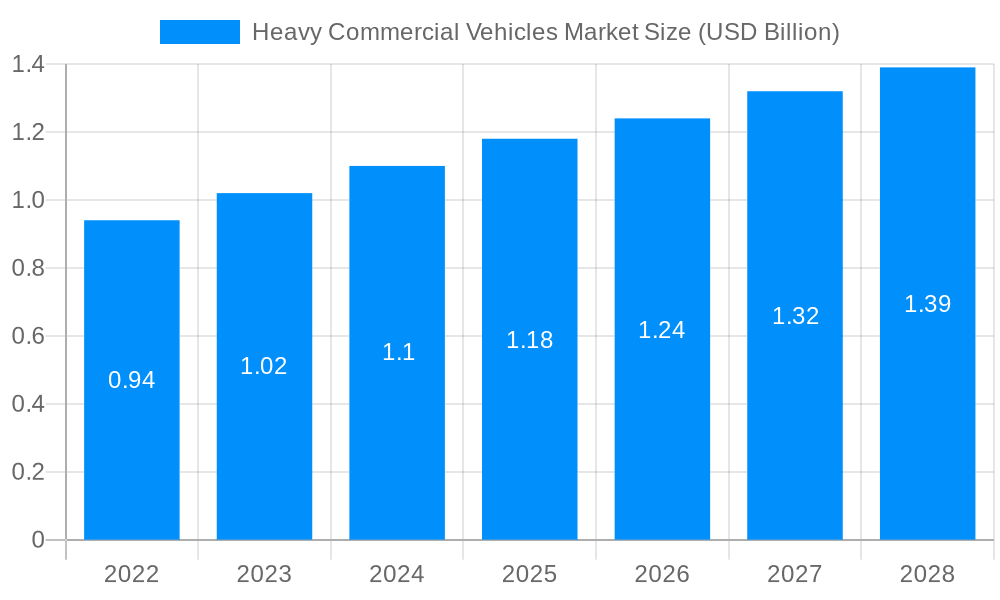

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Commercial Vehicles Market?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy Commercial Vehicles Market

Heavy Commercial Vehicles MarketHeavy Commercial Vehicles Market by Powertrain (ICE, BEV, HEV/PHEV, LPG & Others, Fuel Cell), by Class (Class 7, Class 8), by Type (Tractor Units (6x4 Axle, 6x6 Axle, Others), by Application (Transportation, Construction, Mining, Agriculture), by North America (U.S., Canada, Mexico), by Europe (Germany, France, U.K., Russia, Italy, Switzerland, Rest of Europe), by Asia Pacific (China, Japan, India, South Korea, Vietnam, Philippines, Australia, Indonesia, Rest of Asia Pacific), by South America (Chile, Brazil, Argentina, Peru, Rest of South America), by Middle East & Africa (Egypt, Turkey, Saudi Arabia, South Africa, Rest of the Middle East & Africa) Forecast 2026-2034

The size of the Heavy Commercial Vehicles Market was valued at USD 210.72 USD Billion in 2023 and is projected to reach USD 264.49 USD Billion by 2032, with an expected CAGR of 3.3% during the forecast period. Heavy Commercial Vehicles (HCVs) are large vehicles primarily designed for transporting goods, materials, or passengers on highways and roads. These vehicles typically have a gross vehicle weight (GVW) of over 3.5 tons and include trucks, lorries, trailers, and buses. HCVs play a vital role in logistics, construction, and public transportation, supporting industries by enabling the movement of large volumes of cargo and passengers over long distances. Due to their size and weight, HCVs are subject to specific regulations concerning safety, emissions, and road usage. They are integral to global supply chains, urban infrastructure, and economic development.

Key Regions & Countries

Key Segments

This comprehensive report on the Heavy Commercial Vehicles Market offers a detailed and insightful analysis of market size, growth trajectories, key drivers, prevalent challenges, and the competitive landscape. The report's key features include:

Companies in the heavy commercial vehicles market employ various pricing strategies to gain competitive advantage. Some common strategies include:

DROCs (direct relationships with operating companies) represent strategic partnerships between heavy commercial vehicle manufacturers and major fleet operators. These collaborations offer significant advantages to both parties:

Benefits to Manufacturers:

Benefits to Fleet Operators:

Strengths:

Weaknesses:

Opportunities:

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

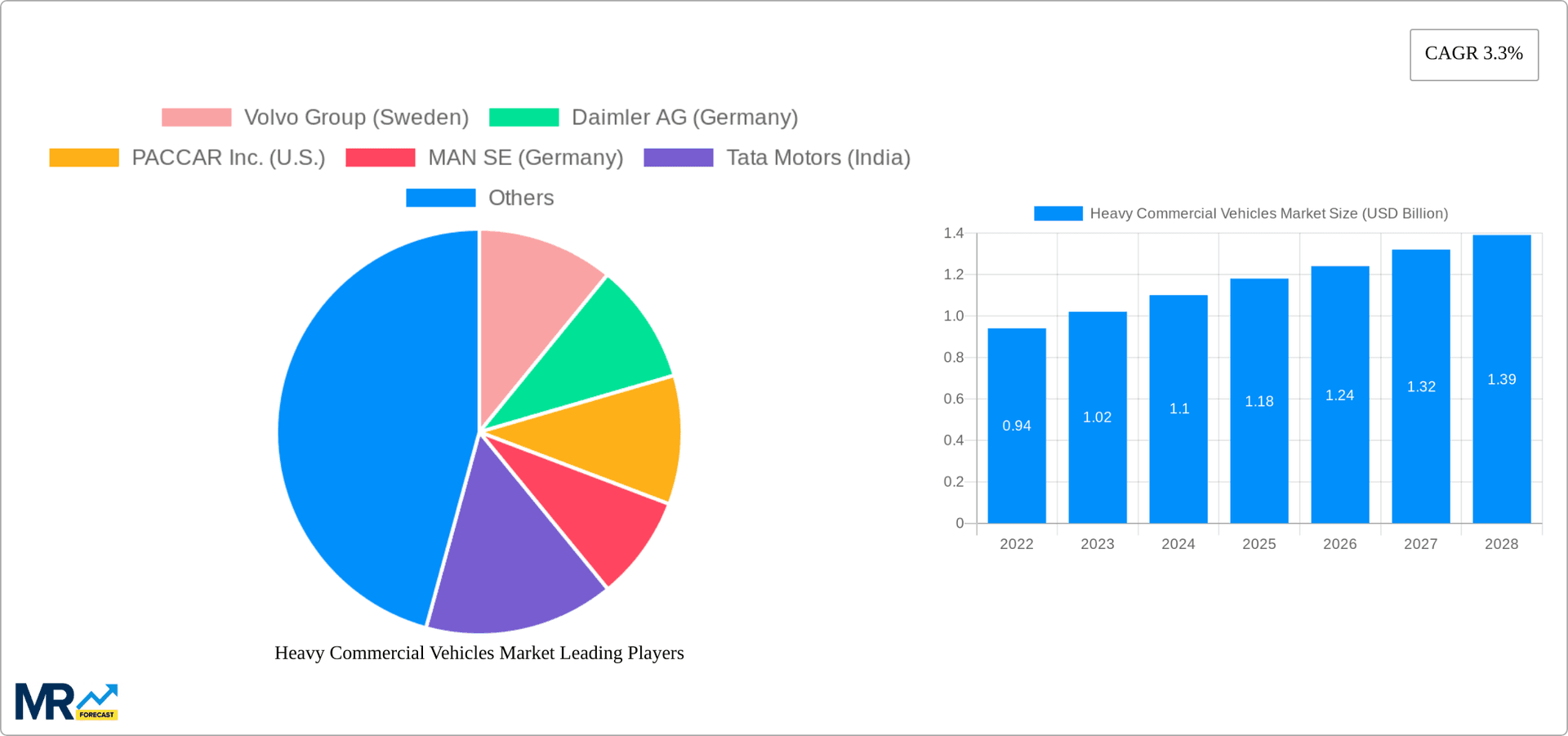

Key companies in the market include Volvo Group (Sweden), Daimler AG (Germany), PACCAR Inc. (U.S.), MAN SE (Germany), Tata Motors (India), Ashok Leyland (India), BharatBenz (India), Eicher Motors Limited (India), Ford Motor Company (U.S.), General Motors (U.S.), Scania AB (Sweden), Hyundai Motor (South Korea), Dongfeng Motor Corporation (China), Shaanxi Automobile Group (China), CNHTC (China National Heavy Duty Truck Group) (China), FAW Group (China), Isuzu Motors (Japan), Volkswagen Truck & Bus (Germany).

The market segments include Powertrain, Class, Type, Application.

The market size is estimated to be USD 210.72 USD Billion as of 2022.

Rising E-commerce Boom and Online Shopping Amplify Product Demand.

Rising E-commerce Boom and Online Shopping Amplify Product Demand.

Rising E-commerce Boom and Online Shopping Amplify Product Demand.

May 2024: Penske Truck Leasing, Daimler Truck North America (DTNA), and Carrier Transicold formed a strategic partnership and introduced an all-electric refrigerated medium-duty truck, tailored for leasing customers transporting temperature-sensitive cargo. This innovative vehicle integrates a Class 7 Freightliner eM2 battery-electric box truck with Carrier Transicold’s Supra e11 eCool electric refrigeration unit, housed within a 26-ft. refrigerated body. The offering is designed specifically for regional and local fleets that are aiming to meet regulatory requirements or transition to cleaner, more sustainable solutions for the distribution of food and other perishable products.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4850, USD 5850, and USD 6850 respectively.

The market size is provided in terms of value, measured in USD Billion and volume, measured in K Units.

Yes, the market keyword associated with the report is "Heavy Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.