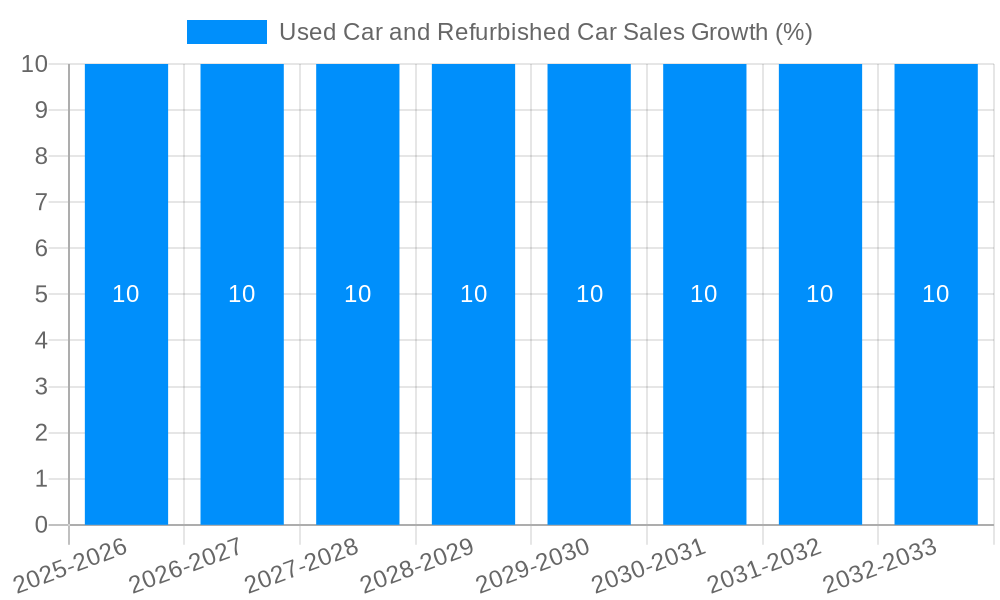

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car and Refurbished Car Sales?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Car and Refurbished Car Sales

Used Car and Refurbished Car SalesUsed Car and Refurbished Car Sales by Type (Gasoline, Diesel, Bio-fuels, Compressed Natural Gas (CNG), Liquefied Petroleum Gas (LPG), Hybrid, Others), by Application (Franchise, Independent, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

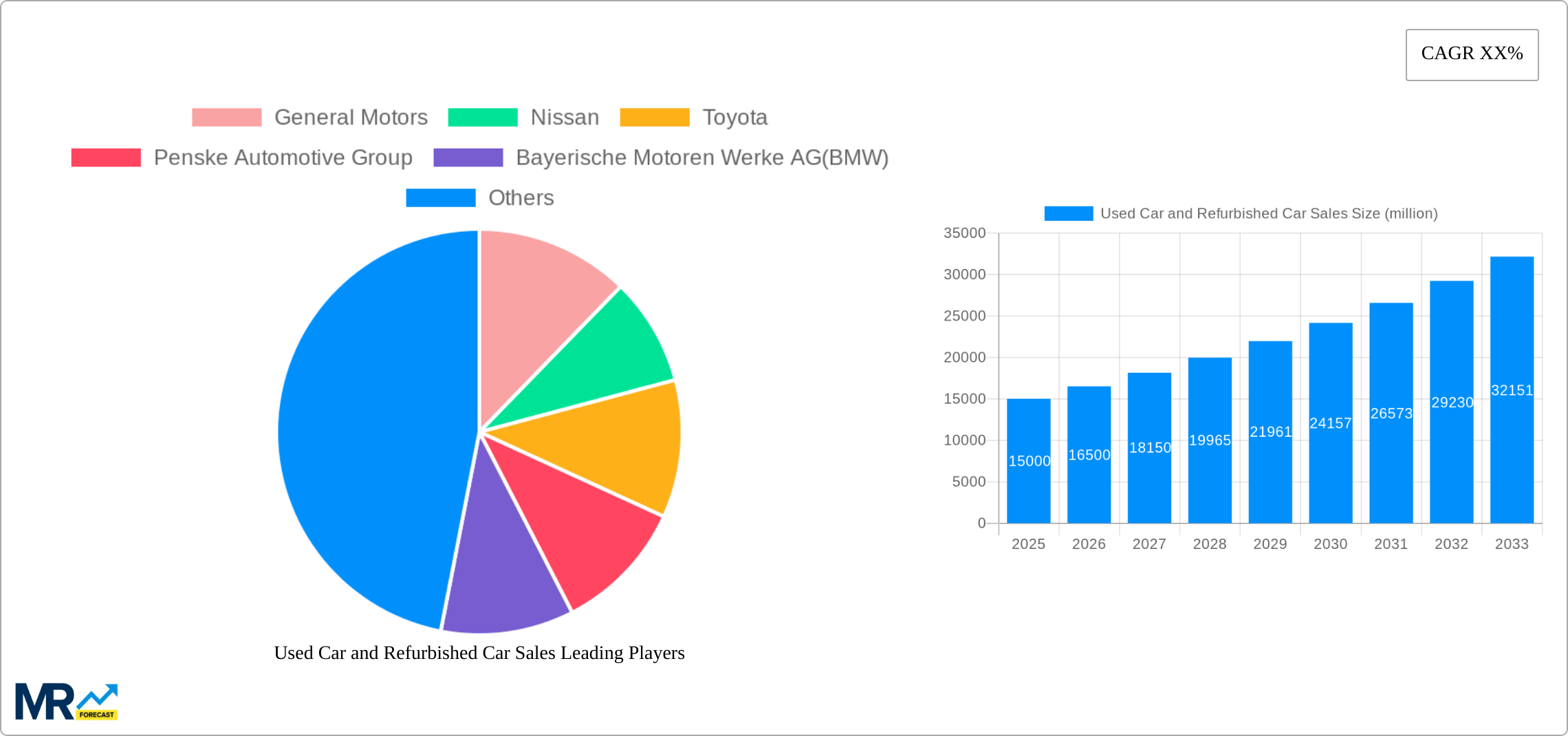

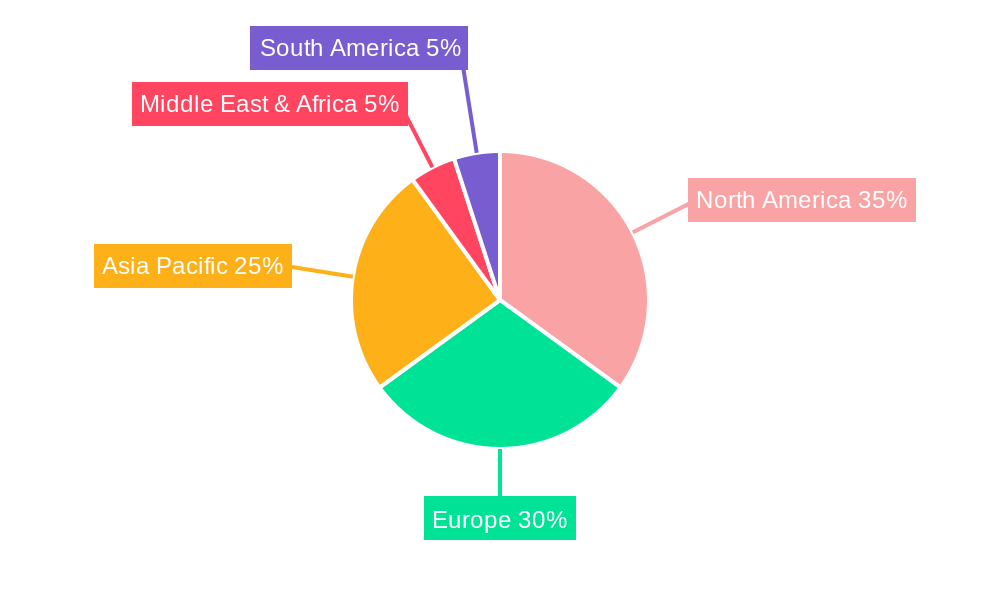

The used and refurbished car market is experiencing robust growth, driven by increasing consumer preference for affordability and the rising cost of new vehicles. This segment offers significant value propositions, including lower purchase prices, reduced depreciation, and a wider selection of models and features compared to the new car market. Factors such as the rising popularity of online car marketplaces, improved vehicle refurbishment technologies, and extended vehicle warranties are further fueling market expansion. While economic downturns can temporarily impact sales, the long-term outlook remains positive, supported by a consistent demand for pre-owned vehicles across various segments, including gasoline, diesel, and alternative fuel options like CNG and LPG. The diverse application segments, spanning franchise dealerships, independent sellers, and online platforms, contribute to the market's dynamism and accessibility. Leading players like General Motors, Toyota, and CarMax are leveraging technological advancements and strategic partnerships to enhance the customer experience and capture market share within this rapidly evolving landscape. Geographic variations exist, with North America and Europe currently holding substantial market shares, although Asia Pacific shows significant growth potential due to expanding middle-class populations and increasing vehicle ownership rates.

The competitive landscape is characterized by a mix of established automotive manufacturers, large dealership groups, and online platforms. Successful strategies involve leveraging data analytics for precise pricing and inventory management, offering flexible financing options, and providing comprehensive vehicle history reports to build consumer trust. Challenges include managing the complexities of used vehicle quality control, ensuring transparent pricing, and mitigating the risks associated with potential mechanical issues. The industry is actively addressing these challenges through advancements in vehicle inspection technologies and the development of more robust certification programs. Future growth will likely be shaped by the increasing integration of electric and hybrid vehicles into the used car market, along with the adoption of innovative sales and service models that leverage technology to improve the customer journey. Sustainable practices within refurbishment processes, aiming to reduce environmental impact, will also become increasingly important.

The used car and refurbished car sales market experienced significant growth between 2019 and 2024, exceeding 100 million units annually by 2024. This surge was driven by a confluence of factors, including rising new car prices, supply chain disruptions impacting new vehicle production, and a shift in consumer preferences towards pre-owned options. The estimated market size in 2025 sits at approximately 115 million units, representing a considerable increase from the historical period. The forecast for 2025-2033 projects continued, albeit potentially moderated, growth, with a projected market size exceeding 150 million units annually by 2033. Key market insights reveal a strong preference for gasoline-powered vehicles within the used car segment, driven largely by their affordability and widespread availability. However, a noticeable trend shows increasing demand for hybrid and alternative fuel vehicles, reflecting a growing environmental consciousness among consumers. The independent segment continues to dominate the application side, offering a broader range of choices and price points compared to franchise dealerships. Furthermore, the increasing digitalization of the used car market, fueled by online marketplaces and vehicle history report services, is streamlining the buying process and boosting transparency. This digital shift has significantly influenced consumer behavior, leading to more informed purchasing decisions and a more competitive marketplace. The emergence of certified pre-owned programs offered by manufacturers further adds to consumer confidence in the quality and reliability of used vehicles. The geographic distribution of sales varies significantly across regions, with developed markets showing slightly slower growth than emerging economies experiencing rapid automotive penetration.

Several key factors are propelling the robust growth within the used car and refurbished car sales market. Firstly, the escalating prices of new vehicles, often exacerbated by inflation and semiconductor shortages, make used cars a significantly more affordable alternative for a large portion of the population. This price disparity is particularly compelling for first-time car buyers and budget-conscious individuals. Secondly, the increasing availability of certified pre-owned vehicles, backed by warranties and rigorous inspections, enhances consumer trust and reduces the perceived risk associated with buying a used car. The improved quality and reliability of used vehicles directly contribute to increased demand. Thirdly, the rise of online marketplaces and digital platforms has revolutionized the used car buying experience, simplifying the search process and allowing for price comparisons across a wider selection of vehicles. This transparency and convenience are crucial in attracting a broader consumer base. Finally, the growing focus on sustainable transportation options is pushing a demand for used hybrid and electric vehicles, creating a niche market with increasing growth potential. The overall impact of these drivers is a significant expansion of the used car market, surpassing predictions in certain segments. Increased consumer confidence, technological advances, and economic factors are all converging to bolster the sector's continuing expansion.

Despite the significant growth, the used car and refurbished car sales market faces several challenges and restraints. One significant hurdle is the inherent uncertainty regarding the vehicle's history and condition. Consumers often lack the technical expertise to assess the mechanical integrity of a used car, leading to potential risks of hidden defects and costly repairs. This necessitates reliance on vehicle history reports and certified pre-owned programs, but these measures can still be insufficient for all consumers. The varying quality of used vehicles also presents a challenge, with inconsistent maintenance and repair histories leading to unpredictable reliability issues. This inconsistency impacts consumer confidence and can potentially deter potential buyers. Furthermore, fluctuating used car prices due to market supply and demand dynamics can create uncertainty for both buyers and sellers. Finally, stringent emission regulations in certain regions may limit the marketability of older, less environmentally friendly vehicles, particularly affecting the sales of gasoline and diesel-powered used cars in the long term. Addressing these challenges requires increased transparency, better quality control mechanisms, and consumer education to ensure sustainable and reliable growth within the sector.

The used car market shows a diverse geographical distribution of sales. However, several key regions and segments are expected to lead the market's growth over the forecast period.

Gasoline Vehicles: Gasoline-powered vehicles are projected to continue dominating the used car market through 2033, largely due to their established infrastructure, affordability, and widespread availability. While the shift towards electric and hybrid vehicles is gaining momentum, gasoline-powered cars remain the most accessible option for a significant portion of the consumer base. The sheer number of gasoline-powered vehicles on the road contributes significantly to their dominance in the used car market. The lower initial cost and readily available parts and services make this segment particularly attractive.

Independent Dealerships: The independent segment within the application category is anticipated to maintain its market share dominance. Independent dealers provide a wider variety of vehicles at different price points, catering to a broader range of consumer needs and budgets. They offer a higher level of flexibility compared to franchise dealerships, contributing to their competitive edge. This flexibility also allows them to react to fluctuating market trends faster and more efficiently than large-scale dealerships. Their localized knowledge of the market contributes to their success. Furthermore, independent dealers often provide more personalized customer service.

North America: The North American market is expected to retain a significant share of the global used car market, reflecting the region's high car ownership rates and established vehicle infrastructure. The large number of vehicles on the road ensures a steady supply of used cars. The relatively strong economy in certain parts of the region continues to drive consumer demand. However, growth in this region might be slower in comparison to emerging markets, which will be a significant part of the market growth.

Emerging Markets (Asia-Pacific & South America): Emerging economies in the Asia-Pacific and South American regions show enormous potential for growth. Rapid economic expansion, growing middle classes, and increasing car ownership rates in these regions will contribute substantially to the expansion of the used car market. The increasing affordability of used vehicles relative to new vehicles is a major driver of this growth in these regions. As these economies continue to develop, the increased demand for personal transportation will further bolster the used car market.

Several factors are catalyzing growth within the used car and refurbished car sales industry. The increasing affordability of used vehicles compared to new cars, driven by rising new car prices and supply chain constraints, is a major driver. Furthermore, the expanding digitalization of the used car market, through online platforms and enhanced vehicle history reports, improves transparency and streamlines the purchasing process. This increased consumer confidence, coupled with the rise of certified pre-owned programs, is fueling market expansion. Finally, the growing environmental consciousness is boosting demand for used hybrid and electric vehicles, creating a significant niche market with impressive growth potential.

This report provides a comprehensive analysis of the used car and refurbished car sales market, encompassing historical data, current market insights, and future projections. It delves into market drivers, challenges, leading players, and emerging trends, offering a detailed understanding of this dynamic sector and its potential for continued expansion over the next decade. The report's key value lies in its detailed segmentation and geographical analysis, providing a granular view of market performance across various regions and vehicle types. This information allows for informed decision-making for businesses and stakeholders in the used car and refurbished car market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include General Motors, Nissan, Toyota, Penske Automotive Group, Bayerische Motoren Werke AG(BMW), Chevrolet, Mahindra First Choice, Maruti Suzuki India Limited, Tata Motors Assured, Asbury Automotive Group, Auto Trader Group plc, CarWoo, CarMax, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Used Car and Refurbished Car Sales," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Car and Refurbished Car Sales, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.