1. What is the projected Compound Annual Growth Rate (CAGR) of the Tea Packing Machines?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tea Packing Machines

Tea Packing MachinesTea Packing Machines by Type (Automatic Tea Packing Machines, Semi-automatic Tea Packing Machines, Manual Tea Packing Machines), by Application (Bag Tea Packing, Silk Tea Packing, Nylon Tea Packing, Muslin Tea Packing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

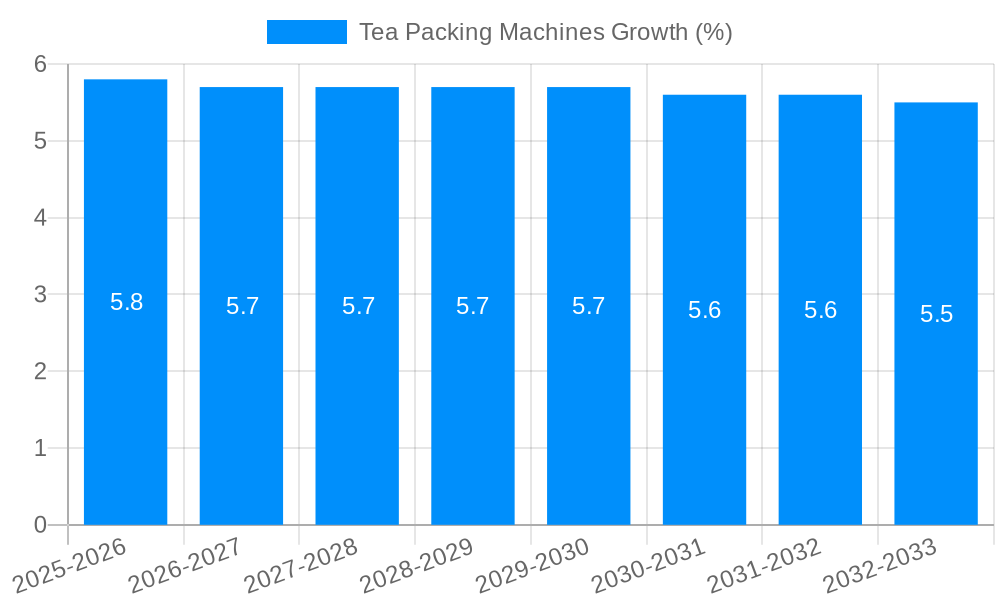

The global tea packing machines market is poised for significant expansion, with an estimated market size of USD 1,250 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This robust growth is primarily driven by the escalating global demand for tea, fueled by increasing health consciousness among consumers and the perception of tea as a healthier beverage alternative to carbonated drinks and coffee. The expanding middle class in emerging economies, particularly in Asia Pacific, is further augmenting this demand, leading to increased production and, consequently, a higher need for efficient and automated tea packing solutions. Advancements in technology, including the development of intelligent, high-speed, and cost-effective packaging machines that can handle diverse tea types and formats, are also key accelerators for market growth. Innovations such as smart sensors for quality control, automated filling and sealing, and eco-friendly packaging materials are shaping the future of tea packaging.

The market is segmented across various machine types, including automatic, semi-automatic, and manual tea packing machines, catering to a wide spectrum of manufacturers from large corporations to smaller artisanal producers. Application-wise, the demand is strong for bag tea packing, silk tea packing, nylon tea packing, and muslin tea packing, reflecting the diverse consumer preferences and product offerings in the tea industry. Major players like TEEPACK Spezialmaschinen, Omag Pack, and WooshinFA Tea Bag Machine are at the forefront, continuously innovating to meet evolving market needs. However, the market also faces certain restraints, including the high initial investment costs for advanced automated machinery, particularly for small and medium-sized enterprises (SMEs), and fluctuating raw material prices for packaging components. Despite these challenges, the sustained consumer preference for tea and the ongoing technological advancements are expected to ensure a positive trajectory for the tea packing machines market.

This report offers a comprehensive and forward-looking analysis of the global tea packing machines market, meticulously examining its trajectory from the historical period of 2019-2024, through the base and estimated year of 2025, and extending into a robust forecast period from 2025 to 2033. The study provides invaluable insights into market dynamics, key drivers, prevailing challenges, dominant segments, and the strategic landscape inhabited by leading manufacturers. With a projected market size reaching hundreds of millions of units by the end of the forecast period, this report serves as an essential guide for stakeholders seeking to navigate this evolving industry.

The global tea packing machines market is experiencing a significant surge, driven by evolving consumer preferences, increasing demand for convenience, and the growing sophistication of the tea industry. From 2019 to 2024, the market witnessed steady growth, fueled by the traditional preference for loose-leaf tea and the foundational demand for basic packing solutions. However, the base and estimated year of 2025 marks a pivotal point, signaling an acceleration in the adoption of advanced technologies and a diversification of packing formats. Looking ahead to the forecast period of 2025-2033, the market is poised for remarkable expansion, with projections indicating a substantial increase in the unit volume of tea packing machines deployed globally, likely reaching hundreds of millions of units. This growth is intrinsically linked to the burgeoning popularity of specialized tea formats such as silk, nylon, and muslin tea bags, which offer premium experiences and cater to a discerning consumer base. Furthermore, the increasing emphasis on sustainability is driving innovation in packaging materials and machine designs, favoring eco-friendly solutions and reduced waste. Automation is no longer a luxury but a necessity, with manufacturers increasingly investing in high-speed, intelligent machines that can handle diverse tea types and packaging requirements with unparalleled efficiency and precision. The rise of e-commerce and the expanding global reach of tea brands also necessitate flexible and adaptable packing solutions capable of meeting varied logistical demands. The integration of smart technologies, including AI and IoT, into tea packing machines is also an emerging trend, promising enhanced operational oversight, predictive maintenance, and optimized production workflows. This confluence of technological advancements, evolving consumer habits, and industry-wide strategic shifts is fundamentally reshaping the tea packing machines landscape, creating a dynamic and opportunity-rich environment for both manufacturers and end-users.

Several potent forces are collectively propelling the global tea packing machines market forward, ensuring its robust growth trajectory over the study period. Foremost among these is the escalating global consumption of tea, a beverage deeply ingrained in the cultural fabric of numerous societies and experiencing renewed popularity due to its perceived health benefits. As tea consumption rises, so too does the demand for efficient and high-volume packing solutions, directly translating into increased sales of tea packing machines. Furthermore, the burgeoning trend of premiumization within the tea sector plays a crucial role. Consumers are increasingly willing to spend more on high-quality, specialty teas, which often come in sophisticated packaging formats like silk, nylon, and muslin tea bags. This shift necessitates the deployment of advanced, specialized tea packing machines capable of handling these delicate and often elaborate packaging styles with precision and aesthetic appeal. The relentless pursuit of operational efficiency and cost optimization by tea manufacturers also serves as a significant driver. Investing in automated tea packing machines allows for higher production speeds, reduced labor costs, and minimized product wastage, thereby enhancing overall profitability. The growing emphasis on food safety and hygiene standards further compels manufacturers to adopt modern packing technologies that ensure the integrity and quality of the packaged tea. Finally, the expanding reach of e-commerce and the increasing globalization of tea brands demand flexible and scalable packing solutions that can cater to diverse market needs and distribution channels, thus reinforcing the sustained demand for innovative tea packing machinery.

Despite the optimistic outlook, the global tea packing machines market encounters certain challenges and restraints that could potentially temper its growth. A primary concern is the high initial investment cost associated with sophisticated, high-speed automatic tea packing machines. This can be a significant barrier for smaller tea manufacturers or those operating in emerging markets with limited capital. The complexity of maintenance and the need for skilled technical personnel to operate and service advanced machinery also pose a challenge. Downtime due to machine malfunctions or a lack of trained technicians can lead to production losses and increased operational costs. Fluctuations in raw material prices, particularly for packaging materials, can impact the profitability of both machine manufacturers and tea packers, indirectly influencing investment in new equipment. The ever-evolving regulatory landscape, especially concerning food safety and environmental standards, requires continuous adaptation and potential upgrades to existing packing machinery, adding to compliance costs. Moreover, the increasing demand for sustainable packaging solutions while still maintaining cost-effectiveness presents a technical and economic hurdle. Developing and implementing eco-friendly packing materials and the machinery to handle them efficiently requires significant research and development investment. Finally, intense competition among machine manufacturers, leading to price wars, can compress profit margins for some players, potentially impacting their ability to invest in further innovation and market expansion.

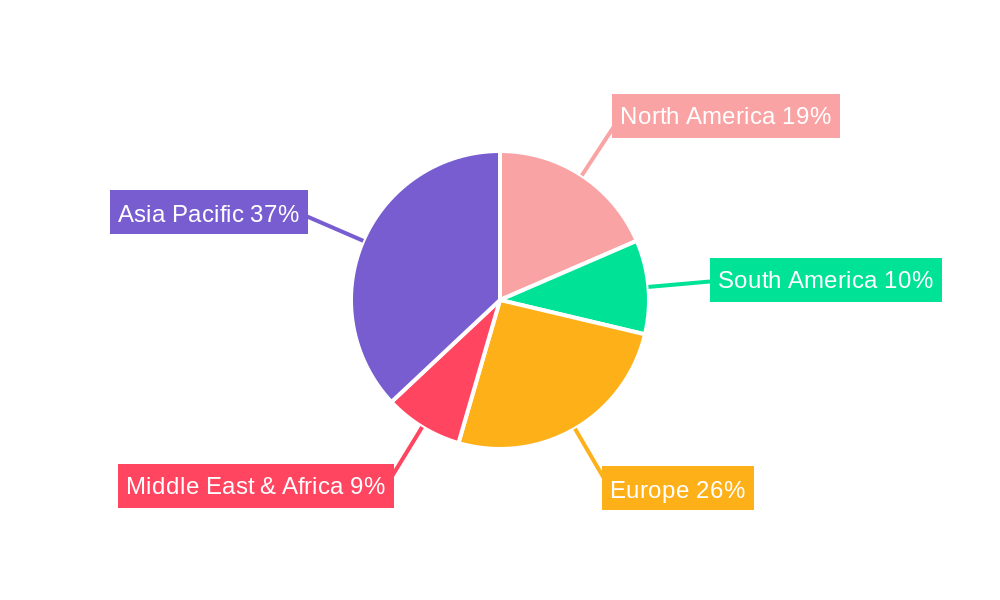

The global tea packing machines market is characterized by distinct regional strengths and dominant segments, with Bag Tea Packing emerging as a universally dominant application and certain regions exhibiting particularly robust demand.

In terms of Segments, the Bag Tea Packing application is poised to continue its reign as the most significant contributor to the global tea packing machines market throughout the forecast period of 2025-2033. This dominance stems from the enduring and widespread popularity of tea bags across virtually all consumer demographics and geographic locations. Bag tea offers unparalleled convenience, portion control, and ease of preparation, making it the go-to choice for a vast majority of tea drinkers worldwide. The sheer volume of tea consumed in bag form necessitates a proportionally high demand for automatic, semi-automatic, and even specialized manual tea packing machines dedicated to this application. The market for bag tea packing machines encompasses a wide spectrum, from high-speed, multi-lane automated machines capable of producing millions of units daily for mass-market brands to more compact and adaptable machines for niche or artisanal tea producers. The continuous innovation in filter materials for tea bags, including the rise of biodegradable and compostable options, further fuels the demand for compatible packing machinery.

Beyond the ubiquitous bag tea, Silk Tea Packing and Nylon Tea Packing are emerging as high-growth segments, particularly within regions with a more affluent consumer base and a taste for premium tea experiences. These segments cater to specialty teas, whole leaf infusions, and herbal blends, where visual appeal and the ability to showcase the quality of the tea leaves are paramount. Silk and nylon pyramids, in particular, allow for greater infusion of flavor and aroma, offering a superior drinking experience. The machines required for these applications are often more specialized and technologically advanced, capable of precisely forming and sealing these delicate pyramid-shaped bags, thereby commanding a higher market value.

In terms of Regions, Asia Pacific is expected to emerge as a key powerhouse, dominating the tea packing machines market. This dominance is multifaceted, driven by several critical factors:

While Asia Pacific is projected to lead, Europe and North America will remain significant markets, driven by a mature consumer base, a strong emphasis on quality and innovation, and the growing demand for sustainable and premium tea products. These regions often lead in the adoption of advanced technologies and niche packaging solutions.

Several key factors are acting as significant growth catalysts for the tea packing machines industry. The ever-increasing global consumption of tea, coupled with the growing demand for convenience in the form of tea bags, is a primary driver. Furthermore, the rising popularity of premium and specialty teas, such as whole leaf and herbal infusions, necessitates specialized packing solutions that preserve quality and enhance presentation. The continuous drive for operational efficiency and cost reduction among tea manufacturers incentivizes investment in advanced, automated packing machinery. Lastly, the global push towards sustainable packaging is fostering innovation in eco-friendly materials and the machines designed to handle them, creating new market opportunities.

This report provides a holistic and in-depth exploration of the global tea packing machines market, encompassing the historical landscape, current market dynamics, and future projections. It meticulously analyzes market trends, identifies the pivotal driving forces and formidable challenges, and highlights the dominant regions and critical segments within the industry. The study delves into the growth catalysts that are shaping the market's expansion and offers a comprehensive overview of the leading manufacturers and their strategic contributions. Through detailed segmentation and insightful market estimations for the period 2019-2033, with a focus on the base year 2025, this report offers an indispensable resource for stakeholders seeking to understand the competitive landscape, identify growth opportunities, and formulate effective business strategies in the dynamic global tea packing machines sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TEEPACK Spezialmaschinen (Teekanne), Omag Pack, WooshinFA Tea Bag Machine, Nasa, Signal-Pack, Romiter Machinery, Synda, Sara Udyog, Omori, Unitek Packaging System, ACMA Machinery, Shanghai Saifeng Packing Machinery Equipment, Spackmachine, Cankey Technology, CONOVAL, CAMA (LUOYANG) ELECTROMECHANIC, Dongguang Sammi Packing Machine, Xiamen Sengong Packing Equipment, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tea Packing Machines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tea Packing Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.