1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Counterfeiting Caps and Closures?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti Counterfeiting Caps and Closures

Anti Counterfeiting Caps and ClosuresAnti Counterfeiting Caps and Closures by Type (Anti-counterfeit Plastic Closures, Anti-counterfeit Aluminium Closures, Anti-counterfeit Combined Closures, World Anti Counterfeiting Caps and Closures Production ), by Application (Alcoholic Beverages, Alcoholic Beverages, Non-Alcoholic Beverages, Healthcare Products, Personal Care Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

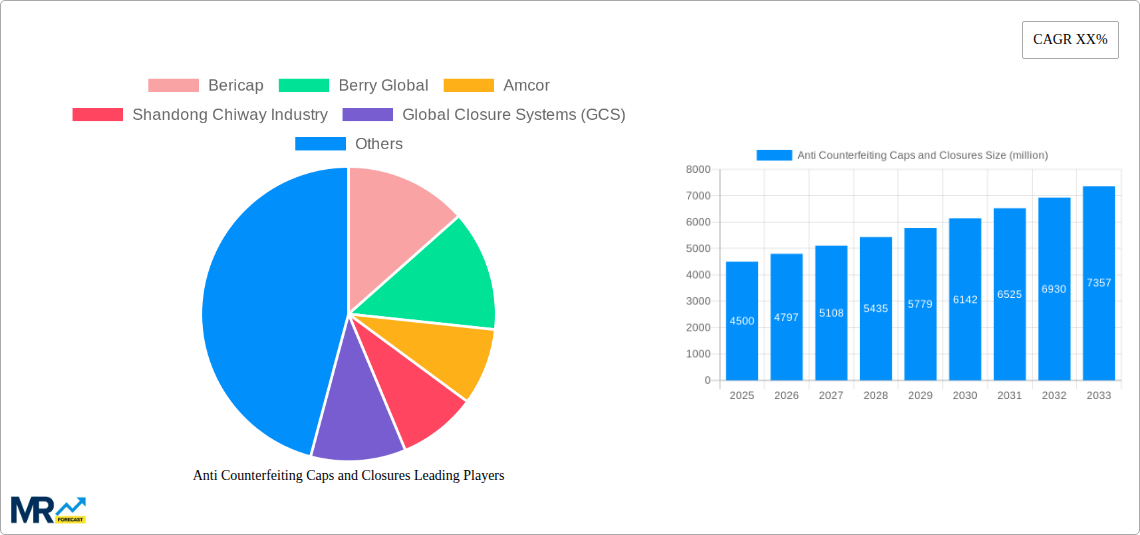

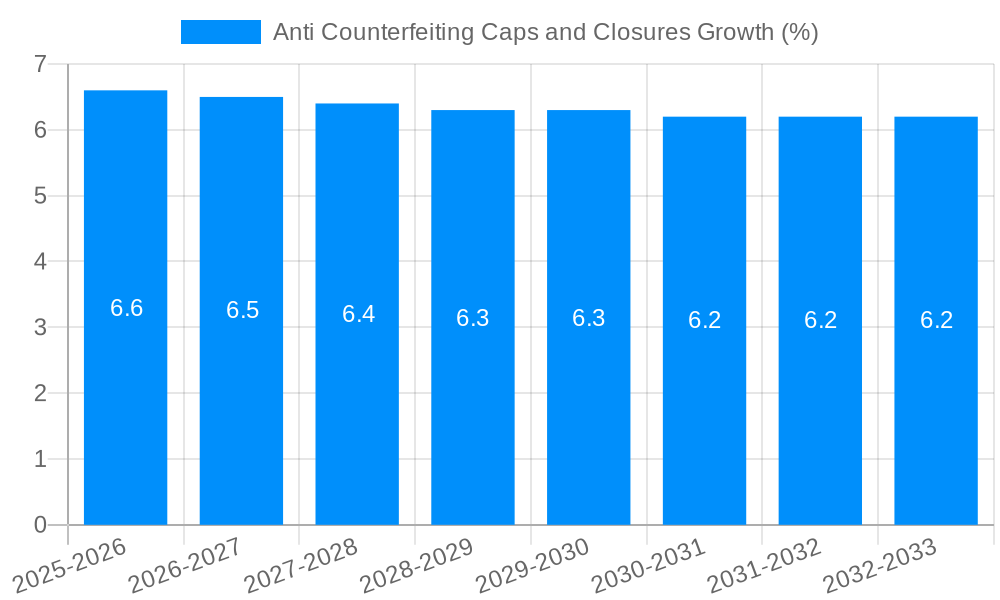

The global market for Anti-Counterfeiting Caps and Closures is poised for significant expansion, driven by the escalating threat of product counterfeiting across diverse industries and increasing regulatory scrutiny. This market, valued at approximately $4,500 million in 2025, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.5% through 2033. The primary impetus behind this growth is the continuous innovation in closure technologies designed to authenticate products and safeguard brands. Industries such as alcoholic beverages, healthcare, and personal care are investing heavily in these advanced solutions to prevent revenue loss, protect consumer safety, and maintain brand integrity. The rising consumer awareness regarding counterfeit goods further fuels demand, pushing manufacturers and brand owners to adopt sophisticated anti-counterfeiting measures. The market is witnessing a surge in demand for tamper-evident seals, holographic features, and track-and-trace capabilities integrated into caps and closures, reflecting a proactive approach to combating illicit trade.

The market landscape is characterized by a strong presence of both plastic and aluminum closures, with a growing segment of combined closures offering enhanced security features. Anti-counterfeit plastic closures are dominating due to their versatility, cost-effectiveness, and ability to incorporate intricate security elements. However, anti-counterfeit aluminum closures are gaining traction in premium product segments for their aesthetic appeal and robust tamper-evident properties. Emerging trends include the integration of digital technologies, such as QR codes and NFC tags, within closures to enable direct consumer engagement and supply chain verification. While growth is widespread, certain regions like Asia Pacific, led by China and India, are expected to exhibit the fastest growth due to a burgeoning manufacturing base and increasing incidences of counterfeiting. Restraints, such as the initial cost of implementing advanced closure systems and the need for global standardization, are being addressed through technological advancements and collaborative industry efforts. Key players like Bericap, Berry Global, and Amcor are at the forefront of this innovation, continually developing sophisticated solutions to meet the evolving demands of a market determined to protect authenticity.

This report provides a comprehensive analysis of the global Anti-Counterfeiting Caps and Closures market, detailing its trajectory from 2019 to 2033, with a deep dive into the base and estimated year of 2025, and a robust forecast period from 2025 to 2033, informed by historical data from 2019-2024. The study delves into the intricate landscape of product protection, examining the innovative solutions that safeguard brands and consumer trust across diverse industries. We will explore the evolving market dynamics, technological advancements, and the strategic initiatives undertaken by key players to combat the pervasive threat of counterfeiting. The report quantifies market sizes in millions of units, offering precise insights into production volumes and consumption patterns.

XXX The global market for anti-counterfeiting caps and closures is experiencing a significant upswing, driven by an escalating demand for robust product authentication solutions across a multitude of industries. During the historical period (2019-2024), the market witnessed steady growth, fueled by increasing consumer awareness regarding the risks associated with counterfeit products, particularly in the Alcoholic Beverages and Healthcare Products segments. The base year, 2025, sets a crucial benchmark, with projections indicating a sustained and accelerated growth trajectory throughout the forecast period (2025-2033). A key trend emerging is the integration of advanced technologies into closure designs. This includes the incorporation of overt security features like holograms, tamper-evident seals, and unique embossing patterns, alongside covert features such as invisible inks, micro-text, and RFID tags that are accessible only through specialized readers. The market is also seeing a rise in the adoption of smart closures that can communicate with smartphones, enabling consumers to verify product authenticity with a simple scan. This surge in technological sophistication is a direct response to the evolving tactics of counterfeiters.

Furthermore, the demand for sustainable anti-counterfeiting solutions is gaining momentum. Manufacturers are exploring eco-friendly materials and production processes for these security closures, aligning with the broader industry trend towards environmental responsibility. The Alcoholic Beverages sector, with its high-value products and susceptibility to counterfeiting, continues to be a dominant application segment, with global production of anti-counterfeiting closures for this category projected to reach several hundred million units by 2025. Similarly, the Healthcare Products segment, where the consequences of counterfeit items can be dire, is witnessing a substantial increase in the implementation of these advanced closures. The Personal Care Products sector is also increasingly adopting these measures as brand integrity and consumer safety become paramount. The Non-Alcoholic Beverages market, while historically less vulnerable, is also recognizing the importance of enhanced security features to maintain brand reputation. The report anticipates a significant volume increase across all these segments, with total world production of anti-counterfeiting caps and closures expected to surpass billions of units by the end of the forecast period. The shift towards digital authentication methods, such as blockchain integration for supply chain traceability, is another critical trend shaping the future of this market, ensuring end-to-end security from production to the end consumer.

The relentless surge in product counterfeiting worldwide stands as the primary catalyst propelling the anti-counterfeiting caps and closures market. The financial losses incurred by legitimate brands, coupled with the grave risks to consumer health and safety, have compelled manufacturers across various sectors to prioritize robust authentication solutions. The Alcoholic Beverages industry, in particular, has been a hotbed for counterfeit activities, leading to significant revenue erosion and reputational damage. This has spurred a substantial investment in advanced closure technologies that offer visual and functional deterrents to illicit replication. Similarly, the Healthcare Products sector faces critical threats from counterfeit medicines and medical devices, where the stakes are life and death. Governments and regulatory bodies are increasingly mandating stricter security measures, thereby driving the adoption of sophisticated anti-counterfeiting closures.

Consumer awareness regarding the dangers of counterfeit goods is also a powerful driving force. As consumers become more educated, they are actively seeking products with verifiable authenticity, thereby putting pressure on brands to implement effective anti-counterfeiting strategies. This burgeoning consumer demand translates into a need for closures that are not only secure but also user-friendly, allowing for easy verification. Furthermore, the evolving technological landscape plays a pivotal role. Innovations in materials science, printing technologies, and digital authentication methods are enabling the development of more sophisticated and cost-effective anti-counterfeiting closures. The integration of features like RFID tags, NFC chips, and blockchain-enabled traceability solutions are transforming traditional closures into intelligent security devices. The growing global trade and complex supply chains further exacerbate the counterfeiting problem, necessitating comprehensive security measures at every touchpoint, thus fueling the demand for advanced caps and closures.

Despite the robust growth trajectory, the anti-counterfeiting caps and closures market is not without its hurdles. One of the most significant challenges is the ever-evolving nature of counterfeiting. As manufacturers implement new security features, counterfeiters adapt and develop increasingly sophisticated methods to bypass them. This creates an ongoing arms race, demanding continuous innovation and investment in research and development from closure manufacturers. The cost of implementation for advanced anti-counterfeiting technologies can also be a restraint, particularly for smaller businesses or companies operating in price-sensitive markets. While the long-term benefits of reduced losses due to counterfeiting are clear, the initial capital outlay for specialized machinery, materials, and integration processes can be prohibitive.

Another challenge lies in the balancing act between security and functionality/aesthetics. While highly secure closures are essential, they must also be user-friendly, easy to open, and visually appealing, especially in consumer-facing products. Overly complex or difficult-to-use security features can frustrate consumers and negatively impact brand perception. Global supply chain complexities and varying regulatory landscapes across different regions can also pose challenges. Ensuring consistent application of anti-counterfeiting measures across diverse geographical markets, each with its own set of regulations and enforcement capabilities, requires meticulous planning and execution. Furthermore, the lack of standardized authentication protocols across industries can lead to fragmented solutions and interoperability issues, hindering widespread adoption. Finally, the perception of anti-counterfeiting measures as a mere cost center rather than a strategic investment by some businesses can limit the willingness to adopt premium security solutions.

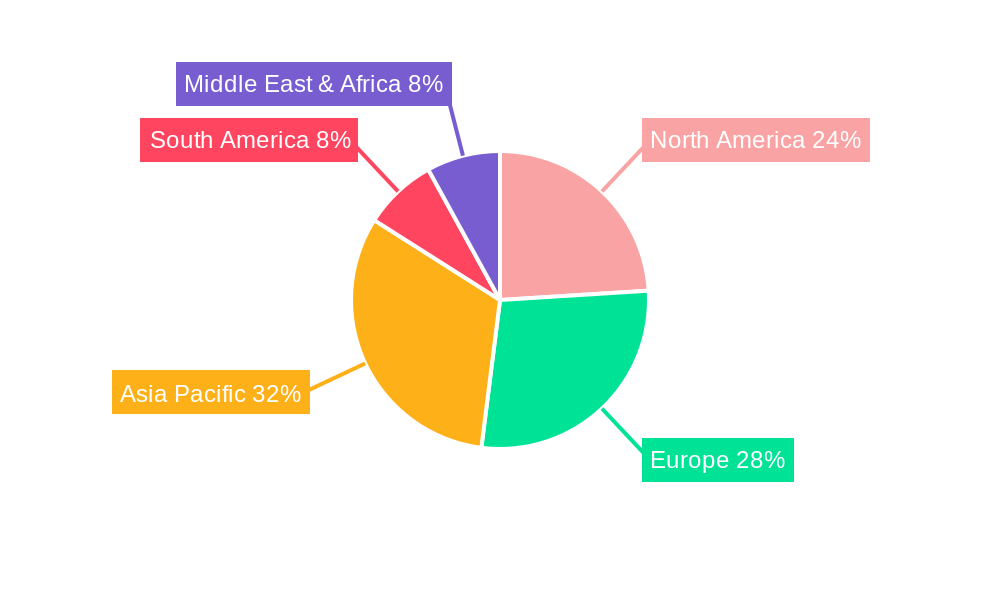

The global anti-counterfeiting caps and closures market is poised for significant dominance by specific regions and market segments, driven by a confluence of factors including the prevalence of counterfeiting, industry concentration, and regulatory stringency.

Dominating Region: Asia Pacific

Dominating Segment: Anti-counterfeit Plastic Closures

Dominating Application: Alcoholic Beverages

While Anti-counterfeit Aluminium Closures and Anti-counterfeit Combined Closures also play crucial roles, particularly in premium segments and for specific product requirements, the sheer volume and broad applicability of plastic closures, coupled with the high risk and value associated with alcoholic beverages and the extensive reach of the Asia Pacific region, position these as the dominant forces shaping the global anti-counterfeiting caps and closures market landscape through the forecast period.

The anti-counterfeiting caps and closures industry is experiencing significant growth catalysts, primarily driven by the escalating global threat of counterfeit products across various sectors. The increasing awareness among consumers about the health and financial risks associated with fake goods is compelling manufacturers to invest more in product protection. Furthermore, stringent government regulations and mandates, especially in the pharmaceutical and alcoholic beverage industries, are compelling the adoption of advanced security features on closures. Technological advancements, including the integration of RFID, NFC, holography, and blockchain technology into closures, are creating more sophisticated and verifiable authentication solutions, thus driving innovation and market expansion. The growing emphasis on brand protection and maintaining consumer trust is also a significant growth driver, as companies recognize that effective anti-counterfeiting measures are crucial for long-term brand equity.

This report offers an in-depth and comprehensive analysis of the global anti-counterfeiting caps and closures market, covering the period from 2019 to 2033. It delves into the intricacies of market dynamics, including historical trends (2019-2024), the base year (2025) with detailed estimations for the same year, and a robust forecast period (2025-2033). The report provides granular insights into market segmentation by type (e.g., Anti-counterfeit Plastic Closures, Anti-counterfeit Aluminium Closures), application (e.g., Alcoholic Beverages, Healthcare Products, Personal Care Products), and geographical regions. It meticulously details the driving forces, challenges, and significant developments that shape this critical industry. Furthermore, the report identifies leading players and their strategic initiatives, offering valuable intelligence for stakeholders seeking to navigate and capitalize on the evolving landscape of product authentication and security. The quantitative data, presented in millions of units, offers a clear understanding of market size and growth projections.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bericap, Berry Global, Amcor, Shandong Chiway Industry, Global Closure Systems (GCS), GualaClosures Group, Taiwan HonChuan Group, Anhui Baishijia Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti Counterfeiting Caps and Closures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti Counterfeiting Caps and Closures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.