1. What is the projected Compound Annual Growth Rate (CAGR) of the Venture Capital Funds?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Venture Capital Funds

Venture Capital FundsVenture Capital Funds by Type (/> Micro Enterprises, Small Enterprises, Medium-Size Enterprises), by Application (/> IT & Telecom, Retail, Consumer Goods, Manufacturing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

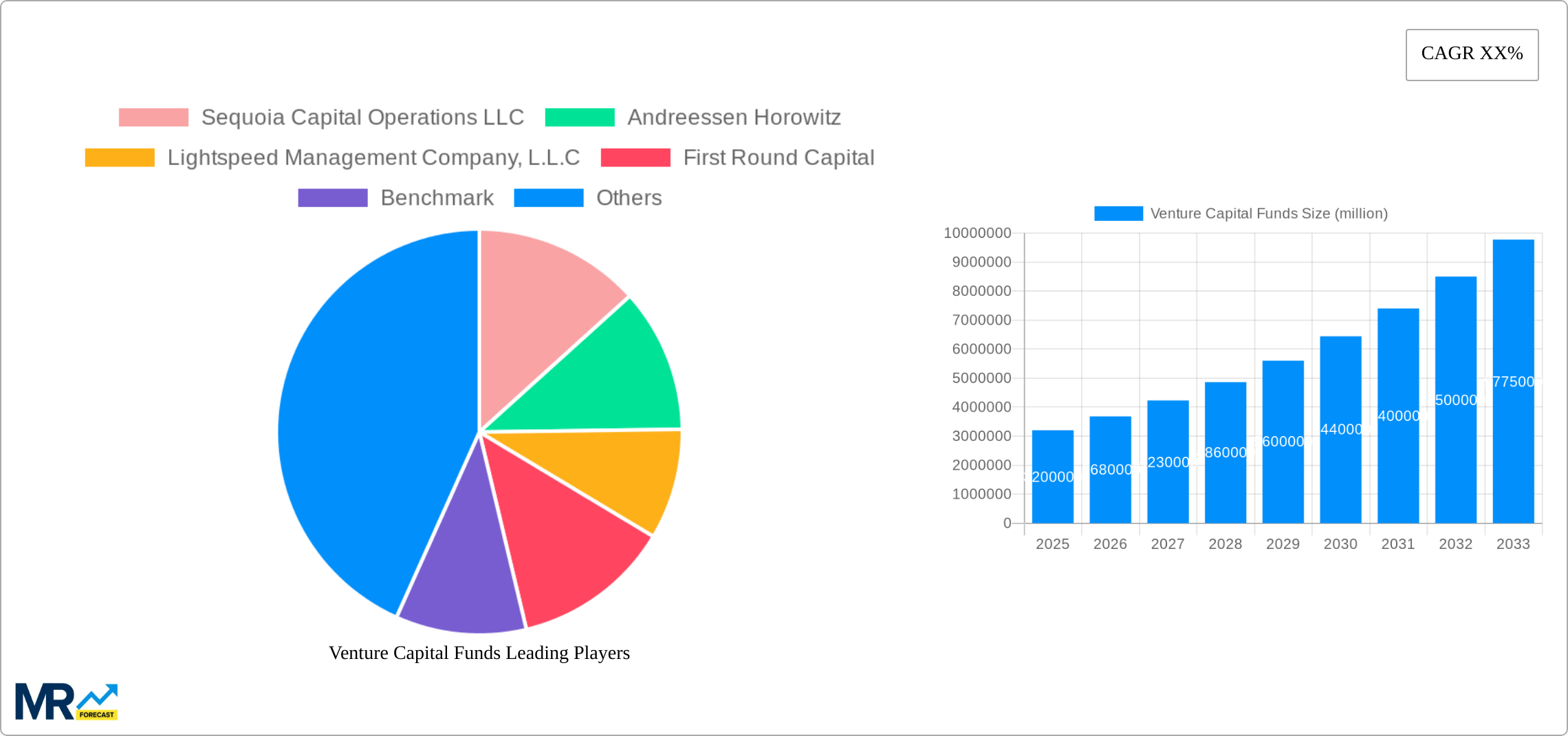

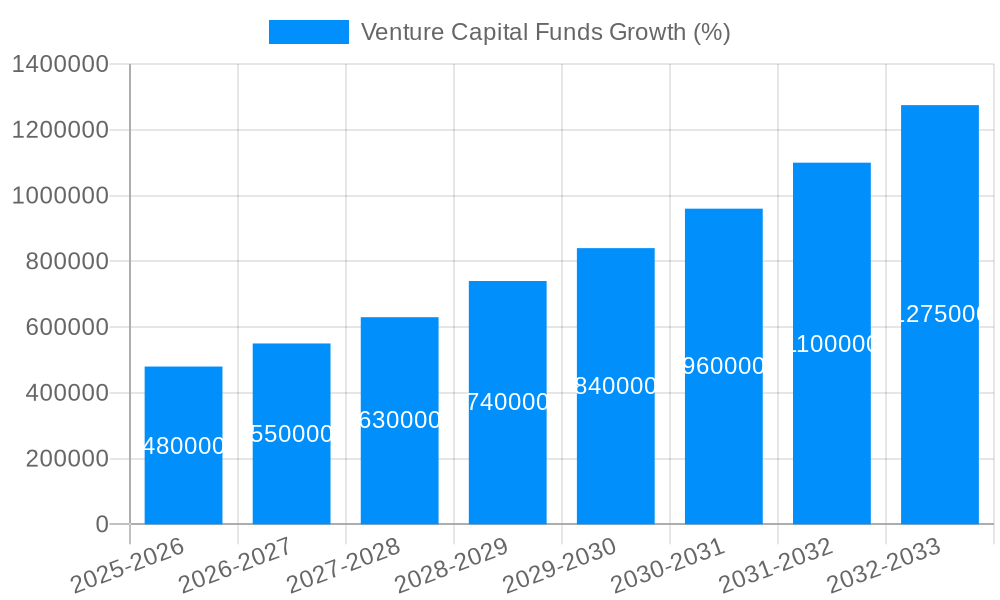

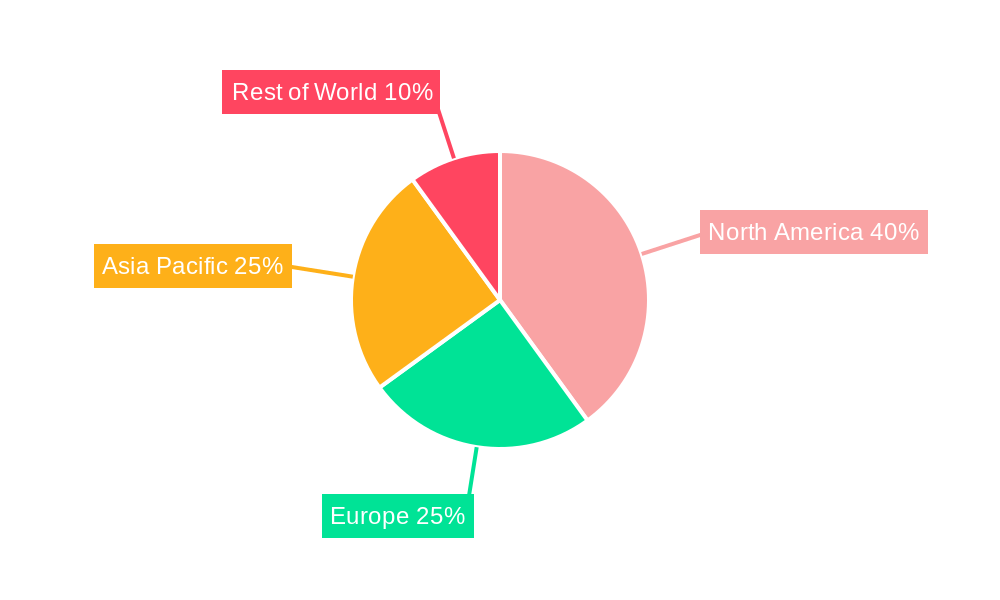

The Venture Capital (VC) market is experiencing robust growth, fueled by a confluence of factors. The increasing number of technology startups and innovative businesses seeking funding, coupled with readily available capital from institutional investors and high-net-worth individuals, is driving significant expansion. A Compound Annual Growth Rate (CAGR) exceeding 15% is projected for the next decade, indicating a substantial increase in the market's value. While precise figures are unavailable, estimations based on industry reports suggest a current market size exceeding $3 trillion globally. The sector is segmented by enterprise size (micro, small, medium) and application (IT & Telecom, Retail, Consumer Goods, Manufacturing, and others), providing diversification and investment opportunities. Key trends include a growing focus on sustainable and impact investing, an increase in later-stage funding rounds, and the emergence of alternative investment structures like venture debt. Geographic distribution reflects the concentration of tech hubs and entrepreneurial activity; North America and Asia Pacific currently hold the largest market shares, but rapid growth is anticipated in regions like South America and Africa.

Despite the positive outlook, challenges persist. Regulatory scrutiny, geopolitical uncertainties, and the cyclical nature of the VC market present potential restraints on growth. Competition among VC firms is fierce, requiring sophisticated strategies and specialized expertise to secure successful investments. The high-risk, high-reward nature of VC investing underscores the importance of rigorous due diligence and portfolio diversification. Nevertheless, the long-term prospects for the VC market remain strong, driven by the continuous innovation and growth potential of emerging technologies and entrepreneurial ventures. The involvement of prominent firms like Sequoia Capital, Andreessen Horowitz, and Lightspeed Venture Partners signifies the market's maturity and attractiveness to major investors. The market's future hinges on the continued success of portfolio companies and the ability of VC firms to adapt to evolving market dynamics.

The global venture capital (VC) funds market experienced significant growth during the historical period (2019-2024), fueled by a confluence of factors including technological advancements, burgeoning entrepreneurial activity, and increased investor appetite for high-growth potential. The estimated market value in 2025 is projected to be in the billions, representing a substantial increase from previous years. This growth is particularly evident in specific segments like IT & Telecom and within the SME (Small and Medium-sized Enterprises) sector. While the overall market demonstrated resilience even during periods of economic uncertainty, certain sub-sectors experienced more pronounced fluctuations. For example, the Retail sector saw a temporary downturn in early 2020, quickly rebounding with the rise of e-commerce. The manufacturing sector, on the other hand, consistently attracted significant VC investment due to automation and Industry 4.0 related opportunities. The forecast period (2025-2033) anticipates continued expansion, driven by emerging technologies such as Artificial Intelligence, blockchain, and the metaverse. However, the rate of growth may vary depending on macroeconomic conditions, regulatory changes, and the overall health of the global economy. Competition among VC firms is intensifying, leading to a more selective investment landscape with a focus on companies with strong fundamentals and demonstrable scalability. This competitiveness is pushing firms to innovate their investment strategies and portfolio management techniques to maintain a competitive edge. The increasing involvement of corporate venture capital arms also adds another layer of complexity to the market dynamics. Finally, the geographical distribution of VC investments is evolving, with previously underserved regions attracting more attention from international investors.

Several key factors are driving the growth of the venture capital funds market. Firstly, the continuous emergence of innovative technologies across various sectors, particularly in IT & Telecom, creates attractive investment opportunities for VC firms. The potential for exponential growth and high returns associated with these technologies incentivizes significant capital allocation. Secondly, the increasing number of startups and small businesses seeking funding provides a large pool of potential investees for VCs. The ease of starting a business in many countries, coupled with supportive government policies in some regions, further fuels this trend. Thirdly, the availability of ample capital from institutional investors, high-net-worth individuals, and sovereign wealth funds provides significant liquidity to the VC market. Low interest rates in previous years have also encouraged investment in higher-risk, higher-reward ventures like those funded by VC. Furthermore, the increasing sophistication of VC firms in evaluating and managing their portfolios leads to better risk mitigation and higher success rates. The evolution of various funding stages, from seed funding to later-stage investments, provides flexibility for both investors and startups, creating a robust and dynamic ecosystem. Finally, the growing trend of mergers and acquisitions within the startup landscape provides exit opportunities for VC investors, enhancing the attractiveness of VC investments and encouraging further capital inflow into the sector.

Despite its significant growth, the venture capital funds market faces several challenges. One major restraint is the inherent risk associated with investing in early-stage companies. Many startups fail, leading to losses for investors. The success of VC investments is highly dependent on various factors including market conditions, management expertise, and the overall execution of the startup’s business plan. Furthermore, regulatory uncertainty and changes in government policies can significantly impact the investment climate. Stricter regulations might increase the compliance costs and limit the flow of capital into the VC sector. The cyclical nature of the economy is another challenge, as economic downturns often lead to reduced investment activity and decreased valuations of existing portfolio companies. Competition among VC firms for attractive investment opportunities is also intense, requiring VCs to constantly refine their investment strategies and build strong networks to secure deals. Finally, the increasing difficulty in securing exits, especially in the later stages of a startup's lifecycle, can create a bottleneck for VCs and limit their ability to realize returns on their investments. This can be affected by macroeconomic factors, changes in investor sentiment, and M&A activity.

The North American region, particularly the United States, is expected to continue dominating the global venture capital funds market throughout the forecast period. This dominance stems from the high concentration of technology companies, a robust entrepreneurial ecosystem, and the availability of abundant capital. Within this region, California's Silicon Valley remains the epicenter of VC activity.

The continued dominance of the US is not only due to historical factors but also to the strength of its venture capital ecosystem. This ecosystem is characterized by a strong network of experienced investors, accelerators, incubators, and supporting infrastructure. The presence of large technology companies and a deep pool of talent also contributes to the region's enduring success. However, the global landscape is evolving, with other regions and countries actively working to develop their own vibrant startup ecosystems, potentially challenging the US's long-held dominance in the years to come.

The venture capital industry is poised for continued expansion, fueled by several key factors. The increasing adoption of digital technologies across all industries creates a fertile ground for innovative startups, attracting significant VC investments. Government initiatives aimed at supporting entrepreneurship and fostering innovation also play a vital role, while favorable macroeconomic conditions further enhance investor confidence. Additionally, the emergence of new technological paradigms like AI and the metaverse opens up new avenues for investment, promising substantial returns. Finally, the rise of diverse funding models and the evolution of fintech solutions streamline the investment process, improving efficiency and accessibility for both investors and startups.

This report provides a comprehensive analysis of the venture capital funds market, covering historical trends, current market dynamics, and future projections. It offers valuable insights into key market drivers, challenges, and opportunities, along with detailed information on leading players and significant market developments. The report also provides segment-specific analysis, allowing investors and industry stakeholders to make informed decisions based on detailed market intelligence. This information is crucial in navigating the complexities of the VC sector and optimizing investment strategies for maximum returns.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sequoia Capital Operations LLC, Andreessen Horowitz, Lightspeed Management Company, L.L.C, First Round Capital, Benchmark, Union Square Ventures, Greylock Partners, Founders Fund, Insight Partners, Bain Capital Ventures LLC, Intel Capital.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Venture Capital Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Venture Capital Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.