1. What is the projected Compound Annual Growth Rate (CAGR) of the Usage-Based Insurance?

The projected CAGR is approximately 15.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Usage-Based Insurance

Usage-Based InsuranceUsage-Based Insurance by Type (Pay-As-You-Drive Insurance, Pay-How-You-Drive Insurance, Distance Based Insurance, Pay-As-You-Go Insurance), by Application (Men, Women), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

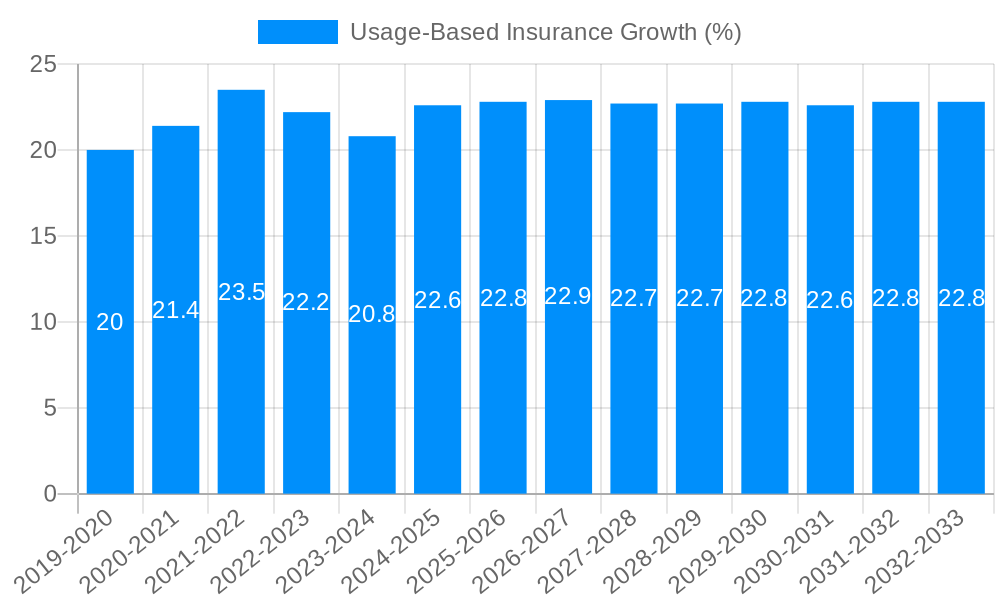

The Usage-Based Insurance (UBI) market, valued at $41,150 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.7% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of telematics technology allows insurers to accurately assess individual driving behavior, leading to more personalized and equitable premiums. Consumers are drawn to the potential for cost savings through safer driving habits, incentivized by lower premiums. Secondly, growing awareness of data privacy and security is shaping the market, with providers implementing robust measures to address concerns and build consumer trust. Furthermore, the increasing penetration of smartphones and connected vehicles fuels the growth of UBI by facilitating easy data collection and integration. Finally, the competitive landscape is fostering innovation, with established insurers and new entrants alike offering diverse UBI products tailored to specific customer needs, such as Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Distance-Based Insurance (DBI).

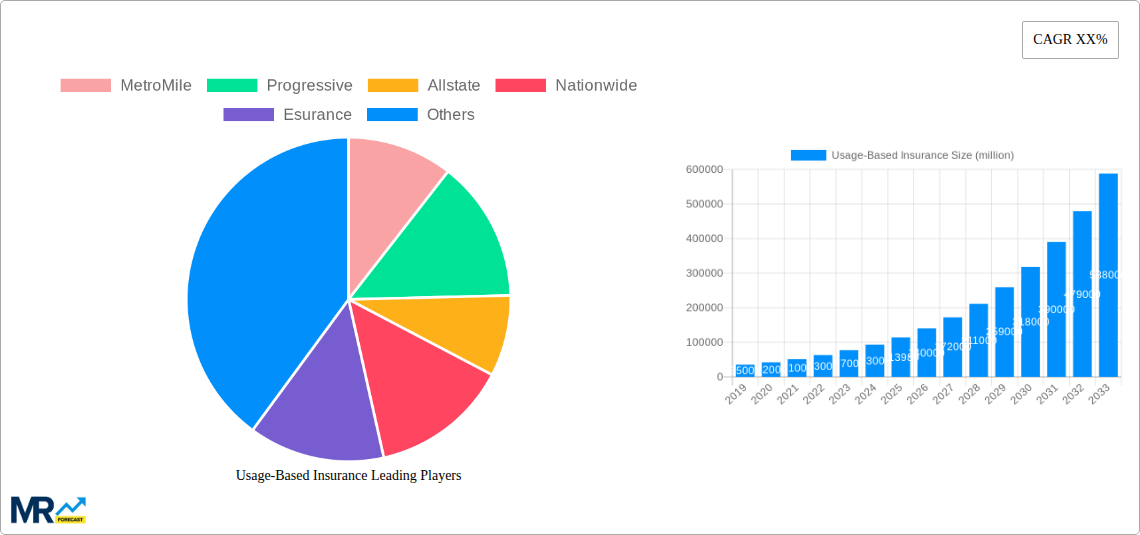

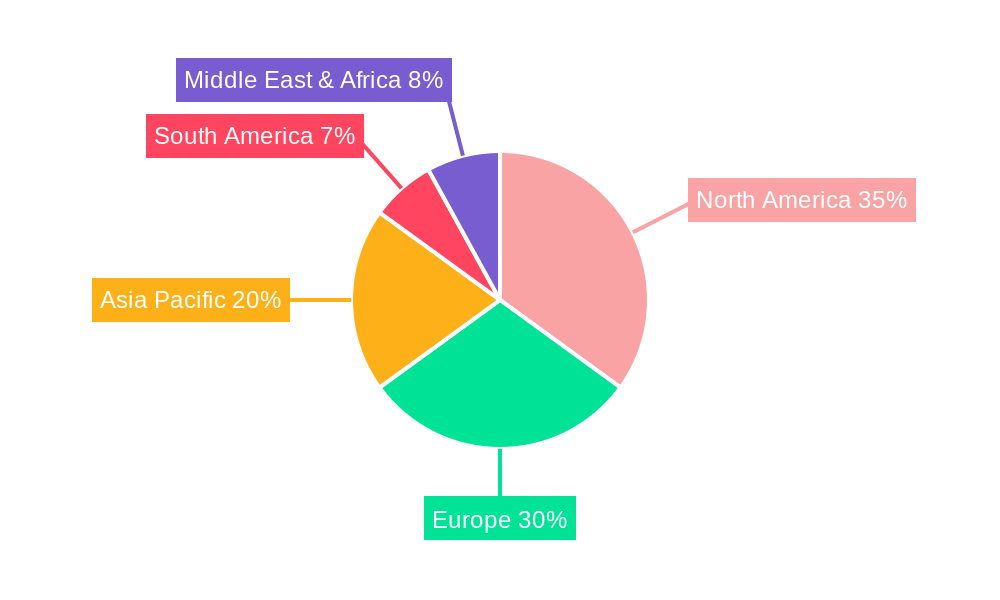

The market segmentation reveals a notable gender disparity, with a higher adoption rate expected among men compared to women. This reflects differing driving habits and risk profiles. Regional variations also exist, with North America, particularly the United States, anticipated to maintain a significant market share due to early adoption of telematics and well-established insurance infrastructure. However, rapid growth is expected in Asia-Pacific regions like India and China driven by increasing vehicle ownership and growing adoption of digital technologies. The presence of established players like Progressive, Allstate, and Nationwide, alongside innovative newcomers, further intensifies competition and drives market expansion. While data privacy concerns and technological limitations pose challenges, the overall market trajectory points towards sustained growth and broader adoption of UBI models in the coming years.

The Usage-Based Insurance (UBI) market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. Driven by technological advancements and a shift towards personalized pricing, UBI is rapidly transforming the insurance landscape. The market witnessed significant expansion during the historical period (2019-2024), with key players like Progressive and Allstate aggressively expanding their UBI offerings. This expansion is fueled by a growing consumer preference for fairer premiums based on actual driving behavior rather than broad demographic assumptions. The estimated market value for 2025 is pegged at several billion dollars, highlighting the considerable traction UBI has gained. The forecast period (2025-2033) promises even more significant growth, driven by increasing adoption across various segments and geographic locations. The shift from traditional, risk-based pricing to usage-based models is attracting a new generation of tech-savvy consumers comfortable sharing driving data in exchange for potentially significant premium savings. This trend is particularly pronounced among younger demographics, who are more receptive to technological innovations and personalized services. Furthermore, the continuous development of sophisticated telematics technology allows for more granular data collection, leading to even more precise risk assessment and refined pricing strategies. This, in turn, strengthens the UBI business model and fosters greater market confidence. The ongoing refinement of algorithms and the integration of artificial intelligence further enhance the accuracy and efficiency of UBI programs, ensuring a more transparent and equitable system for both insurers and policyholders.

Several factors are propelling the rapid growth of the usage-based insurance market. Firstly, advancements in telematics technology are enabling the cost-effective collection and analysis of vast amounts of driving data. This data provides insurers with unprecedented insights into driver behavior, allowing for more accurate risk assessment and personalized pricing. Secondly, the increasing penetration of smartphones and connected cars is facilitating the seamless integration of UBI programs into consumers' daily lives. The convenience and accessibility of these technologies are contributing to higher adoption rates. Thirdly, consumers are increasingly seeking personalized and fair insurance premiums. UBI offers a transparent and equitable pricing model that rewards safe driving habits, making it attractive to a large segment of the population. Finally, the regulatory environment is becoming more supportive of UBI, with many governments recognizing the potential of this technology to improve road safety and reduce insurance costs. This regulatory support is vital for the continued growth and widespread adoption of UBI. Moreover, insurers themselves are actively investing in developing innovative UBI programs and leveraging data analytics to optimize their offerings, further accelerating market expansion. The competitive landscape is also driving innovation, with companies constantly striving to offer the most attractive and effective UBI products.

Despite its potential, the growth of the usage-based insurance market faces several challenges. Data privacy and security concerns remain paramount. Consumers are rightfully hesitant to share their driving data if they are not confident in the security measures implemented by insurers. Addressing these concerns through robust data protection protocols and transparent communication is critical for building consumer trust. Furthermore, the technological infrastructure required to support UBI, particularly in less developed regions, may be lacking. The cost of deploying and maintaining the necessary telematics systems can be a barrier to entry for some insurers, particularly smaller ones. Another hurdle is consumer education. Many potential customers are unfamiliar with UBI and its benefits, leading to low awareness and adoption rates. Effective marketing and educational campaigns are essential to increase understanding and dispel misconceptions about UBI. Finally, accurate data collection can be affected by factors such as GPS signal disruptions and variations in driving conditions, leading to inaccurate risk assessments and potential dissatisfaction among policyholders. Ongoing improvements in data analysis techniques are crucial to mitigate these issues.

The North American market, particularly the United States, is expected to dominate the global UBI market due to high technological adoption rates, a robust regulatory framework, and a large pool of tech-savvy consumers. European countries are also witnessing significant growth, driven by increasing awareness of UBI's benefits and supportive government policies.

Pay-As-You-Drive (PAYD) Insurance: This segment is projected to hold the largest market share due to its simplicity and ease of understanding. The direct correlation between mileage driven and premium cost is easily grasped by consumers. This transparency is a significant driver of adoption within this segment. Millions of drivers are already benefiting from the lower premiums associated with lower mileage.

Application: Men and Women: While the precise market share of men versus women within UBI might vary slightly, the market is expanding across both demographics. Both genders are showing interest in the value proposition of paying for only the risk they pose based on their individual driving behaviors.

Distance Based Insurance: This category is experiencing rapid growth due to the increasing integration of telematics into vehicles, enabling accurate mileage tracking. The potential for substantial premium savings based on actual driving habits appeals broadly to both male and female consumers.

Pay-How-You-Drive (PHYD) Insurance: While slightly more complex than PAYD, PHYD, which considers factors beyond just mileage, such as braking habits and time of day driving, is gradually gaining popularity. The ability to capture a more comprehensive risk profile increases its attractiveness, albeit with a slightly higher technological barrier to entry.

The significant growth in these segments is driven by increased awareness of cost savings and a growing desire for personalized insurance solutions, particularly among young drivers.

The UBI industry is experiencing a surge in growth due to several key factors: Firstly, continuous advancements in telematics technology allow for more accurate and comprehensive data collection, leading to fairer and more personalized pricing. Secondly, the increasing adoption of connected cars and smartphones is simplifying the integration of UBI programs into consumers' daily lives. Thirdly, a rising demand for transparency and fairness in insurance pricing fuels consumer interest in UBI, further driving market expansion.

This report provides a comprehensive overview of the Usage-Based Insurance market, analyzing its current trends, growth drivers, challenges, and key players. The detailed analysis includes market segmentation by type (PAYD, PHYD, Distance-Based, PAYG) and application (men, women), regional analysis, and forecast projections until 2033, providing valuable insights for industry stakeholders. The report also explores significant developments impacting the market and highlights the strategies of leading players. This in-depth research offers a robust understanding of the UBI landscape and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.7%.

Key companies in the market include MetroMile, Progressive, Allstate, Nationwide, Esurance, Safeco, Travellers, Liberty Mutual Insurance, AIOI, QBE, .

The market segments include Type, Application.

The market size is estimated to be USD 41150 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Usage-Based Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Usage-Based Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.