1. What is the projected Compound Annual Growth Rate (CAGR) of the Ventilated FIBCs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ventilated FIBCs

Ventilated FIBCsVentilated FIBCs by Type (Two Sides, Four Sides, Other), by Application (Food & Beverages, Agriculture, Pharmaceuticals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

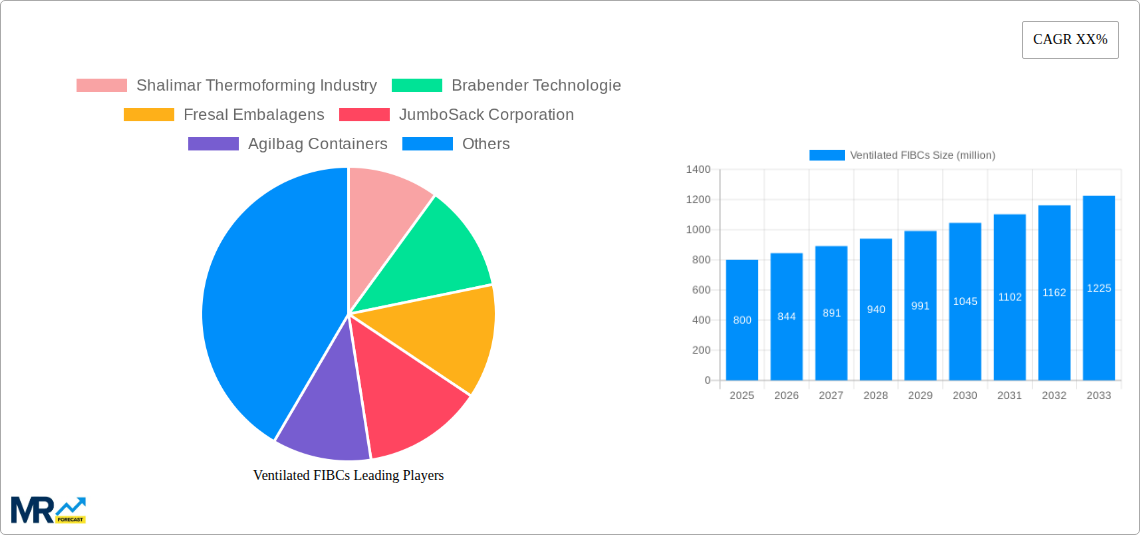

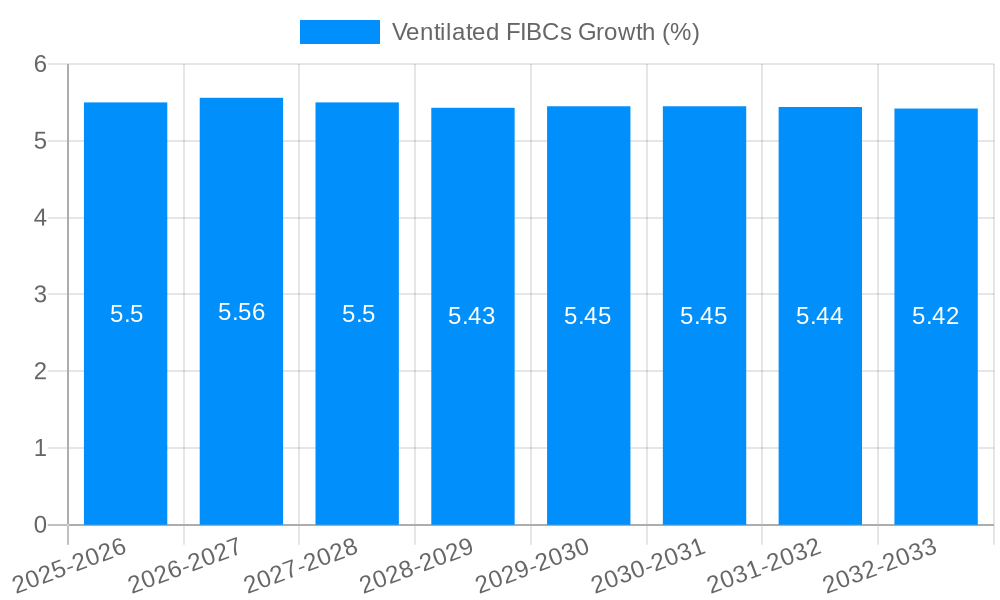

The global Ventilated FIBC (Flexible Intermediate Bulk Container) market is projected to experience robust growth, reaching an estimated market size of approximately $800 million in 2025. This expansion is driven by the increasing demand for efficient and safe packaging solutions across various industries, notably food and beverages, agriculture, and pharmaceuticals. Ventilated FIBCs offer superior airflow and moisture control, making them ideal for packaging breathable products like fresh produce, grains, and certain chemical compounds. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of around 5.5% from 2025 to 2033, indicating sustained momentum in adoption. Key drivers include the escalating need for cost-effective and reusable packaging alternatives to traditional sacks and drums, coupled with growing environmental consciousness and the emphasis on sustainable supply chains. The convenience in handling, storage, and transportation further fuels their widespread application.

Emerging trends shaping the Ventilated FIBC market include advancements in material science leading to stronger, lighter, and more eco-friendly container designs. The development of specialized ventilated FIBCs tailored for specific product requirements, such as UV resistance or enhanced breathability for temperature-sensitive goods, is also on the rise. While the market exhibits strong growth potential, certain restraints might influence the pace of expansion. These could include the fluctuating costs of raw materials, particularly polypropylene, and the initial investment required for specialized handling equipment. However, the inherent advantages of ventilated FIBCs in preserving product quality, reducing spoilage, and streamlining logistics are expected to outweigh these challenges. The market is characterized by a competitive landscape with numerous established players, and strategic collaborations and product innovations will be crucial for sustained success.

The Ventilated Flexible Intermediate Bulk Container (FIBC) market is poised for substantial expansion, driven by evolving industrial needs and a growing emphasis on efficient product handling and preservation. XXX This report provides an in-depth analysis of the Ventilated FIBCs market from 2019 to 2033, with a base year of 2025, offering valuable insights for stakeholders. The historical period (2019-2024) has witnessed a steady uptake of these specialized bulk bags, primarily due to their superior breathability and moisture control capabilities, crucial for a wide array of products. The estimated market size in the base year of 2025 is projected to be in the tens of millions of units, reflecting significant production and consumption. Looking ahead to the forecast period of 2025-2033, the market is anticipated to experience robust compound annual growth. This growth is underpinned by several key trends. Firstly, the increasing demand for agricultural products, such as grains, potatoes, and onions, which require aeration to prevent spoilage and maintain quality, is a primary driver. Secondly, the expanding food and beverage sector, particularly for products that need to breathe during transport and storage, like cocoa beans, coffee, and certain dairy products, is fueling market growth. Furthermore, the pharmaceutical industry's need for controlled environments for sensitive ingredients and intermediates, even if not directly breathable, can benefit from the controlled airflow facilitated by ventilated FIBCs in specific applications. The "Other" application segment, encompassing materials like textiles, recycling waste, and various industrial powders, also presents considerable opportunities. The market's trajectory is characterized by a continuous quest for innovative designs and materials that offer enhanced durability, recyclability, and cost-effectiveness, further solidifying the position of ventilated FIBCs as an indispensable packaging solution. The overall market sentiment points towards a sustained upward trend, making this a critical area for investment and strategic planning within the packaging industry.

Several potent forces are propelling the Ventilated FIBCs market forward, contributing to its projected growth trajectory over the study period. The paramount driver is the escalating global demand for agricultural commodities. As the world population continues to grow, the need for efficient and safe storage and transportation of grains, legumes, fruits, and vegetables intensifies. Ventilated FIBCs are uniquely suited for these products as they allow for natural air circulation, significantly reducing the risk of spoilage, mold formation, and moisture build-up, thereby preserving product quality and extending shelf life. This direct correlation between agricultural output and packaging requirements creates a consistent demand for these specialized bags. Beyond agriculture, the burgeoning food and beverage industry also plays a pivotal role. Many food items, from coffee beans and cocoa beans to specialty ingredients, require a controlled atmospheric environment during transit and storage to maintain their freshness and flavor profiles. Ventilated FIBCs offer a cost-effective and efficient solution for managing this requirement. Furthermore, the increasing awareness and adoption of sustainable packaging solutions are indirectly benefiting the ventilated FIBC market. While not inherently more sustainable than non-ventilated counterparts, their robust design and reusability contribute to reduced waste, aligning with broader environmental goals. The continuous innovation in material science and manufacturing processes is also a significant propellant, leading to the development of more durable, lighter, and cost-efficient ventilated FIBCs, making them an increasingly attractive option for a wider range of applications.

Despite the promising growth outlook, the Ventilated FIBCs market is not without its challenges and restraints, which could potentially temper its expansion. One of the primary concerns is the inherent limitation in the types of products that can be effectively packaged using ventilated FIBCs. Their breathability, while a key advantage for certain applications, makes them unsuitable for very fine powders, highly volatile chemicals, or products that require a completely sealed environment to prevent contamination or loss of contents. This limits their applicability compared to standard FIBCs. Another significant restraint is the competition from alternative packaging solutions. While ventilated FIBCs offer distinct advantages, other forms of bulk packaging, such as rigid containers, bulk bags with liners, or even smaller format packaging for highly sensitive goods, can sometimes present more suitable or cost-effective options depending on the specific application and logistical requirements. Fluctuations in raw material prices, particularly for polypropylene, a primary component in FIBC manufacturing, can impact the production costs and, consequently, the pricing of ventilated FIBCs. Volatility in these costs can create uncertainty for both manufacturers and end-users. Furthermore, stringent regulatory compliance and quality control standards, especially for applications in the food, pharmaceutical, and agricultural sectors, can pose a challenge. Ensuring that ventilated FIBCs meet specific food-grade certifications, UV resistance requirements, or load-bearing capacities necessitates rigorous testing and adherence to international standards, adding to the operational complexity and cost. Finally, the logistical complexities associated with transporting and handling bulk quantities of even flexible packaging can sometimes present challenges in certain infrastructure-limited regions.

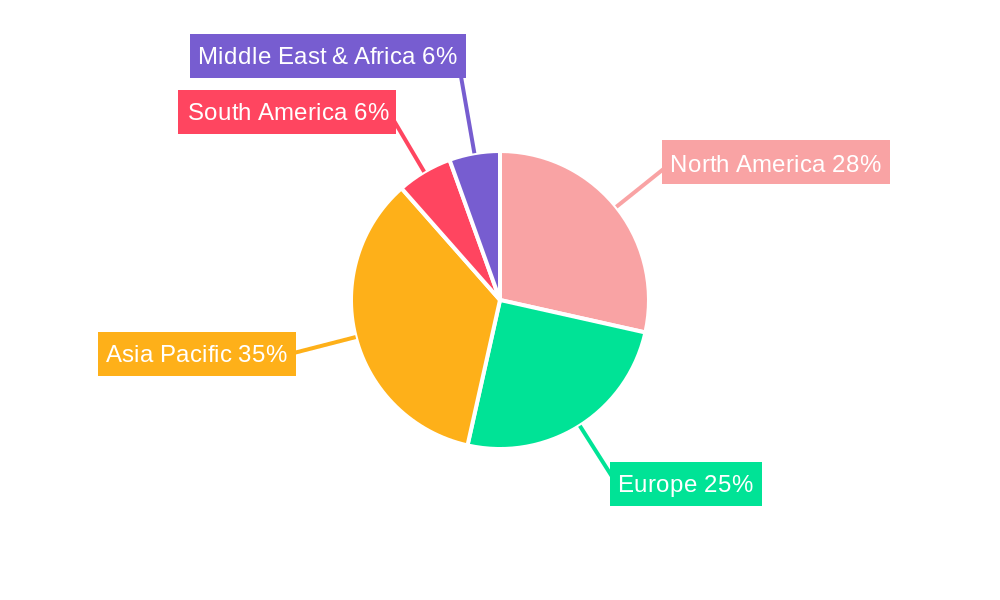

The Ventilated FIBCs market is expected to witness significant dominance from specific regions and segments over the forecast period. Among the segments, Food & Beverages stands out as a key contributor to market growth.

Dominance of Food & Beverages Segment: The increasing global consumption of processed and raw food products, coupled with a growing emphasis on maintaining freshness and quality during transit and storage, positions the Food & Beverages segment as a primary driver. This segment benefits immensely from the breathability offered by ventilated FIBCs, which is crucial for products like:

The estimated consumption of ventilated FIBCs for the Food & Beverages sector is projected to reach tens of millions of units annually by the base year 2025 and is expected to see a substantial CAGR during the forecast period (2025-2033). This sustained demand is fueled by evolving consumer preferences for high-quality, fresh food products and the globalized nature of the food supply chain.

Emerging Dominance in Asia-Pacific: Geographically, the Asia-Pacific region is anticipated to emerge as a dominant market for Ventilated FIBCs. This dominance is attributed to several intertwined factors:

While other regions like North America and Europe also represent significant markets, the sheer scale of agricultural production, the burgeoning food industry, and the growing economic dynamism of the Asia-Pacific region position it to be the leading force in the global Ventilated FIBCs market in the coming years. The market in this region is projected to account for a significant share of the global market size, estimated to be in the tens of millions of units annually by 2025, with a projected growth trajectory exceeding other regions.

The Ventilated FIBCs industry is propelled by several key growth catalysts. The escalating global population and increasing demand for food security are driving the need for efficient agricultural product handling and preservation, directly benefiting ventilated FIBCs. Furthermore, the expanding food and beverage processing sectors, particularly in emerging economies, are creating a sustained demand for packaging solutions that maintain product quality. Innovations in material science are leading to the development of more durable, cost-effective, and sustainable ventilated FIBCs, broadening their application scope. The growing emphasis on reducing food waste and spoilage throughout the supply chain also acts as a significant catalyst, as ventilated FIBCs play a crucial role in preserving product integrity.

This comprehensive report delves into the intricate landscape of the Ventilated FIBCs market, offering a detailed exploration of its trends, drivers, challenges, and future prospects. The study encompasses a broad spectrum of data, from the historical performance during 2019-2024 to the projected growth from 2025-2033, with 2025 serving as the base and estimated year. It meticulously analyzes key market segments such as Type (Two Sides, Four Sides, Other) and Application (Food & Beverages, Agriculture, Pharmaceuticals, Others), identifying areas of significant demand and potential. The report highlights industry-specific developments, technological advancements, and regional market dynamics, providing actionable intelligence for stakeholders to strategically position themselves. With an estimated market size projected to be in the tens of millions of units by 2025, this analysis is crucial for understanding the evolving needs of industries reliant on efficient bulk packaging solutions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shalimar Thermoforming Industry, Brabender Technologie, Fresal Embalagens, JumboSack Corporation, Agilbag Containers, Berg Bag Company, Capro Industries, Grayling Industries, Global-Pak Inc., Karur K.C.P. Packagings Ltd, Jet Tech Pvt Ltd, LC Packaging, Kingswell Industries, Allied Propack Pvt Ltd, Paglierani Srl, Bulk Lift International, Daman Polyfabs, Eastco Industries (Group) Corp, AceBulk Co., Ad-Manum Packagings Ltd, Fischer Bag Company, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ventilated FIBCs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ventilated FIBCs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.