1. What is the projected Compound Annual Growth Rate (CAGR) of the Usage-based Insurance For Automotive?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Usage-based Insurance For Automotive

Usage-based Insurance For AutomotiveUsage-based Insurance For Automotive by Type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive), by Application (Passenger Auto, Commercial Auto), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

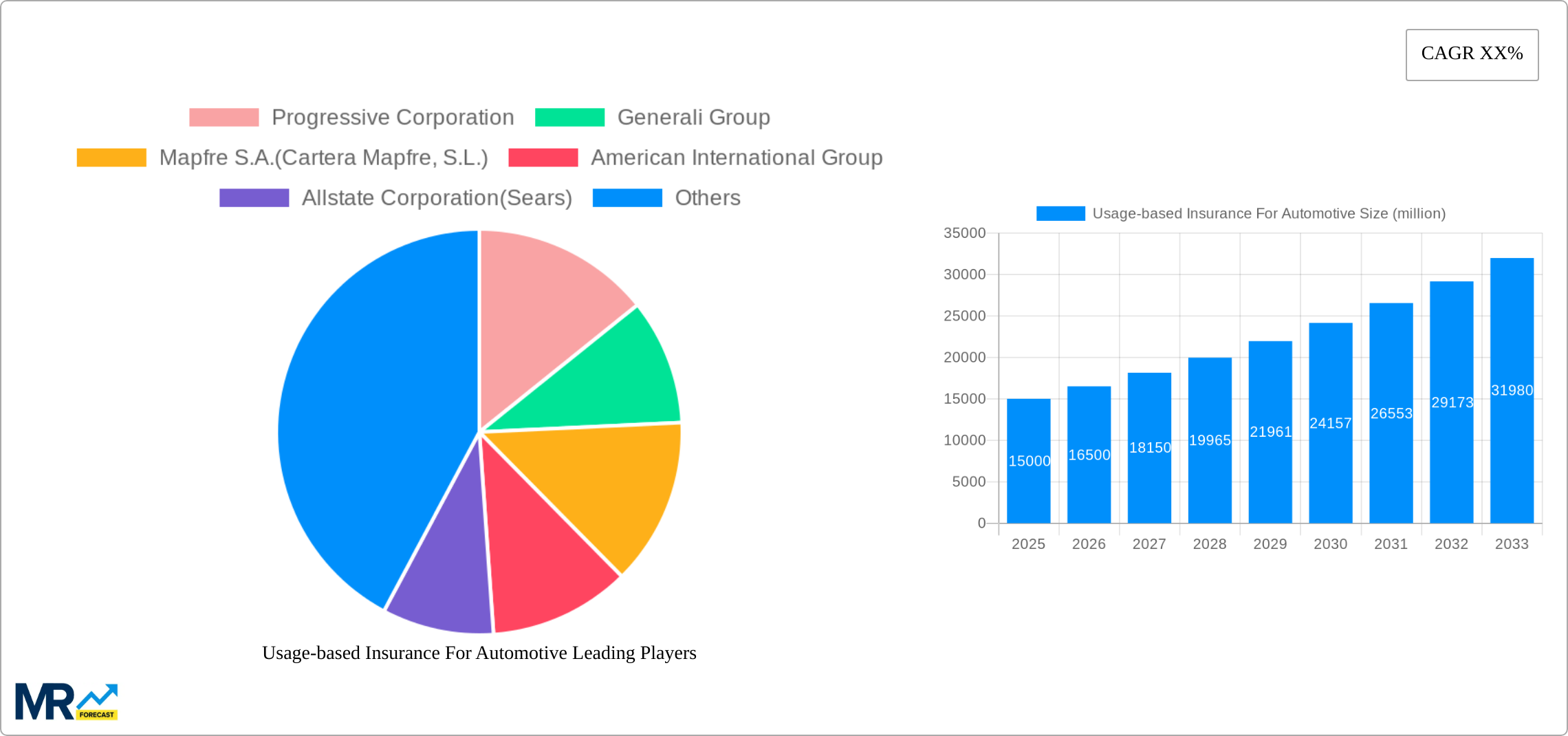

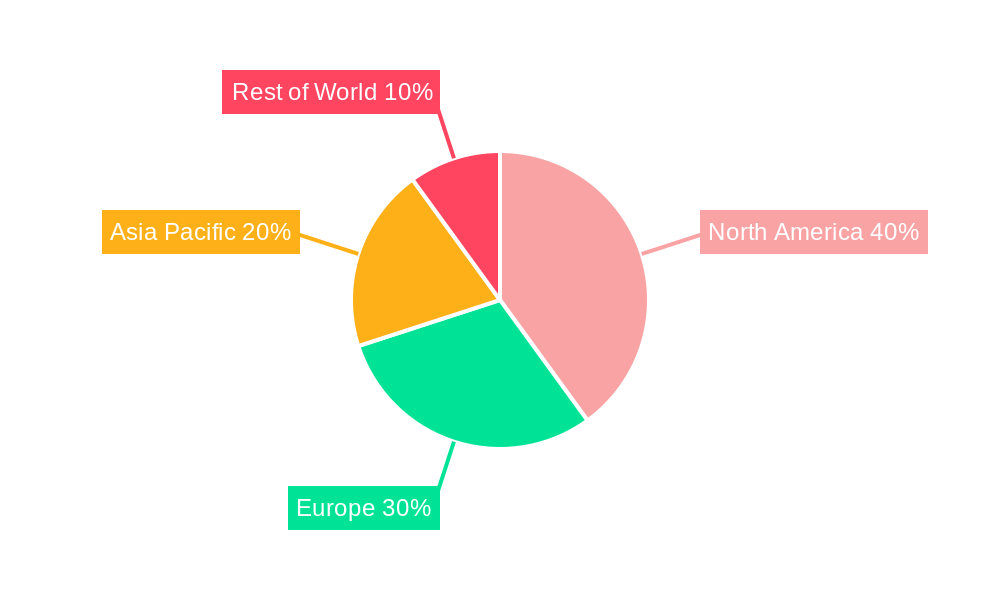

The Usage-Based Insurance (UBI) market for automotive is experiencing robust growth, driven by the increasing adoption of telematics and the desire for personalized insurance premiums. The market, segmented by payment model (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and application (Passenger Auto, Commercial Auto), is witnessing a significant shift towards data-driven pricing. This allows insurers to offer more accurate and fairer premiums based on individual driving behavior, leading to cost savings for safe drivers and potentially higher premiums for riskier drivers. Key players like Progressive, Generali, and Allianz are investing heavily in technological advancements and data analytics to enhance their UBI offerings, fostering intense competition and innovation within the sector. The North American market currently holds a significant share, fueled by early adoption and advanced technological infrastructure. However, rapid growth is expected in regions like Asia Pacific and Europe, driven by increasing smartphone penetration, improving digital infrastructure, and government regulations promoting road safety. The market's expansion is further propelled by the rising adoption of connected cars, which provide richer data sets for more precise risk assessment.

Despite the significant growth potential, challenges remain. Data privacy concerns and the need for robust cybersecurity measures are crucial considerations. Furthermore, the successful implementation of UBI hinges on consumer acceptance and understanding of the pricing model. Addressing these challenges will be pivotal in realizing the full potential of the UBI market. Future growth will likely be shaped by the development of more sophisticated algorithms for risk assessment, the integration of UBI with other insurance products, and the expansion of UBI into new vehicle categories like commercial fleets and autonomous vehicles. The continued refinement of telematics technology and the increasing affordability of connected car features will likely accelerate market penetration over the forecast period. We project sustained, albeit slightly moderated, growth compared to initial rapid expansion due to these factors.

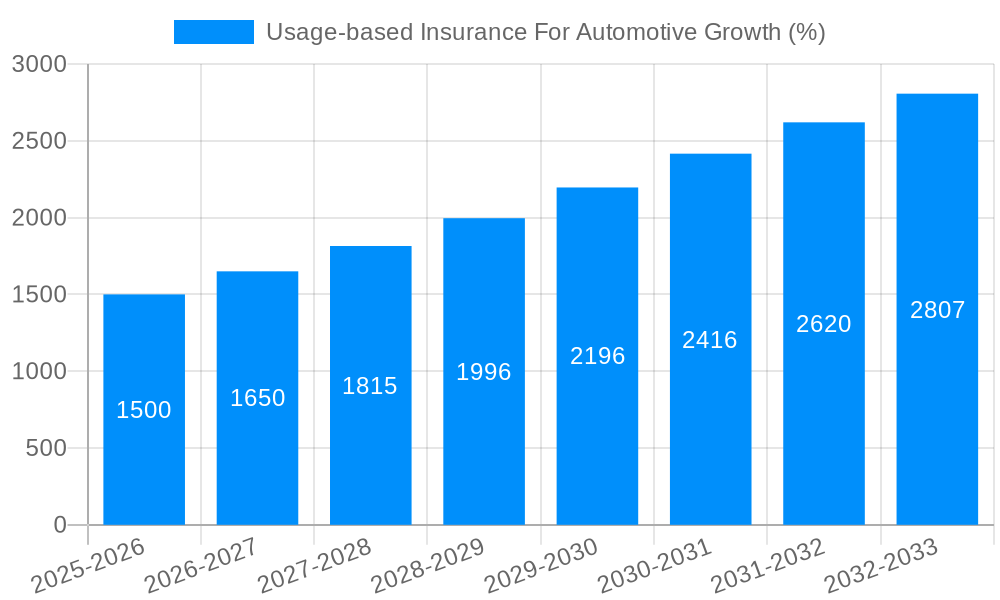

The usage-based insurance (UBI) market for automotive is experiencing robust growth, driven by technological advancements and a shifting consumer landscape. The global UBI market, valued at approximately 15 million units in 2024, is projected to reach over 40 million units by 2033. This surge reflects a fundamental change in how auto insurance is priced, moving away from traditional risk-assessment models based solely on demographics to a system that accurately reflects individual driving behaviors. The historical period (2019-2024) witnessed significant adoption of UBI, particularly in the passenger auto segment, with Pay-As-You-Drive (PAYD) models leading the way due to their simplicity and appeal to cost-conscious consumers. The forecast period (2025-2033) anticipates accelerated growth, fueled by the increasing availability of sophisticated telematics technologies capable of capturing granular driving data. This data allows insurers to offer more personalized and accurate premiums, leading to significant cost savings for safe drivers. The base year (2025) marks a crucial turning point, with the market poised for substantial expansion as more insurers integrate UBI programs into their core offerings and consumers become increasingly aware of the potential financial benefits. The estimated year (2025) values indicate a substantial increase from the historical data, highlighting the rapid growth trajectory of the UBI market. Major players are investing heavily in developing advanced analytics and data processing capabilities to extract meaningful insights from the vast amounts of driver data collected, further enhancing the accuracy and efficiency of UBI programs. This trend suggests that the future of auto insurance is increasingly data-driven, personalized, and ultimately, more equitable.

Several factors are propelling the growth of usage-based insurance for automotive. Firstly, the widespread adoption of smartphones and connected car technologies provides a readily available infrastructure for data collection. Telematics devices, either embedded in vehicles or connected via mobile apps, seamlessly transmit driving data, allowing insurers to accurately assess risk. Secondly, the increasing affordability of telematics technology is making UBI accessible to a broader range of consumers and insurers alike. This reduction in implementation costs has lowered the barriers to entry for both large established insurance companies and smaller, more agile startups, leading to increased competition and innovation. Thirdly, the growing consumer awareness of the potential cost savings associated with UBI is driving adoption. Safe drivers are particularly attracted to the prospect of lower premiums, while insurers benefit from reduced risk and improved profitability. Finally, regulatory support in various jurisdictions is paving the way for wider adoption, creating a favorable environment for the growth of the UBI market. Governments are increasingly recognizing the potential of UBI to improve road safety and reduce insurance costs. These combined factors are accelerating the transition towards a more data-driven and personalized insurance landscape.

Despite the significant growth potential, the UBI market faces several challenges. Data privacy and security concerns remain a major hurdle. Consumers are understandably hesitant to share detailed driving data, particularly given the potential for misuse or unauthorized access. Insurers must implement robust security measures and transparent data handling policies to address these concerns and build consumer trust. The complexity of integrating UBI programs into existing insurance systems also presents a challenge. This requires significant investment in technology and infrastructure, which can be prohibitive for some insurers, particularly smaller players. Furthermore, the accuracy and fairness of UBI pricing models are subject to scrutiny. Algorithmic biases, inaccuracies in data collection, and the potential for discriminatory outcomes need to be carefully addressed to ensure equitable pricing. Finally, the varying levels of technological adoption and infrastructure across different regions create geographic disparities in the penetration of UBI programs. Overcoming these challenges requires a collaborative effort among insurers, technology providers, and regulatory bodies.

The Pay-As-You-Drive (PAYD) segment within the passenger auto application is poised to dominate the UBI market in the coming years.

Pay-As-You-Drive (PAYD) Dominance: PAYD's straightforward pricing model, directly linking premiums to actual driving distance, appeals to a broad consumer base, particularly those who drive less frequently. This simplicity drives adoption, especially among younger drivers and those in urban areas with limited driving needs. The ease of implementation further contributes to its market leadership.

Passenger Auto Application: The passenger auto segment currently represents the largest portion of the UBI market. The ubiquity of personal vehicles and the relatively high volume of insurance policies make this segment a fertile ground for UBI expansion. Technological advancements in smartphone integration and in-vehicle telematics make data acquisition and processing easier and more efficient within this sector.

North America and Europe Leading the Charge: North America and Europe, with their developed technological infrastructures and higher levels of consumer awareness, are expected to be the primary drivers of market growth. The regulatory landscape in these regions is also relatively favorable to the adoption of UBI. The strong presence of major insurance players actively investing in UBI solutions further reinforces this projection.

Data-Driven Precision: The PAYD model’s reliance on precise data contributes to its appeal. Advanced telematics offer the ability to accurately measure distance traveled, potentially leading to more fair and accurate pricing for individual drivers, compared to traditional insurance methods which rely more on broader demographic assumptions.

The combination of readily available technology, clear pricing structures, and a large target market within the passenger auto sector positions PAYD as a dominant force in the UBI landscape, particularly in the developed markets of North America and Europe. The ongoing advancements in telematics and data analytics will further solidify this dominance.

Several factors are catalyzing growth in the UBI industry. Technological advancements continue to reduce the cost and improve the accuracy of telematics data collection, making UBI more accessible and appealing. Government regulations and incentives aimed at promoting road safety and reducing insurance costs are creating a favorable environment for widespread adoption. Moreover, increasing consumer awareness of the potential for cost savings, combined with growing trust in data security and privacy measures, is driving demand for UBI products. These factors are collectively pushing the market towards accelerated growth.

This report provides a comprehensive overview of the usage-based insurance market for automotive, covering market size and growth projections, key trends, driving forces, challenges, regional and segmental analysis, and profiles of leading players. The report analyzes both historical data (2019-2024) and forecasts (2025-2033), offering valuable insights for stakeholders involved in the automotive insurance industry. The analysis emphasizes the growing importance of data-driven decision-making and personalized insurance offerings in this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Progressive Corporation, Generali Group, Mapfre S.A.(Cartera Mapfre, S.L.), American International Group, Allstate Corporation(Sears), State Farm, Liberty Mutual Insurance, Allianz SE, Axa S.A., Metromile Inc., Octo Telematics, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Usage-based Insurance For Automotive," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Usage-based Insurance For Automotive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.