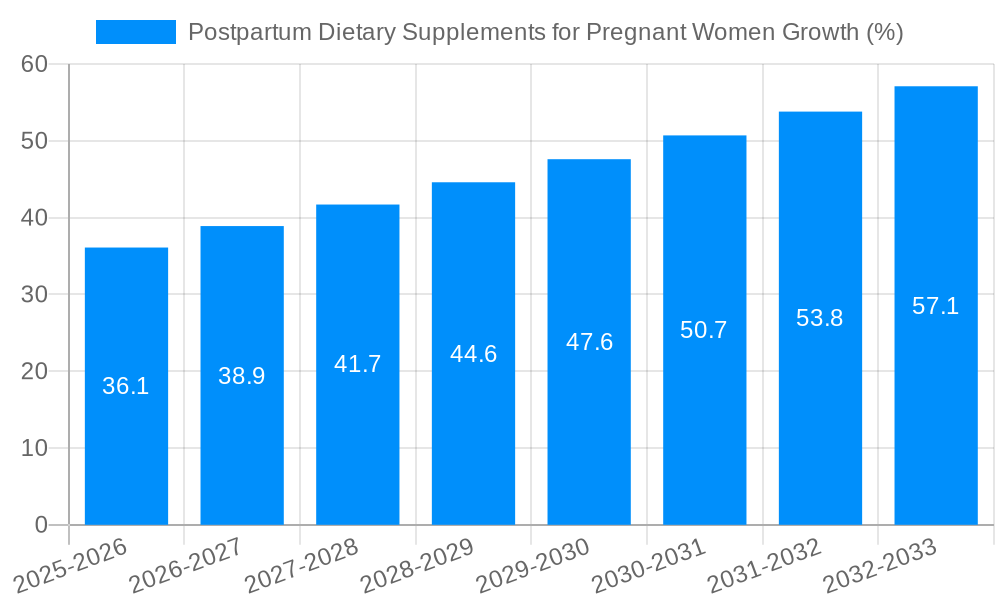

1. What is the projected Compound Annual Growth Rate (CAGR) of the Postpartum Dietary Supplements for Pregnant Women?

The projected CAGR is approximately 2.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Postpartum Dietary Supplements for Pregnant Women

Postpartum Dietary Supplements for Pregnant WomenPostpartum Dietary Supplements for Pregnant Women by Type (Liquid, Tablet, Capsule), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

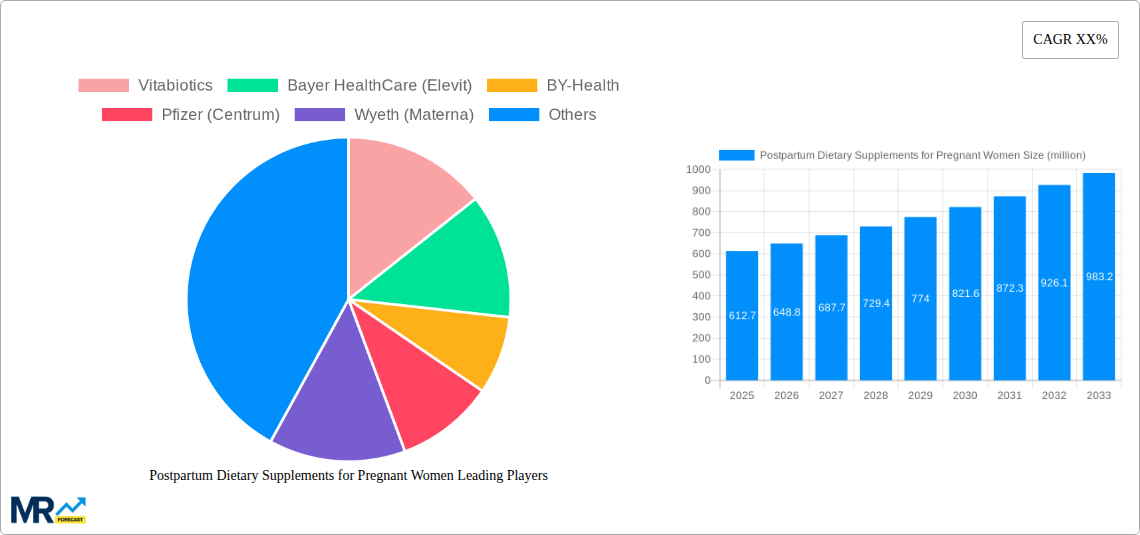

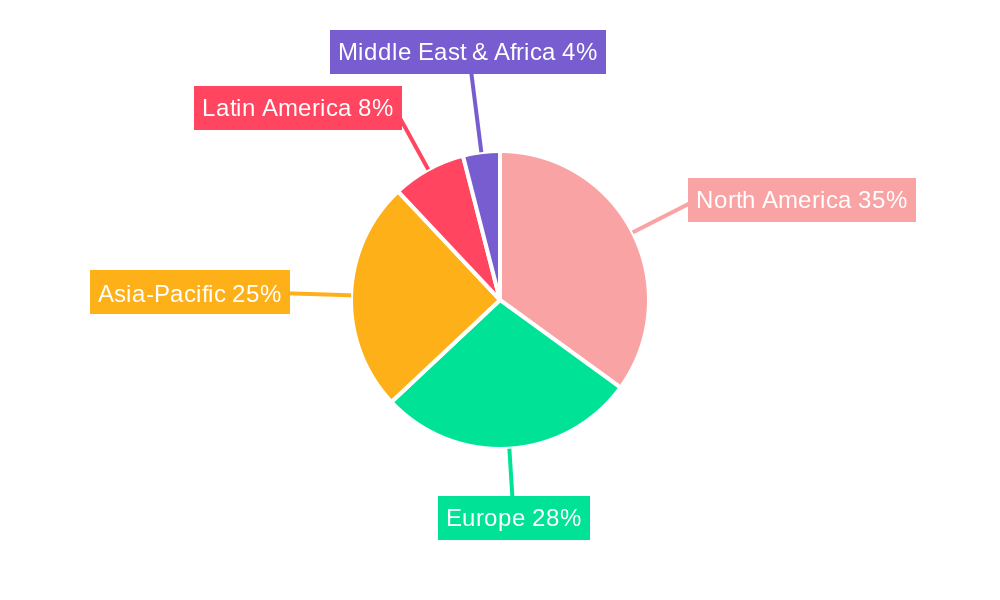

The global market for postpartum dietary supplements for pregnant women is a significant and growing sector, projected to be valued at $515.9 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 2.5%. This growth is fueled by several key drivers. Increasing awareness of the importance of maternal nutrition for both the mother's health and the baby's development is a primary factor. Furthermore, the rising prevalence of nutritional deficiencies during pregnancy and postpartum, coupled with busy lifestyles leading to insufficient nutrient intake through diet alone, significantly boosts demand. The market is segmented by supplement type (liquid, tablet, capsule) and sales channel (online, offline), reflecting evolving consumer preferences and distribution strategies. Online sales are likely to experience faster growth due to increased accessibility and convenience. While specific regional data is not provided, North America and Europe are anticipated to hold substantial market shares given higher levels of awareness and disposable income. However, rapidly developing economies in Asia-Pacific are expected to demonstrate strong future growth potential as healthcare awareness improves and purchasing power increases. Competitive pressures are high, with established players like Vitabiotics, Bayer Healthcare, and Pfizer competing alongside emerging brands focusing on natural and organic options. The market faces potential restraints from concerns about potential side effects, stringent regulatory frameworks surrounding supplement claims, and price sensitivity in certain regions.

The competitive landscape is dynamic, with both established multinational corporations and smaller niche players vying for market share. Product innovation, particularly in areas such as specialized formulations addressing specific postpartum needs (e.g., iron deficiency, lactation support) and convenient delivery methods, will be critical for success. The increasing demand for transparent and ethically sourced ingredients, alongside a growing focus on sustainability, presents opportunities for brands aligning with consumer values. Future growth will likely be driven by targeted marketing campaigns emphasizing the benefits of postpartum supplements, collaborative efforts with healthcare professionals to endorse their use, and expansion into underserved markets. The strategic development of strong distribution networks, both online and offline, will be crucial for effective market penetration and building customer loyalty.

The global postpartum dietary supplements market for pregnant women experienced robust growth during the historical period (2019-2024), exceeding XXX million units in sales by 2024. This surge is primarily attributed to the rising awareness regarding the importance of maternal nutrition both during and after pregnancy. Women are increasingly recognizing the crucial role of adequate nutrient intake in postpartum recovery, breastfeeding success, and the overall health of both mother and child. This heightened awareness is fueled by educational campaigns conducted by healthcare professionals, government initiatives, and the proliferation of information readily available online. Furthermore, the market's growth is significantly driven by the increasing prevalence of nutritional deficiencies among pregnant and postpartum women. These deficiencies, often linked to lifestyle choices, demanding schedules, and underlying health conditions, have compelled many women to seek supplemental support to bridge the nutrient gap. The market also benefits from the continuous innovation in supplement formulations. Companies are developing products specifically tailored to address the unique nutritional needs of postpartum women, focusing on ingredients known to promote energy levels, boost immunity, and support mental well-being. This trend towards specialized formulations, combined with improved product efficacy and palatability, has broadened the market's appeal. The convenience offered by diverse product formats—tablets, capsules, and liquids—further contributes to the market's expansion, catering to the varied preferences and lifestyles of expectant and new mothers. Looking ahead, the market is poised for continued expansion, driven by similar factors and supported by the increasing demand for convenient, accessible, and effective solutions for postpartum health management. The estimated market size in 2025 is projected to reach XXX million units, with further substantial growth anticipated throughout the forecast period (2025-2033).

Several key factors are propelling the growth of the postpartum dietary supplements market. The increasing awareness among expectant and new mothers regarding the importance of proper nutrition for both their health and their baby's development is paramount. Educational campaigns, readily available online information, and recommendations from healthcare providers are contributing to this increased awareness. The rising prevalence of nutritional deficiencies among pregnant and postpartum women is another significant driver. Many women struggle to meet their recommended daily intake of essential nutrients through diet alone, particularly during the demanding periods of pregnancy and postpartum recovery. Consequently, dietary supplements offer a convenient and effective way to bridge this nutritional gap. Furthermore, the market benefits from continuous innovation and product development. Supplement manufacturers are creating specialized formulas designed to address the unique nutritional demands of postpartum women, focusing on ingredients that aid in energy restoration, immune system support, and mental well-being. Finally, the convenience of different product formats (liquids, tablets, capsules) enhances market appeal by catering to individual preferences and lifestyles. This combined effect of increased awareness, nutritional deficiencies, innovative product development, and convenience is driving substantial market expansion.

Despite the market's growth potential, several challenges and restraints could hinder its expansion. One significant factor is the regulatory landscape surrounding dietary supplements, which varies across different regions. Strict regulations and stringent approval processes can increase the cost of product development and launch, potentially limiting market entry for some companies. Another significant concern is the potential for adverse effects or drug interactions associated with certain supplements. This necessitates accurate labeling, thorough product testing, and clear consumer education to mitigate potential risks and ensure responsible consumption. The market is also susceptible to consumer perception and trust. Negative publicity regarding the safety or efficacy of specific products can significantly impact market sentiment and consumer confidence. Moreover, the increasing availability of affordable, nutritious foods could potentially reduce reliance on dietary supplements, impacting market growth. Finally, price sensitivity, especially among price-conscious consumers, can pose a challenge for premium-priced supplements, demanding strategic pricing and marketing approaches to maintain market competitiveness.

The North American and European markets currently dominate the postpartum dietary supplement sector, largely driven by high levels of consumer awareness, strong regulatory frameworks, and significant disposable income. However, developing economies in Asia-Pacific and Latin America are exhibiting high growth potential, fueled by rising disposable incomes and increasing awareness about maternal and infant health.

Dominant Segments:

Application: Offline sales currently hold a larger market share compared to online sales, reflecting the preference of many women for in-person consultations with healthcare professionals or pharmacists before purchasing supplements. However, online sales are growing rapidly, driven by the convenience and accessibility offered by e-commerce platforms. The projected growth rate of online sales exceeds that of offline sales, indicating a significant shift towards online purchasing in the coming years.

Type: Capsules are a popular choice due to their ease of consumption and convenient dosage forms. Tablets maintain a strong market presence due to their widespread availability and cost-effectiveness, while liquid supplements are experiencing increasing popularity for their superior bioavailability and pleasant taste, especially for women who experience difficulty swallowing pills.

The forecast shows strong growth across all types, though capsules and tablets are expected to retain the largest market share throughout the forecast period due to established market presence and consumer familiarity.

In summary: While the North American and European markets maintain leadership, the Asia-Pacific region displays significant growth potential. Offline sales currently dominate, yet online channels are exhibiting rapid growth. Capsules and tablets continue to lead in terms of product type, but liquid supplements are expected to witness significant expansion due to increasing demand for bioavailability and ease of consumption.

The continued rise in awareness about the importance of optimal nutrition during and after pregnancy, alongside technological advancements resulting in innovative and more effective supplement formulations, are key catalysts for market growth. Furthermore, rising disposable incomes in several developing countries are expanding the consumer base willing to invest in premium healthcare products, further driving market expansion.

This report offers a comprehensive analysis of the postpartum dietary supplements market for pregnant women, encompassing market sizing, segmentation, growth drivers, challenges, and competitive landscape. It provides detailed insights into key market trends, future projections, and potential opportunities, equipping stakeholders with crucial information for informed decision-making in this rapidly evolving market. The forecast period extends to 2033, providing a long-term perspective on market dynamics and future prospects.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.5%.

Key companies in the market include Vitabiotics, Bayer HealthCare (Elevit), BY-Health, Pfizer (Centrum), Wyeth (Materna), New Chapter, Similac, Nature Made, GNC, Silian, .

The market segments include Type, Application.

The market size is estimated to be USD 515.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Postpartum Dietary Supplements for Pregnant Women," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Postpartum Dietary Supplements for Pregnant Women, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.