1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Wrap?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Reusable Wrap

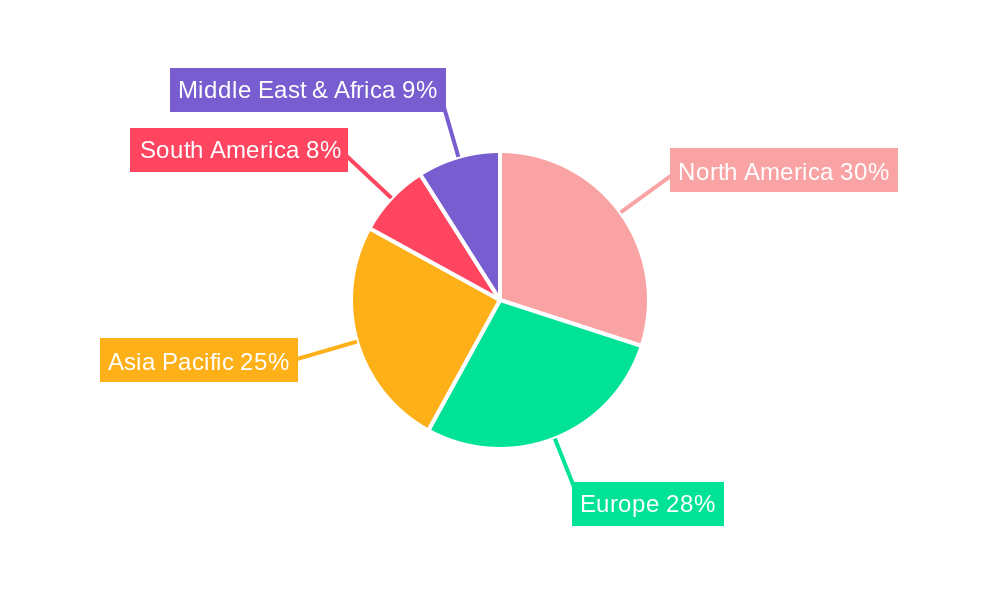

Reusable WrapReusable Wrap by Type (Small (7 x 8 inch), Medium (10 x 11 inch), Large (13 x 14 inch), World Reusable Wrap Production ), by Application (Supermarket/Hypermarket, Health food Stores, Third-party Online, Other Channels, World Reusable Wrap Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

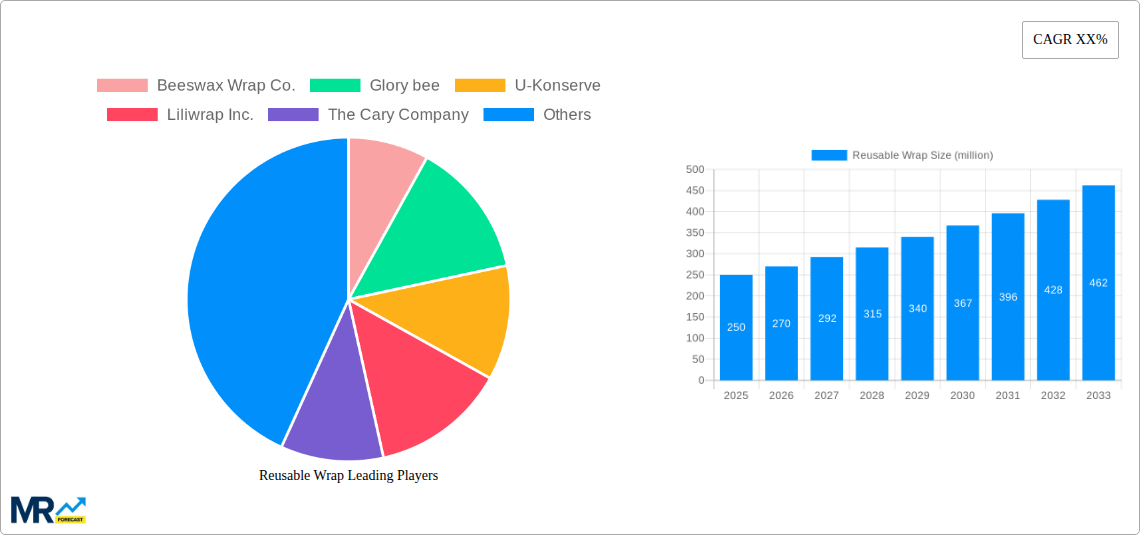

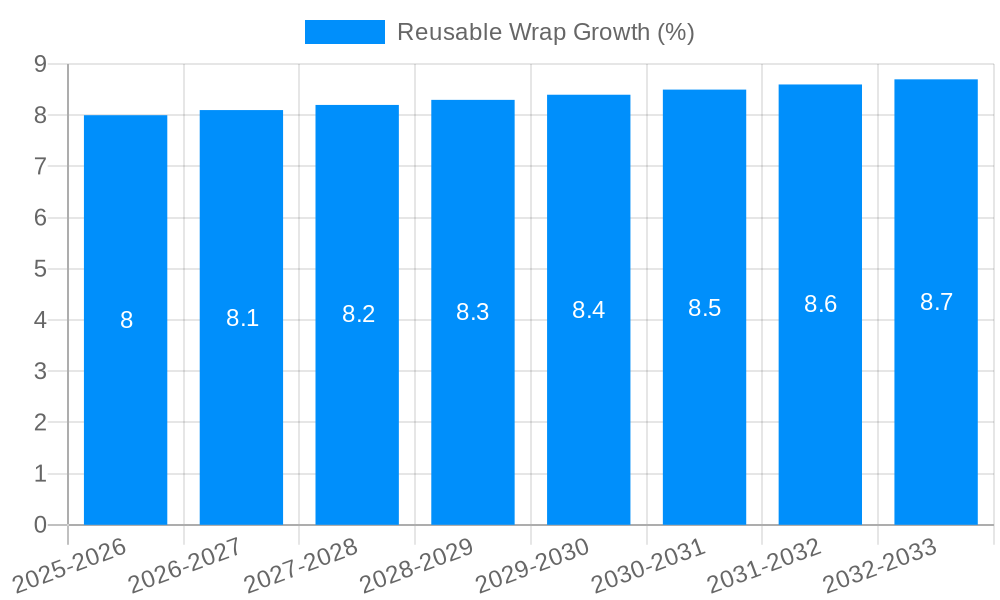

The global reusable wrap market is experiencing significant growth, driven by increasing consumer awareness of environmental sustainability and the desire to reduce single-use plastic waste. Estimated to be valued at approximately $250 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of around 8% over the forecast period of 2025-2033. This robust expansion is fueled by a confluence of factors, including government initiatives promoting eco-friendly alternatives, a growing preference for natural and biodegradable products, and the inherent cost-effectiveness of reusable wraps over their disposable counterparts. The rising popularity of health food stores and direct-to-consumer online channels further bolsters market penetration. The convenience and versatility of reusable wraps, suitable for a wide array of applications from food storage in homes to packaging in commercial settings, are key adoption drivers.

The market segmentation by type indicates a strong demand for medium-sized (10 x 11 inch) reusable wraps, catering to everyday food storage needs, followed by large and small variants. In terms of applications, supermarkets and hypermarkets are emerging as significant distribution channels, alongside health food stores, as retailers increasingly embrace sustainable packaging solutions. While the market is poised for strong growth, certain restraints exist, such as initial consumer perception regarding durability and ease of cleaning, as well as the competitive pricing of traditional plastic wraps. However, continuous product innovation, particularly in material science and design, coupled with effective marketing campaigns highlighting the long-term economic and environmental benefits, are expected to overcome these challenges. Key players like Beeswax Wrap Co., Glory bee, and U-Konserve are actively investing in research and development to offer diverse product lines and expand their global footprint.

This report provides an in-depth analysis of the global reusable wrap market, offering critical insights for stakeholders across the value chain. Spanning the historical period of 2019-2024 and projecting forward to 2033, the study leverages 2025 as its base and estimated year to deliver robust forecasts. With a focus on current and future market dynamics, the report quantifies production volumes in the millions, providing a clear understanding of market scale and potential.

XXX paints a compelling picture of the reusable wrap market's evolution, driven by a confluence of environmental consciousness and shifting consumer preferences. The historical period of 2019-2024 witnessed a nascent but rapidly growing adoption of reusable alternatives to single-use plastics. This trend was fueled by increasing awareness of plastic pollution's detrimental impact on ecosystems and human health, leading consumers to actively seek sustainable solutions for food storage. The market has seen a significant surge in demand for products that offer both functionality and eco-friendliness, with reusable wraps emerging as a prominent contender. In 2025, the market is projected to reach [insert value in millions] units in World Reusable Wrap Production, indicating a robust foundation for future expansion.

The primary driver behind these trends is a growing global imperative to reduce waste. As governments worldwide implement stricter regulations on single-use plastics and consumers become more informed and vocal about their environmental concerns, businesses are compelled to innovate and adapt. This has led to a diversification of reusable wrap types, catering to various needs and preferences. From the compact convenience of Small (7 x 8 inch) wraps for snacks and half-cut produce to the expansive coverage offered by Large (13 x 14 inch) options for larger food items and bowls, the market is responding with a comprehensive product portfolio. The proliferation of online retail channels has also democratized access, allowing smaller brands like Beeswax Wrap Co. and Liliwrap Inc. to reach a global audience alongside established players. Furthermore, the emphasis on natural and sustainable materials, such as beeswax and plant-based waxes, has resonated deeply with consumers seeking healthier and more ethical choices. The estimated production volume in 2025 for World Reusable Wrap Production is projected at [insert value in millions] units, a testament to the market's rapid ascent. This growth trajectory is expected to continue, with forecasts suggesting [insert value in millions] units by 2033, underscoring the long-term viability and expanding appeal of reusable wraps.

The reusable wrap market's ascent is intrinsically linked to a powerful wave of environmental awareness and a subsequent shift in consumer behavior. The pervasive issue of plastic pollution, a critical concern amplified throughout the historical period of 2019-2024, has spurred individuals to seek tangible alternatives for their daily lives. This heightened ecological consciousness directly translates into a demand for products that minimize environmental impact, with reusable wraps at the forefront of this movement. Consumers are increasingly prioritizing sustainability, actively seeking out brands and products that align with their values, and reusable wraps, often made from natural and biodegradable materials, perfectly fit this evolving consumer ethos.

Furthermore, governmental initiatives and regulatory pressures worldwide have played a pivotal role in shaping the market. Bans and restrictions on single-use plastics, coupled with incentives for eco-friendly alternatives, have created a fertile ground for the growth of reusable wrap manufacturers. This regulatory push, combined with the growing corporate social responsibility (CSR) initiatives of businesses, encourages a broader adoption of sustainable practices across the supply chain. The market's production is estimated to reach [insert value in millions] units in 2025 for World Reusable Wrap Production, reflecting the strong impetus behind its expansion. As this trend solidifies, the demand for reusable wraps is anticipated to further escalate, propelled by both conscious consumer choices and supportive policy frameworks.

Despite the promising growth trajectory, the reusable wrap market is not without its impediments. A significant challenge revolves around consumer education and awareness regarding the proper use, care, and longevity of reusable wraps. While awareness of plastic pollution is high, the practicalities of adopting reusable alternatives, including the initial cost and the learning curve associated with their maintenance, can deter some consumers. This is particularly relevant when considering the diverse range of materials and techniques employed by various manufacturers.

Another restraint lies in the competition from established, albeit less sustainable, alternatives like plastic cling film. The convenience and established infrastructure surrounding traditional plastic wraps present a formidable barrier to entry for newer, eco-friendly products. Furthermore, while production is projected to reach [insert value in millions] units in 2025 for World Reusable Wrap Production, scaling up production to meet a rapidly growing global demand can present logistical and financial challenges for many companies. Ensuring consistent quality and affordability across different segments, from Small (7 x 8 inch) to Large (13 x 14 inch) wraps, is crucial for wider market penetration. Price sensitivity, especially in emerging markets, can also limit the adoption of reusable wraps, which often carry a higher upfront cost than their disposable counterparts, despite offering long-term savings.

The global reusable wrap market is poised for significant growth, with North America and Europe emerging as dominant regions in terms of both production and consumption. This dominance is underpinned by several interconnected factors, including robust consumer awareness of environmental issues, strong governmental support for sustainable practices, and a higher disposable income that facilitates the adoption of premium eco-friendly products.

North America: This region, particularly the United States and Canada, has witnessed a substantial increase in demand for reusable wraps.

Europe: European nations have historically been at the forefront of environmental activism and policy.

Segment Dominance:

Within the market, the Medium (10 x 11 inch) and Large (13 x 14 inch) segments are projected to experience substantial growth and dominate the World Reusable Wrap Production in terms of volume.

Medium (10 x 11 inch) Wraps:

Large (13 x 14 inch) Wraps:

The synergy between environmentally conscious regions and versatile product segments is driving the reusable wrap market forward. The projected World Reusable Wrap Production in 2025 is estimated to reach [insert value in millions] units, with a significant portion attributed to these dominant segments and regions.

The reusable wrap industry's growth is significantly propelled by escalating consumer demand for sustainable alternatives to single-use plastics, driven by heightened environmental awareness. Government regulations and bans on plastic waste further catalyze adoption. Innovation in material science, leading to more durable and user-friendly wraps, also plays a crucial role. The expanding e-commerce landscape provides wider market access, while endorsements from environmental influencers and organizations amplify consumer interest, fostering a positive feedback loop for production and sales.

This comprehensive report offers an in-depth analysis of the global reusable wrap market, providing critical insights for stakeholders across the value chain. Spanning the historical period of 2019-2024 and projecting forward to 2033, the study leverages 2025 as its base and estimated year to deliver robust forecasts. With a focus on current and future market dynamics, the report quantifies production volumes in the millions, providing a clear understanding of market scale and potential, and details the key trends, driving forces, challenges, leading players, and significant developments that shape this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Beeswax Wrap Co., Glory bee, U-Konserve, Liliwrap Inc., The Cary Company, Hexton Bee Company, Abeego Wrap, Wrag Wrap Co..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Reusable Wrap," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Reusable Wrap, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.