchandising as a key component of brand building and sales conversion is another significant driver. Brands are recognizing that a well-executed POS display can significantly impact brand perception and product desirability, leading to increased investment in innovative and aesthetically pleasing designs. The continuous evolution of retail technologies, such as interactive screens, augmented reality integration, and QR codes, is also opening up new avenues for POS display functionality, allowing for more dynamic and informative product presentations. This technological integration enhances consumer engagement and provides valuable data insights for retailers. Moreover, the increasing emphasis on impulse buying at the point of purchase is a fundamental driver. POS displays are strategically placed to capture the attention of shoppers who may not have initially intended to purchase a particular item, leveraging product placement and attractive presentation to encourage spontaneous decisions. Finally, the growing global consumer base and the expansion of retail footprints in emerging economies are creating new markets and opportunities for POS display manufacturers and suppliers, further propelling market growth.

Despite the promising growth trajectory, the Point of Sale (POS) display market is not without its significant challenges and restraints that can impede its full potential. A paramount concern is the considerable capital investment required for the design, manufacturing, and deployment of sophisticated POS displays, particularly those incorporating advanced digital technologies or premium materials. This can pose a barrier for smaller retailers or brands with limited budgets, restricting their ability to adopt cutting-edge solutions. The increasing complexity of supply chains and global logistics also presents a significant hurdle. The timely and cost-effective delivery of POS displays to diverse retail locations, often across international borders, can be fraught with delays, customs issues, and rising transportation costs, impacting profitability and project timelines. Furthermore, the rapid pace of technological obsolescence is a growing concern. As new digital technologies emerge, older POS systems can quickly become outdated, requiring frequent upgrades or replacements, which adds to the overall cost of ownership and management for retailers. The increasing emphasis on sustainability, while a positive trend, also introduces challenges in sourcing and manufacturing. The availability of truly eco-friendly and cost-competitive materials, along with the expertise to integrate them effectively into display designs, can be limited, leading to higher production costs for sustainable options. Regulatory compliance, particularly concerning safety standards, material certifications, and environmental regulations in different regions, can also add complexity and cost to the POS display development process. The need for regular maintenance and updates for digital POS displays, including software updates and hardware servicing, can place an additional operational burden on retailers, potentially leading to downtime if not managed effectively. Lastly, the consolidation of retail chains and the increasing power of large retail groups can lead to greater price pressure on POS display suppliers, forcing them to operate on thinner margins. This can stifle innovation and investment in research and development for smaller players within the industry.

The Point of Sale (POS) display market's dominance is projected to be significantly influenced by a combination of key regions and specific material and application segments, painting a picture of where future growth and opportunity will be most concentrated.

Dominant Segments:

Key Dominant Regions:

These segments and regions are expected to collectively drive a substantial portion of the global POS display market's growth due to their inherent market dynamics, consumer preferences, and ongoing retail evolution.

The Point of Sale (POS) display industry is experiencing robust growth fueled by several key catalysts. The escalating competition in the retail sector compels brands to invest in visually striking POS displays that capture consumer attention and drive impulse purchases. Furthermore, the increasing adoption of omnichannel retail strategies necessitates that physical stores offer compelling in-store experiences, with POS displays playing a pivotal role in drawing customers and creating brand engagement. The continuous innovation in display technologies, including interactive screens, AR integration, and smart solutions, is creating new possibilities for dynamic and informative product showcases. This technological advancement enhances consumer interaction and provides valuable data insights for retailers. The growing consumer preference for tangible product exploration before purchase further amplifies the demand for well-designed and accessible POS displays. Finally, the expansion of retail formats and the growing consumer markets in emerging economies are creating new avenues for POS display adoption and growth.

This report offers a holistic and exhaustive examination of the Point of Sale (POS) display market. It meticulously analyzes market dynamics from historical performance (2019-2024) through to future projections (2025-2033), with a crucial base year of 2025 for detailed segmentation. The report quantifies market potential in millions of units, providing tangible insights into scale and opportunity. It dissects trends, identifies key drivers and restraints, and pinpoints dominant regions and segments, including detailed breakdowns by material type (Paper, Foam, Plastic, Glass, Metal) and application (Food & Beverages, Personal Care, Pharmaceuticals, Electronics, Automotive, Others). Furthermore, it sheds light on crucial growth catalysts, profiles leading global players, and chronicles significant industry developments. This comprehensive coverage ensures stakeholders have the data and insights needed for strategic decision-making in this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

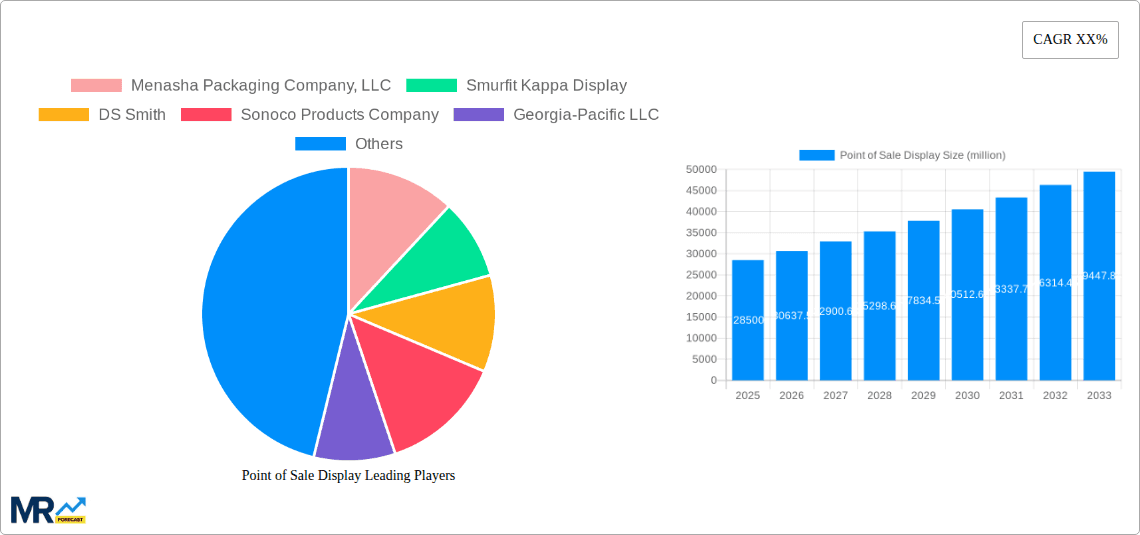

Key companies in the market include Menasha Packaging Company, LLC, Smurfit Kappa Display, DS Smith, Sonoco Products Company, Georgia-Pacific LLC, WestRock Company, Felbro, Inc., FFR Merchandising, Creative Displays Now, Fencor Packaging Group Limited, Marketing Alliance Group, Hawver Display, Swisstribe, International Paper.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Point of Sale Display," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Point of Sale Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.