1. What is the projected Compound Annual Growth Rate (CAGR) of the Dairy Product Packaging?

The projected CAGR is approximately 5.2%.

Dairy Product Packaging

Dairy Product PackagingDairy Product Packaging by Type (Bottles, Cans, Pouches, Boxes, World Dairy Product Packaging Production ), by Application (Milk, Cheese, Yogurt, Others, World Dairy Product Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

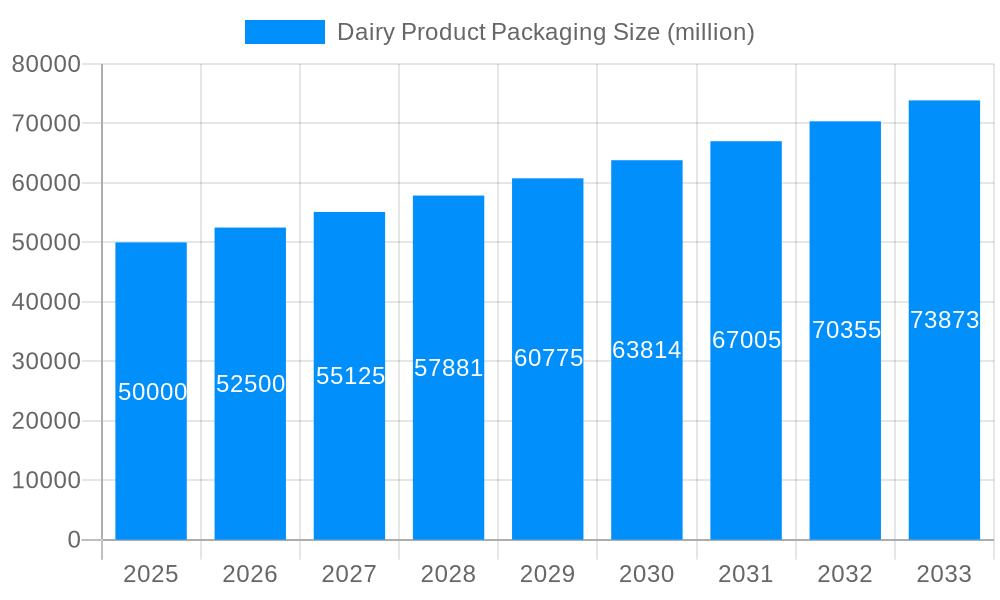

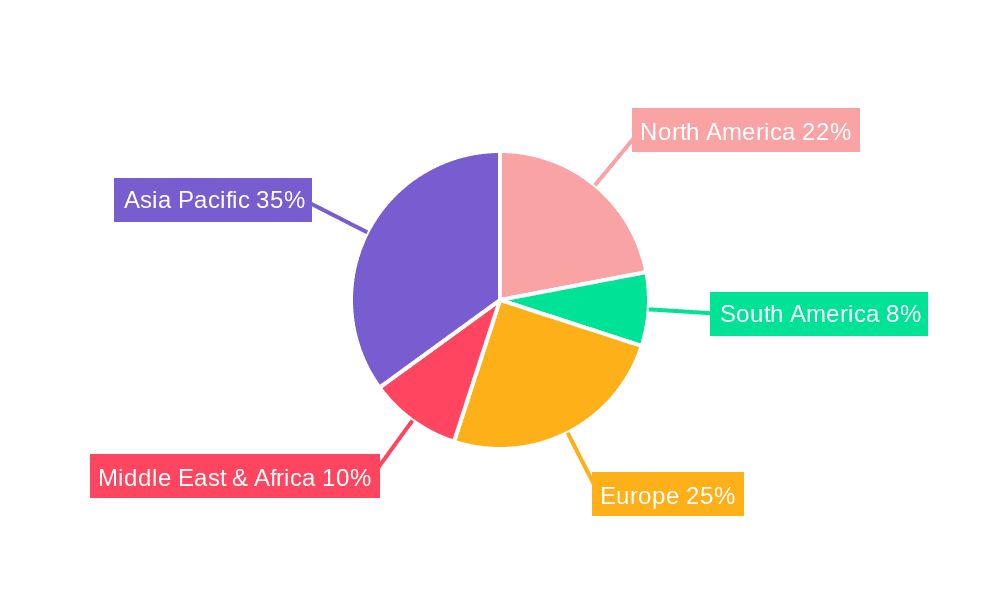

The global dairy product packaging market is projected to reach $36.45 billion by 2025, exhibiting a robust CAGR of 5.2% through 2033. This expansion is driven by increasing global dairy consumption, a growing consumer preference for convenient and portable packaging, and a heightened focus on extending product shelf life. Advancements in packaging materials, including high-barrier technologies and sustainable options like biodegradable and recyclable plastics, are key market influencers. Dominant packaging types include bottles, cans, and pouches, valued for their versatility and consumer appeal, alongside boxes for larger formats. Milk, yogurt, and cheese are the primary applications leveraging these packaging innovations. The Asia Pacific region, particularly China and India, is expected to lead growth due to a rising middle class and increased disposable incomes, boosting dairy consumption and packaging demand.

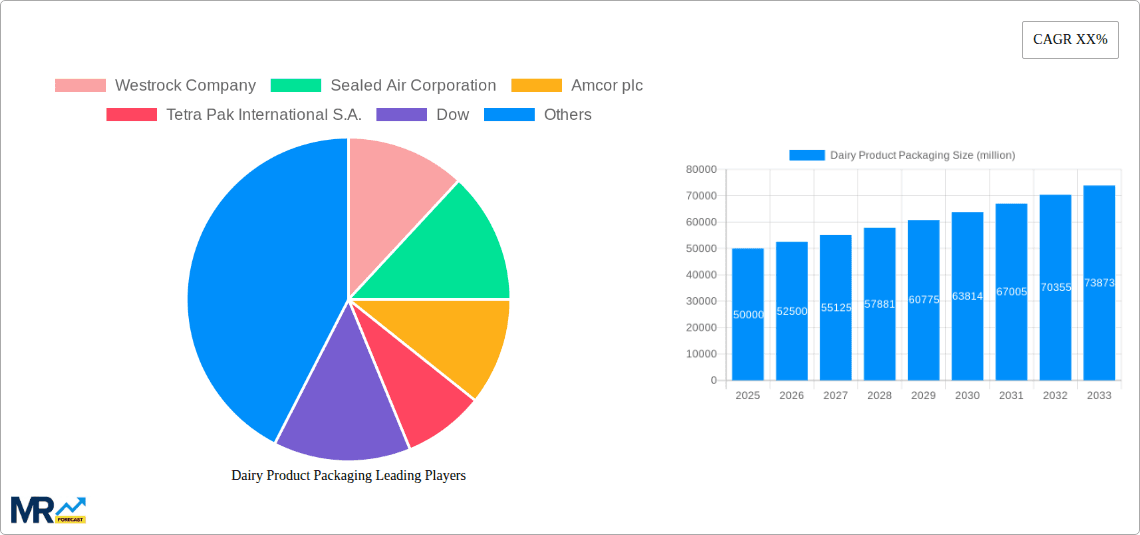

Market challenges include raw material price volatility, particularly for plastics, and stringent regulations on food packaging materials and environmental impact. While sustainability initiatives foster eco-friendly packaging innovation, they also present cost and scalability challenges. Nevertheless, growing consumer health consciousness, expanding cold chain logistics, and the development of smart packaging solutions for enhanced traceability and freshness are anticipated to propel market growth. Leading companies such as Amcor plc, Tetra Pak International S.A., and Westrock Company are investing in R&D to develop sustainable and functional packaging that improves consumer experience and product integrity.

This report provides an in-depth analysis of the global dairy product packaging market, covering trends, drivers, challenges, and future projections from 2019 to 2033. The analysis includes the historical period (2019-2024), base year (2025), and forecast period (2025-2033). We project significant growth in global dairy product packaging production, with key segments and regions identified for substantial expansion. The report details packaging types (bottles, cans, pouches, boxes) and applications (milk, cheese, yogurt, other dairy products), offering precise quantitative data. It also highlights crucial industry developments and profiles leading market players, providing valuable insights for stakeholders. The report aims to offer a comprehensive understanding of the market's trajectory for strategic decision-making and opportunity identification.

The global dairy product packaging market is experiencing a transformative era, driven by evolving consumer preferences, technological advancements, and a growing emphasis on sustainability. From 2019-2024, the market witnessed a steady rise in demand for convenient and portion-controlled packaging formats, particularly for yogurt and cheese. The Estimated Year 2025 is expected to see a continued surge in the adoption of flexible packaging solutions like pouches, driven by their lightweight nature, reduced material usage, and enhanced shelf appeal. These pouches, projected to see production figures in the hundreds of millions of units, are increasingly incorporating innovative features such as resealability, extended shelf-life technologies, and attractive graphic printing capabilities. For milk, while traditional bottles and cartons remain dominant, there's a discernible shift towards lighter-weight plastics and paperboard-based alternatives that offer a better environmental footprint. The production volume for milk packaging alone is expected to be in the billions of units annually. Cheese packaging, often requiring robust barrier properties to maintain freshness and prevent spoilage, is seeing innovation in modified atmosphere packaging (MAP) and advanced film technologies, with the market segment for cheese packaging expected to exceed hundreds of millions of units by 2025. The "Other" dairy product category, encompassing items like butter, cream, and ice cream, also presents a diverse packaging landscape, with tubs, sticks, and specialized containers all contributing to significant production volumes. Across all segments, a key trend is the integration of smart packaging features, such as QR codes for traceability and digital engagement, which are expected to become more prevalent in the Forecast Period 2025-2033. The ongoing pursuit of enhanced food safety and reduced food waste is a constant undercurrent, pushing manufacturers to invest in packaging that not only protects but also communicates efficacy and quality.

Several potent forces are propelling the global dairy product packaging market forward, painting a picture of robust growth and innovation. The escalating global population and the subsequent increase in demand for protein-rich food products, with dairy being a staple, are fundamental drivers. This demographic shift translates directly into higher consumption of dairy products, necessitating a commensurate increase in packaging production. The World Dairy Product Packaging Production is thus intrinsically linked to population dynamics. Furthermore, rising disposable incomes in emerging economies are leading to greater accessibility and preference for packaged dairy goods. Consumers in these regions are increasingly seeking convenient, safe, and hygienically packaged products, aligning perfectly with the offerings of the dairy packaging industry. Technological advancements in packaging materials and machinery are also playing a pivotal role. Innovations in barrier films, printing technologies, and sealing mechanisms are enabling the creation of packaging that extends shelf life, reduces spoilage, and enhances product appeal, thereby minimizing food waste. This focus on sustainability and waste reduction, coupled with stringent food safety regulations, is compelling manufacturers to adopt advanced and eco-friendly packaging solutions. The convenience factor, driven by modern lifestyles, also fuels the demand for single-serve and easy-to-open packaging, particularly for yogurt and cheese, further boosting the production of pouches and smaller containers. The market is also being influenced by the growing importance of brand differentiation and consumer engagement, prompting greater investment in visually appealing and informative packaging designs.

Despite the promising growth trajectory, the dairy product packaging market is not without its significant challenges and restraints. The most prominent among these is the escalating environmental concern surrounding plastic waste. While plastic packaging offers numerous advantages in terms of cost-effectiveness, durability, and barrier properties, its environmental impact is under intense scrutiny. This is leading to increased regulatory pressure, consumer backlash, and a growing demand for sustainable alternatives, which can sometimes be more expensive or technologically challenging to implement. The transition to fully recyclable, compostable, or biodegradable packaging materials without compromising product integrity or shelf life remains a complex hurdle. Furthermore, the volatility in raw material prices, particularly for polymers used in plastic packaging, can significantly impact production costs and profit margins. Fluctuations in the price of crude oil, a key component in plastic manufacturing, can create uncertainty and affect market stability. The complex global supply chains, prone to disruptions from geopolitical events, natural disasters, or trade disputes, can also pose challenges in terms of timely procurement of materials and delivery of finished products. Stringent and evolving food safety regulations across different regions require continuous investment in compliance and quality control, adding to operational costs. For smaller players, meeting these regulatory standards and investing in advanced packaging technologies can be particularly challenging, potentially leading to market consolidation. The initial capital investment required for state-of-the-art packaging machinery can also be a significant barrier to entry for new businesses or for existing ones looking to upgrade their facilities.

Several regions and segments are poised to dominate the global dairy product packaging market in the coming years, driven by a confluence of factors including population growth, economic development, and consumer behavior.

Among the segments, Pouches are anticipated to exhibit the most substantial growth across various dairy applications. Their versatility, cost-effectiveness, and ability to offer extended shelf life make them ideal for yogurt, cheese, and other dairy products. The production of pouches for dairy is expected to reach hundreds of millions of units annually.

The dairy product packaging industry is fueled by several powerful growth catalysts. The persistent global population expansion, coupled with rising disposable incomes in developing nations, directly boosts dairy consumption and, consequently, packaging demand. The increasing consumer focus on health and wellness also drives demand for nutrient-rich dairy products, requiring robust and safe packaging solutions. Furthermore, significant investments in research and development are leading to innovations in sustainable materials, intelligent packaging, and advanced barrier technologies, all of which are creating new market opportunities and enhancing product appeal.

This comprehensive report provides an unparalleled deep dive into the global dairy product packaging market, offering critical insights for informed decision-making. The Study Period from 2019-2033, with a keen focus on the Base Year 2025, meticulously analyzes historical trends, current market dynamics, and future projections. The World Dairy Product Packaging Production is quantified in the millions of units across key segments like Bottles, Cans, Pouches, and Boxes, and for applications including Milk, Cheese, Yogurt, and Others. The report details the intricate interplay of drivers and challenges, the dominance of specific regions and segments, and the impactful Industry Developments shaping the market. It serves as an indispensable resource for stakeholders seeking to understand market segmentation, growth catalysts, and the strategic positioning of leading players, empowering them to navigate this evolving landscape effectively and identify lucrative opportunities within the projected growth trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.2%.

Key companies in the market include Westrock Company, Sealed Air Corporation, Amcor plc, Tetra Pak International S.A., Dow, Marchesini Group S.p.A., Huhtamaki Oyj, Videojet Technologies, Inc., Berry Plastic Corporation, Smurfit Kappa, DS Smith, Bemis Company, Inc., Robert Bosch GmbH, GEA Group Aktiengesellschaft, ISHIDA CO., L.T.D., Winpak, Muller L.C.S., OPTIMA packaging group GmbH, Union packaging, Ball Corporation, Genpak, L.L.C., Coesia S.p.A..

The market segments include Type, Application.

The market size is estimated to be USD 36.45 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Dairy Product Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dairy Product Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.