1. What is the projected Compound Annual Growth Rate (CAGR) of the Venture Capital Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Venture Capital Service

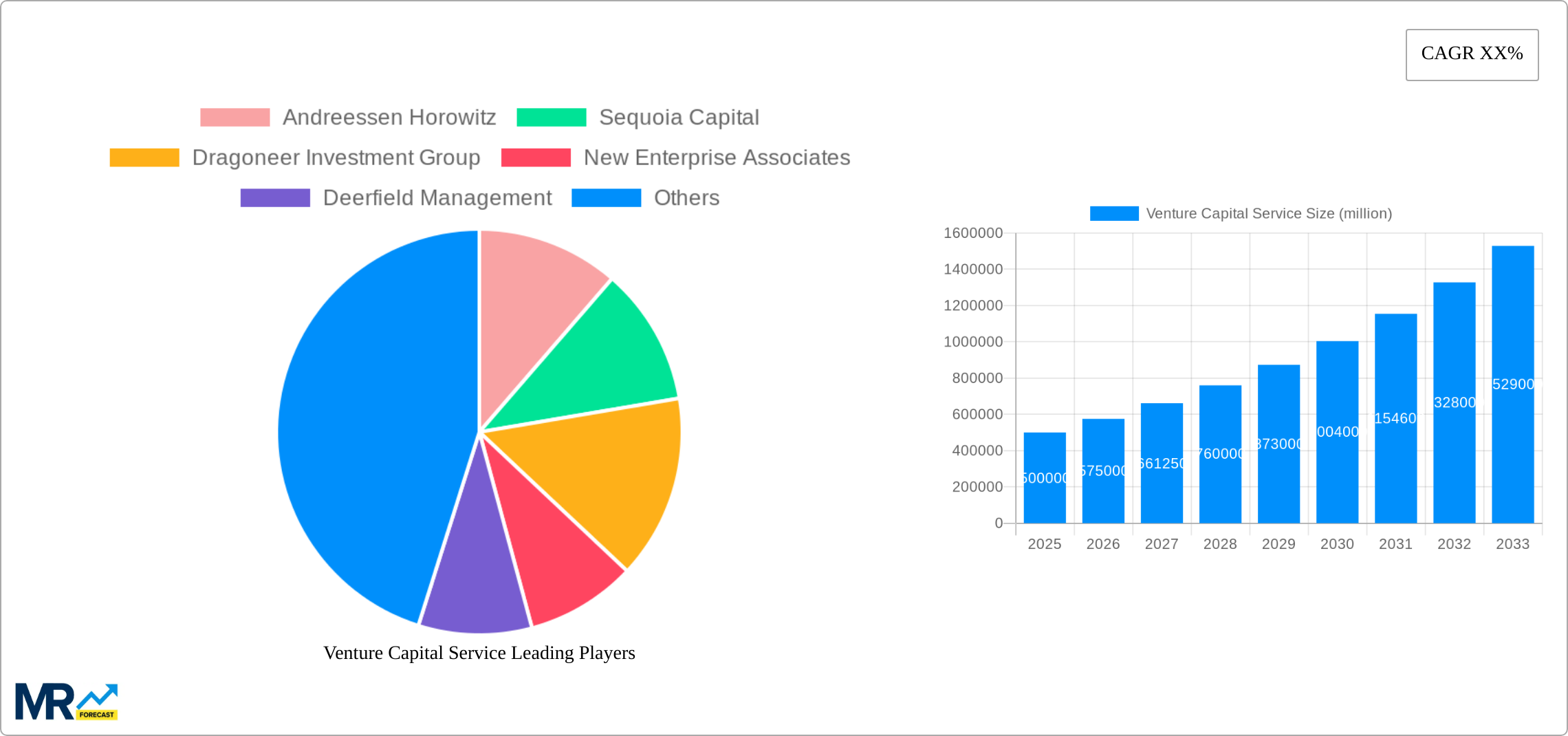

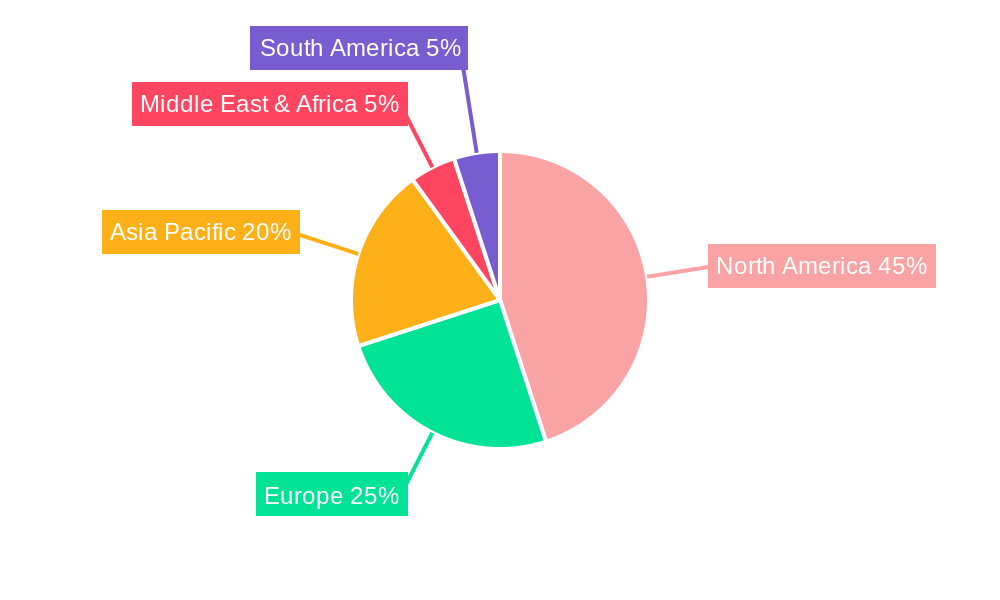

Venture Capital ServiceVenture Capital Service by Type (Capital Raised, Assets Management), by Application (Startups, Small Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Venture Capital (VC) service market is experiencing robust growth, driven by a confluence of factors. The increasing number of startups and small enterprises seeking funding, coupled with a favorable regulatory environment in several key regions, is fueling demand. Technological advancements, particularly in sectors like artificial intelligence, biotechnology, and fintech, are attracting significant VC investment, leading to a higher market valuation. Furthermore, the involvement of established players like Andreessen Horowitz, Sequoia Capital, and Dragoneer Investment Group signifies the market's maturity and the substantial capital inflow. While geopolitical uncertainties and economic downturns can pose challenges, the long-term outlook for the VC market remains positive, particularly in regions like North America and Asia-Pacific, which boast a large concentration of innovative companies and a supportive ecosystem for venture funding.

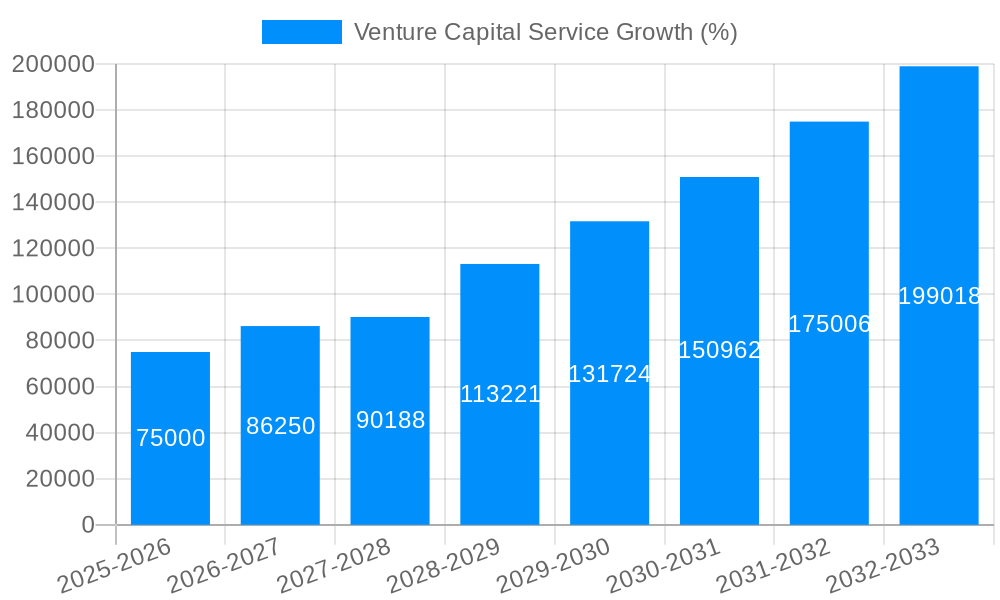

Based on a plausible CAGR (let's assume 15% for illustration) and a 2025 market size of $500 billion (a reasonable estimate given the prominent firms involved), the market is projected to experience significant expansion throughout the forecast period (2025-2033). The segmentation by capital raised, asset management, and application (startups, small enterprises) provides valuable insights into investment strategies and market dynamics. While North America currently dominates the market share, rapid growth in Asia-Pacific, particularly in China and India, is anticipated due to the burgeoning startup ecosystem in these regions. Competition among VC firms is intense, but the overall market remains highly attractive due to high returns and significant growth potential. The consistent involvement of major players indicates long-term confidence in this sector, underscoring the continued demand and promising growth trajectory of the VC service market.

The venture capital (VC) service market experienced significant growth between 2019 and 2024, fueled by a confluence of factors including increased technological innovation, a burgeoning startup ecosystem, and the availability of substantial capital from both traditional and non-traditional sources. The historical period (2019-2024) witnessed a substantial increase in funding rounds, with mega-rounds exceeding $100 million becoming increasingly common. This trend is expected to continue throughout the forecast period (2025-2033), though possibly at a moderated pace. The estimated market value for 2025 sits at several hundred billion dollars, reflecting the continued importance of VC funding for high-growth companies. The shift towards later-stage investments, particularly Series C and beyond, is a notable trend, driven by the longer timeframes required for many technology companies to achieve profitability. This has also led to increased competition among VC firms, resulting in higher valuations and more favorable terms for startups. Moreover, the geographical distribution of VC investment is becoming increasingly diverse, with regions beyond Silicon Valley attracting substantial funding. This diversification is driven by the rise of regional tech hubs and government initiatives aimed at fostering innovation. The increasing focus on ESG (environmental, social, and governance) factors in investment decisions is also shaping the VC landscape, with firms increasingly incorporating these considerations into their due diligence processes. We're also seeing a rise in specialized VC funds focused on specific industries or technologies, leading to deeper industry expertise and more targeted investment strategies. This increased specialization enables VCs to better understand the unique challenges and opportunities within specific sectors, resulting in more informed investment decisions and potentially higher returns. Finally, the emergence of alternative funding models, such as crowdfunding and angel investing, is adding another layer of complexity and competition to the market, forcing traditional VC firms to adapt and innovate.

Several key factors are driving the expansion of the venture capital service market. Firstly, the relentless pace of technological innovation continues to generate a steady stream of promising startups requiring significant capital to scale. Artificial intelligence, biotechnology, and renewable energy are just a few sectors attracting substantial VC investment. Secondly, a growing pool of high-net-worth individuals and institutional investors are actively seeking high-growth investment opportunities, contributing to the overall increase in available capital. This influx of capital fuels competition among VC firms, pushing them to identify and invest in the most promising ventures. Thirdly, government initiatives and policies designed to support entrepreneurship and innovation in various countries are also playing a significant role. Tax incentives, grants, and incubator programs are all helping to create a more favorable environment for startups, thereby attracting more VC investment. Furthermore, the increasing sophistication of VC investment strategies and analytical tools allows for better risk assessment and portfolio diversification, leading to increased investor confidence. The rise of data-driven decision-making in venture capital is facilitating more effective due diligence and improved portfolio management. Lastly, the growing interconnectedness of the global economy is facilitating cross-border investments, allowing VC firms to tap into promising opportunities in emerging markets. This global reach expands the investment landscape and creates new avenues for growth.

Despite the positive growth trends, several challenges and restraints hinder the venture capital service market. The inherent risk associated with investing in early-stage companies remains a significant concern. Many startups fail, resulting in significant capital losses for investors. Accurately assessing the risk profile of a startup and predicting its future success is a complex and challenging task, often involving significant uncertainty. Furthermore, the competitive landscape is becoming increasingly crowded, with numerous VC firms vying for the most promising investment opportunities. This fierce competition can lead to inflated valuations and less favorable terms for investors. The regulatory environment also presents challenges, with regulations regarding fundraising, disclosure, and investor protection varying across different jurisdictions. Navigating these regulatory complexities can be time-consuming and costly for VC firms. Another challenge is the difficulty in finding and evaluating talented management teams. The success of a startup often hinges on the skills and experience of its leadership team. Identifying and securing the right management team is a crucial factor in the investment decision-making process. Lastly, the macroeconomic environment can significantly impact the VC market. Economic downturns can lead to decreased investor confidence and reduced investment activity, while geopolitical instability can create additional uncertainty.

The United States continues to dominate the global venture capital market, attracting the lion's share of investment. This dominance stems from several factors, including:

However, other regions are rapidly catching up. Asia, particularly China, is witnessing significant growth in venture capital activity, driven by rapid economic expansion and a burgeoning tech sector. Europe also demonstrates strong potential, with several countries experiencing a surge in startup activity and VC investment.

Focusing on the Startups segment, the dominance of the U.S. is even more pronounced, due to:

The concentration of capital raised by startups in the US is a clear indicator of its prominence. Early-stage funding rounds continue to be abundant, allowing the startup ecosystem to flourish. In contrast, while other regions are showing growth, they are still catching up to the scale and maturity of the US startup ecosystem.

The VC service industry's growth is propelled by several catalysts: increased digitalization and technological advancements continually creating new investment opportunities; the rise of innovative business models and disruptive technologies attracting significant investor interest; a growing pool of high-net-worth individuals and institutional investors seeking higher returns; and government initiatives fostering entrepreneurship and innovation, further fueling VC activity.

This report provides a comprehensive analysis of the venture capital service market, encompassing historical data, current market trends, and future projections. It offers valuable insights into the key drivers and challenges impacting the market, identifies leading players, and highlights significant developments shaping the industry's future. The report's detailed segmentation allows for a nuanced understanding of various market aspects, including capital raised, asset management, and applications within startups and small enterprises. This thorough analysis is essential for investors, entrepreneurs, and industry stakeholders seeking to navigate this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Andreessen Horowitz, Sequoia Capital, Dragoneer Investment Group, New Enterprise Associates, Deerfield Management, Khosla Ventures, Legend Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Venture Capital Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Venture Capital Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.