1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Refurbished Electronics?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Used Refurbished Electronics

Used Refurbished ElectronicsUsed Refurbished Electronics by Type (Smart Phone, Household Appliances, Wearables, Others, World Used Refurbished Electronics Production ), by Application (Corporate Offices, Schools and Colleges, Individuals, Others, World Used Refurbished Electronics Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

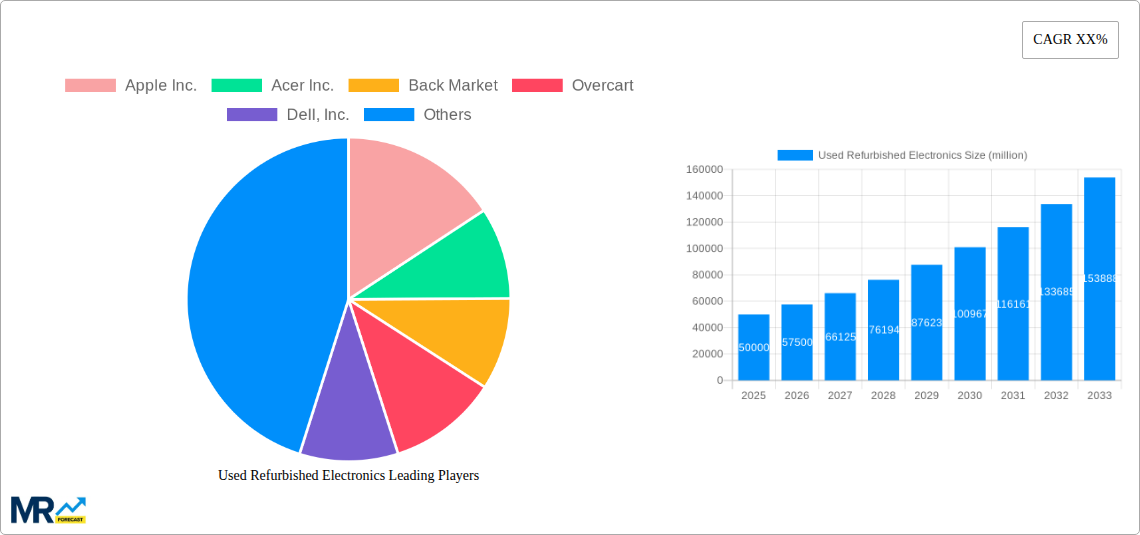

The global used and refurbished electronics market is experiencing robust growth, driven by increasing environmental awareness, the rising cost of new electronics, and a growing preference for budget-friendly options. The market encompasses a wide range of devices, including smartphones, household appliances, and wearables, catering to diverse user segments such as individuals, corporate offices, and educational institutions. While smartphones currently dominate the market share, the wearables segment is poised for significant expansion due to increasing adoption of smartwatches and fitness trackers. The market's expansion is further fueled by the rise of e-commerce platforms specializing in refurbished electronics, offering consumers greater accessibility and trust. Key players in this competitive landscape include established tech giants like Apple and Samsung, alongside specialized refurbishment companies and online marketplaces. Geographical distribution shows strong demand in North America and Europe, while the Asia-Pacific region, particularly India and China, presents significant growth potential due to increasing disposable incomes and expanding consumer electronics markets. Challenges include concerns about product quality and the need for robust certification and warranty programs to build consumer confidence. Overcoming these hurdles will be crucial for sustaining the market's trajectory and tapping into its full potential.

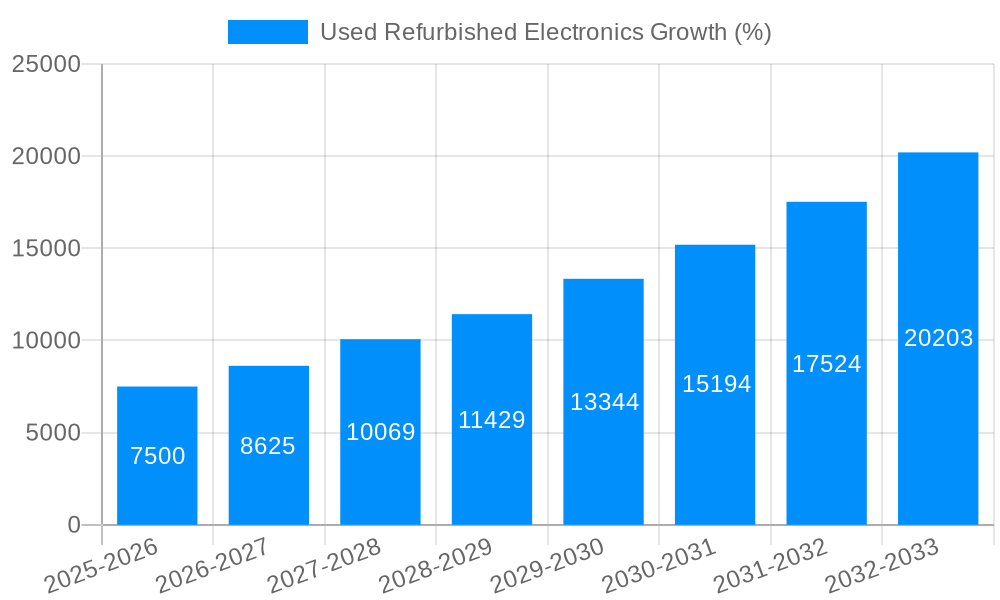

The forecast period (2025-2033) anticipates a sustained upward trend, influenced by technological advancements leading to longer product lifecycles and the increasing focus on circular economy principles. Government initiatives promoting e-waste management and sustainable consumption patterns are expected to further bolster the market. However, fluctuations in raw material prices and potential disruptions in global supply chains could pose moderate risks. Specific segment growth will depend on factors such as technological innovation within each category, pricing strategies, and the effectiveness of marketing campaigns aimed at increasing consumer awareness and trust in the quality and reliability of refurbished products. Successfully navigating these dynamics will be critical for both established players and emerging companies seeking a share of this dynamic and expanding market.

The used and refurbished electronics market is experiencing explosive growth, projected to reach multi-million unit sales by 2033. Driven by increasing environmental awareness, economic constraints, and the inherent longevity of modern electronics, this sector is transforming how consumers and businesses acquire technology. From smartphones and laptops to household appliances and wearables, the demand for pre-owned devices is steadily rising. The market's expansion isn't merely about affordability; it's also fueled by a growing understanding of the environmental impact of e-waste. Refurbishing extends the lifespan of existing electronics, reducing the need for new manufacturing and minimizing the electronic waste burden on the planet. The emergence of online marketplaces specializing in refurbished goods has further streamlined the process, making it easier than ever for consumers to access quality pre-owned electronics with warranties and guarantees. This trend is significantly impacting major players in the electronics industry, prompting them to develop and incorporate sustainable practices into their supply chains. The increasing availability of certified refurbished products directly from original equipment manufacturers (OEMs) itself signifies a major shift. Finally, the adoption of circular economy principles further supports the growth of this market segment, indicating its position as a viable and sustainable alternative to purchasing new devices. The market is segmented based on device type (smartphones, household appliances, wearables, and others) and application (corporate offices, schools, individuals, and others). Smartphones and individual consumers represent substantial segments within this dynamic landscape. The historical period (2019-2024) shows a steady increase in sales, laying a strong foundation for the impressive forecast period (2025-2033) indicating millions of units in annual sales.

Several key factors are propelling the growth of the used and refurbished electronics market. Firstly, the rising cost of new electronics is making refurbished options increasingly attractive to budget-conscious consumers and businesses. Secondly, the growing environmental awareness among consumers is driving demand for sustainable alternatives. Refurbishing extends the lifespan of electronics, reducing e-waste and lessening the environmental impact associated with manufacturing new products. Thirdly, the improved quality and reliability of refurbished electronics, often backed by warranties from reputable sellers, are building consumer confidence. The availability of certified pre-owned devices directly from major brands like Apple and Samsung further adds to this confidence. Fourthly, the expansion of online marketplaces dedicated to refurbished goods simplifies the purchase process and increases accessibility. Finally, the increasing focus on the circular economy and sustainable consumption patterns globally is further bolstering the growth of this sector, transforming it from a niche market to a mainstream alternative for technological needs.

Despite its impressive growth, the used and refurbished electronics market faces several challenges. One major hurdle is the perception of quality and reliability. While many reputable companies offer high-quality refurbished products with warranties, some consumers remain hesitant about purchasing used items, worrying about potential malfunctions or hidden defects. Another challenge is the lack of standardization in the refurbishment process. The inconsistency in quality control across different vendors can affect consumer trust. Furthermore, the logistics and infrastructure needed to efficiently collect, refurbish, and distribute used electronics pose significant operational hurdles. Finally, the effective management of data security and privacy concerns related to pre-owned devices requires ongoing effort and attention across the entire supply chain. Addressing these challenges through standardization, improved quality control, and increased consumer education is crucial for continued market expansion.

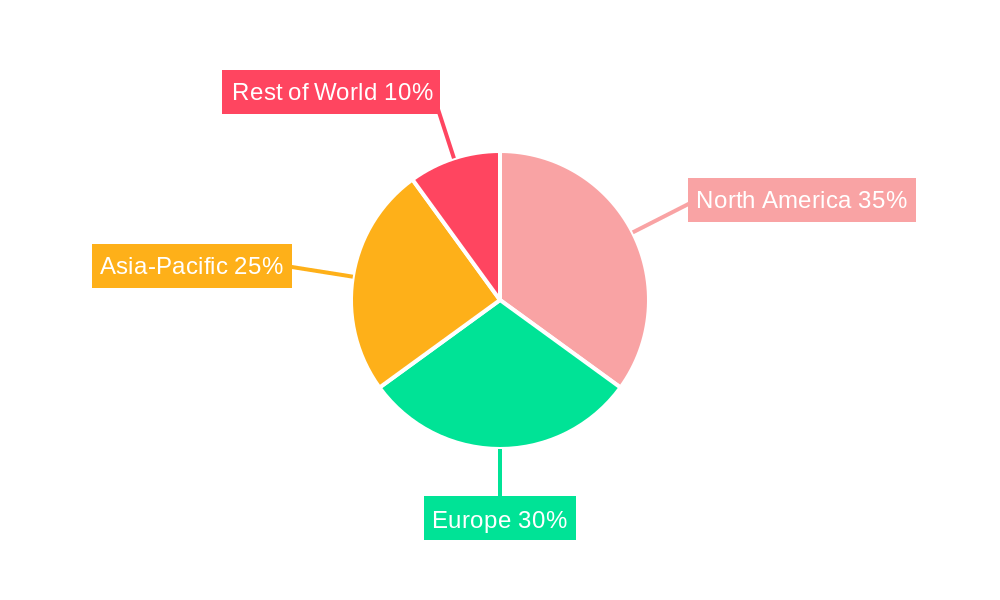

The global used and refurbished electronics market is expected to show significant growth across various regions, but certain segments and geographies are poised to dominate.

North America & Europe: These regions are anticipated to lead the market due to high consumer awareness of environmental sustainability and a higher purchasing power for pre-owned electronics. The established e-commerce infrastructure in these areas further supports the industry’s growth.

Smartphone Segment: The smartphone segment is projected to hold the largest market share due to the high replacement rate of smartphones and the availability of a vast number of used devices entering the market. Consumers upgrade their devices frequently, making the refurbished market a significant source for affordable alternatives.

Individual Consumers: This segment will constitute the largest application-based market segment. Individuals are the primary drivers of demand for affordable, yet reliable, refurbished electronics. Factors like budget constraints and environmental consciousness significantly influence their purchasing decisions.

Asia-Pacific (excluding China): This region is showing rapid growth, driven by increasing disposable incomes and a growing tech-savvy population. While the sheer scale of China’s market is impressive, the emerging markets within Asia-Pacific are displaying particularly strong potential.

In Paragraph Form:

The used and refurbished electronics market is geographically diverse, with North America and Europe leading due to strong environmental awareness and robust e-commerce infrastructure. However, significant growth is also anticipated in the Asia-Pacific region (excluding China), fueled by rising disposable incomes and a burgeoning tech-savvy consumer base. In terms of product segments, smartphones dominate due to high replacement rates, while the individual consumer sector represents the largest application-based segment. These segments interact dynamically – the high demand for affordable smartphones from individual consumers is directly driving the growth of the used and refurbished smartphone market. This convergence of geographical and segment-specific factors creates a vibrant and dynamic market landscape with significant future growth prospects.

The used and refurbished electronics industry is experiencing significant growth propelled by rising consumer awareness of environmental sustainability, increasing affordability compared to new products, and the development of robust online marketplaces that provide trust and transparency. The rise of the circular economy further supports this trend, encouraging responsible consumption and waste reduction. The growing confidence in the quality and reliability of refurbished electronics, often backed by warranties, is a key factor in this expanding market.

This report offers a comprehensive analysis of the used and refurbished electronics market, covering key trends, drivers, challenges, and leading players. It provides valuable insights into the market's growth potential, highlighting significant segments and regions, and offering forecasts up to 2033. The report also addresses critical factors such as sustainability, data security, and market dynamics, making it a useful resource for businesses and investors interested in this rapidly growing sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Apple Inc., Acer Inc., Back Market, Overcart, Dell, Inc., HP Inc., Amazon.com, Inc., ASUSTeK Computer Inc., Samsung Electronics Co., Ltd., Lenovo Group Ltd., Reboot Systems India Private Limited.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Used Refurbished Electronics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Used Refurbished Electronics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.