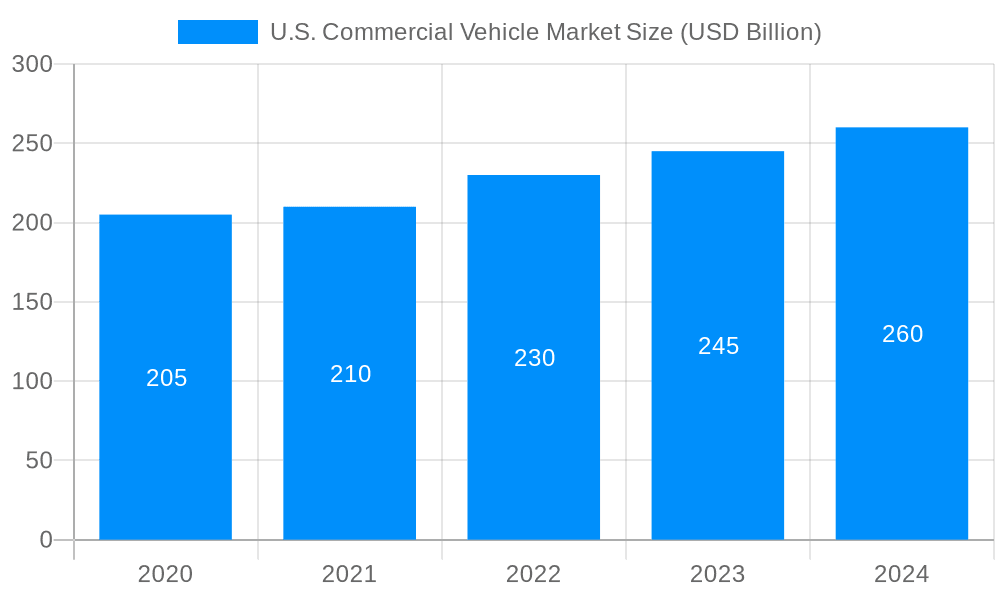

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Commercial Vehicle Market?

The projected CAGR is approximately 10.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

U.S. Commercial Vehicle Market

U.S. Commercial Vehicle MarketU.S. Commercial Vehicle Market by Vehicle Type (Light Commercial Vehicles, Medium Commercial Vehicles, Heavy Commercial Vehicles), by Propulsion Type (ICE, BEV, Hybrids, FCEVs), by Forecast 2026-2034

The U.S. Commercial Vehicle Market size was valued at USD 581.31 USD Billion in 2023 and is projected to reach USD 1161.96 USD Billion by 2032, exhibiting a CAGR of 10.4 % during the forecast period. A commercial vehicle is an automobile that is used for business purposes and not for personal uses. Some of the familiar uses of commercial vehicles include transporting cargo, machinery, or people for business reasons. These vehicles include trucks, vans, buses, and trailers for commercial use, all of which are designed uniquely to suit business necessities. Commercial vehicles often have powertrain systems such as powerful engines, structural framework, and body such as extra car capacity for carrying goods and easy loading and offloading. In general, there are several advantages of using commercial vehicles, these are higher efficiency, affordable transport services, as well as the ability to do more business. Current trends in the US market can be attributed to the customer’s inclinations towards green solutions and innovations in technology preference the technological usage of trucks and vans in an environmentally responsible manner due to certain environmental policies that have been passed to curb on emission and fuel consumption.

Globally, North America stands out as the largest and most influential market for commercial vehicles, closely followed by Europe and the Asia-Pacific region. Within North America, the United States plays a dominant role, contributing over 70% to the region's total revenue generated by commercial vehicle sales and services. On a global scale, China commands the largest market share within the Asia-Pacific landscape, while Germany leads the European market in commercial vehicle penetration and innovation.

Pricing strategies vary depending on the type of vehicle, propulsion system, and manufacturer. Electric and autonomous vehicles tend to be more expensive than traditional diesel vehicles. However, government incentives and rebates may reduce the cost of these vehicles.

The market is segmented based on the following factors:

Strengths:

Weaknesses:

Opportunities:

Threats:

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.4%.

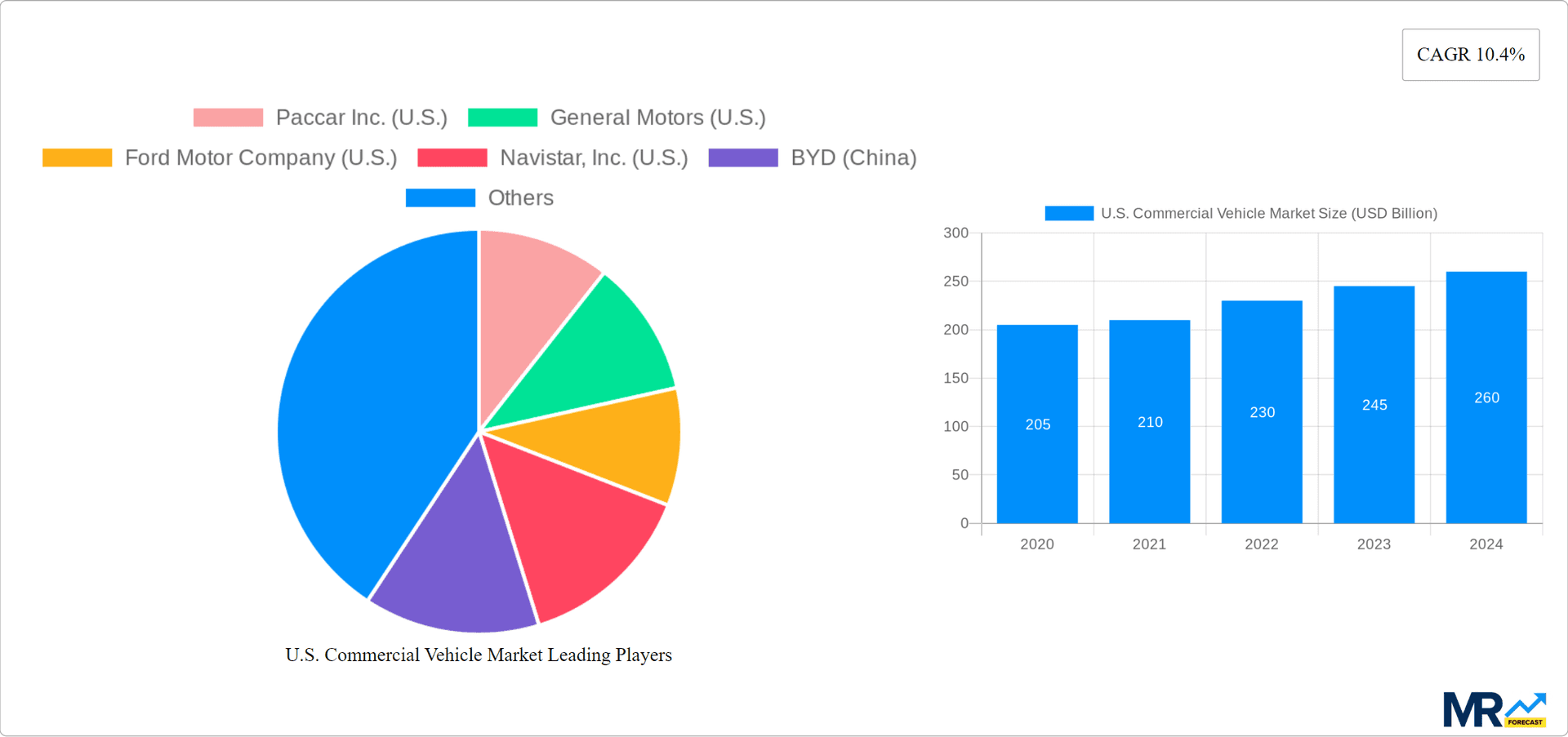

Key companies in the market include Paccar Inc. (U.S.), General Motors (U.S.), Ford Motor Company (U.S.), Navistar, Inc. (U.S.), BYD (China), Mercedes-Benz Group (Germany), AB Volvo (Sweden), Scania (Sweden), Nikola Corporation (U.S.), Workhorse Group (U.S.).

The market segments include Vehicle Type, Propulsion Type.

The market size is estimated to be USD 581.31 USD Billion as of 2022.

Increasing Demand for Forged Products in Power. Agriculture. Aerospace. and Defense to Drive Industry Expansion.

Rising Adoption of Automation in Manufacturing to Drive Market Growth.

High Maintenance Cost May Limit the Market Growth.

August 2023 – BYD | RIDE delivered two K7M 30’ battery-electric buses to the City of Burlington in North Carolina to serve the passengers of its Link Transit Fleet. The 30-foot buses can accommodate up to 22 passengers and are equipped with the industry’s safest batteries, providing a smooth, quiet, and sustainable ride throughout the city.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2850, USD 3850, and USD 4850 respectively.

The market size is provided in terms of value, measured in USD Billion and volume, measured in Thousand Units.

Yes, the market keyword associated with the report is "U.S. Commercial Vehicle Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the U.S. Commercial Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.