1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed Boxes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Printed Boxes

Printed BoxesPrinted Boxes by Type (Slotted Box, Folder Box, Telescopic Box, Die Cut Box, Hinged Box, Shoulder Neck Box), by Application (Food & Beverages, Homecare, Personal Care & Cosmetics, Pharmaceuticals, Automotive, Building & Construction, Fashion, Apparels and Accessories), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

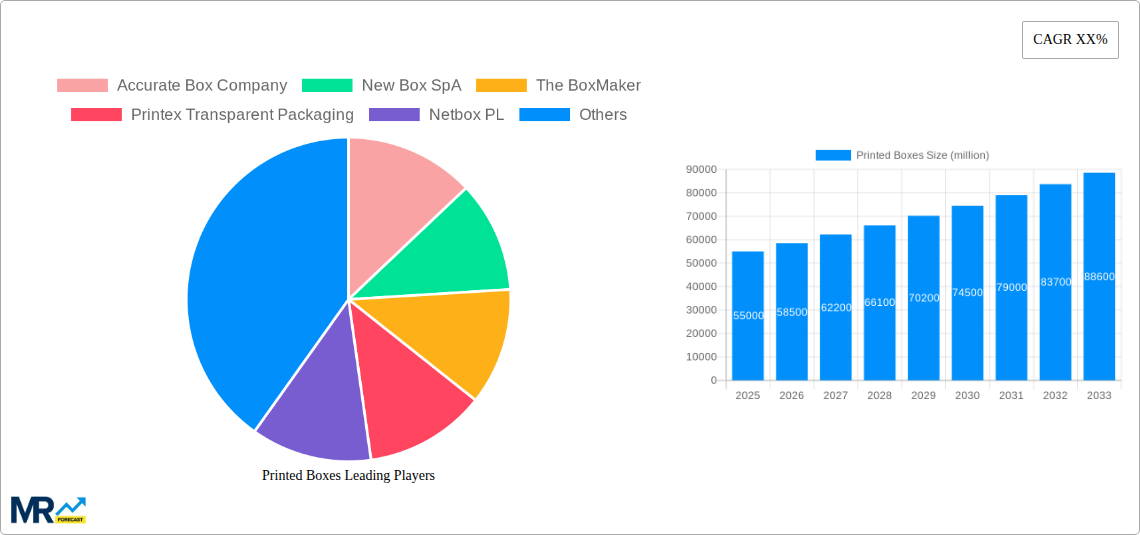

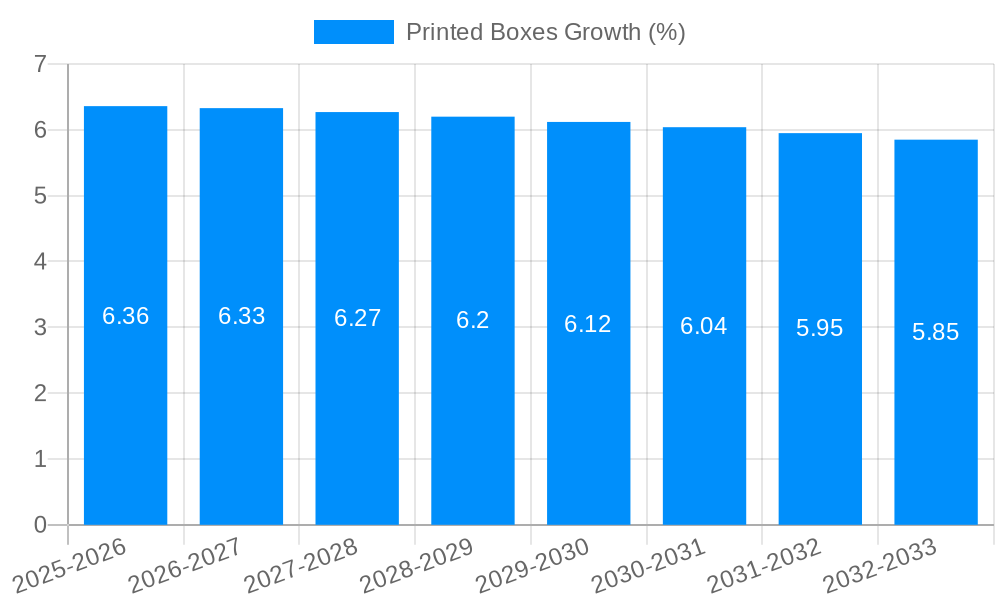

The global printed boxes market is poised for substantial growth, estimated to reach approximately $55 billion in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust expansion is fueled by a burgeoning demand across diverse end-use industries, including food & beverages, personal care, pharmaceuticals, and fashion. The increasing emphasis on brand visibility, product differentiation, and consumer engagement is driving the adoption of visually appealing and informative printed packaging solutions. Furthermore, advancements in printing technologies, such as digital and flexographic printing, are enabling manufacturers to offer cost-effective, customized, and high-quality printed boxes with faster turnaround times. E-commerce growth also plays a significant role, as businesses increasingly rely on printed boxes for safe and branded shipping of their products directly to consumers, enhancing the unboxing experience.

The market dynamics are shaped by several key drivers and trends. The growing consumer preference for sustainable packaging solutions is prompting manufacturers to explore eco-friendly printing inks and recycled materials for printed boxes. This eco-consciousness is becoming a critical factor in purchasing decisions, pushing the market towards greener alternatives. However, the market also faces certain restraints, including fluctuating raw material costs, particularly for paperboard and inks, which can impact profit margins. Additionally, stringent environmental regulations in some regions regarding printing processes and waste disposal can add to operational costs and complexity for manufacturers. Despite these challenges, the inherent versatility of printed boxes in enhancing brand perception and product appeal, coupled with continuous innovation in design and material science, ensures a positive growth trajectory for the global printed boxes market in the foreseeable future. Key segments like Slotted Boxes and Folder Boxes, along with applications in Food & Beverages and Personal Care, are expected to witness the most significant uptake.

This report provides an in-depth analysis of the global printed boxes market, offering a comprehensive overview of its trajectory from the historical period of 2019-2024 through to the forecast period of 2025-2033, with a specific focus on the base and estimated year of 2025. The study will delve into critical market dynamics, including evolving trends, key growth drivers, prevalent challenges, and the strategic advantages of various market segments and regions. Furthermore, it will highlight the innovative advancements shaping the industry and identify the leading companies that are at the forefront of this dynamic sector. The market size is projected to reach significant figures, with valuations in the millions of units annually, underscoring its substantial economic impact. The report aims to equip stakeholders with actionable insights to navigate and capitalize on the opportunities within the printed boxes market.

The global printed boxes market is undergoing a dynamic transformation, driven by a confluence of technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. Throughout the study period of 2019-2033, with a significant focus on the base and estimated year of 2025, the market has witnessed a palpable shift towards more sophisticated and aesthetically pleasing packaging solutions. Customization and personalization have emerged as paramount trends, with businesses increasingly leveraging printed boxes to enhance brand visibility, communicate product information, and create a memorable unboxing experience. This is particularly evident in sectors like Fashion, Apparels and Accessories, where unique designs and intricate printing techniques are used to convey brand identity and exclusivity. The surge in e-commerce has further amplified the demand for robust, attractive, and information-rich printed packaging, capable of withstanding the rigors of shipping while simultaneously acting as a powerful marketing tool. Advancements in printing technologies, including digital printing, flexography, and offset printing, are enabling higher resolution graphics, vibrant color reproduction, and the incorporation of special finishes like embossing, debossing, and foiling. This allows for a greater degree of design freedom and a premium feel for the packaging. The growing awareness around environmental concerns is also a dominant trend, pushing manufacturers to adopt eco-friendly materials and printing processes. Recycled content, biodegradable inks, and minimalist designs are gaining traction. Consumers are increasingly making purchasing decisions based on the sustainability credentials of a product and its packaging, creating a direct incentive for brands to prioritize green solutions. Furthermore, the integration of smart features, such as QR codes and NFC tags, for enhanced traceability, authentication, and consumer engagement is becoming more prevalent, particularly in the Pharmaceuticals and Food & Beverages sectors. The overall market is characterized by a continuous pursuit of innovation, aiming to balance functionality, visual appeal, and environmental responsibility. The anticipated market valuation in the millions of units reflects the sheer volume of this evolving industry.

Several potent forces are propelling the growth of the global printed boxes market. A primary driver is the escalating demand from the e-commerce sector, which necessitates robust yet visually appealing packaging for product protection and branding during transit. The burgeoning online retail landscape, especially for categories like Fashion, Apparels and Accessories and Homecare, has created an insatiable appetite for custom-designed printed boxes that not only safeguard goods but also enhance the customer unboxing experience, fostering brand loyalty. Secondly, the increasing emphasis on branding and marketing by businesses of all sizes is a significant contributor. Printed boxes serve as a cost-effective and highly visible medium for brand storytelling, logo placement, and conveying essential product information, making them an indispensable tool in a company's marketing arsenal. The Food & Beverages and Personal Care & Cosmetics industries, in particular, leverage intricate designs and vibrant printing to attract consumers and differentiate their products on crowded shelves or digital platforms. Thirdly, the growing consumer awareness and demand for sustainable packaging solutions are acting as a catalyst for innovation in materials and printing processes, pushing the market towards eco-friendly alternatives. This includes the use of recycled paperboard, biodegradable inks, and minimalist designs that reduce material waste, aligning with global environmental initiatives. Finally, technological advancements in printing and converting machinery are enabling greater efficiency, higher quality output, and the ability to produce more complex and customized packaging designs, thereby driving down costs and increasing accessibility for a wider range of businesses. The market's projected scale, measured in the millions of units, is a testament to these compounding growth factors.

Despite the robust growth trajectory, the printed boxes market faces several inherent challenges and restraints that could impede its progress. A significant concern is the escalating cost of raw materials, particularly paperboard and inks. Fluctuations in the global supply chain and increased demand for these commodities can lead to price volatility, impacting the overall profitability for manufacturers and potentially increasing costs for end-users. The environmental impact associated with traditional printing processes and the disposal of packaging materials remains a critical challenge. While there is a growing trend towards sustainability, the adoption of eco-friendly alternatives is not always cost-effective or readily available across all regions, and consumer education on proper disposal and recycling is still evolving. Stringent environmental regulations in certain countries regarding waste management and the use of certain inks or coatings can also pose compliance challenges for manufacturers operating on a global scale. Furthermore, the highly competitive nature of the market, with numerous players vying for market share, can lead to price wars and reduced profit margins, especially for smaller and medium-sized enterprises. The rapid pace of technological change requires continuous investment in new machinery and training, which can be a substantial financial burden. The demand for highly customized and short-run printed boxes, while a growth opportunity, also presents logistical complexities in terms of production scheduling, inventory management, and ensuring consistent quality across different batches, further adding to operational challenges. The market's expansion, though significant, is therefore subject to navigating these intricate hurdles, impacting the potential volume measured in millions of units.

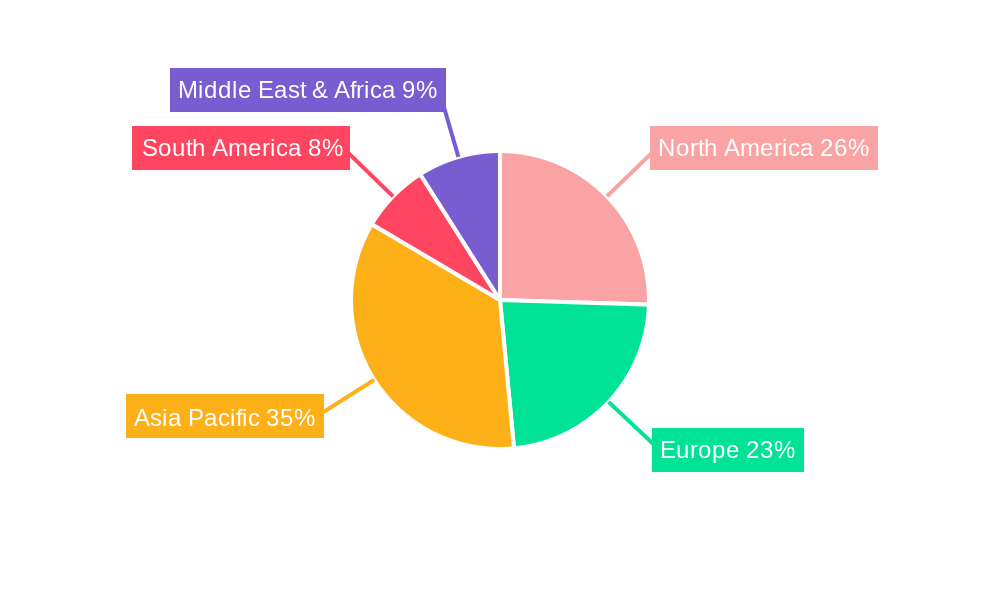

The global printed boxes market is poised for significant growth, with certain regions and segments demonstrating a stronger propensity for dominance. North America and Europe are projected to be key regions, driven by well-established e-commerce infrastructures, a high concentration of consumer goods industries, and a strong consumer preference for branded and premium packaging. The sophisticated consumer base in these regions readily adopts innovative packaging solutions, pushing demand for aesthetically pleasing and informative printed boxes. For instance, the Personal Care & Cosmetics segment within these regions is expected to be a major contributor, with brands heavily investing in attractive packaging to capture consumer attention on retail shelves and online. The pharmaceutical industry also contributes significantly due to strict regulatory requirements demanding clear labeling and traceability, often achieved through sophisticated printing on specialized boxes.

The Asia-Pacific region, particularly China and India, is emerging as a rapidly growing market, fueled by a burgeoning middle class, increasing disposable incomes, and the exponential growth of e-commerce. The sheer volume of manufacturing and consumer base in this region will undoubtedly contribute substantially to the overall market volume. Countries like Japan and South Korea, with their advanced technology sectors and consumer-centric markets, are also strong contenders, especially in driving innovation in packaging design and functionality.

In terms of segments, the Food & Beverages application is expected to hold a commanding position throughout the forecast period (2025-2033). The ubiquitous nature of food and beverage consumption, coupled with the constant need for product differentiation and consumer appeal, makes this sector a perpetual driver of demand for printed boxes. The industry relies heavily on printed packaging for branding, nutritional information, promotional messaging, and ensuring product safety and integrity. This includes various box types such as Slotted Boxes for efficient shipping and handling of packaged food items, and increasingly, visually appealing Die Cut Boxes for premium food products and gift sets.

The Fashion, Apparels and Accessories segment is another critical area of dominance, particularly in driving value-added printing techniques and customization. The desire for a luxurious unboxing experience and strong brand identity in this sector leads to extensive use of high-quality printing, special finishes, and intricate designs on boxes, transforming them into integral components of the brand's overall presentation. The demand for visually appealing Die Cut Boxes and elegantly designed Shoulder Neck Boxes in this segment is particularly noteworthy.

Furthermore, the Slotted Box type is expected to remain the most dominant in terms of sheer volume, owing to its versatility, cost-effectiveness, and widespread use across almost all industries, from shipping heavy goods in Building & Construction to everyday items in Homecare. However, the growth in specialized applications and the increasing demand for premium presentation are expected to fuel significant market share gains for Die Cut Boxes and Telescopic Boxes, especially in sectors like luxury goods, electronics, and high-end food products. The market's overall expansion, measured in millions of units, will be a composite of these regional and segmental strengths.

Several key factors are acting as growth catalysts for the printed boxes industry. The persistent expansion of the global e-commerce sector is a primary driver, necessitating reliable and visually appealing packaging for online retail. Furthermore, the increasing emphasis on branding and product differentiation by businesses across all sectors fuels demand for customized and high-quality printed boxes. The growing consumer awareness regarding sustainability is also a significant catalyst, pushing manufacturers to innovate with eco-friendly materials and printing processes, creating new market opportunities.

This report offers a complete 360-degree view of the printed boxes market. It delves into the intricate trends shaping the industry, from the rising demand for sustainable packaging to the influence of digital printing technologies and the personalization of brand experiences. The analysis dissects the key growth drivers, including the booming e-commerce sector, increasing brand consciousness, and evolving consumer preferences, while also candidly addressing the challenges such as raw material price volatility and environmental concerns. Furthermore, the report pinpoints dominant regions and market segments, providing strategic insights into where market opportunities are most pronounced. It also highlights significant industry developments and lists the key players that are instrumental in driving the market forward. This comprehensive coverage is designed to empower stakeholders with the knowledge necessary to make informed decisions and capitalize on the evolving landscape of the printed boxes market, which is projected to reach substantial volumes in the millions of units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Accurate Box Company, New Box SpA, The BoxMaker, Printex Transparent Packaging, Netbox PL, Packaging Corporation of America, Tin King, CBS Packaging Group, Custom Packaging Boxes, ThecustomeBoxes, THN cardboard, Packlane, CompanyBox, Glenmore Custom Print & Packaging, AXIS Corrugated Container, G.R. Packers, Npack, PackMojo, G. K. P. Printing & Packaging, Kane Packaging & Printing.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Printed Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Printed Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.