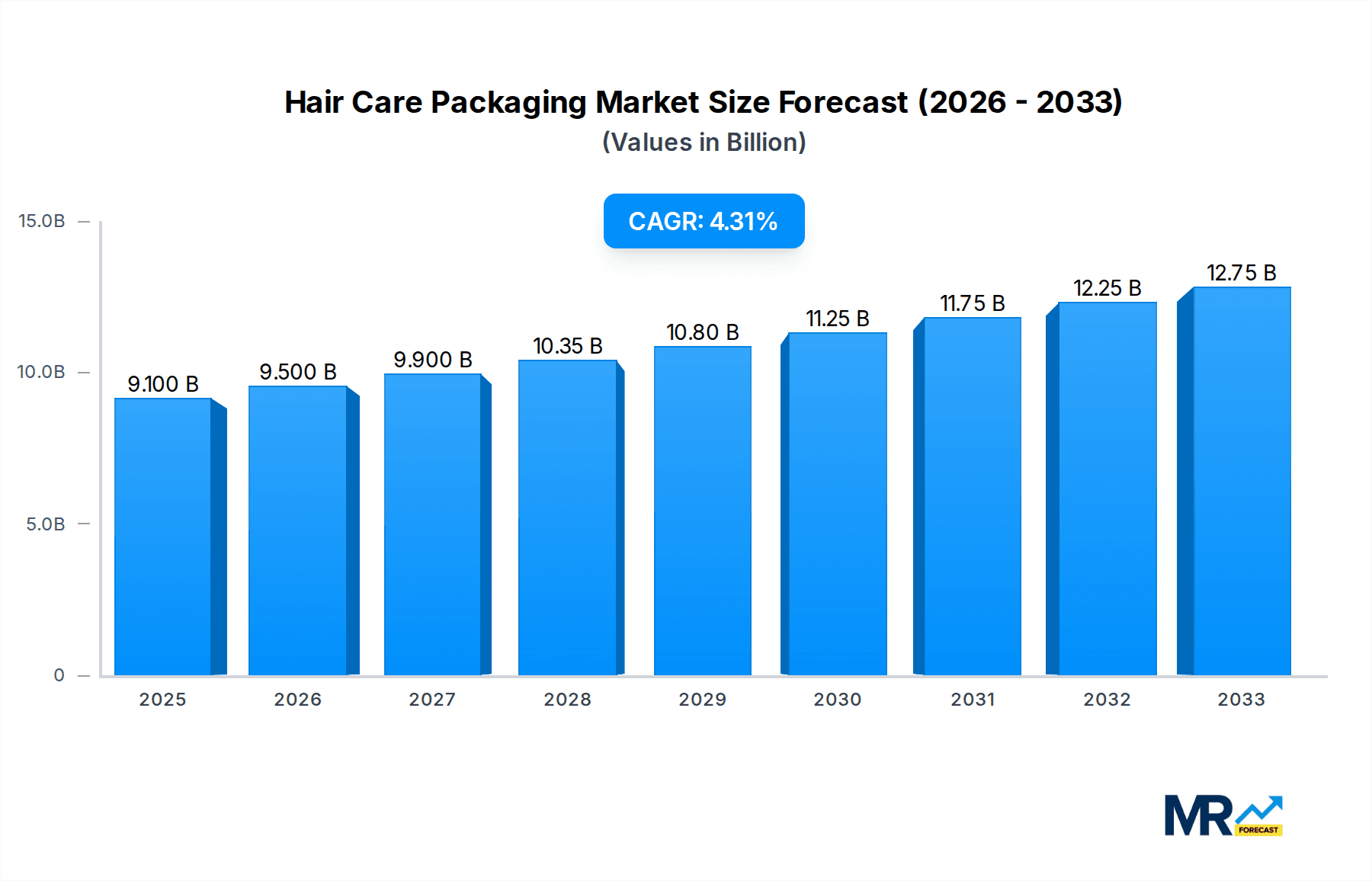

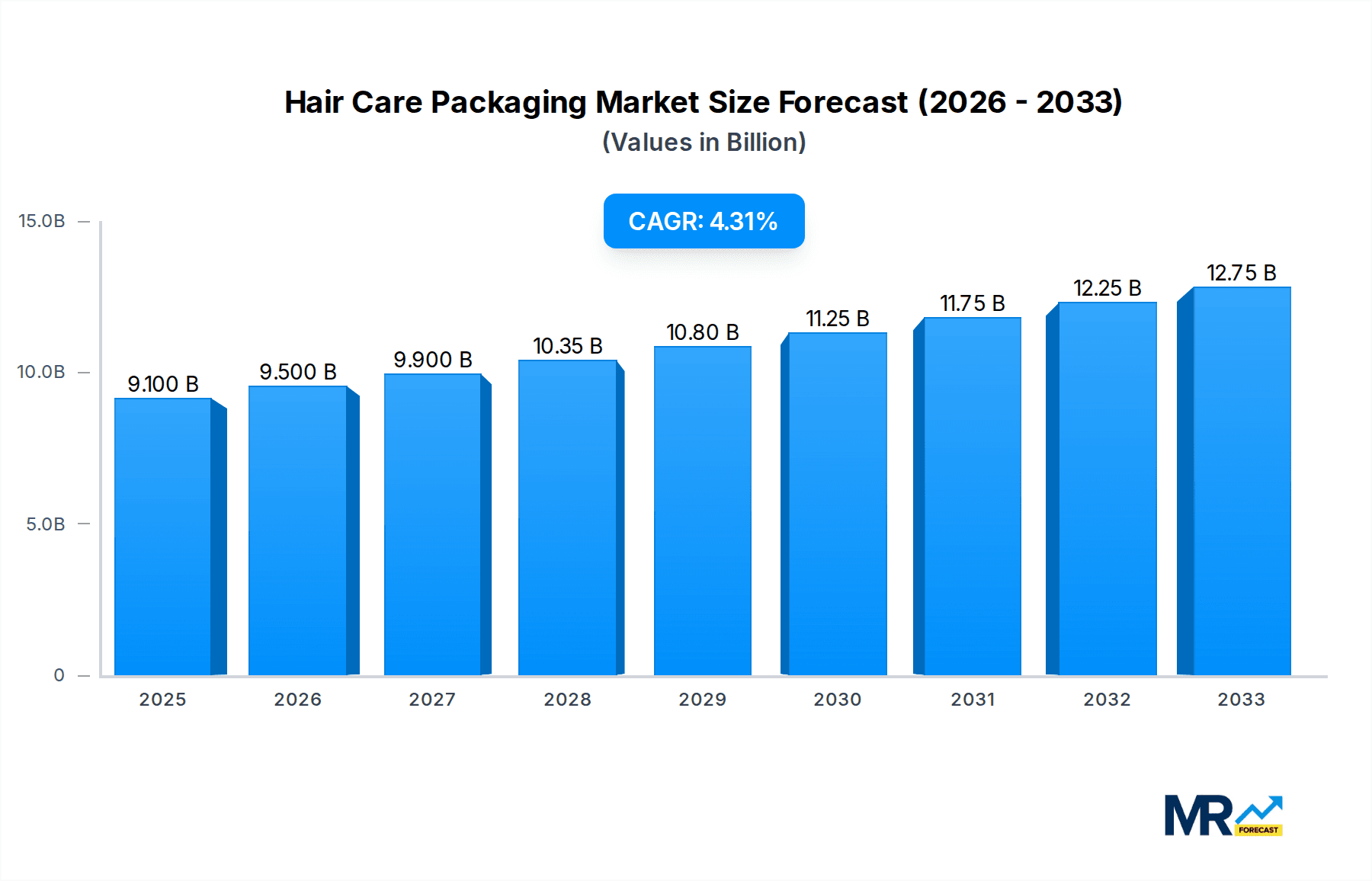

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Care Packaging?

The projected CAGR is approximately 4.5%.

Hair Care Packaging

Hair Care PackagingHair Care Packaging by Type (Plastic Packaging, Metal Packaging, Glass Packaging, World Hair Care Packaging Production ), by Application (Shampoos, Conditioners, Hair Wax, Others, World Hair Care Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Hair Care Packaging market is poised for robust growth, projected to reach a substantial USD 9.1 billion by 2025. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.5% anticipated over the forecast period of 2019-2033. Several key drivers are fueling this upward trajectory. Increasing consumer demand for premium and innovative hair care products, coupled with a growing emphasis on product aesthetics and functionality, is a primary catalyst. The evolving beauty landscape, characterized by personalized formulations and specialized treatments, necessitates packaging solutions that are not only protective but also aesthetically appealing and convenient to use. Furthermore, the rising disposable incomes in emerging economies are contributing to a greater expenditure on personal care products, including hair care, thereby expanding the market for its packaging. The shift towards sustainable and eco-friendly packaging solutions is also a significant trend, influencing material choices and design innovations.

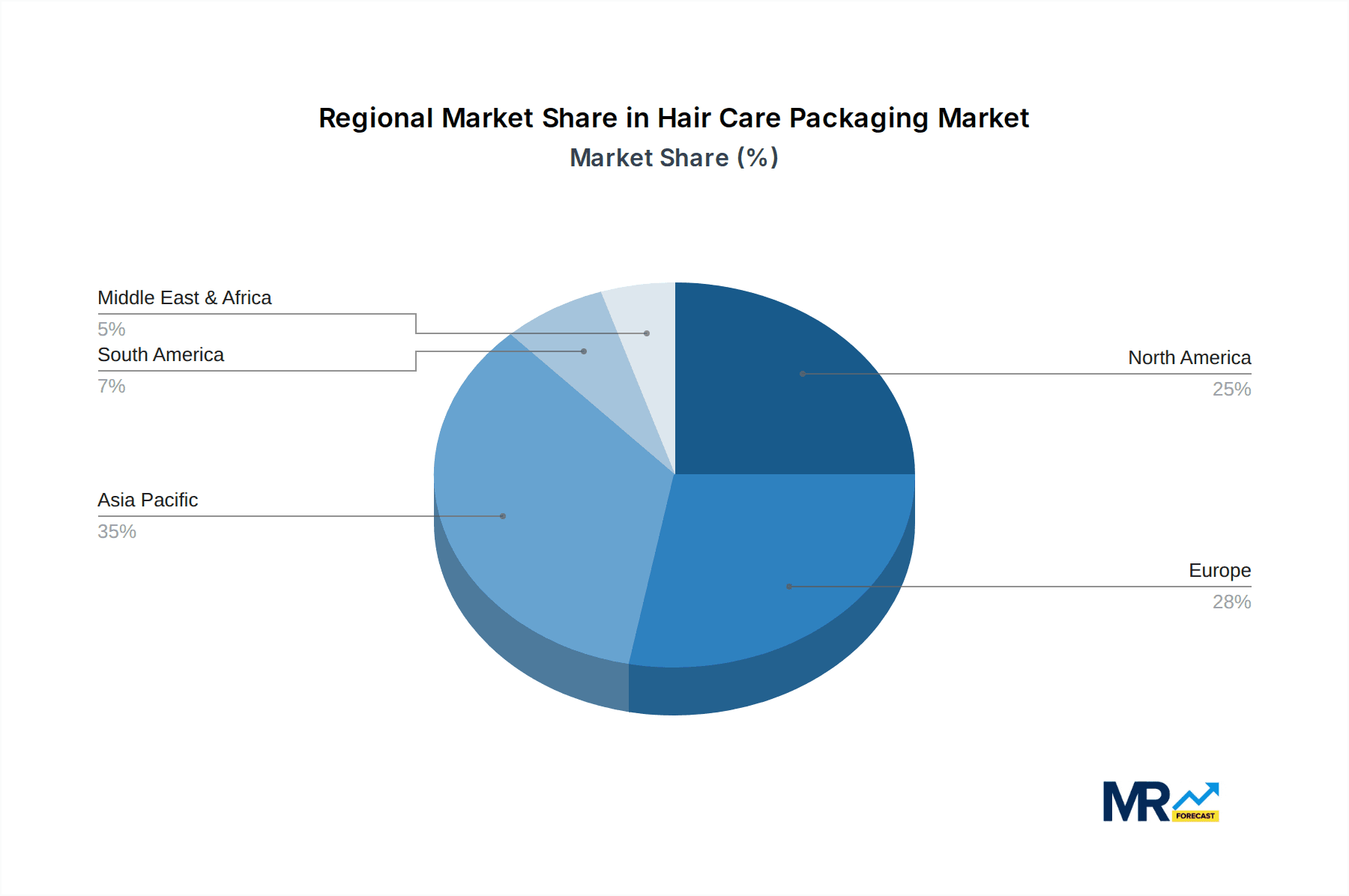

The market segmentation reveals a diverse landscape of packaging types and applications. Plastic packaging is expected to retain a dominant share due to its versatility, cost-effectiveness, and suitability for a wide range of hair care products. However, the growing environmental consciousness is driving innovation in biodegradable and recyclable plastics. Metal packaging offers a premium feel and excellent barrier properties, making it ideal for certain high-end formulations. Glass packaging, while less prevalent due to fragility and weight, is also witnessing a resurgence in niche premium segments where exclusivity and perceived quality are paramount. In terms of applications, shampoos and conditioners represent the largest segments, followed by hair wax and other specialized styling and treatment products. Geographically, Asia Pacific, driven by China and India, is emerging as a powerhouse for hair care packaging production, owing to its massive consumer base and rapidly developing manufacturing capabilities. North America and Europe remain significant markets, driven by mature economies and a strong focus on product innovation and sustainability.

This comprehensive report delves into the dynamic world of hair care packaging, offering an in-depth analysis of its production, evolving trends, and future projections. Spanning the Study Period: 2019-2033, with a Base Year: 2025 and Estimated Year: 2025, the report meticulously examines the Historical Period: 2019-2024 and provides a robust Forecast Period: 2025-2033. Our analysis encompasses the global production landscape, dissecting it by packaging Type (Plastic Packaging, Metal Packaging, Glass Packaging), Application (Shampoos, Conditioners, Hair Wax, Others), and the overarching World Hair Care Packaging Production. Furthermore, we explore crucial Industry Developments shaping this vibrant market. This report is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the challenges within the multi-billion dollar hair care packaging industry.

The hair care packaging market, a critical enabler for product appeal and functionality, is undergoing a profound transformation driven by evolving consumer preferences and heightened environmental consciousness. Within the Study Period: 2019-2033, and specifically focusing on the Estimated Year: 2025, the market's global production is projected to reach significant figures, potentially in the tens of billions of units. A primary trend dominating this landscape is the escalating demand for sustainable packaging solutions. Consumers are increasingly scrutinizing the environmental footprint of their purchases, compelling brands and manufacturers to explore alternatives like recycled plastics (rPET), bio-based polymers, and biodegradable materials. This shift is not merely altruistic; it's a strategic imperative for brand loyalty and market differentiation. The aesthetic appeal of packaging also remains paramount. Brands are investing in innovative designs, premium finishes, and minimalist aesthetics to capture consumer attention on crowded shelves. The rise of direct-to-consumer (DTC) models is also influencing packaging, necessitating smaller, more portable formats and the inclusion of detailed usage instructions. Personalization is another emerging trend, with opportunities for customizable packaging to cater to specific hair types and concerns. The integration of smart packaging technologies, while still nascent, offers potential for enhanced consumer engagement through QR codes linking to product information or augmented reality experiences. Furthermore, the influence of social media and influencer marketing continues to shape packaging design, with visually striking and "Instagrammable" containers gaining traction. The pursuit of lightweight yet durable materials is also a constant, aiming to reduce transportation costs and carbon emissions. This intricate interplay of sustainability, aesthetics, functionality, and technological integration is defining the future trajectory of the hair care packaging sector, moving beyond mere containment to become a powerful brand storytelling tool.

Several potent forces are orchestrating the significant growth observed and projected within the hair care packaging market. The ever-expanding global population, coupled with a rising disposable income in emerging economies, directly translates to an increased demand for personal care products, including hair care. As more individuals gain access to these items, the need for their accompanying packaging naturally escalates. This demographic shift is a fundamental driver, underpinning the market's expansion. Furthermore, the increasing awareness and adoption of diverse hair care routines and specialized products are fueling demand. Consumers are no longer satisfied with basic shampoos and conditioners; they are seeking solutions for specific issues like frizz, damage, color protection, and scalp health. This diversification necessitates a wider array of packaging formats and sizes to accommodate these specialized formulations. The influence of marketing and advertising, particularly through digital channels and social media, plays a crucial role in shaping consumer perception and driving purchasing decisions. Visually appealing and innovative packaging often acts as a silent salesperson, attracting consumers and communicating product benefits effectively. Moreover, the continuous innovation in product formulations within the hair care industry itself necessitates corresponding advancements in packaging technology to ensure product integrity, shelf-life, and ease of use. The demand for convenience and on-the-go solutions is also a significant propellant, leading to the development of travel-sized packs and multi-functional containers.

Despite the robust growth trajectory, the hair care packaging market is not without its hurdles. The primary challenge confronting the industry is the increasing regulatory pressure surrounding plastic waste and environmental sustainability. Governments worldwide are implementing stricter regulations on single-use plastics, extended producer responsibility schemes, and targets for recycled content. Navigating this complex and evolving regulatory landscape requires significant investment in research and development for compliant and sustainable alternatives. Furthermore, the cost associated with implementing these sustainable solutions can be a restraint. Recycled materials and advanced biodegradable polymers often come at a higher price point compared to virgin plastics, which can impact profit margins, especially for smaller manufacturers. Consumer perception and acceptance of alternative materials also present a challenge. While many consumers advocate for sustainability, concerns about the performance, durability, and aesthetic appeal of recycled or bio-based packaging can sometimes hinder their adoption. The supply chain complexities and volatility of raw material prices, particularly for plastics and metals, can also pose a significant restraint, impacting production costs and lead times. Moreover, the threat of counterfeiting and product diversion necessitates secure and tamper-evident packaging solutions, adding another layer of complexity and cost to the manufacturing process. The capital-intensive nature of transitioning to new packaging technologies and materials also acts as a barrier to entry for new players and a significant investment hurdle for established ones.

The global hair care packaging market exhibits significant regional and segmental dominance, with several key players poised to steer its future trajectory. In terms of Type, Plastic Packaging is undeniably the most dominant segment. This dominance stems from its versatility, cost-effectiveness, and established infrastructure for production and recycling (though recycling rates vary significantly). Within plastic packaging, PET (Polyethylene Terephthalate) and HDPE (High-Density Polyethylene) are widely utilized for their durability, chemical resistance, and ability to be molded into various shapes and sizes, making them ideal for shampoos, conditioners, and styling products. The Application segment of Shampoos and Conditioners collectively represents the largest share of the market. These are staple hair care products with high consumption rates globally, directly translating to substantial packaging demand. The sheer volume of daily use and the frequency of repurchase for these items ensure a consistent and significant market presence.

Geographically, Asia Pacific is emerging as a dominant region, driven by its burgeoning population, increasing disposable incomes, and a growing middle class with a rising penchant for personal grooming and branded hair care products. Countries like China and India are pivotal within this region, boasting massive consumer bases and rapid urbanization, leading to accelerated demand for diverse hair care solutions and their corresponding packaging. North America and Europe, while mature markets, continue to be significant contributors due to strong consumer demand for premium and specialized hair care products, coupled with a heightened awareness of sustainability. The emphasis on advanced formulations and eco-friendly packaging in these regions drives innovation and influences global trends. The World Hair Care Packaging Production is therefore intricately linked to these dominant segments and regions. The sheer scale of plastic packaging production for high-volume applications like shampoos and conditioners, particularly within the rapidly expanding Asia Pacific market, will continue to define the overall market landscape. The adoption of new materials and designs in mature markets like Europe and North America often sets benchmarks and influences production strategies worldwide, creating a ripple effect across the global industry. The intricate interplay between material innovation, application demand, and regional economic growth will continue to shape the dominance within the hair care packaging market.

Several factors are acting as powerful catalysts for growth within the hair care packaging industry. The escalating demand for premium and specialized hair care products, driven by consumers seeking tailored solutions for their specific hair concerns, is a significant driver. This necessitates innovative packaging that not only protects the product but also communicates efficacy and luxury. Furthermore, the growing trend of natural and organic hair care products is spurring demand for packaging that reflects these values, such as glass, wood accents, and biodegradable materials, appealing to environmentally conscious consumers. The burgeoning e-commerce sector is also a key growth catalyst, requiring robust, protective, and often aesthetically pleasing packaging that can withstand the rigors of online shipping and enhance the unboxing experience.

This report provides an unparalleled and comprehensive view of the World Hair Care Packaging market. It meticulously analyzes production volumes, with data reaching into the billions, across various Types of packaging including Plastic Packaging, Metal Packaging, and Glass Packaging. The report delves deep into the Application segments of Shampoos, Conditioners, Hair Wax, and Others, offering detailed insights into their respective market shares and growth potentials. Furthermore, the World Hair Care Packaging Production is mapped out in granular detail, highlighting key regional contributions and manufacturing hubs. The report’s extensive Study Period: 2019-2033, with a focused Base Year: 2025 and Estimated Year: 2025, provides a robust foundation for understanding historical performance and future projections through the Forecast Period: 2025-2033. It is an essential tool for stakeholders seeking strategic market intelligence, competitive analysis, and a clear roadmap for navigating the evolving landscape of hair care packaging.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include HCP Packaging, Berry Global Group, Gerresheimer Holdings, Silgan Holdings, ABC Packaging, AptarGroup, AREXIM Packaging, DS Smith, Fusion Packaging Solutions, GRAHAM PACKAGING HOLDINGS.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Hair Care Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hair Care Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.