1. What is the projected Compound Annual Growth Rate (CAGR) of the Usage-Based Car Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Usage-Based Car Insurance

Usage-Based Car InsuranceUsage-Based Car Insurance by Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD)), by Application (Passenger Vehicle, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Usage-Based Insurance (UBI) market, encompassing Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD) models, is experiencing robust growth driven by advancements in telematics technology, the increasing adoption of connected cars, and a growing consumer preference for personalized insurance solutions. This market caters to both passenger and commercial vehicles, offering significant potential for insurers and technology providers. The market's expansion is fueled by the ability of UBI to accurately reflect individual driving behavior, leading to fairer premiums and reduced overall costs for safer drivers. Data-driven insights enable insurers to offer customized risk assessments and reward safe driving habits, ultimately creating a more equitable and efficient insurance ecosystem. The increasing availability of affordable telematics devices and the integration of UBI into existing insurance platforms further accelerate market penetration. While challenges remain, such as data privacy concerns and the need for robust infrastructure, the long-term outlook for UBI remains exceptionally positive, with substantial growth projected across all geographical segments.

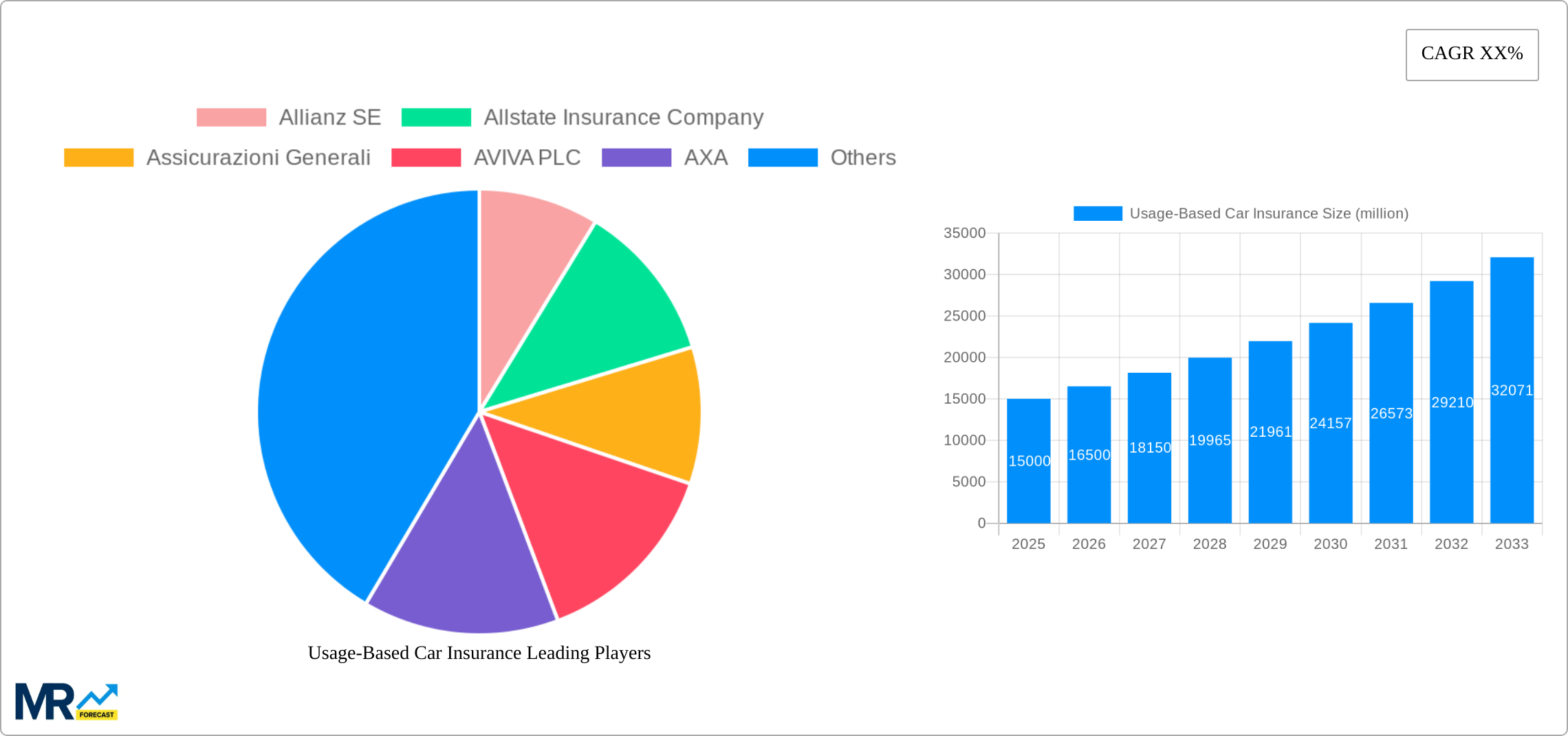

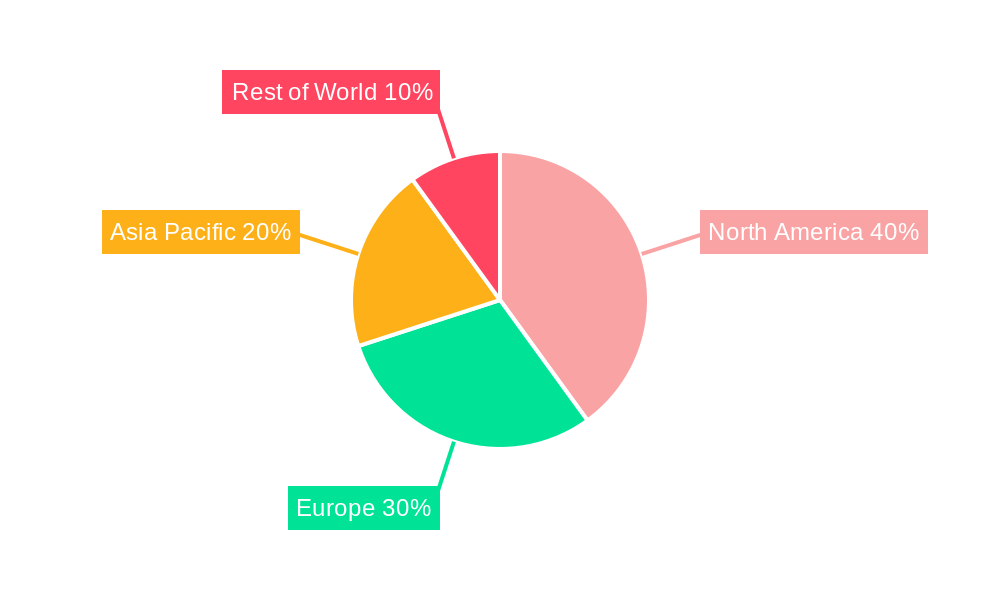

Significant regional variations exist within the UBI market. North America, with its established technological infrastructure and high adoption rates of connected car technologies, currently holds a significant market share. However, Europe and Asia-Pacific regions are experiencing rapid growth, driven by increasing smartphone penetration and government initiatives promoting road safety and technological advancements in these regions. The competitive landscape is dynamic, with established insurance giants like Allianz, Allstate, and AXA vying for market share alongside innovative technology companies specializing in telematics. The future will likely see increased mergers and acquisitions as companies seek to expand their UBI offerings and leverage advanced data analytics to enhance their competitive advantage. Furthermore, the ongoing development of artificial intelligence and machine learning will further refine risk assessment models, allowing for even more precise and personalized pricing.

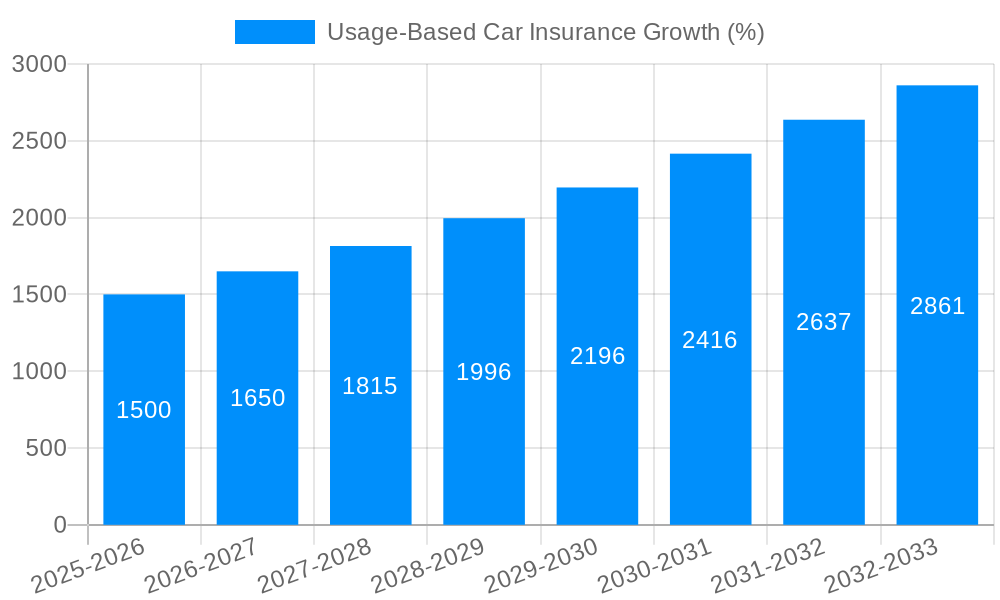

The usage-based car insurance (UBCI) market is experiencing explosive growth, projected to reach tens of billions of dollars in value by 2033. Driven by advancements in telematics and a rising consumer demand for personalized and fairer insurance premiums, the market demonstrates a significant shift away from traditional, risk-profile-based models. The historical period (2019-2024) saw steady adoption, primarily in developed nations with robust digital infrastructure. However, the forecast period (2025-2033) anticipates a much steeper trajectory, fueled by several key factors discussed later. The estimated market value in 2025 sits at a substantial figure (replace with specific multi-million dollar figure from your data). This growth isn't solely driven by technological innovation; changing consumer expectations regarding pricing transparency and fairness are equally important. Consumers are increasingly receptive to insurance models that directly reflect their individual driving habits, leading to potential savings and a more equitable premium structure. This trend is further amplified by the increasing affordability and accessibility of telematics devices, making UBCI a viable option for a broader demographic. The shift towards PAYD and PHYD models is contributing to a more dynamic and competitive insurance landscape, with established players and innovative startups vying for market share. The integration of UBCI with other emerging technologies, like AI-powered risk assessment and predictive analytics, will further refine pricing accuracy and enhance customer experience. This creates a positive feedback loop, attracting more customers and driving further innovation within the sector.

Several key factors are driving the rapid expansion of the usage-based car insurance market. The increasing affordability and availability of telematics devices are crucial, enabling insurers to collect precise data on driving behavior. This data precision allows for more accurate risk assessment, leading to fairer and more personalized premiums. Furthermore, the growing consumer demand for transparency and customized insurance solutions plays a significant role. Consumers are seeking insurance products that reflect their individual driving habits rather than relying on broad demographic profiles. This aligns perfectly with the principles of usage-based insurance, offering potential savings for safe drivers and encouraging safer driving practices. Technological advancements, specifically in areas such as artificial intelligence (AI) and machine learning (ML), are also significantly contributing to the growth of this market. These technologies enable sophisticated analysis of driving data, allowing for more nuanced risk profiling and the development of innovative insurance products. The growing adoption of connected cars and the proliferation of smartphone-based telematics applications further expand the reach of UBCI, making it accessible to a wider range of consumers. Finally, the regulatory support in various countries that encourages the adoption of innovative insurance models is contributing to the expansion of the UBCI market.

Despite its promising growth trajectory, the UBCI market faces several challenges. Data privacy and security concerns are paramount. Collecting and storing vast amounts of driving data raise significant privacy concerns for consumers. Insurers must implement robust data protection measures and transparent data handling policies to build consumer trust. Another significant hurdle is the need for widespread consumer education and awareness. Many potential customers remain unfamiliar with the benefits of UBCI or are hesitant to share their driving data. Effective marketing campaigns and clear communication are essential to overcoming this barrier. Moreover, integrating UBCI with existing insurance infrastructure can be complex and expensive for insurers, requiring significant investment in technology and personnel. This can hinder market entry for smaller players and may create disparities in market access. Finally, the accuracy and fairness of the algorithms used to assess driving behavior are crucial for maintaining consumer trust. Any perceived bias or inaccuracy in these algorithms can lead to negative perceptions and hinder widespread adoption. Addressing these concerns through robust data security practices, transparent algorithms, and effective consumer education is vital for the long-term success of the UBCI market.

The passenger vehicle segment within the PAYD (Pay-As-You-Drive) model is projected to dominate the UBCI market during the forecast period. This dominance stems from several factors:

Geographical Dominance: North America and Europe are expected to lead the market due to the higher rates of vehicle ownership, advanced telematics infrastructure, and a receptive regulatory environment. These regions are at the forefront of technological innovation and consumer adoption of digital solutions, creating an ideal setting for UBCI expansion. Within these regions, countries with strong digital infrastructure and high vehicle ownership rates, such as the United States and Germany, will be key drivers of market growth. However, the Asia-Pacific region is also showing significant potential, with growing adoption rates driven by increasing vehicle ownership, particularly in rapidly developing economies. The increasing smartphone penetration and affordability of telematics solutions are paving the way for UBCI expansion in this region. Overall, the convergence of advanced technology, consumer demand, and favorable regulatory environments will propel the passenger vehicle PAYD segment to dominate the global usage-based car insurance market.

The growth of the usage-based car insurance industry is being significantly catalyzed by the convergence of several key factors. The decreasing cost of telematics devices is making them increasingly accessible to a broader range of consumers and insurers. Moreover, the rising adoption of connected cars is providing a readily available source of driving data, streamlining the process of data collection and analysis. This, coupled with advancements in data analytics and AI, allows for the development of increasingly sophisticated and accurate risk assessment models, leading to more personalized and equitable insurance premiums. The increasing awareness of the benefits of usage-based insurance among consumers, driven by both marketing efforts and word-of-mouth, is also contributing to the rapid expansion of this market segment.

This report provides a detailed analysis of the usage-based car insurance market, covering historical data, current market trends, and future projections. The report explores key market drivers and challenges, identifies leading players, and offers insights into the dominating segments and geographical regions. The comprehensive analysis includes data on market size, growth rates, and key industry developments, providing valuable insights for businesses and stakeholders interested in the UBCI market. The detailed segment breakdown by type (PAYD, PHYD) and application (passenger, commercial) allows for a granular understanding of market dynamics and potential growth opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz SE, Allstate Insurance Company, Assicurazioni Generali, AVIVA PLC, AXA, Desjardins Group, Liberty Mutual Insurance, Mapfre S.A., Metromile Inc., Nationwide, Progressive Casualty Insurance Company, State Farm, UnipolSai Assicurazioni S.P.A., Verizon Communication Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Usage-Based Car Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Usage-Based Car Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.