1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-counterfeit Plastic Caps and Closures?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-counterfeit Plastic Caps and Closures

Anti-counterfeit Plastic Caps and ClosuresAnti-counterfeit Plastic Caps and Closures by Type (PP Caps and Closures, PE Caps and Closures, World Anti-counterfeit Plastic Caps and Closures Production ), by Application (Alcoholic Beverages, Alcoholic Beverages, Non-Alcoholic Beverages, Healthcare Products, Personal Care Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

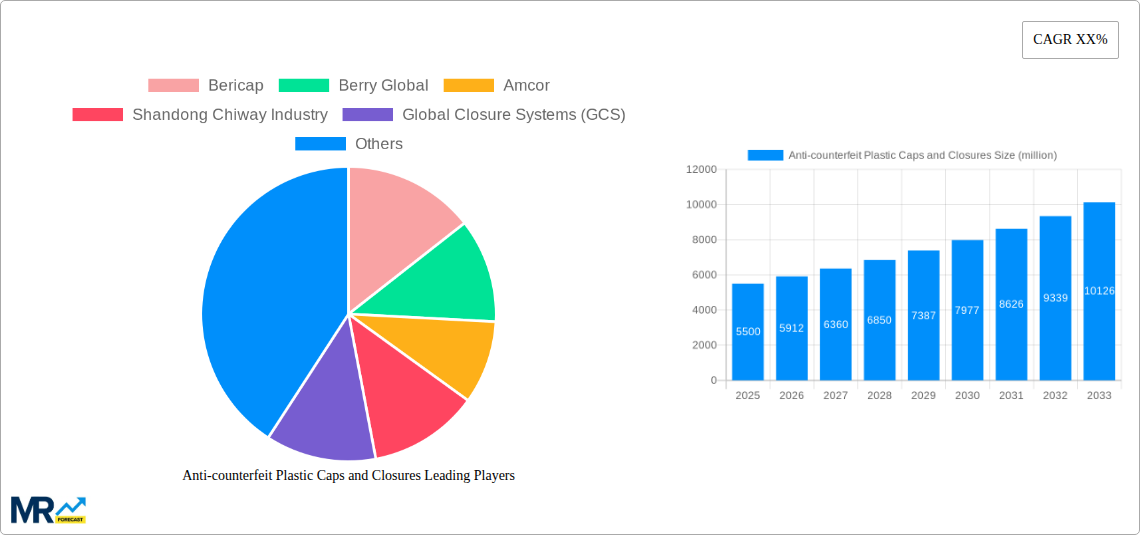

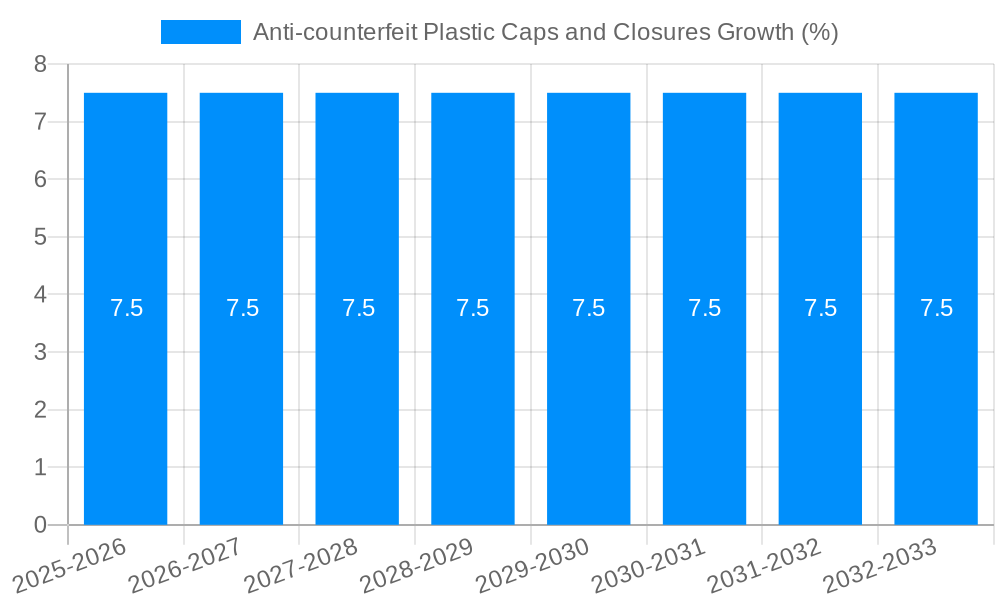

The global Anti-counterfeit Plastic Caps and Closures market is projected to witness robust expansion, estimated at approximately USD 5,500 million in 2025. This growth is fueled by a strong Compound Annual Growth Rate (CAGR) of around 7.5% expected over the forecast period of 2025-2033. The increasing prevalence of product counterfeiting across various industries, particularly in alcoholic beverages, healthcare, and personal care, is the primary driver for this market's surge. Manufacturers are investing heavily in advanced anti-counterfeiting technologies embedded within plastic caps and closures, such as holograms, unique tamper-evident features, RFID tags, and advanced printing techniques. These innovations aim to enhance product integrity, protect brand reputation, and safeguard consumer health and safety from the influx of fake goods. The demand for secure and traceable packaging solutions continues to rise as regulatory bodies and consumers become more vigilant against counterfeit products.

The market's trajectory is further shaped by evolving consumer preferences for sustainable and secure packaging. While the inherent value proposition of anti-counterfeit solutions is strong, certain restraints might include the initial high cost of implementing advanced technologies and the need for continuous innovation to stay ahead of sophisticated counterfeiting methods. The market is segmented by type, with PP Caps and Closures and PE Caps and Closures dominating production due to their widespread application and cost-effectiveness, alongside specialized World Anti-counterfeit Plastic Caps and Closures. Key applications span across Alcoholic Beverages, Non-Alcoholic Beverages, Healthcare Products, and Personal Care Products, each presenting unique challenges and opportunities for counterfeit prevention. Leading companies like Bericap, Berry Global, and Amcor are at the forefront, investing in research and development to offer cutting-edge solutions that meet the dynamic demands of this critical market segment. Asia Pacific, particularly China and India, is expected to be a significant growth engine due to its large manufacturing base and rising domestic consumption, coupled with a growing awareness of product authenticity.

This comprehensive report delves into the dynamic global market for Anti-counterfeit Plastic Caps and Closures, providing an in-depth analysis from the historical period of 2019-2024 through to an extensive forecast extending to 2033, with a specific focus on the base and estimated year of 2025. The study meticulously examines production volumes in millions of units, shedding light on the sheer scale and intricate supply chains underpinning this vital industry. We dissect the market by key company players and critically analyze segment-specific performance, including PP Caps and Closures and PE Caps and Closures, alongside the overarching "World Anti-counterfeit Plastic Caps and Closures Production" metric. Furthermore, the report explores the diverse application landscape, with dedicated segments for Alcoholic Beverages, Non-Alcoholic Beverages, Healthcare Products, Personal Care Products, and "Other" crucial sectors. Industry developments are tracked and analyzed to provide a forward-looking perspective.

The global Anti-counterfeit Plastic Caps and Closures market is experiencing a significant evolutionary surge, driven by an escalating global concern over product authenticity and consumer safety. The historical period of 2019-2024 has witnessed a palpable increase in counterfeit goods across various sectors, ranging from high-value alcoholic beverages to critical healthcare products. This surge has directly fueled demand for sophisticated anti-counterfeiting solutions embedded within everyday packaging components. The base year of 2025 marks a critical juncture, where established trends are solidifying, and innovative technologies are gaining traction. By 2025, production of anti-counterfeit plastic caps and closures is projected to reach significant figures, with projections suggesting a steady upward trajectory in the millions of units produced globally. The focus is shifting from simple tamper-evident features to more advanced, multi-layered security elements. This includes the integration of overt features like holograms and visually distinct printing, alongside covert features such as micro-taggants and specialized inks that require specific detection equipment. The report highlights a growing preference for integrated solutions that offer both immediate visual confirmation of authenticity and deeper, technological safeguards. This trend is particularly pronounced in the Alcoholic Beverages segment, where brand reputation and consumer trust are paramount. The proliferation of advanced counterfeiting techniques has compelled manufacturers to invest heavily in R&D for novel anti-counterfeit technologies. The study predicts a continued rise in the adoption of smart packaging solutions, where caps and closures are equipped with QR codes, NFC tags, or even RFID chips that can be authenticated via smartphone applications. This not only aids in combating counterfeiting but also opens avenues for enhanced supply chain traceability and consumer engagement. The Personal Care Products and Healthcare Products segments are also witnessing a substantial increase in the demand for robust anti-counterfeiting measures, owing to the potential health risks associated with counterfeit items. The forecast period of 2025-2033 anticipates a sustained growth in this market, driven by a confluence of regulatory pressures, increased consumer awareness, and continuous technological advancements in security features. The sheer volume of production, estimated to be in the hundreds of millions of units annually by the end of the forecast period, underscores the critical role these closures play in safeguarding brand integrity and consumer well-being across a vast array of industries.

The burgeoning global market for Anti-counterfeit Plastic Caps and Closures is propelled by a powerful confluence of economic, regulatory, and consumer-driven factors that are reshaping packaging strategies worldwide. The primary impetus stems from the relentless and ever-evolving threat of counterfeiting. In 2025, the economic losses incurred by businesses due to counterfeit products are substantial, impacting revenue streams, brand reputation, and intellectual property. This makes the adoption of effective anti-counterfeit measures not merely a preference but a strategic imperative. Regulatory bodies across various nations are increasingly implementing stringent regulations aimed at protecting consumers from harmful counterfeit goods, particularly within the healthcare and food and beverage sectors. These regulations often mandate the use of specific security features on packaging, thereby directly boosting the demand for advanced plastic caps and closures designed to meet these compliance requirements. Furthermore, consumer awareness regarding the dangers of counterfeit products has reached an all-time high. Consumers are becoming more discerning and are actively seeking products that offer verifiable authenticity. This heightened awareness translates into a willingness to pay a premium for products that are clearly protected by robust anti-counterfeiting measures, influencing purchasing decisions and compelling manufacturers to invest in such solutions. The growth of e-commerce has also inadvertently contributed to the rise of counterfeit goods, making it easier for illicit products to reach consumers. In response, the industry is developing more sophisticated digital and physical security features that can be integrated into caps and closures to ensure the integrity of products sold online. The increasing complexity of supply chains, with products often traversing multiple countries and distribution channels, further amplifies the risk of counterfeiting. This necessitates the implementation of secure packaging solutions that can be easily authenticated at various points in the supply chain, underscoring the critical role of advanced plastic caps and closures in maintaining product integrity from production to the end consumer.

Despite the robust growth trajectory, the Anti-counterfeit Plastic Caps and Closures market is not without its hurdles. One of the most significant challenges is the escalating cost of implementing advanced anti-counterfeiting technologies. Integrating sophisticated security features such as holographic foils, specialty inks, micro-taggants, or RFID chips often adds a considerable cost to the production of individual caps and closures. This increased cost can be a substantial barrier for smaller manufacturers or for products in price-sensitive markets, potentially limiting the widespread adoption of the most effective solutions. Furthermore, the rapid evolution of counterfeiting techniques poses a continuous challenge. As anti-counterfeit technologies become more sophisticated, counterfeiters often find innovative ways to bypass them. This necessitates a constant cycle of research and development to stay ahead of illicit operations, requiring significant ongoing investment from cap and closure manufacturers. The lack of standardized regulations and enforcement across different regions can also create complexities. While some countries have strict mandates, others have weaker regulatory frameworks, leading to a fragmented market and making it difficult for global brands to implement a uniform anti-counterfeiting strategy. The potential for complexity in manufacturing and integration is another restraint. Introducing new security features can sometimes disrupt existing high-speed production lines or require specialized equipment, leading to operational inefficiencies and increased capital expenditure. Finally, consumer perception and education play a role. While consumer awareness is growing, a segment of the market may not fully understand the importance of anti-counterfeit features or may perceive them as unnecessary additions, particularly if they do not clearly understand the value proposition. Overcoming these challenges requires a concerted effort from industry stakeholders to drive down costs, foster innovation, and promote greater understanding and adoption of these critical security measures.

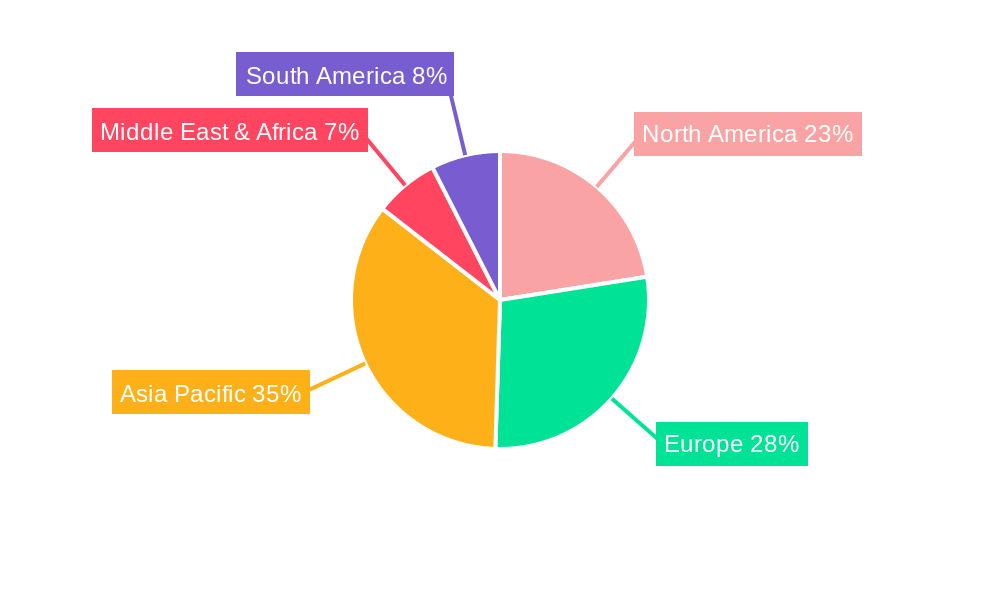

The global Anti-counterfeit Plastic Caps and Closures market presents a compelling landscape of regional dominance and segment leadership, with specific areas exhibiting pronounced growth and adoption.

Asia Pacific Region: This region, particularly China, is emerging as a powerhouse in both production and consumption of anti-counterfeit plastic caps and closures. Its vast manufacturing capabilities, coupled with a rapidly growing domestic market and a significant export base, position it as a key driver of global production volumes. The sheer scale of its packaging industry, serving sectors from food and beverage to pharmaceuticals, necessitates robust anti-counterfeiting solutions. The increasing awareness of brand protection and the government's efforts to curb the proliferation of counterfeit goods within its borders further bolster demand. By 2025, it is projected that the World Anti-counterfeit Plastic Caps and Closures Production from this region will account for a substantial portion of the global output, estimated to be in the tens of millions of units.

North America and Europe: These regions remain significant markets due to a mature consumer base with high purchasing power and stringent regulatory environments. The presence of leading global brands in sectors like Alcoholic Beverages and Healthcare Products mandates the highest standards of product authenticity. The Healthcare Products segment in these regions, driven by concerns over patient safety and regulatory compliance (e.g., pharmaceutical track-and-trace initiatives), is a major contributor to market growth. The demand for tamper-evident and traceable closures is particularly high, leading to significant investment in advanced technologies.

Segment Dominance: PP Caps and Closures: Within the material types, PP (Polypropylene) Caps and Closures are expected to dominate the anti-counterfeit market. Polypropylene's versatility, cost-effectiveness, and inherent durability make it an ideal material for a wide range of applications, including beverages, personal care, and certain healthcare products. Its suitability for various molding techniques allows for the seamless integration of sophisticated anti-counterfeiting features. The production of PP caps and closures, especially those incorporating advanced security elements, is projected to reach hundreds of millions of units globally by 2025.

Segment Dominance: Alcoholic Beverages: The Alcoholic Beverages segment stands out as a prime beneficiary and driver of the anti-counterfeit plastic caps and closures market. The high value of many alcoholic products, coupled with the severe damage counterfeiting can inflict on brand reputation and consumer trust, makes it a critical application area. The market for premium spirits and wines, in particular, sees a strong demand for visually appealing and technologically secure closures that deter illicit replication. The estimated production of anti-counterfeit closures for this segment alone is in the tens of millions of units annually, with a consistent upward trend projected throughout the forecast period.

These regional and segment-specific dynamics are crucial for understanding the market's future trajectory. The synergy between manufacturing hubs like Asia Pacific and high-demand sectors like Alcoholic Beverages and Healthcare, supported by the widespread adoption of PP Caps and Closures, creates a powerful engine for continued market expansion.

Several key factors are acting as significant growth catalysts for the Anti-counterfeit Plastic Caps and Closures industry. The relentless global rise in counterfeit goods, impacting brand integrity and consumer safety, is a primary driver. Increasing governmental regulations and mandates, particularly in the pharmaceutical and food sectors, requiring enhanced product traceability and authentication, are compelling manufacturers to adopt advanced closure solutions. Furthermore, the growing consumer awareness and demand for genuine products, especially for premium goods, are pushing brands to invest in visible and verifiable anti-counterfeiting measures. The continuous innovation in security features, from advanced inks and holograms to integrated digital solutions like QR codes and NFC tags, provides a wider array of options for brands to protect their products, thereby stimulating market expansion.

This report offers an exhaustive examination of the Anti-counterfeit Plastic Caps and Closures market, spanning crucial aspects from production volumes in millions of units to intricate market dynamics. The study covers the historical period of 2019-2024, the base and estimated year of 2025, and projects future trends until 2033. It provides a granular breakdown of leading companies and segments, including PP Caps and Closures and PE Caps and Closures, alongside the overarching "World Anti-counterfeit Plastic Caps and Closures Production." The report also meticulously analyzes the application spectrum, with detailed insights into Alcoholic Beverages, Non-Alcoholic Beverages, Healthcare Products, Personal Care Products, and Other sectors. Furthermore, it explores critical industry developments and growth catalysts, offering a holistic view of this vital market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bericap, Berry Global, Amcor, Shandong Chiway Industry, Global Closure Systems (GCS), GualaClosures Group, Taiwan HonChuan Group, Anhui Baishijia Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-counterfeit Plastic Caps and Closures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-counterfeit Plastic Caps and Closures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.