1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Portion Cosmetic Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Single Portion Cosmetic Packaging

Single Portion Cosmetic PackagingSingle Portion Cosmetic Packaging by Type (Plastic Material, Glass Material, Metal Material, Paper Material), by Application (Hair Care, Skincare, Nail Care, Make-up), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

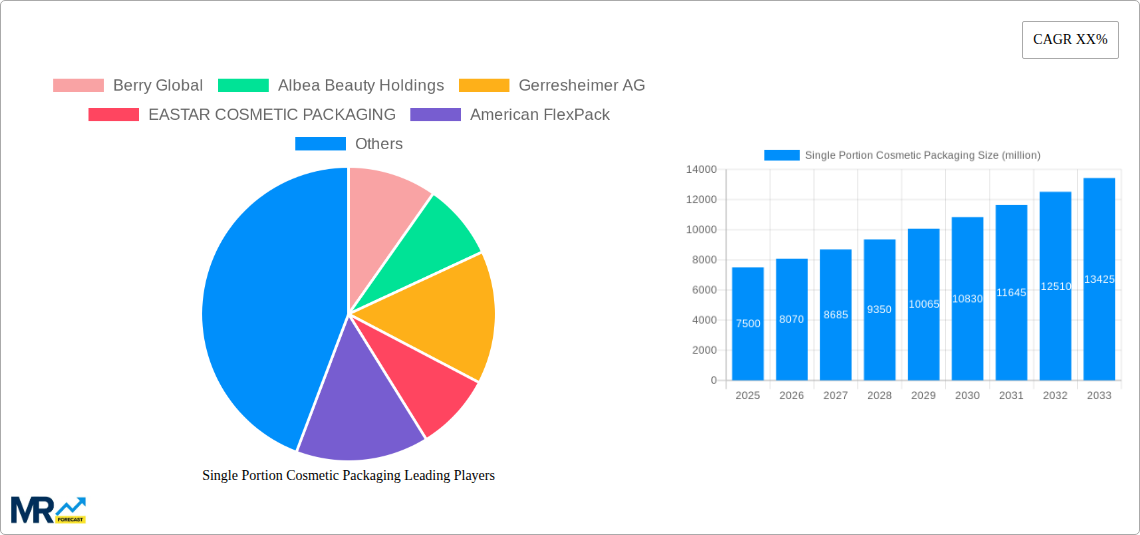

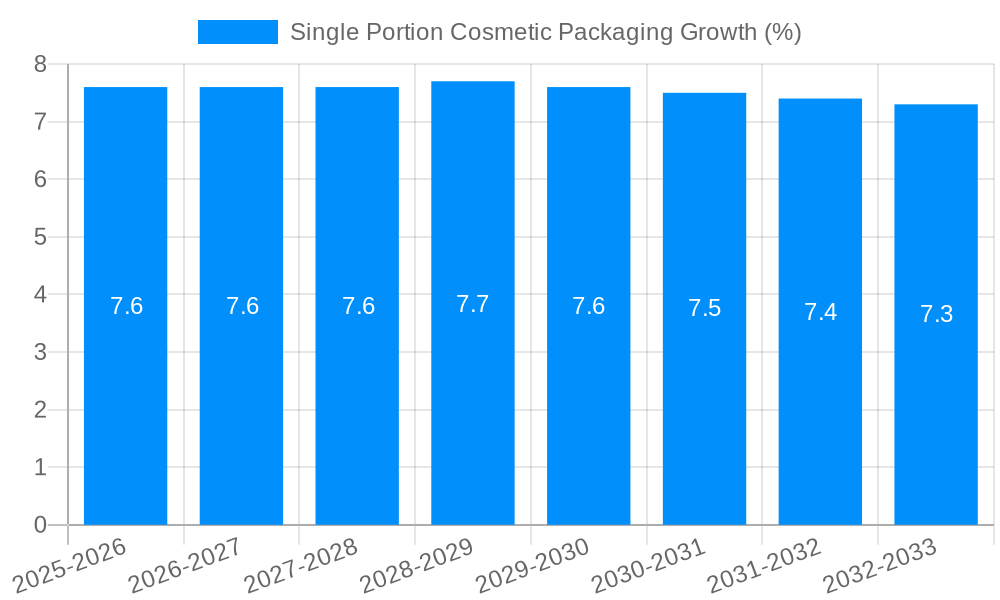

The global single-portion cosmetic packaging market is poised for significant expansion, estimated to reach approximately USD 7,500 million in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of around 7.2% through 2033. This impressive trajectory is largely fueled by increasing consumer demand for convenience, hygiene, and personalized beauty solutions. The trend towards travel-sized and trial-sized products, driven by a mobile lifestyle and a desire to explore new formulations without full commitment, is a primary accelerator. Furthermore, the growing emphasis on sustainability and reduced waste is propelling the adoption of single-portion packaging made from eco-friendly materials like recycled plastics and biodegradable options. The market's expansion is also supported by advancements in material science and packaging technology, enabling the creation of innovative, user-friendly, and aesthetically appealing single-portion formats.

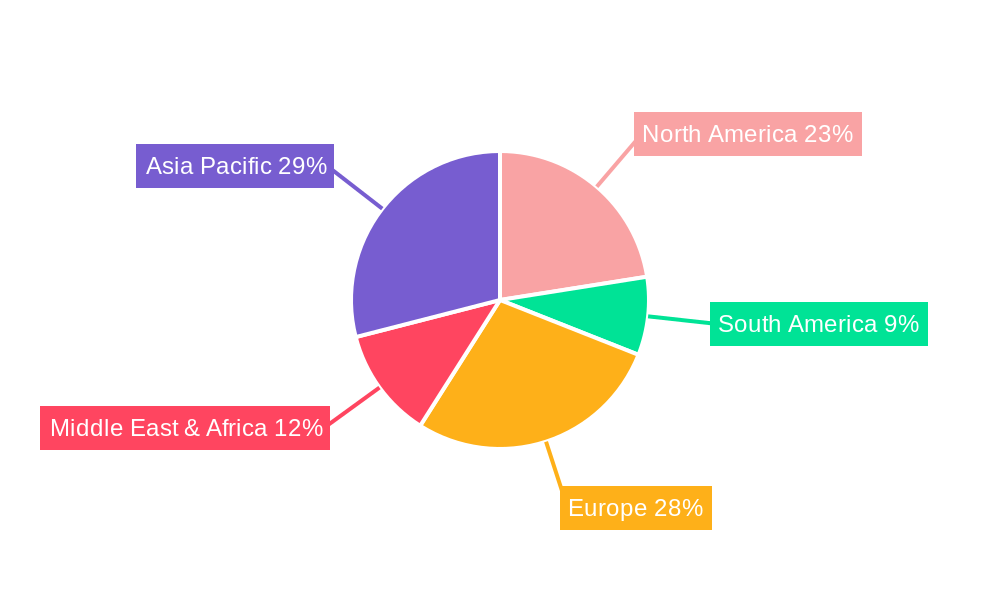

The market segmentation reveals a dynamic landscape, with Plastic Material dominating in terms of volume due to its versatility, cost-effectiveness, and advanced barrier properties. However, Glass Material is gaining traction, particularly in premium skincare and luxury cosmetic segments, owing to its perceived elegance and recyclability. In terms of application, Hair Care and Skincare are the leading segments, benefiting from the consistent demand for sample sizes and specialized treatments. The rise of direct-to-consumer (DTC) beauty brands and the increasing popularity of subscription boxes further amplify the need for single-portion packaging. Geographically, the Asia Pacific region, particularly China and India, is emerging as a high-growth area, driven by a burgeoning middle class, rising disposable incomes, and a rapidly expanding beauty industry. While the market benefits from these strong drivers, potential restraints include fluctuations in raw material prices and stringent regulatory compliance requirements for cosmetic packaging in certain regions.

Here's a unique report description on Single Portion Cosmetic Packaging, incorporating your specified elements:

This comprehensive report delves into the dynamic landscape of the Single Portion Cosmetic Packaging market, providing an in-depth analysis of trends, drivers, challenges, and growth opportunities. Spanning a study period from 2019 to 2033, with a base year of 2025 and an extended forecast period, this report offers actionable intelligence for stakeholders. We meticulously examine market dynamics across various material types, including Plastic Material, Glass Material, Metal Material, and Paper Material, and analyze their penetration within key application segments such as Hair Care, Skincare, Nail Care, and Make-up. This report leverages historical data from 2019-2024 and presents a robust forecast for the future, with a particular focus on the estimated year of 2025.

The global single portion cosmetic packaging market is experiencing a significant evolutionary phase, driven by a confluence of consumer preferences, sustainability imperatives, and evolving retail strategies. In the [Estimated Year: 2025], the market is projected to witness robust growth, with an estimated volume exceeding [Insert a value in millions of units, e.g., 500 million units] units. A pivotal trend is the escalating demand for "discovery-sized" and "trial-sized" products, enabling consumers to explore new formulations and brands without significant financial commitment. This strategy is particularly resonant in the Skincare segment, where product efficacy and ingredient compatibility are paramount. Furthermore, the rise of direct-to-consumer (DTC) e-commerce platforms has amplified the need for miniaturized, travel-friendly, and sample-ready packaging solutions. Brands are increasingly leveraging single portions for targeted marketing campaigns, loyalty programs, and as value-added inclusions with larger purchases, aiming to reduce customer acquisition costs and foster brand loyalty. The aesthetic appeal of these miniature packages is also a critical factor; brands are investing in sophisticated designs, premium finishes, and innovative dispensing mechanisms to elevate the perceived value and user experience, even at a smaller scale.

The sustainability narrative is no longer a niche consideration but a core tenet influencing packaging choices. As consumers become more environmentally conscious, there's a palpable shift towards recyclable, biodegradable, and compostable single portion packaging. This is pushing manufacturers to explore novel materials and production processes that minimize environmental impact. Innovations in material science are leading to the development of lightweight yet durable plastics derived from recycled content or bioplastics, as well as advanced paper-based alternatives that offer comparable protection and barrier properties. The reduction of material usage through minimalist designs and efficient packing techniques is also a significant trend. Moreover, the rise of refillable and reusable single-portion systems, while still in nascent stages, signals a potential long-term paradigm shift towards a circular economy in cosmetic packaging. This focus on eco-friendliness is not only driven by consumer demand but also by increasingly stringent regulations and corporate social responsibility initiatives.

Several key forces are collectively propelling the growth of the single portion cosmetic packaging market. A primary driver is the rapidly evolving consumer behavior, characterized by a growing appetite for experimentation and personalized beauty routines. Consumers, particularly millennials and Gen Z, are more inclined to try new products and brands, making sample-sized packaging an essential gateway. This desire for exploration is further fueled by social media trends and influencer marketing, which often showcase a diverse range of beauty products, creating demand for trial sizes. The convenience factor associated with single-portion packs cannot be overstated; their portability makes them ideal for travel, gym bags, and on-the-go touch-ups, catering to the fast-paced lifestyles of modern consumers. This convenience is a significant draw across all application segments, from Hair Care travel kits to emergency Make-up fixes.

Furthermore, the burgeoning e-commerce sector has created a fertile ground for single portion packaging. Online retailers and direct-to-consumer brands frequently utilize these smaller units for product sampling, customer acquisition initiatives, and as promotional add-ons. The cost-effectiveness of distributing single portions, both in terms of production and shipping, makes them an attractive option for online businesses seeking to minimize overheads while maximizing customer reach and engagement. The pharmaceutical and healthcare industries' increasing adoption of miniature packaging for certain cosmetic and topical treatments also indirectly contributes to the market's expansion, driving innovation and economies of scale in manufacturing. The overall expansion of the global cosmetics industry, coupled with a growing middle class in emerging economies, further bolsters the demand for accessible and trial-friendly product formats.

Despite its robust growth trajectory, the single portion cosmetic packaging market faces several inherent challenges and restraints that can impede its full potential. A significant hurdle is the inherent inefficiency and waste associated with single-use packaging. The very nature of single portions, designed for one-time use, contributes to a substantial volume of packaging waste, raising environmental concerns among consumers and regulatory bodies alike. This challenge is particularly acute given the increasing global emphasis on sustainability and circular economy principles. Developing cost-effective and truly biodegradable or compostable single-portion solutions that maintain product integrity and shelf-life remains a complex technical and economic challenge.

Another restraint lies in the perceived higher cost per unit volume. While single portions offer accessibility, the cost of packaging and manufacturing each individual unit can be proportionally higher than that of larger formats. This can impact profit margins for manufacturers and potentially lead to higher retail prices for consumers, which might deter price-sensitive segments of the market. The complexity of packaging machinery and filling processes for very small volumes can also present operational challenges and require significant capital investment. Furthermore, ensuring the shelf-life and efficacy of cosmetic products within very small containers, especially for sensitive formulations, can be demanding. Maintaining product stability against factors like light, air, and moisture within these limited volumes requires advanced packaging materials and design strategies, adding to the overall cost and complexity.

The global single portion cosmetic packaging market is characterized by distinct regional dynamics and segment dominance.

Dominant Region/Country: North America and Europe are projected to be the leading regions in terms of consumption and innovation within the single portion cosmetic packaging market during the forecast period. This leadership is attributed to several factors:

Dominant Segment (Application): The Skincare application segment is poised to be a significant dominator within the single portion cosmetic packaging market.

The synergy between these dominant regions and the skincare segment, driven by informed consumer choices and strategic brand initiatives, will continue to shape the market's trajectory.

The single portion cosmetic packaging industry's growth is significantly catalyzed by the increasing adoption of e-commerce and the subsequent rise in direct-to-consumer (DTC) sales models. These channels rely heavily on cost-effective sampling and trial strategies, where single portions are indispensable for customer acquisition and product discovery. Furthermore, the global focus on sustainability is a powerful catalyst, driving innovation in eco-friendly materials and packaging designs, which in turn opens new market opportunities and appeals to environmentally conscious consumers. The growing trend of personalized beauty and the demand for customized product experiences also fuel the need for smaller, more adaptable packaging formats that can cater to individual needs.

This report offers unparalleled comprehensive coverage of the single portion cosmetic packaging market. It provides a granular analysis of market segmentation by material type and application, identifying the most lucrative opportunities and emerging trends. The report meticulously details industry developments from 2019 to 2024, projecting future market sizes and growth rates through 2033, with a crucial focus on the [Estimated Year: 2025]. By dissecting the driving forces and challenges, stakeholders gain a clear understanding of the competitive landscape and potential roadblocks. Furthermore, the report identifies key regions and dominant segments, offering strategic insights for market entry and expansion. The inclusion of leading players and significant past developments contextualizes the market's evolution and future potential. This report is an essential resource for any business looking to navigate and capitalize on the dynamic single portion cosmetic packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Berry Global, Albea Beauty Holdings, Gerresheimer AG, EASTAR COSMETIC PACKAGING, American FlexPack, Raepak Ltd, AptarGroup, Libo Cosmetics Company, Shaoxing Shangyu Yastar Plastic, Yuyao Weida Sprayer, Maheshwari Caps, Sun Rise Agency, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Single Portion Cosmetic Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single Portion Cosmetic Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.