1. What is the projected Compound Annual Growth Rate (CAGR) of the Sugarcane Fiber Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sugarcane Fiber Packaging

Sugarcane Fiber PackagingSugarcane Fiber Packaging by Type (Tableware, Food Packaging, Beverage packaging, World Sugarcane Fiber Packaging Production ), by Application (Fresh Food, Dry and Frozen Food, Meat Products, Dairy Products, Bakery Products, Beverage, World Sugarcane Fiber Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

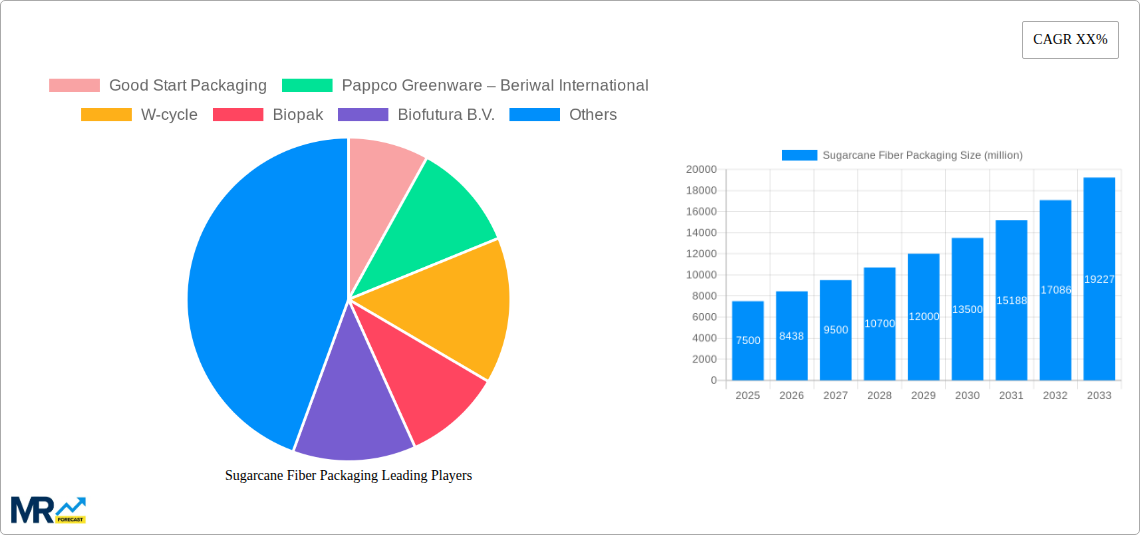

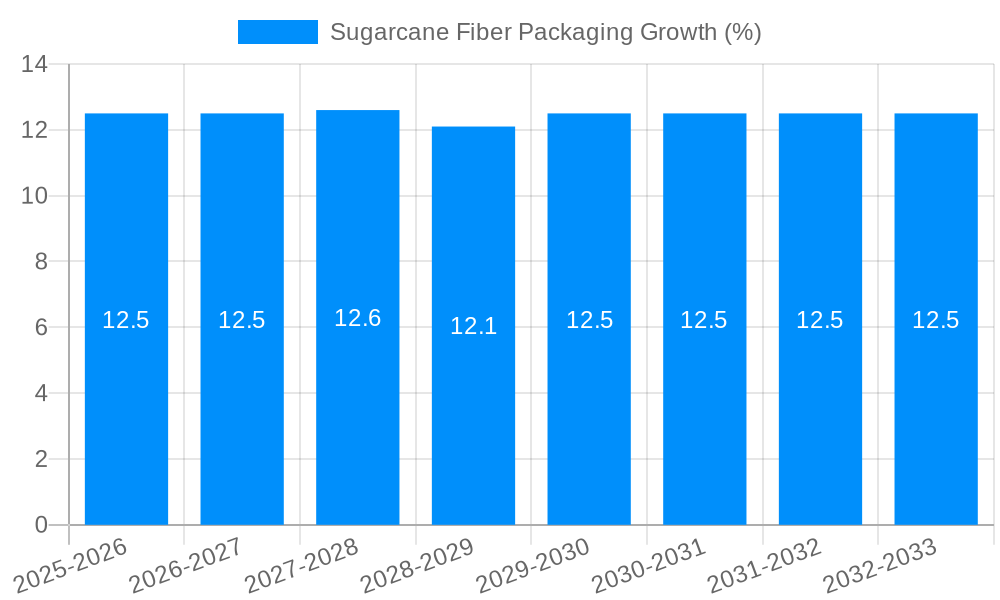

The global sugarcane fiber packaging market is poised for significant expansion, driven by a growing environmental consciousness and increasing regulatory pressure to reduce plastic waste. With an estimated market size of USD 7,500 million in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating demand for sustainable alternatives in food and beverage packaging, as consumers and businesses alike seek eco-friendly solutions. Key drivers include the inherent biodegradability and compostability of sugarcane fiber, its durability, and its capacity to replace conventional plastic and Styrofoam packaging across various applications. The "World Sugarcane Fiber Packaging Production" is a testament to this growing trend, highlighting the industry's commitment to innovation and sustainability.

The market's growth will be further propelled by advancements in manufacturing technologies, leading to improved product quality and cost-effectiveness. Key segments like food packaging and beverage packaging are expected to dominate, with fresh food, meat products, and bakery products emerging as significant application areas. The versatility of sugarcane fiber packaging, suitable for both fresh and frozen food applications, positions it as a highly adaptable material. While the market presents a strong growth outlook, potential restraints may include initial higher production costs compared to traditional materials, limited consumer awareness in certain regions, and the need for established composting infrastructure. However, the clear environmental benefits and the increasing adoption by leading global companies like Good Start Packaging and Eco-Products, Inc. signal a bright future, with Asia Pacific anticipated to be a major growth engine due to its large population and rapidly developing economies.

This comprehensive report delves into the dynamic global sugarcane fiber packaging market, offering an in-depth analysis of its present landscape and future trajectory. Spanning the Study Period: 2019-2033, with a Base Year: 2025 and Estimated Year: 2025, this report meticulously examines the market's evolution through the Historical Period: 2019-2024 and provides robust projections for the Forecast Period: 2025-2033. We explore key market insights, driving forces, challenges, dominant regions and segments, growth catalysts, leading players, and significant industry developments, providing stakeholders with actionable intelligence for strategic decision-making. The report will also detail the World Sugarcane Fiber Packaging Production figures, estimating them in the millions of units for a clear understanding of market scale.

The global sugarcane fiber packaging market is witnessing a significant upswing, driven by an increasing global awareness of environmental sustainability and the urgent need to reduce plastic waste. Consumers, governments, and businesses are actively seeking eco-friendly alternatives, and sugarcane fiber packaging, derived from the residual fibrous material left after sugarcane juice extraction, has emerged as a prominent contender. This trend is not merely a fleeting fad but a fundamental shift in consumer preferences and regulatory landscapes. The report anticipates that the World Sugarcane Fiber Packaging Production will continue its upward trajectory, projected to reach [Insert Estimated Production Value in Millions] million units by 2025, and further expand to [Insert Forecasted Production Value in Millions] million units by 2033. This substantial growth is fueled by several key trends. Firstly, the demand for biodegradable and compostable packaging solutions is skyrocketing, particularly in the food service industry and for single-use items. Consumers are increasingly scrutinizing product packaging, opting for brands that align with their environmental values. Secondly, government regulations worldwide are tightening, with bans and restrictions on single-use plastics becoming more prevalent. This legislative push directly benefits alternatives like sugarcane fiber packaging. Thirdly, technological advancements in the processing of sugarcane fiber are leading to improved product quality, functionality, and cost-effectiveness, making it a more viable and attractive option for manufacturers across various sectors. The versatility of sugarcane fiber packaging, ranging from tableware and food containers to specialized applications, further cements its position. The report will analyze these trends in detail, providing a granular view of market dynamics and their impact on production volumes and market share.

Key Market Insights include:

The surge in the sugarcane fiber packaging market is underpinned by a confluence of powerful driving forces that are reshaping the global packaging industry. Foremost among these is the escalating consumer demand for sustainable products. As environmental consciousness permeates society, consumers are actively seeking out brands that demonstrate a commitment to reducing their ecological footprint. This has translated into a clear preference for packaging materials that are biodegradable, compostable, and derived from renewable resources, with sugarcane fiber emerging as a frontrunner. Concurrently, stringent government regulations and initiatives aimed at curbing plastic pollution are playing a pivotal role. Many countries and regions are implementing bans on single-use plastics and promoting the use of eco-friendly alternatives, thereby creating a regulatory push that directly benefits the sugarcane fiber packaging sector. The economic viability and functional advantages of sugarcane fiber packaging are also significant drivers. Advancements in manufacturing processes have led to improved product performance, including enhanced durability, grease resistance, and heat tolerance, making it a competitive alternative to traditional plastic and paper-based packaging. Furthermore, the circular economy principles are gaining traction, encouraging the use of materials that can be reused, recycled, or biodegraded, aligning perfectly with the inherent properties of sugarcane fiber. The report will quantify the impact of these drivers on the World Sugarcane Fiber Packaging Production, illustrating how they translate into increased demand and market expansion.

Despite its promising growth trajectory, the sugarcane fiber packaging market is not without its challenges and restraints. One of the primary hurdles is the cost of production. While innovations are making sugarcane fiber more competitive, it can still be more expensive than conventional plastic packaging, particularly for large-scale applications. This price differential can be a significant deterrent for some businesses, especially small and medium-sized enterprises with tighter budgets. Another notable challenge is scalability and supply chain logistics. As demand grows, ensuring a consistent and sufficient supply of sugarcane fiber feedstock and establishing robust manufacturing and distribution networks can be complex. The availability of raw materials can also be influenced by agricultural factors, such as crop yields and seasonal variations. Furthermore, consumer perception and awareness regarding the proper disposal of sugarcane fiber packaging can be a barrier. While it is often biodegradable and compostable, consumers need to be educated on how to compost it effectively to realize its full environmental benefits, otherwise, it can end up in landfills, negating its intended purpose. Performance limitations in certain niche applications also exist; for instance, sugarcane fiber packaging might not be suitable for extremely high-temperature applications or prolonged contact with highly acidic or oily foods without specific coatings, which can sometimes impact its biodegradability. Lastly, competition from other sustainable packaging materials, such as bamboo fiber, mycelium, and advanced bioplastics, poses an ongoing challenge, requiring continuous innovation and differentiation within the sugarcane fiber segment. The report will analyze how these restraints might influence the projected World Sugarcane Fiber Packaging Production figures and market growth rates.

The global sugarcane fiber packaging market is poised for significant growth, with several regions and segments expected to lead the charge. Asia-Pacific, particularly countries like India and China, is anticipated to emerge as a dominant force in both production and consumption. This dominance stems from several interconnected factors. Firstly, these regions are major sugarcane-producing nations, ensuring a readily available and cost-effective supply of raw material. The World Sugarcane Fiber Packaging Production figures are heavily influenced by this region's output. Secondly, burgeoning populations, rapid urbanization, and a growing middle class are fueling increased demand for convenient and disposable food packaging solutions. As environmental awareness also rises in these economies, the preference for sustainable alternatives like sugarcane fiber is gaining momentum, creating a powerful dual-engine of supply and demand. The report estimates that the Asia-Pacific region alone will account for [Insert Estimated Regional Market Share Percentage]% of the global market by 2025, contributing significantly to the [Insert Estimated Production Value in Millions] million units of World Sugarcane Fiber Packaging Production.

Within the Type segment, Food Packaging is projected to be the dominant category, driven by its extensive application in various sub-segments. This includes:

The Application segment of Beverage packaging, while substantial, will likely be led by Food Packaging in terms of sheer volume and growth rate due to its versatility across a wider spectrum of food items and its direct link to the growing food service industry and takeaway culture. The demand for sustainable disposable cups, bowls, plates, and containers for restaurants, cafes, and catering services is immense. The report anticipates that the Food Packaging segment will capture an estimated [Insert Estimated Segment Market Share Percentage]% of the total sugarcane fiber packaging market by 2025, further solidifying its dominant position and influencing the overall World Sugarcane Fiber Packaging Production figures. North America and Europe are also crucial markets, driven by advanced economies with strong environmental regulations and high consumer awareness, contributing significantly to the demand for premium and innovative sugarcane fiber packaging solutions.

Several key growth catalysts are propelling the sugarcane fiber packaging industry forward. The increasing global imperative to combat plastic pollution and embrace circular economy principles is a primary driver. This is reinforced by stringent government regulations, such as single-use plastic bans, which create a favorable market environment for sustainable alternatives. Furthermore, rising consumer environmental consciousness and the growing preference for eco-friendly products are compelling businesses to adopt sustainable packaging. Technological advancements in processing sugarcane fiber are leading to improved functionality, durability, and cost-effectiveness, making it a more viable option for a wider range of applications. The expansion of the food service industry, particularly the growth of takeaway and delivery services, also fuels demand for convenient and disposable, yet sustainable, packaging.

This report offers an unparalleled deep dive into the global sugarcane fiber packaging market, providing stakeholders with a comprehensive understanding of its present dynamics and future potential. We meticulously dissect market trends, analyze the driving forces behind its growth, and scrutinize the challenges and restraints that shape its trajectory. The report also pinpoints key regions and segments poised for dominance, offering detailed insights into the World Sugarcane Fiber Packaging Production figures, estimated in the millions of units. Leading players are identified, and significant industry developments are chronicled. With a robust analytical framework covering the Study Period: 2019-2033, a precise Base Year: 2025 and Estimated Year: 2025, and detailed projections for the Forecast Period: 2025-2033, this report is an indispensable resource for strategizing and navigating the evolving landscape of sustainable packaging.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Good Start Packaging, Pappco Greenware – Beriwal International, W-cycle, Biopak, Biofutura B.V., Vegware Ltd., Dart Container Corporation, Visfortec Pvt. Ltd., Eco-Products, Inc, Geotegrity, Inc, Detpak India Pvt. Ltd..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sugarcane Fiber Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sugarcane Fiber Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.