1. What is the projected Compound Annual Growth Rate (CAGR) of the Venture Capital Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Venture Capital Service

Venture Capital ServiceVenture Capital Service by Type (Capital Raised, Assets Management), by Application (Startups, Small Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

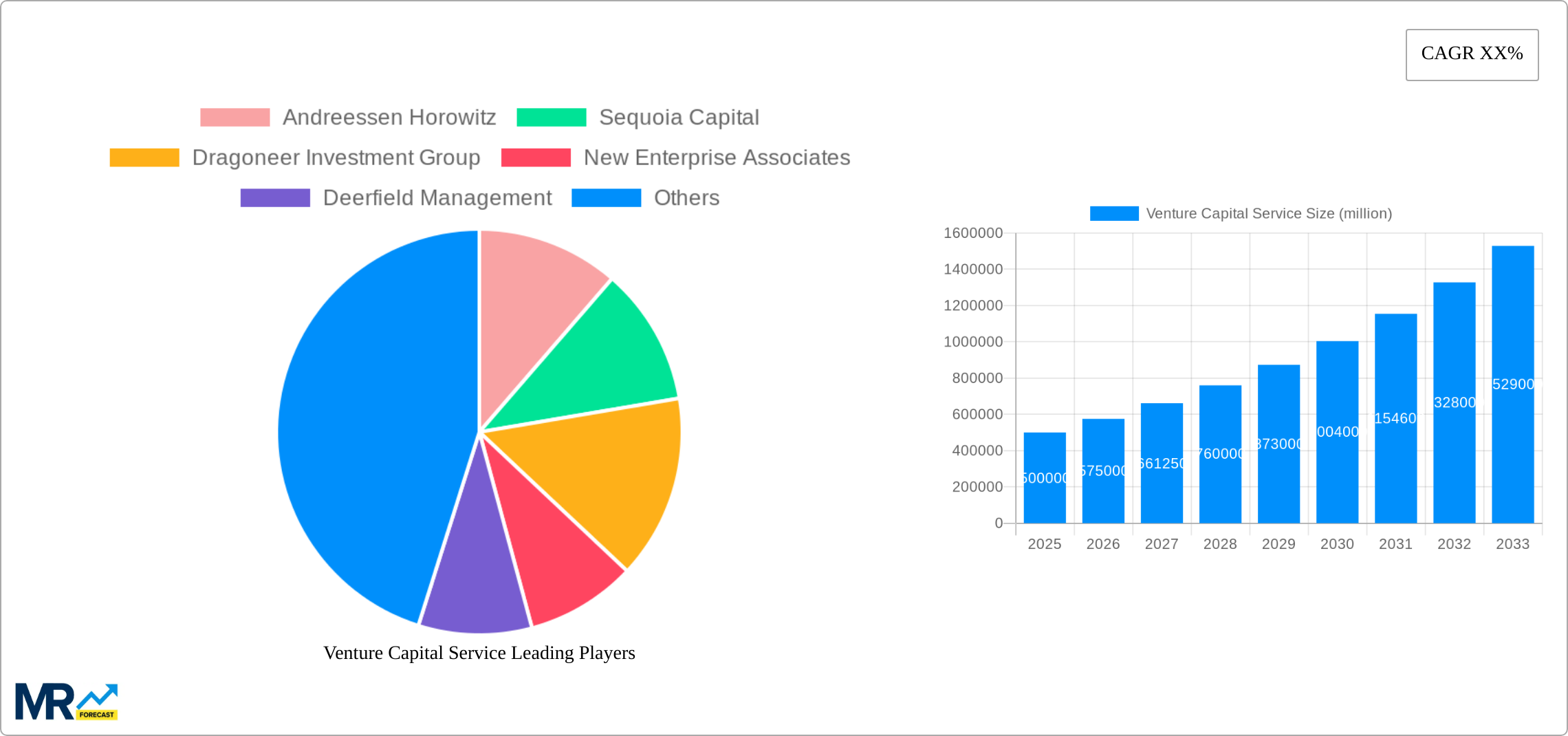

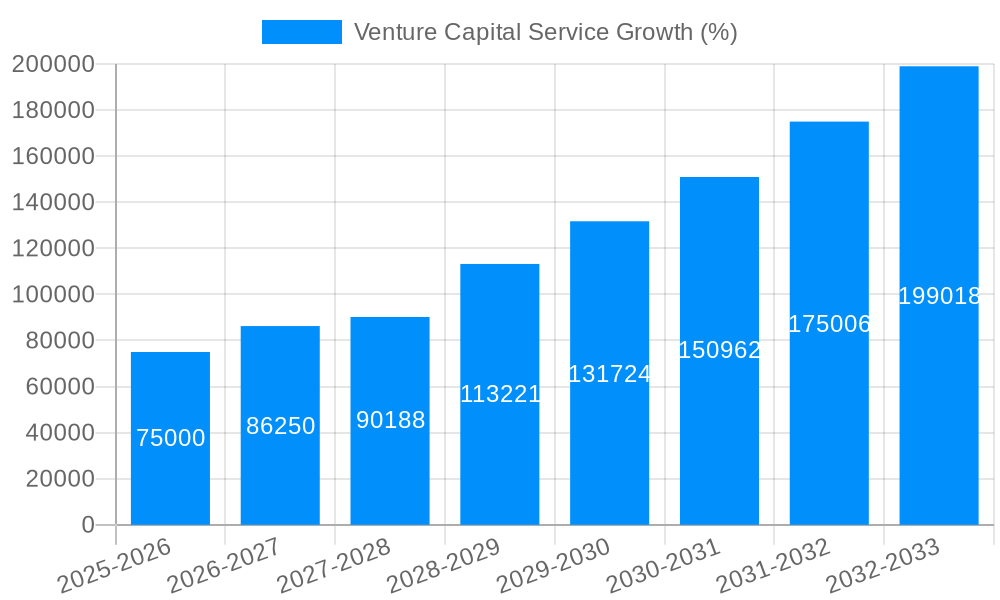

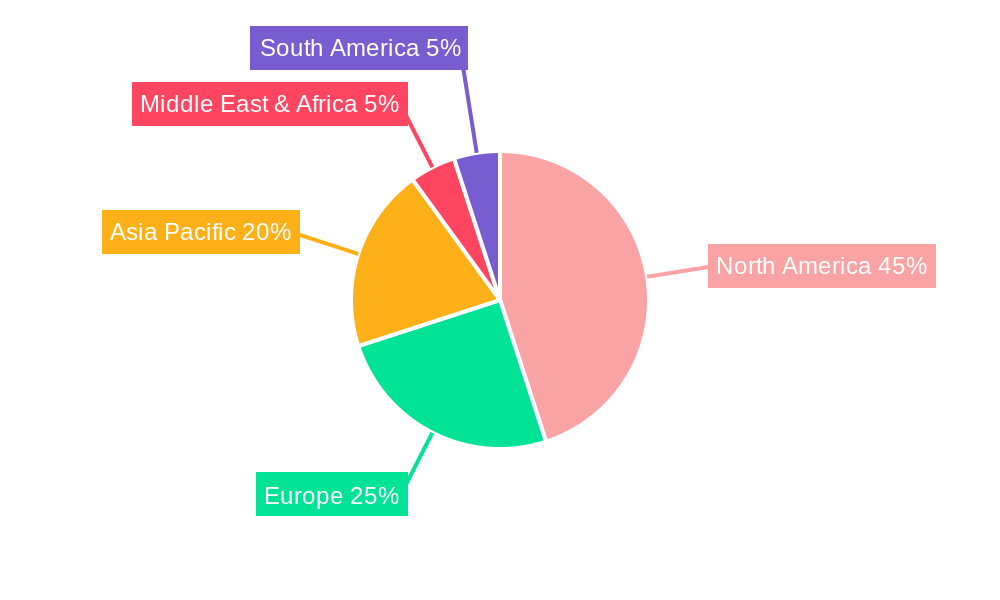

The global venture capital (VC) market is experiencing robust growth, driven by a confluence of factors including increasing technological advancements, the rise of innovative startups, and favorable regulatory environments in several key regions. The market, estimated at $500 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $1.5 trillion by 2033. This significant expansion is fueled by substantial capital inflows from institutional investors, high-net-worth individuals, and sovereign wealth funds actively seeking high-growth opportunities. Key drivers include the burgeoning FinTech and Biotech sectors, the increasing adoption of cloud computing and AI, and the growing prevalence of angel investors and accelerator programs fostering early-stage company growth. Segment-wise, capital raised and asset management segments show robust growth, with startups and small enterprises being the primary beneficiaries. North America and Asia Pacific currently hold the largest market share, driven by the presence of established VC firms like Andreessen Horowitz, Sequoia Capital, and numerous emerging players in China and India. However, other regions like Europe and the Middle East & Africa are witnessing increasing VC activity, indicating a more geographically diversified market in the coming years. Despite this positive outlook, challenges remain, including potential economic downturns, geopolitical instability, and increased regulatory scrutiny which could act as potential restraints on future growth.

The competitive landscape is highly dynamic, with both established firms and new entrants vying for market share. Strategic partnerships, mergers and acquisitions, and the emergence of specialized VC funds focused on specific industry verticals are shaping the industry. The increasing sophistication of investment strategies, particularly in later-stage funding rounds, is another notable trend. The ongoing evolution of technology and the emergence of new business models will continue to reshape the VC landscape, presenting both opportunities and challenges for investors and entrepreneurs alike. The future of the VC market hinges on several interconnected factors, including macroeconomic conditions, technological innovation, and the overall health of the global economy. A continued focus on sustainable investing and ESG (Environmental, Social, and Governance) criteria will further influence investment decisions and shape future market trends.

The venture capital (VC) service market witnessed significant expansion during the historical period (2019-2024), fueled by a confluence of factors including burgeoning technological advancements, a conducive regulatory environment in several key regions, and a robust appetite for high-growth investments from both established and emerging players. The base year 2025 shows a market valuation in the hundreds of millions, reflecting the sustained momentum. Our analysis indicates that the market will continue its upward trajectory throughout the forecast period (2025-2033), reaching billions in valuation. This growth is not uniformly distributed; certain segments, such as early-stage funding for technology startups, are experiencing exponential growth, while others, like investments in traditional industries, are showing more moderate increases. The rise of impact investing, focused on ventures with positive social and environmental outcomes, is also a notable trend, attracting significant capital inflows and shaping the investment landscape. Furthermore, the increasing sophistication of VC firms' analytical capabilities and data-driven decision-making processes are enhancing their ability to identify and nurture high-potential ventures. Competition among VC firms remains fierce, leading to innovative investment strategies, competitive fee structures, and a constant pursuit of superior returns. Geographic diversification is also a significant trend, with VC activity expanding beyond traditional hubs in Silicon Valley and expanding into regions with rapidly growing tech ecosystems. The interplay of these trends paints a dynamic picture of the VC service market, characterized by rapid growth, evolving investment strategies, and a continuous reshaping of the industry landscape. This detailed analysis will dissect these trends, quantifying their impact on the market's expansion and identifying potential future inflection points.

Several key factors are propelling the growth of the venture capital service market. Firstly, the burgeoning startup ecosystem, particularly within the technology sector, presents a vast pool of high-growth investment opportunities. The continuous emergence of innovative technologies, such as artificial intelligence, biotechnology, and sustainable energy, attracts substantial VC funding. Secondly, the increased availability of funding channels, including angel investors, crowdfunding platforms, and government initiatives, creates a supportive environment for early-stage ventures, which in turn increases the overall deal flow for VCs. Thirdly, the growing involvement of institutional investors, such as pension funds and sovereign wealth funds, in the VC market injects significant capital and broadens the pool of available funds. Fourthly, the improved access to data analytics and sophisticated investment tools enables VC firms to make more informed investment decisions, reduce risks, and optimize portfolio performance. Finally, governmental policies aimed at fostering innovation and entrepreneurship, including tax incentives and regulatory frameworks, are conducive to the growth of the VC industry. The synergistic interaction of these drivers fuels a positive feedback loop, accelerating the expansion of the VC market and creating a vibrant ecosystem for innovation and growth.

Despite its robust growth, the venture capital service market faces several challenges. Firstly, the inherent risk associated with investing in early-stage companies leads to a high failure rate, resulting in potential capital losses for VC firms. This risk is amplified by market volatility and macroeconomic uncertainties. Secondly, competition among VC firms is intense, necessitating a continuous search for innovative investment strategies and differentiated approaches to attract promising startups. Thirdly, regulatory complexities and compliance requirements in different jurisdictions can add significant operational burdens and costs for VC firms operating globally. Fourthly, the difficulty in accurately assessing the long-term potential of startups, particularly those in nascent technological fields, makes it challenging to identify truly disruptive and scalable businesses. Finally, the limited availability of skilled professionals with deep expertise in evaluating and managing high-growth ventures creates a bottleneck in the industry's expansion. Addressing these challenges effectively will be crucial for sustaining the healthy growth of the VC market and ensuring its continued contribution to innovation and economic development.

The United States is projected to continue dominating the global venture capital market throughout the forecast period (2025-2033), driven by the presence of a mature startup ecosystem, abundant capital, and a strong regulatory framework supportive of innovation. Other key regions, such as Europe (especially the UK and Germany) and Asia (particularly China and India), are experiencing rapid growth, but still lag behind the US in terms of overall market size.

In terms of segments, the early-stage funding for startups is the dominant segment. This is due to several reasons:

While assets under management (AUM) is a critical metric, the focus on early-stage investments directly impacts its growth. A successful portfolio of early-stage investments significantly boosts AUM, thereby reinforcing the segment's dominance. The success of individual startups within the portfolio drives the growth of AUM, further consolidating this segment's leading position.

The significant capital raised in early-stage rounds reflects the continuous flow of funds into this high-growth, high-risk segment. The interplay between capital raised, AUM, and the focus on startups creates a dynamic feedback loop that reinforces the dominance of this segment in the VC market.

The venture capital service industry is experiencing robust growth fueled by the convergence of several key catalysts. The increasing digitization of industries, coupled with the emergence of disruptive technologies such as AI and blockchain, creates a constant stream of innovative startups vying for funding. Simultaneously, the rising availability of capital from both traditional and non-traditional sources, such as institutional investors and high-net-worth individuals, fuels the investment ecosystem. This confluence of technological advancements and abundant capital creates a fertile ground for the growth of venture capital services. Furthermore, supportive government policies that encourage entrepreneurship and innovation amplify the positive growth trajectory of this industry.

This report provides a comprehensive overview of the venture capital service market, analyzing historical trends, current market dynamics, and future growth projections. The report delves into key market segments, including capital raised, assets under management, and applications across startups and small enterprises. A detailed analysis of leading players and their strategies, coupled with an assessment of significant industry developments, provides a nuanced perspective on the market landscape. The report concludes with an assessment of growth catalysts and potential challenges, offering valuable insights for investors, entrepreneurs, and industry professionals.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Andreessen Horowitz, Sequoia Capital, Dragoneer Investment Group, New Enterprise Associates, Deerfield Management, Khosla Ventures, Legend Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Venture Capital Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Venture Capital Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.