1. What is the projected Compound Annual Growth Rate (CAGR) of the Serum Stoppers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Serum Stoppers

Serum StoppersSerum Stoppers by Type (13mm, 20mm, 32mm, Other), by Application (Biologics, Small Molecules, Vaccines, Animal Health, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

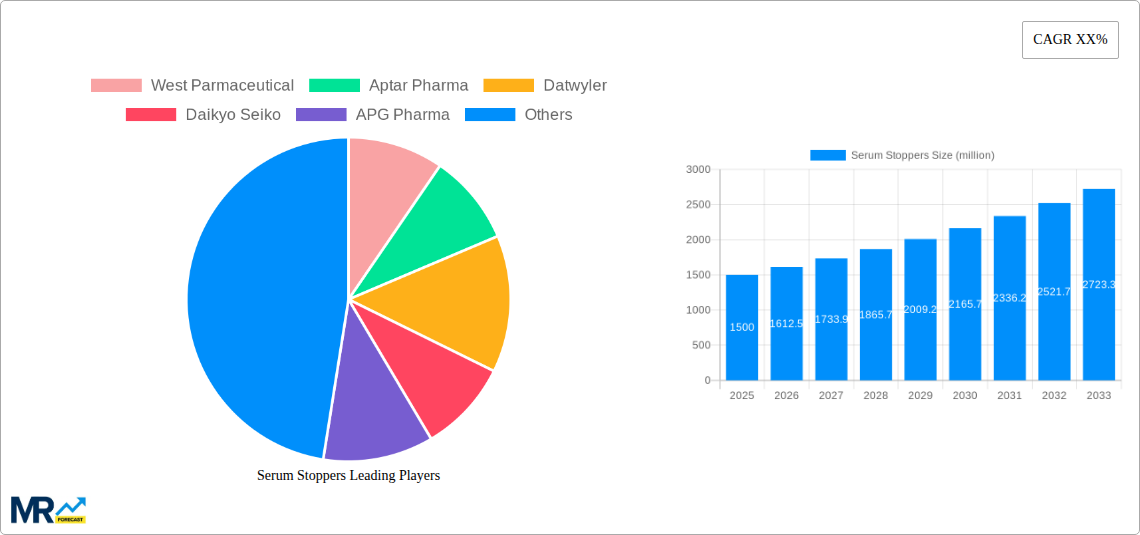

The global Serum Stoppers market is experiencing robust growth, driven by the increasing demand for sterile and safe packaging solutions in the pharmaceutical and biopharmaceutical industries. With an estimated market size of approximately $1.5 billion in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This upward trajectory is primarily fueled by the escalating production of biologics, vaccines, and complex small molecule drugs, all of which necessitate high-quality stoppers to maintain product integrity and prevent contamination. Advancements in material science, leading to the development of more resilient and chemically inert stoppers, further bolster market expansion. The growing emphasis on patient safety and stringent regulatory requirements worldwide are also significant drivers, compelling manufacturers to adopt premium stoppers that meet international standards. The market is segmented by type, with 13mm and 20mm stoppers dominating due to their widespread application in vials for various pharmaceutical formulations.

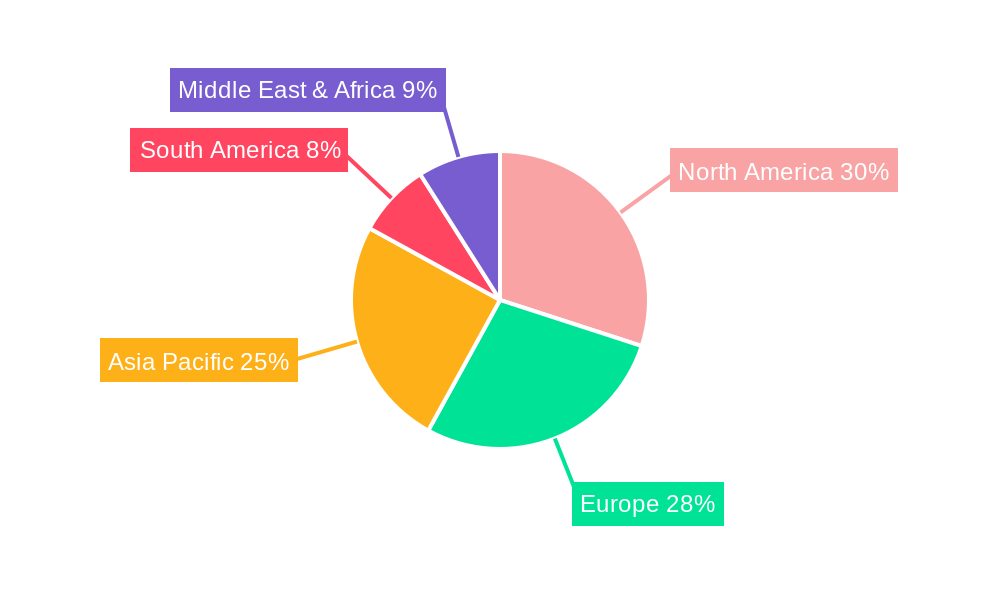

Geographically, North America and Europe currently hold significant market shares, owing to the presence of major pharmaceutical companies and advanced healthcare infrastructure. However, the Asia Pacific region is poised for rapid growth, driven by the burgeoning pharmaceutical manufacturing sector in countries like China and India, increasing healthcare expenditure, and a growing focus on domestic drug production. Key players such as West Pharmaceutical Services, Aptar Pharma, and Datwyler are continuously investing in research and development to innovate new stopper technologies and expand their production capacities to meet the escalating global demand. Despite the positive outlook, challenges such as fluctuating raw material costs and intense competition among market participants could pose moderate restraints to market growth. Nevertheless, the sustained demand for safe and effective drug packaging solutions ensures a promising future for the serum stoppers market.

Here's a comprehensive report description on Serum Stoppers, incorporating your specified details and formatting:

This in-depth report provides a thorough examination of the global Serum Stoppers market, offering a comprehensive understanding of its historical performance, current dynamics, and future trajectory. Spanning the study period of 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this analysis delves into the intricate factors shaping this critical segment of pharmaceutical packaging. We will analyze market size in millions of units, providing granular insights into the volume of serum stoppers produced and consumed worldwide.

The global Serum Stoppers market is experiencing robust growth, projected to reach significant figures in the millions of units by the end of the forecast period. XXX insights reveal a discernible shift in demand towards specialized stoppers designed for advanced drug delivery systems, particularly in the biologics and vaccine segments. The historical period (2019-2024) witnessed a steady expansion driven by the increasing prevalence of chronic diseases and the rising global healthcare expenditure. This trend is expected to accelerate as pharmaceutical companies invest heavily in research and development for novel therapeutics. The estimated year of 2025 marks a pivotal point, with the market demonstrating strong momentum. A key trend observed is the growing preference for stoppers offering enhanced barrier properties, crucial for maintaining the integrity and efficacy of sensitive biopharmaceutical products. Furthermore, the demand for sterile and high-purity stoppers is paramount, driven by stringent regulatory requirements and a zero-tolerance policy for contamination in parenteral drug products. The market is also seeing a rise in the adoption of advanced elastomer materials and innovative designs that minimize extractables and leachables, ensuring product safety and patient well-being. The increasing focus on self-injection devices and pre-filled syringes also contributes to the demand for specialized stoppers designed for seamless integration and reliable functionality. This evolving landscape highlights the dynamic nature of the serum stoppers market, where innovation and adherence to quality standards are key differentiators.

Several powerful forces are propelling the growth of the global Serum Stoppers market. The relentless advancement in biopharmaceutical research and development is a primary driver, leading to a surge in the production of complex biological drugs, including monoclonal antibodies, vaccines, and gene therapies. These sophisticated therapeutics often require specialized packaging solutions to maintain their stability and efficacy, thus escalating the demand for high-quality serum stoppers. The escalating global burden of chronic diseases, coupled with an aging population worldwide, is another significant contributor, fueling the demand for a wider range of injectable medications and, consequently, serum stoppers. Moreover, the increasing investments in healthcare infrastructure, particularly in emerging economies, are expanding access to advanced medical treatments, thereby creating a larger addressable market for pharmaceutical packaging. The widespread adoption of pre-filled syringes and auto-injectors, designed for patient convenience and improved drug administration, further amplifies the need for precisely engineered stoppers that ensure secure sealing and controlled fluid dynamics. The continuous drive for enhanced drug safety and extended shelf life also compels manufacturers to develop and utilize stoppers with superior barrier properties, minimizing drug degradation and contamination risks.

Despite the optimistic growth outlook, the Serum Stoppers market faces several notable challenges and restraints that could temper its expansion. Stringent regulatory compliance remains a significant hurdle. Manufacturers must adhere to rigorous quality standards and undergo extensive testing to ensure their products meet the exacting requirements of global regulatory bodies like the FDA and EMA. The cost of raw materials, particularly specialized elastomers, can fluctuate significantly, impacting production costs and profit margins for stopper manufacturers. Furthermore, the development and validation of new stopper formulations and designs require substantial investment in research and development, which can be a barrier for smaller players in the market. The presence of established players with strong market share and extensive distribution networks can also make it difficult for new entrants to gain traction. Moreover, the pharmaceutical industry's inherent conservatism and the lengthy drug approval processes mean that the adoption of novel stopper technologies can be slow. Geopolitical uncertainties and supply chain disruptions, as witnessed in recent global events, can also pose risks to the consistent availability of raw materials and finished products.

The Biologics application segment, across various stopper types including 20mm and 13mm, is poised to dominate the Serum Stoppers market in terms of volume and value. This dominance is particularly pronounced in key regions and countries characterized by robust pharmaceutical manufacturing capabilities and high adoption rates of advanced therapeutics.

Dominant Segments:

Regional Dominance and Segment Interplay: North America, with its leading pharmaceutical research institutions and a significant concentration of biologics manufacturers, is a primary driver for the demand for high-performance serum stoppers. The region's strong focus on innovation in oncology, immunology, and regenerative medicine translates directly into a higher demand for specialized stoppers designed to preserve the integrity of these sensitive and often high-value biologics. The stringent regulatory environment in the United States further pushes manufacturers to adopt the highest quality stoppers, particularly those offering advanced barrier properties and low extractables. This makes the Biologics segment, especially for 20mm stoppers used in vials for these complex therapies, a cornerstone of market dominance.

Europe follows closely, driven by a mature pharmaceutical industry with a strong emphasis on vaccines and biopharmaceutical production. The COVID-19 pandemic, in particular, highlighted and amplified the demand for vaccine stoppers, making the Vaccines application segment and its associated 13mm and 20mm stopper requirements exceptionally significant during the historical and ongoing periods. European countries have also been at the forefront of developing advanced biologics for rare diseases and chronic conditions, further bolstering the demand for specialized stopper solutions.

The Asia Pacific region, particularly countries like China and India, is emerging as a powerhouse in both pharmaceutical manufacturing and consumption. While historically strong in small molecule production, the region is witnessing a rapid expansion in its biologics and vaccine manufacturing capabilities. Government initiatives to boost domestic pharmaceutical production and increasing healthcare expenditure are fueling the demand for a wide array of serum stoppers. The sheer volume of production for both biologics and vaccines in this region, coupled with a growing middle class demanding better healthcare access, positions Asia Pacific as a key growth engine. The Biologics and Vaccines segments, utilizing a mix of 13mm and 20mm stoppers, are expected to see substantial growth here. The increasing focus on biosimilars in this region also contributes to the consistent demand for reliable serum stoppers.

The dominance of 13mm and 20mm stopper types is intrinsically linked to their widespread use in vials for injectable drugs. These sizes are standard for a vast majority of small molecule drugs, biologics, and vaccines, making them the workhorses of the pharmaceutical industry. While 32mm and 'Other' sizes cater to specific niche applications, the sheer volume and frequency of use for 13mm and 20mm stoppers, particularly within the rapidly expanding Biologics and Vaccines segments, solidify their position as the market leaders.

The Serum Stoppers industry is poised for accelerated growth, fueled by several key catalysts. The ongoing surge in biopharmaceutical innovation, leading to the development of novel vaccines and complex biologics, is a primary driver. Increased global healthcare expenditure and rising disposable incomes in emerging economies are expanding access to essential medicines and advanced therapies, thereby boosting demand. The growing preference for pre-filled syringes and auto-injectors, offering convenience and improved patient compliance, directly translates into higher demand for specialized stoppers. Furthermore, the increasing emphasis on drug safety and extended shelf life necessitates the use of high-performance stoppers with superior barrier properties.

This comprehensive report offers a holistic view of the Serum Stoppers market, delving into its intricate segments, regional dynamics, and the competitive landscape. Beyond the analysis of market size in millions of units for the historical (2019-2024), base (2025), estimated (2025), and forecast (2025-2033) periods, the report provides critical insights into the strategic initiatives of leading players. It examines the impact of industry developments, technological advancements, and regulatory changes on market evolution. Furthermore, the report dissects the interplay between various stopper types (13mm, 20mm, 32mm, Other) and applications (Biologics, Small Molecules, Vaccines, Animal Health, Other), offering a granular understanding of demand patterns. This detailed exploration empowers stakeholders with the knowledge to make informed strategic decisions and capitalize on future opportunities within the dynamic Serum Stoppers industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include West Parmaceutical, Aptar Pharma, Datwyler, Daikyo Seiko, APG Pharma, Sagar Rrubber, Bormioli Pharma, Shandong Pharmaceutical Glass, Jiangsu Hualan New Pharmaceutical Material, Hebei First Rubber Medical Technology, Jiangsu Best New Medical Material, Hubei Huaqiang High-tech, Zhengzhou Aoxiang pharmaceutical packing, Shengzhou Rubber & Plastic, Anhui Huaneng, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Serum Stoppers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Serum Stoppers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.